Valid Texas Transfer-on-Death Deed Template

The Texas Transfer-on-Death Deed (TODD) form offers a unique and innovative approach to estate planning, allowing individuals to transfer real property to designated beneficiaries upon their death without the need for probate. This form serves as a powerful tool for property owners who wish to ensure a smooth transition of their assets while minimizing the complexities often associated with traditional inheritance processes. By executing a TODD, a property owner retains full control over their property during their lifetime, as the deed does not take effect until their passing. Importantly, this form must be properly executed and recorded to be valid, requiring the signature of the property owner and acknowledgment by a notary public. The beneficiaries named in the deed receive the property automatically, bypassing the probate court entirely, which can save both time and money. However, it is crucial for individuals to understand the implications of designating beneficiaries, as well as the potential effects on their overall estate plan. The Texas Transfer-on-Death Deed thus represents a strategic option for those looking to simplify the transfer of real estate while ensuring their wishes are honored after they are gone.

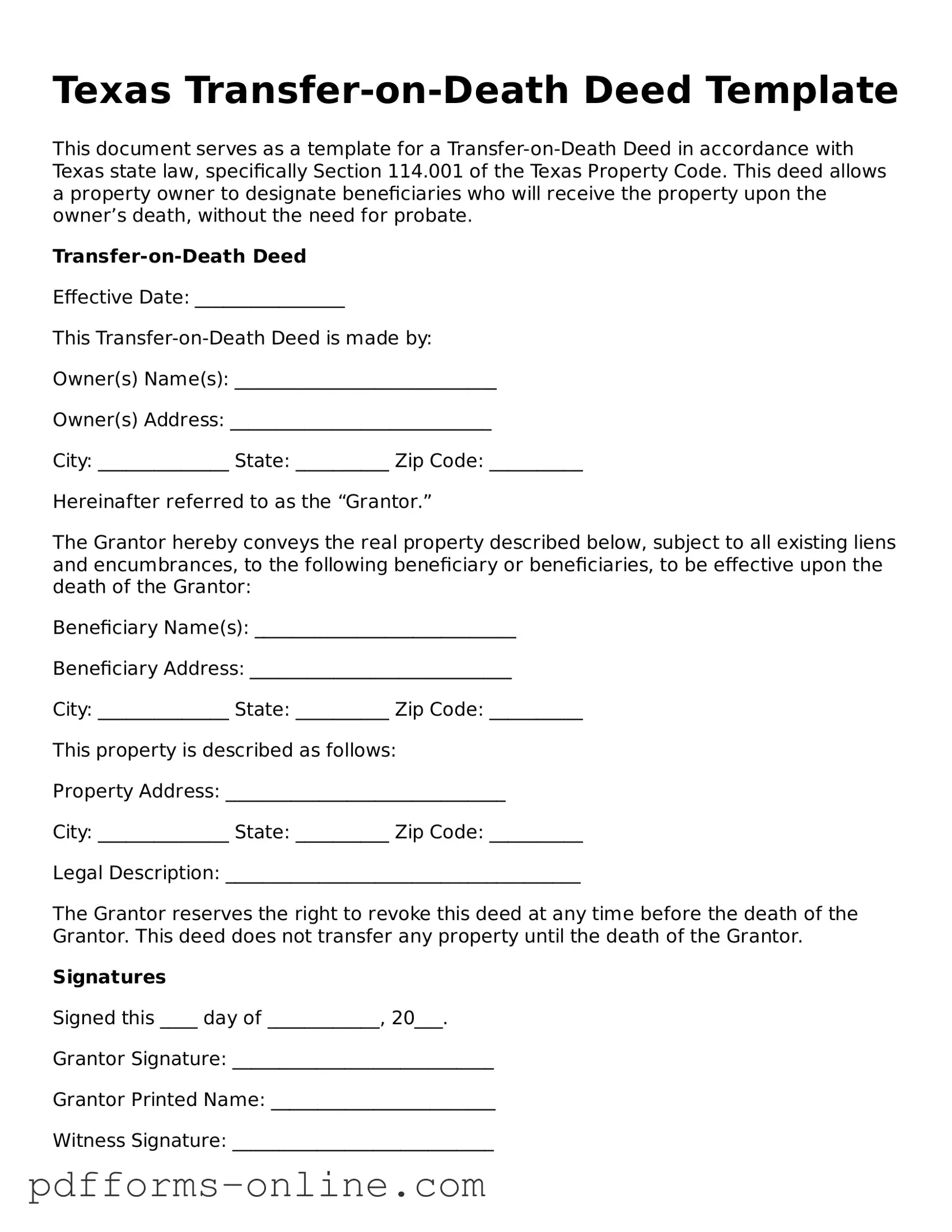

Document Example

Texas Transfer-on-Death Deed Template

This document serves as a template for a Transfer-on-Death Deed in accordance with Texas state law, specifically Section 114.001 of the Texas Property Code. This deed allows a property owner to designate beneficiaries who will receive the property upon the owner’s death, without the need for probate.

Transfer-on-Death Deed

Effective Date: ________________

This Transfer-on-Death Deed is made by:

Owner(s) Name(s): ____________________________

Owner(s) Address: ____________________________

City: ______________ State: __________ Zip Code: __________

Hereinafter referred to as the “Grantor.”

The Grantor hereby conveys the real property described below, subject to all existing liens and encumbrances, to the following beneficiary or beneficiaries, to be effective upon the death of the Grantor:

Beneficiary Name(s): ____________________________

Beneficiary Address: ____________________________

City: ______________ State: __________ Zip Code: __________

This property is described as follows:

Property Address: ______________________________

City: ______________ State: __________ Zip Code: __________

Legal Description: ______________________________________

The Grantor reserves the right to revoke this deed at any time before the death of the Grantor. This deed does not transfer any property until the death of the Grantor.

Signatures

Signed this ____ day of ____________, 20___.

Grantor Signature: ____________________________

Grantor Printed Name: ________________________

Witness Signature: ____________________________

Witness Printed Name: ________________________

Notarization (if required):

State of Texas

County of _________________

Subscribed, sworn to, and acknowledged before me this ____ day of ____________, 20___.

Notary Public Signature: _____________________

Notary Printed Name: ________________________

My Commission Expires: ______________________

This deed shall be recorded in the county where the property is located.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This deed enables property owners to retain full control of their property during their lifetime while ensuring that the property passes directly to the beneficiary without the need for probate.

-

How do I create a Transfer-on-Death Deed in Texas?

To create a TOD Deed in Texas, the property owner must complete the appropriate form, which includes details such as the property description and the beneficiary's information. The deed must be signed by the owner and notarized. After completion, it should be filed with the county clerk in the county where the property is located. It is essential to ensure that the deed is executed properly to avoid any legal issues in the future.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner’s death. To do this, the owner must execute a new TOD Deed that explicitly revokes the previous one or file a revocation form with the county clerk. It is crucial to follow the proper procedures to ensure that the changes are legally recognized.

-

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed will typically become void unless there are alternative beneficiaries named in the deed. In such cases, the property may pass according to the owner’s will or, if there is no will, according to Texas intestacy laws. It is advisable to review and update the deed regularly to reflect any changes in circumstances.

Misconceptions

Understanding the Texas Transfer-on-Death Deed (TODD) is important for anyone considering estate planning in Texas. However, there are several misconceptions surrounding this legal tool. Here are ten common misunderstandings:

- It is a Will. Many people think a Transfer-on-Death Deed is the same as a will. In reality, it is a separate document that allows property to transfer directly to a beneficiary upon the owner's death, bypassing probate.

- It can transfer any type of property. Some believe that TODDs can be used for all types of property. However, they are only valid for real estate, not personal property or financial accounts.

- It requires witnesses or notarization. A common misconception is that TODDs need to be witnessed or notarized. In Texas, a TODD must be signed by the property owner but does not need witnesses or notarization to be valid.

- It can be revoked easily. While a Transfer-on-Death Deed can be revoked, the process is not as simple as just changing your mind. The owner must follow specific steps to revoke the deed formally.

- It automatically transfers all property. Some people think that a TODD transfers all of a person's property. However, it only applies to the specific property mentioned in the deed.

- Beneficiaries have immediate access to the property. Many assume that beneficiaries can access the property as soon as the owner passes away. In truth, they must wait until the owner’s death and the deed is recorded.

- It is only for married couples. Some believe that only married couples can use a TODD. In fact, any individual can create a Transfer-on-Death Deed to benefit anyone they choose.

- It avoids all taxes. A misconception exists that using a TODD eliminates all taxes. While it can help avoid probate taxes, beneficiaries may still owe property taxes or capital gains taxes.

- It is permanent once filed. Some think that once a TODD is filed, it cannot be changed. However, property owners can modify or revoke the deed as long as they follow the proper procedures.

- It is a complicated process. Many fear that creating a Transfer-on-Death Deed is overly complicated. In reality, it is a straightforward process that can provide peace of mind for property owners.

By clearing up these misconceptions, individuals can make informed decisions about their estate planning and the use of Transfer-on-Death Deeds in Texas.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the names of the grantor and grantee, can invalidate the deed.

-

Incorrect Legal Descriptions: Using inaccurate or vague property descriptions may lead to confusion and potential disputes over property ownership.

-

Not Following Signature Requirements: The deed must be signed by the grantor. If the signature is missing or improperly executed, the deed may not be recognized.

-

Failure to Record the Deed: Not filing the deed with the county clerk's office means it won't be legally effective upon the grantor's death.

-

Improper Witnessing: Some individuals may overlook the need for witnesses or notarization, depending on local laws, which can affect the deed's validity.

-

Confusing Joint Ownership: Misunderstanding how joint ownership works can lead to complications, especially if multiple parties are involved.

-

Ignoring Existing Liens or Mortgages: Not accounting for existing debts tied to the property can create issues for the heirs.

-

Not Updating the Deed: Failing to revise the deed after significant life changes, such as marriage or divorce, may lead to unintended consequences.

Find Some Other Transfer-on-Death Deed Forms for Specific States

How Much Does It Cost to Do a Transfer on Death Deed - The deed can help reduce stress for your loved ones during a difficult time.

Transfer on Death Deed Nc - The property remains under the owner’s control during their lifetime, with no immediate impact on ownership.

Transfer on Death Deed Form Florida - The deed should be filed with the county recorder's office to ensure it is recognized legally.

An Arizona Deed form is a legal document used to transfer ownership of real estate from one person to another in the state of Arizona. This form ensures the new owner's rights are protected while clearly documenting the transaction. For those looking to complete a property transfer, click the button below to fill out your form accurately and securely, and refer to All Arizona Forms for more information.

Can a Transfer on Death Account Be Contested - It allows property owners to retain full control until death while ensuring a seamless transfer to heirs.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Texas Estates Code, Title 2, Chapter 114. |

| Eligibility | Any individual who owns real estate in Texas can create a Transfer-on-Death Deed to designate beneficiaries. |

| Revocation | The deed can be revoked or modified at any time before the property owner's death, provided the changes are properly recorded. |

| Execution Requirements | The deed must be signed by the property owner and acknowledged by a notary public to be valid. |

Similar forms

The Texas Transfer-on-Death Deed is similar to a Last Will and Testament. Both documents serve to transfer property upon the death of the owner. However, a key difference lies in the timing of the transfer. A will takes effect only after the owner's death and must go through probate, while a Transfer-on-Death Deed allows the property to pass directly to the beneficiary without the need for probate, making the process simpler and quicker for the heirs.

An Affidavit of Heirship also shares similarities with the Transfer-on-Death Deed. This document is used to establish the heirs of a deceased person when there is no will. Like the Transfer-on-Death Deed, it helps clarify ownership and can facilitate the transfer of property. However, the Affidavit of Heirship is typically used after death, while the Transfer-on-Death Deed is executed during the owner’s lifetime, allowing for a smoother transition of property ownership.

For those looking to facilitate the sale of their recreational vehicle, understanding the importance of a properly executed document is crucial. Utilizing a fillable form can streamline this process, making it easier for both parties involved. You can find a comprehensive resource outlining the necessary steps in the RV Bill of Sale process.

The General Power of Attorney is also comparable to the Transfer-on-Death Deed in that it involves the transfer of rights related to property. A General Power of Attorney allows someone to act on behalf of another person regarding financial and legal matters. However, it is effective during the person’s lifetime, while the Transfer-on-Death Deed only takes effect after death. Both documents can be used to manage property, but their purposes and timing differ significantly.

Lastly, the Revocable Living Trust shares similarities with the Transfer-on-Death Deed. Both documents are designed to facilitate the transfer of assets upon death without going through probate. A Revocable Living Trust allows the creator to manage their assets during their lifetime and specifies how those assets should be distributed after death. While the Transfer-on-Death Deed applies specifically to real estate, a Revocable Living Trust can encompass a broader range of assets, offering more comprehensive estate planning options.