Blank Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TOD Deed) serves as a valuable estate planning tool, allowing property owners to designate beneficiaries who will receive their real estate upon their death without the need for probate. This straightforward form is particularly beneficial for individuals looking to simplify the transfer of their property, ensuring that their loved ones can inherit their assets quickly and efficiently. By filling out a TOD Deed, property owners can retain full control over their property during their lifetime, with the transfer occurring automatically upon their passing. Additionally, the form can be revoked or modified at any time, providing flexibility as circumstances change. It is essential to understand the requirements and implications of using a TOD Deed, including state-specific regulations and the importance of proper execution, to ensure that the intended transfer takes place smoothly. Overall, the Transfer-on-Death Deed can be an effective way to manage property transfers while minimizing legal complications for heirs.

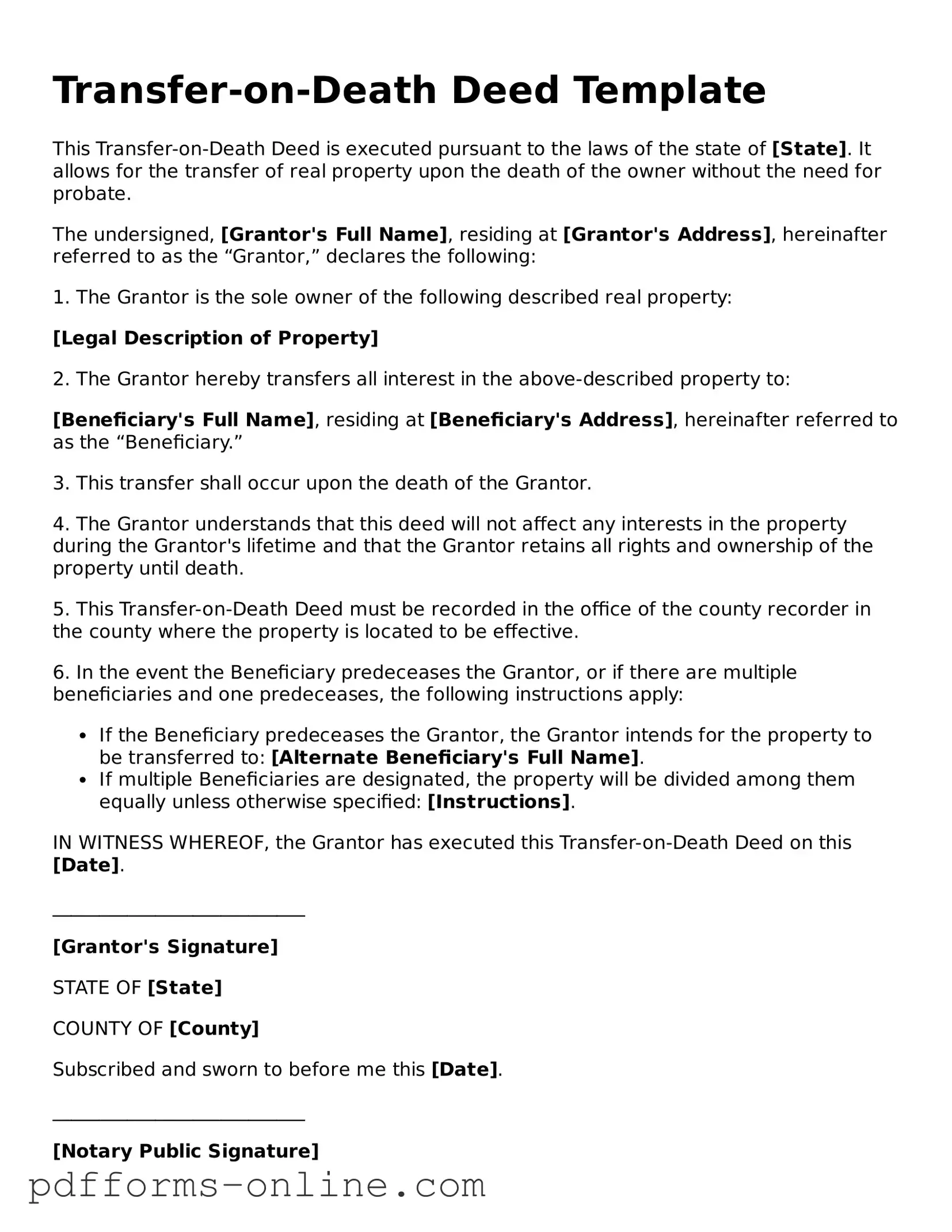

Document Example

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to the laws of the state of [State]. It allows for the transfer of real property upon the death of the owner without the need for probate.

The undersigned, [Grantor's Full Name], residing at [Grantor's Address], hereinafter referred to as the “Grantor,” declares the following:

1. The Grantor is the sole owner of the following described real property:

[Legal Description of Property]

2. The Grantor hereby transfers all interest in the above-described property to:

[Beneficiary's Full Name], residing at [Beneficiary's Address], hereinafter referred to as the “Beneficiary.”

3. This transfer shall occur upon the death of the Grantor.

4. The Grantor understands that this deed will not affect any interests in the property during the Grantor's lifetime and that the Grantor retains all rights and ownership of the property until death.

5. This Transfer-on-Death Deed must be recorded in the office of the county recorder in the county where the property is located to be effective.

6. In the event the Beneficiary predeceases the Grantor, or if there are multiple beneficiaries and one predeceases, the following instructions apply:

- If the Beneficiary predeceases the Grantor, the Grantor intends for the property to be transferred to: [Alternate Beneficiary's Full Name].

- If multiple Beneficiaries are designated, the property will be divided among them equally unless otherwise specified: [Instructions].

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this [Date].

___________________________

[Grantor's Signature]

STATE OF [State]

COUNTY OF [County]

Subscribed and sworn to before me this [Date].

___________________________

[Notary Public Signature]

[Notary Public Name]

My commission expires: [Date]

State-specific Guides for Transfer-on-Death Deed Documents

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to designate one or more beneficiaries to receive their property upon their death. This deed does not transfer ownership until the owner passes away, allowing the owner to retain full control during their lifetime.

-

How does a Transfer-on-Death Deed work?

When the property owner dies, the property automatically transfers to the designated beneficiaries without the need for probate. The beneficiaries must provide a certified copy of the death certificate to the local recorder's office to complete the transfer.

-

Who can be named as a beneficiary?

Beneficiaries can be individuals, such as family members or friends, or entities like trusts or organizations. It is important to ensure that the beneficiaries are clearly identified in the deed to avoid any confusion.

-

Can a Transfer-on-Death Deed be revoked?

Yes, a TOD Deed can be revoked at any time during the property owner's lifetime. To revoke the deed, the owner must file a new deed that explicitly states the revocation or record a formal revocation document with the local recorder's office.

-

Are there any tax implications?

Generally, the property is not subject to estate taxes upon transfer because it is not considered part of the estate until the owner's death. However, it is advisable to consult a tax professional for specific guidance based on individual circumstances.

-

Can a Transfer-on-Death Deed be used for all types of property?

A TOD Deed can be used for various types of real property, including residential homes, land, and commercial properties. However, it may not apply to personal property, such as vehicles or bank accounts, which require different transfer methods.

-

Is a Transfer-on-Death Deed valid in all states?

Not all states recognize Transfer-on-Death Deeds. It is essential to check the laws in your specific state to determine if this type of deed is valid and what requirements must be met.

-

What are the benefits of using a Transfer-on-Death Deed?

The primary benefit is that it allows for a smooth transfer of property without the need for probate, saving time and costs for the beneficiaries. It also provides the property owner with control over the property during their lifetime.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must complete the form according to your state's requirements. It typically requires the property owner's information, a description of the property, and the beneficiaries' details. After signing, the deed must be recorded with the appropriate local authority.

Misconceptions

Transfer-on-Death Deeds (TOD Deeds) are valuable tools for estate planning, but several misconceptions can lead to confusion. Here are eight common misunderstandings about TOD Deeds:

- TOD Deeds are only for wealthy individuals. Many people believe that only those with significant assets need a TOD Deed. In reality, anyone with property can benefit from this deed, regardless of their financial status.

- A TOD Deed avoids all probate issues. While a TOD Deed can help bypass probate for the property it covers, it does not eliminate probate for other assets. It only applies to the specific property named in the deed.

- You cannot change a TOD Deed once it's created. This is not true. A TOD Deed can be revoked or modified at any time before the owner's death. Flexibility is one of its key advantages.

- A TOD Deed is the same as a will. Although both documents deal with the transfer of property, they serve different purposes. A will goes into effect after death, while a TOD Deed takes effect immediately upon the owner's death.

- The beneficiaries must pay taxes on the property immediately. Beneficiaries typically do not owe taxes on the property until it is sold. However, they should consult with a tax professional for specific advice.

- You must have a lawyer to create a TOD Deed. While consulting a lawyer is advisable for complex situations, many states allow individuals to create TOD Deeds without legal assistance, provided they follow the correct procedures.

- A TOD Deed cannot be contested. Like any estate planning tool, a TOD Deed can be contested under certain circumstances, such as claims of undue influence or lack of capacity.

- Once a TOD Deed is signed, the property is no longer yours. This is a misconception. The owner retains full control over the property during their lifetime, including the right to sell or mortgage it.

Understanding these misconceptions can help individuals make informed decisions about their estate planning needs. Always consider consulting with a professional for personalized advice.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a clear and accurate description of the property. This can lead to confusion or disputes later on.

-

Not Including All Owners: If the property is co-owned, all owners must be listed. Omitting a co-owner can invalidate the deed.

-

Missing Signatures: The form requires the signature of the property owner. Forgetting to sign can render the deed ineffective.

-

Improper Witness or Notary Requirements: Some states require the deed to be witnessed or notarized. Failing to meet these requirements can cause issues with the transfer.

-

Not Recording the Deed: After completing the deed, it must be recorded with the appropriate local government office. Neglecting this step means the transfer may not be recognized.

-

Ignoring State-Specific Rules: Each state has different laws regarding Transfer-on-Death Deeds. Not being aware of these can lead to mistakes that affect the validity of the deed.

Fill out Common Types of Transfer-on-Death Deed Forms

Simple Deed of Gift Template - A Gift Deed can protect the giver by documenting the transfer officially.

Correction Deed California - This corrective action can enhance overall trust in property dealings.

The Texas Hold Harmless Agreement form is a legal document that protects one party from legal and financial responsibilities arising from specific incidents. This agreement is commonly used in situations involving potential risks or damages and can be obtained through resources like OnlineLawDocs.com. It is tailored to ensure that individuals or entities can conduct business or engage in activities within Texas without worrying about unforeseen liabilities.

Deed in Lieu of Foreclosure - Completing this form can enable financial institutions to acquire properties with fewer costs and time.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows an individual to transfer real property to a designated beneficiary upon the individual's death without going through probate. |

| Governing Law | The use and regulation of Transfer-on-Death Deeds vary by state. For example, in California, it is governed by California Probate Code Section 5600. |

| Beneficiary Designation | Individuals can name one or more beneficiaries in the deed. The transfer occurs automatically upon the death of the owner. |

| Revocability | A Transfer-on-Death Deed can be revoked or changed by the property owner at any time before their death. |

| Effect on Ownership | During the owner's lifetime, the property remains under their control. The beneficiary has no rights to the property until the owner's death. |

| Tax Implications | The property may still be subject to estate taxes, and beneficiaries may face capital gains taxes when they sell the property after inheriting it. |

| Filing Requirements | In many states, the TOD Deed must be recorded with the county recorder's office to be valid. This typically occurs before the owner's death. |

| Limitations | Some states may have restrictions on the types of property that can be transferred using a TOD Deed, such as certain types of real estate or interests. |

Similar forms

The Transfer-on-Death Deed (TOD) form allows individuals to transfer real estate to beneficiaries upon their death without going through probate. This document is similar to a Will, which also dictates the distribution of assets after death. However, a Will takes effect only after the testator's death and requires probate, while a TOD deed allows for direct transfer, bypassing the probate process entirely. This can simplify the transfer of property and reduce associated costs.

For those looking to establish a limited liability company, understanding the nuances of various legal documents is essential. The documentonline.org/blank-new-york-operating-agreement serves as a valuable resource for business owners navigating the complexities of forming an LLC, ensuring clarity in governance and operational procedures.

A Living Trust is another document that shares similarities with the Transfer-on-Death Deed. Like the TOD, a Living Trust allows for the transfer of assets outside of probate. In a Living Trust, assets are placed into a trust during the grantor's lifetime, and beneficiaries receive them upon the grantor's death. The key difference lies in the management of assets; a Living Trust can provide for the grantor’s needs during their lifetime, while a TOD deed is strictly a transfer mechanism upon death.