Valid Texas Quitclaim Deed Template

The Texas Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in real estate without guaranteeing the title's validity. This straightforward document allows one party, known as the grantor, to convey their rights to another party, the grantee, often without the complexities associated with other deed types. Unlike warranty deeds, a quitclaim deed does not come with any promises regarding the property's title; thus, it is commonly used in situations such as transferring property between family members, settling estates, or clearing up title issues. The form requires specific information, including the names of the parties involved, a legal description of the property, and the signature of the grantor. It must also be notarized to ensure its validity. Understanding the nuances of this form is essential for anyone considering a property transfer in Texas, as it helps clarify ownership and can facilitate smoother transactions.

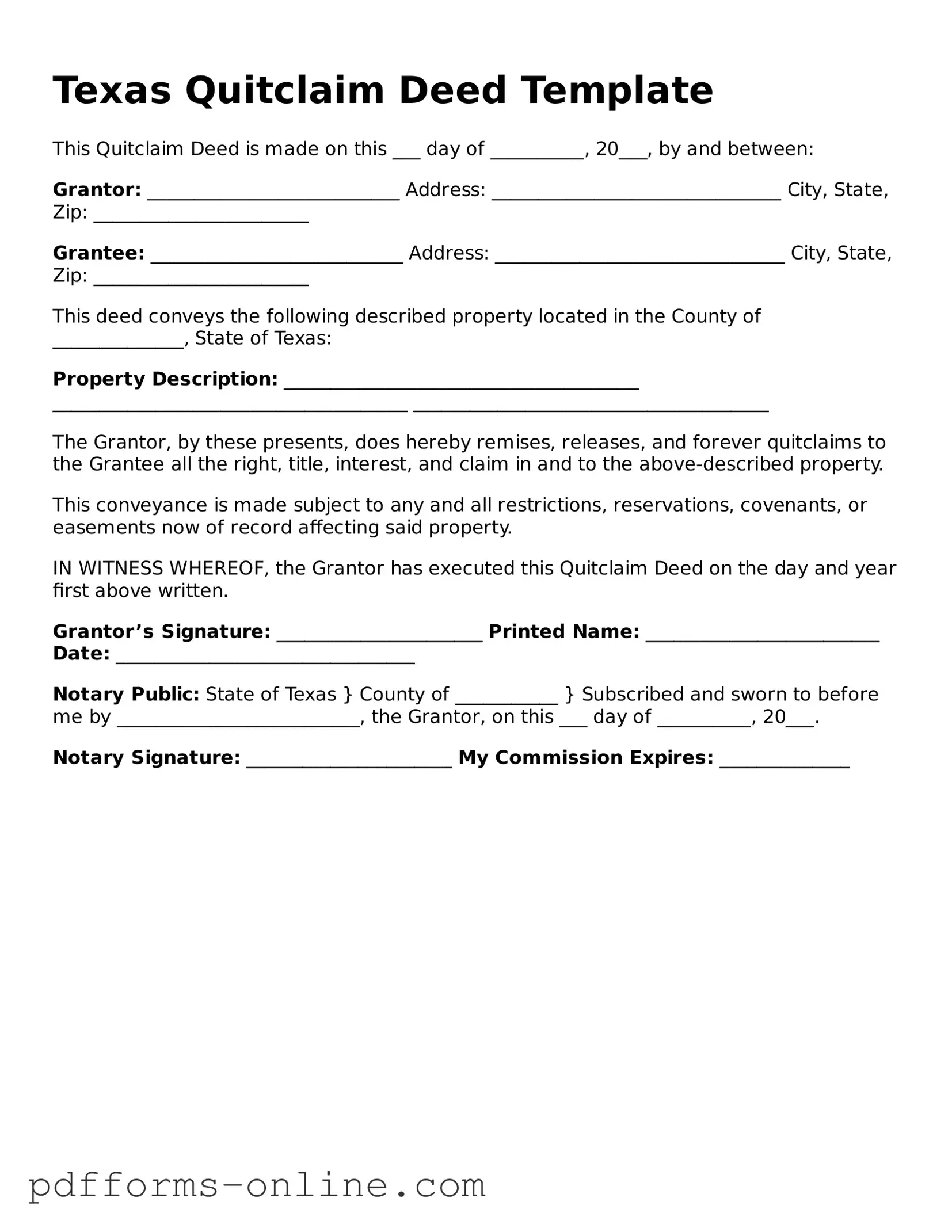

Document Example

Texas Quitclaim Deed Template

This Quitclaim Deed is made on this ___ day of __________, 20___, by and between:

Grantor: ___________________________ Address: _______________________________ City, State, Zip: _______________________

Grantee: ___________________________ Address: _______________________________ City, State, Zip: _______________________

This deed conveys the following described property located in the County of ______________, State of Texas:

Property Description: ______________________________________ ______________________________________ ______________________________________

The Grantor, by these presents, does hereby remises, releases, and forever quitclaims to the Grantee all the right, title, interest, and claim in and to the above-described property.

This conveyance is made subject to any and all restrictions, reservations, covenants, or easements now of record affecting said property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor’s Signature: ______________________ Printed Name: _________________________ Date: ________________________________

Notary Public: State of Texas } County of ___________ } Subscribed and sworn to before me by __________________________, the Grantor, on this ___ day of __________, 20___.

Notary Signature: ______________________ My Commission Expires: ______________

Frequently Asked Questions

-

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property's title. This type of deed is often used among family members or in situations where the seller does not want to be held liable for any title issues that may arise after the transfer. Unlike a warranty deed, a quitclaim deed does not provide any warranties regarding the quality of the title being transferred.

-

When should I use a Quitclaim Deed in Texas?

Quitclaim Deeds are particularly useful in specific scenarios. They are commonly used for:

- Transferring property between family members, such as in cases of inheritance or divorce.

- Clearing up title issues, such as when a property owner wants to remove an ex-spouse's name from the title.

- Transferring property into a trust or business entity.

However, it is important to remember that a quitclaim deed does not guarantee that the property is free of liens or other claims.

-

How do I complete a Quitclaim Deed in Texas?

Completing a Quitclaim Deed involves several key steps:

- Identify the parties involved: Clearly state the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Describe the property: Include a legal description of the property, which can usually be found on the original deed or tax documents.

- Sign the document: The grantor must sign the quitclaim deed in front of a notary public. This step is crucial for the deed to be legally binding.

- File the deed: After notarization, the deed should be filed with the county clerk's office in the county where the property is located.

-

Are there any risks associated with using a Quitclaim Deed?

Yes, there are some risks to consider. Since a quitclaim deed offers no warranties, the grantee assumes the risk of any title issues that may exist. If there are outstanding liens, debts, or claims against the property, the new owner may be held responsible. Therefore, it is advisable to conduct a title search before completing the transfer. Additionally, consulting with a real estate attorney can provide further guidance and help mitigate potential risks.

Misconceptions

Many people hold misconceptions about the Texas Quitclaim Deed form. Understanding these misconceptions can help individuals make informed decisions regarding property transfers. Here are ten common misconceptions:

-

Quitclaim deeds transfer ownership completely.

While a quitclaim deed transfers whatever interest the grantor has in the property, it does not guarantee that the grantor actually owns the property. If the grantor has no legal claim, the recipient receives nothing.

-

Quitclaim deeds are only used between family members.

Although they are often used in family transactions, quitclaim deeds can be used in any situation where property ownership needs to be transferred, including sales or transfers between strangers.

-

A quitclaim deed eliminates all liabilities.

Transferring property with a quitclaim deed does not eliminate any existing liens or debts associated with that property. The new owner may still be responsible for these obligations.

-

Quitclaim deeds are only for residential properties.

Quitclaim deeds can be used for any type of property, including commercial real estate, land, and personal property. The form is versatile and not limited to residential transactions.

-

A quitclaim deed is the same as a warranty deed.

A warranty deed provides guarantees about the property’s title and ownership, while a quitclaim deed does not offer any such assurances. This is a crucial distinction.

-

Quitclaim deeds are difficult to create.

In reality, quitclaim deeds are relatively simple to draft. They typically require basic information about the parties involved and a description of the property.

-

Once a quitclaim deed is signed, it cannot be revoked.

While a quitclaim deed is effective upon signing and delivery, it can be revoked or challenged in certain circumstances, such as fraud or lack of capacity.

-

Quitclaim deeds must be notarized to be valid.

While notarization is strongly recommended to ensure validity and prevent disputes, it is not a strict requirement for the deed to be legally effective in Texas.

-

All property transfers require a quitclaim deed.

Not all property transfers necessitate a quitclaim deed. Different situations may call for different types of deeds, depending on the specifics of the transaction.

-

Using a quitclaim deed is always the best option.

While quitclaim deeds are useful in certain situations, they may not be the best choice for every property transfer. It is essential to evaluate the specific circumstances before deciding on the type of deed to use.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details, such as the full legal names of the grantor and grantee. Missing information can lead to delays or legal complications.

-

Incorrect Property Description: A common mistake is using an inaccurate or vague description of the property. It is crucial to include the correct address and legal description to avoid future disputes.

-

Failure to Sign: The deed must be signed by the grantor. Omitting a signature invalidates the document, rendering it ineffective in transferring property ownership.

-

Not Notarizing the Document: In Texas, a quitclaim deed requires notarization. Without a notary's acknowledgment, the deed may not be accepted by the county clerk for recording.

-

Improper Execution: The deed must be executed according to state laws. Failing to follow the correct procedure can lead to the deed being challenged in the future.

-

Ignoring Local Requirements: Different counties may have specific requirements for filing a quitclaim deed. Not checking local regulations can result in rejection of the document.

-

Not Recording the Deed: After completing the quitclaim deed, it is essential to record it with the county clerk. Failing to do so can lead to issues with property rights and ownership claims.

Find Some Other Quitclaim Deed Forms for Specific States

Quit Claim Deed Florida - A Quitclaim Deed can help facilitate straightforward property donations.

Quitclaim Deed Form Ohio - When there’s no monetary exchange, a Quitclaim Deed can streamline the process.

Quick Claim Deed Illinois - A quitclaim deed is a legal document to transfer property ownership without warranty.

Quit Claim Deed Sample - The process is typically quicker and less formal than other forms of deed transfer.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed transfers ownership of real property without guaranteeing the title. |

| Governing Law | The Texas Property Code governs the use and execution of quitclaim deeds in Texas. |

| Parties Involved | The grantor (seller) and grantee (buyer) are the two main parties involved in the deed. |

| Consideration | While not required, a nominal consideration is often included to validate the transaction. |

| Execution Requirements | The deed must be signed by the grantor and acknowledged before a notary public. |

| Recording | To protect the grantee's interest, the deed should be recorded in the county where the property is located. |

| Limitations | A quitclaim deed does not clear any existing liens or encumbrances on the property. |

| Use Cases | Commonly used among family members or in divorce settlements to transfer property rights. |

Similar forms

The Texas Warranty Deed is a document that, like the Quitclaim Deed, facilitates the transfer of property ownership. However, it provides a greater level of assurance to the buyer. In a Warranty Deed, the seller guarantees that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding the property’s title, the seller is legally responsible for resolving them. The Quitclaim Deed, in contrast, does not offer such guarantees, making it a more straightforward, but riskier option for the buyer.

The Texas Special Warranty Deed is another document similar to the Quitclaim Deed. This type of deed also transfers ownership of property but includes limited warranties. The seller guarantees that they have not encumbered the property during their ownership but does not provide any assurances about prior claims or issues. This makes the Special Warranty Deed a middle ground between the Quitclaim Deed and the Warranty Deed, offering some protection while still being less comprehensive than a full Warranty Deed.

The Texas Grant Deed is similar in that it also serves to transfer property ownership. However, it typically includes implied warranties that the property has not been sold to anyone else and is free from undisclosed encumbrances. Unlike the Quitclaim Deed, which offers no warranties, the Grant Deed provides a degree of security to the buyer, making it a more favorable option for those concerned about title issues.

The Texas Deed of Trust is another document related to property transactions, though it serves a different purpose. This document is used to secure a loan with real estate as collateral. While it does not transfer ownership like the Quitclaim Deed, it does involve property rights and can be crucial in the context of real estate financing. The Quitclaim Deed may be used in conjunction with a Deed of Trust to transfer ownership after a loan is paid off.

The Texas Affidavit of Heirship is similar in that it deals with property ownership, particularly in the context of inheritance. When a property owner passes away without a will, this affidavit can establish the heirs' rights to the property. While the Quitclaim Deed transfers ownership directly, the Affidavit of Heirship provides a legal basis for those heirs to claim ownership, making it an important document in estate planning and property transfer after death.

Finally, the Texas Bill of Sale is a document that, while primarily used for personal property, shares similarities with the Quitclaim Deed in terms of transferring ownership. A Bill of Sale provides proof of the sale and transfer of ownership of personal property, such as vehicles or equipment. While the Quitclaim Deed pertains to real estate, both documents serve to formalize the transfer of ownership and protect the interests of the parties involved.