Blank Vehicle Repayment Agreement Form

The Vehicle Repayment Agreement form is a crucial document designed to outline the terms and conditions of a loan or financing arrangement for a vehicle. This form serves multiple purposes, including detailing the repayment schedule, specifying the interest rate, and clarifying the total amount financed. It is important for both the lender and the borrower, as it establishes clear expectations and responsibilities. Additionally, the form may include clauses regarding late payments, default consequences, and the rights of both parties in case of disputes. Understanding each aspect of this agreement is essential for ensuring a smooth transaction and protecting the interests of everyone involved. Properly filling out this form can prevent misunderstandings and legal complications down the line, making it a vital step in the vehicle purchasing process.

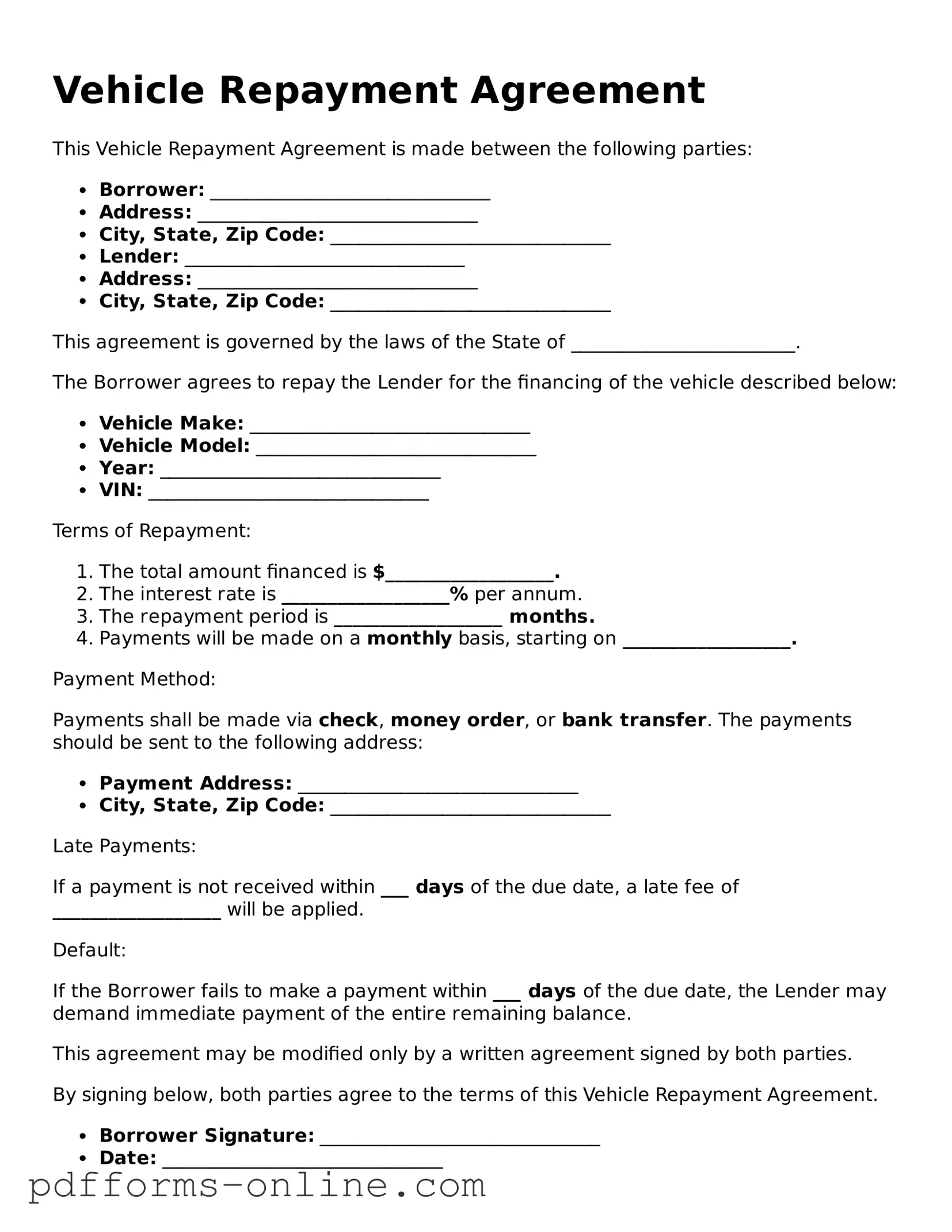

Document Example

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made between the following parties:

- Borrower: ______________________________

- Address: ______________________________

- City, State, Zip Code: ______________________________

- Lender: ______________________________

- Address: ______________________________

- City, State, Zip Code: ______________________________

This agreement is governed by the laws of the State of ________________________.

The Borrower agrees to repay the Lender for the financing of the vehicle described below:

- Vehicle Make: ______________________________

- Vehicle Model: ______________________________

- Year: ______________________________

- VIN: ______________________________

Terms of Repayment:

- The total amount financed is $__________________.

- The interest rate is __________________% per annum.

- The repayment period is __________________ months.

- Payments will be made on a monthly basis, starting on __________________.

Payment Method:

Payments shall be made via check, money order, or bank transfer. The payments should be sent to the following address:

- Payment Address: ______________________________

- City, State, Zip Code: ______________________________

Late Payments:

If a payment is not received within ___ days of the due date, a late fee of __________________ will be applied.

Default:

If the Borrower fails to make a payment within ___ days of the due date, the Lender may demand immediate payment of the entire remaining balance.

This agreement may be modified only by a written agreement signed by both parties.

By signing below, both parties agree to the terms of this Vehicle Repayment Agreement.

- Borrower Signature: ______________________________

- Date: ______________________________

- Lender Signature: ______________________________

- Date: ______________________________

Frequently Asked Questions

-

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document used to outline the terms under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

-

Who needs to fill out this form?

Both the borrower and the lender must complete the Vehicle Repayment Agreement form. The borrower is usually the individual or entity taking out the loan, while the lender is the financial institution or individual providing the funds. Ensuring that both parties understand and agree to the terms is crucial.

-

What information is required on the form?

The form typically requires several key pieces of information, including:

- The names and addresses of both the borrower and lender

- The vehicle's make, model, year, and Vehicle Identification Number (VIN)

- The total loan amount and interest rate

- The repayment schedule, including due dates and payment amounts

- Any fees associated with late payments or defaults

-

Is the Vehicle Repayment Agreement legally binding?

Yes, once both parties sign the Vehicle Repayment Agreement form, it becomes a legally binding contract. This means that both the borrower and lender are obligated to adhere to the terms outlined in the agreement. If either party fails to comply, the other may have legal recourse.

-

What happens if I miss a payment?

Missing a payment can lead to several consequences. Depending on the terms of your agreement, you may incur late fees, and your lender may report the missed payment to credit bureaus, which could negatively affect your credit score. In severe cases, the lender may initiate repossession of the vehicle.

-

Can the terms of the agreement be modified?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but both parties must agree to any changes. It’s essential to document any modifications in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

-

Where can I obtain a Vehicle Repayment Agreement form?

You can typically find a Vehicle Repayment Agreement form at banks, credit unions, or online legal resources. Ensure that you choose a form that complies with your state’s laws and meets the specific needs of your transaction.

Misconceptions

Understanding the Vehicle Repayment Agreement form is crucial for anyone involved in a vehicle financing situation. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- It is only for individuals with poor credit. Many believe that the Vehicle Repayment Agreement is solely for those with bad credit. In reality, it is used by anyone who is financing a vehicle, regardless of credit status.

- Signing the agreement means you own the vehicle outright. Some think that signing the agreement grants them full ownership of the vehicle. However, ownership typically remains with the lender until the loan is fully repaid.

- The terms are non-negotiable. A common belief is that the terms laid out in the agreement cannot be changed. In fact, many lenders are open to negotiation on certain aspects, such as interest rates or payment schedules.

- It protects you from repossession. Many assume that signing the agreement guarantees protection from repossession. While it outlines your repayment obligations, failing to meet those obligations can still lead to repossession.

- All lenders use the same form. Some people think that all Vehicle Repayment Agreements are identical. In truth, different lenders may have varying terms and conditions, so it’s essential to read each agreement carefully.

- Late payments are not a big deal. There is a misconception that late payments will not significantly impact the agreement. However, consistent late payments can lead to penalties and damage your credit score.

- You can easily cancel the agreement. Many believe that they can simply walk away from the agreement without consequences. In reality, canceling a repayment agreement often involves penalties and can have lasting financial repercussions.

Being aware of these misconceptions can help individuals make informed decisions regarding their vehicle financing. Always take the time to read and understand the terms of any agreement before signing.

Common mistakes

-

Incomplete Information: Failing to provide all required personal details can lead to delays. This includes missing names, addresses, or contact information.

-

Incorrect Vehicle Details: Listing the wrong make, model, or VIN of the vehicle can cause issues. It is essential to verify that all vehicle information matches official documents.

-

Not Reading Terms Carefully: Overlooking the terms and conditions can result in misunderstandings. Individuals should ensure they understand their obligations before signing.

-

Signature Errors: Forgetting to sign or providing an illegible signature can invalidate the agreement. A clear and proper signature is necessary for the document to be effective.

Popular Templates

Parking Lease Agreement - Emergency contact information related to the parking space may be included.

A Living Will Is Written to Indicate - A Living Will is a thoughtful gift to your loved ones, sparing them from making tough choices.

This Investment Letter of Intent serves a crucial role in the investment process. To ensure that you are well-prepared, understand how to effectively utilize an Investment Letter of Intent template for your needs, which simplifies the drafting phase and clarifies commitments between parties.

Purchase Agreement Addendum - Provide changes regarding warranties or guarantees with this form.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Governing Law | Each state has specific laws governing vehicle loans, which influence the structure of the repayment agreement. |

| Essential Components | This form typically includes details such as loan amount, interest rate, repayment schedule, and consequences of default. |

| Signatures Required | Both the borrower and the lender must sign the agreement to make it legally binding. |

| State Variations | Some states may have unique requirements or additional disclosures that must be included in the form. |

| Consumer Protection | Many states have consumer protection laws that ensure borrowers are treated fairly in vehicle loan agreements. |

| Record Keeping | It’s crucial for both parties to keep a copy of the signed agreement for their records, as it serves as proof of the terms agreed upon. |

Similar forms

The Vehicle Repayment Agreement form shares similarities with a Loan Agreement. Both documents outline the terms of borrowing money to purchase a vehicle. They specify the loan amount, interest rate, repayment schedule, and consequences of default. A Loan Agreement can be used for various types of loans, but when it pertains to vehicle financing, it often includes clauses specific to the vehicle’s condition and ownership. This ensures both parties understand their obligations and rights regarding the vehicle and the repayment of the loan.

Another document that resembles the Vehicle Repayment Agreement is the Promissory Note. A Promissory Note is a written promise to pay a specified amount of money at a designated time. Like the Vehicle Repayment Agreement, it includes details such as the principal amount, interest rate, and payment schedule. The key difference lies in the level of detail regarding the collateral. While a Vehicle Repayment Agreement explicitly ties the loan to the vehicle, a Promissory Note may not specify the collateral unless explicitly stated.

The Vehicle Repayment Agreement is also similar to a Bill of Sale, particularly in the context of vehicle transactions. A Bill of Sale documents the transfer of ownership of a vehicle from one party to another. While it primarily serves as proof of sale, it may also include terms regarding payment. If the vehicle is being financed, the Bill of Sale may reference the Vehicle Repayment Agreement to clarify that the buyer has not yet fully paid for the vehicle. This connection ensures that both parties are aware of the financial arrangement involved in the sale.

When seeking to join a sorority, having a Sorority Recommendation Letter can be crucial in presenting your candidacy favorably. This unique document not only outlines your strengths but also provides insight into your character through the endorsement of an alumna. To better understand the composition of such letters, resources like TopTemplates.info can be invaluable in guiding prospective members through the process.

Lastly, the Vehicle Repayment Agreement can be compared to a Security Agreement. A Security Agreement is used to outline the terms under which a borrower offers an asset as collateral for a loan. In the context of vehicle financing, the Vehicle Repayment Agreement often includes a security clause that identifies the vehicle as collateral. This means that if the borrower defaults, the lender has the right to reclaim the vehicle. Both documents work together to protect the interests of the lender while providing the borrower with the necessary funds to purchase the vehicle.