Valid Texas Promissory Note Template

The Texas Promissory Note is a crucial document for anyone involved in lending or borrowing money in Texas. This form outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payments. It serves as a legal agreement between the lender and borrower, ensuring that both parties understand their rights and responsibilities. Additionally, the note can specify whether it is secured or unsecured, which can significantly impact the lender's ability to recover funds in case of default. Understanding the nuances of this form is essential for both parties to avoid potential disputes and ensure a smooth transaction. By clearly defining the terms, the Texas Promissory Note helps create a solid foundation for financial agreements, promoting trust and accountability in lending practices.

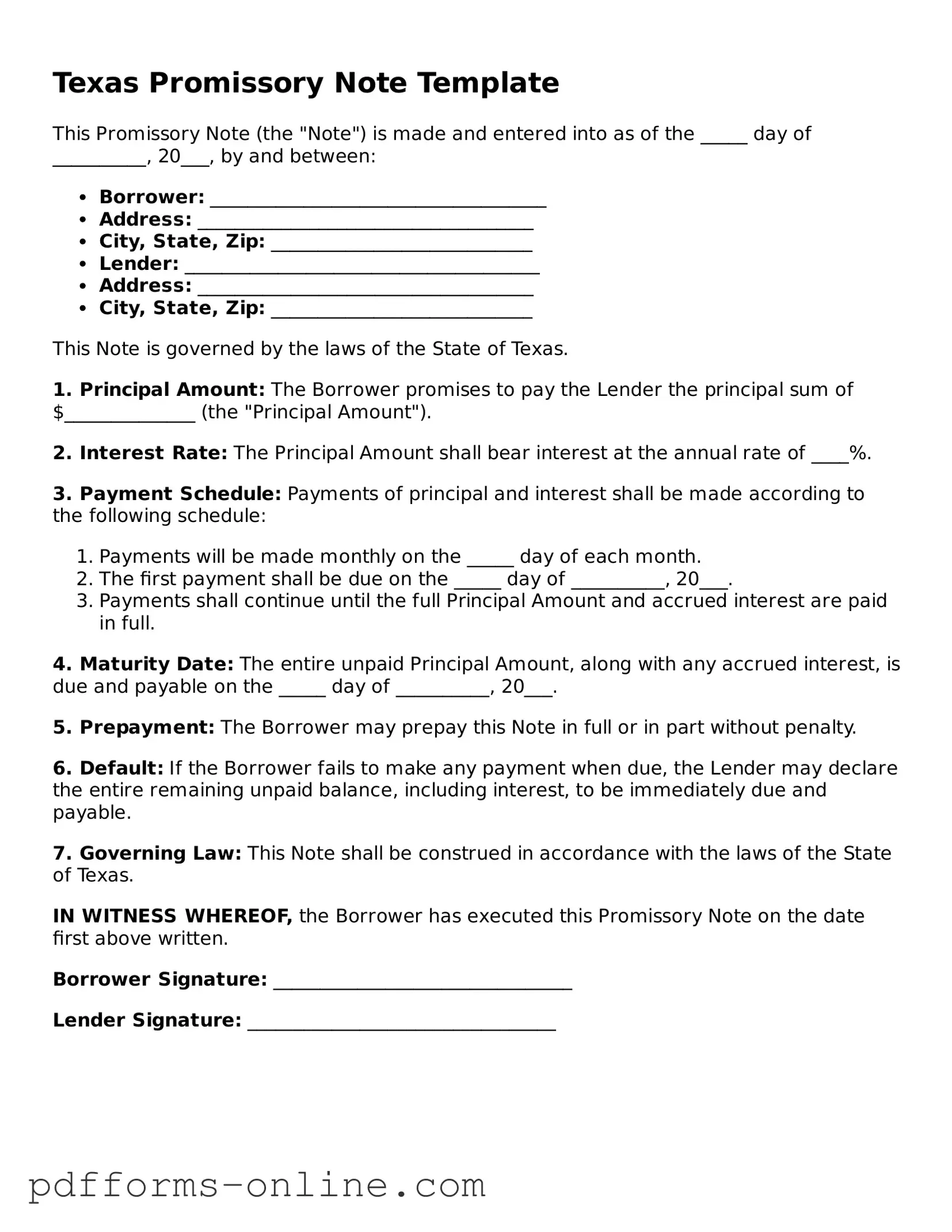

Document Example

Texas Promissory Note Template

This Promissory Note (the "Note") is made and entered into as of the _____ day of __________, 20___, by and between:

- Borrower: ____________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

- Lender: ______________________________________

- Address: ____________________________________

- City, State, Zip: ____________________________

This Note is governed by the laws of the State of Texas.

1. Principal Amount: The Borrower promises to pay the Lender the principal sum of $______________ (the "Principal Amount").

2. Interest Rate: The Principal Amount shall bear interest at the annual rate of ____%.

3. Payment Schedule: Payments of principal and interest shall be made according to the following schedule:

- Payments will be made monthly on the _____ day of each month.

- The first payment shall be due on the _____ day of __________, 20___.

- Payments shall continue until the full Principal Amount and accrued interest are paid in full.

4. Maturity Date: The entire unpaid Principal Amount, along with any accrued interest, is due and payable on the _____ day of __________, 20___.

5. Prepayment: The Borrower may prepay this Note in full or in part without penalty.

6. Default: If the Borrower fails to make any payment when due, the Lender may declare the entire remaining unpaid balance, including interest, to be immediately due and payable.

7. Governing Law: This Note shall be construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note on the date first above written.

Borrower Signature: ________________________________

Lender Signature: _________________________________

Frequently Asked Questions

-

What is a Texas Promissory Note?

A Texas Promissory Note is a written agreement in which one party (the borrower) promises to pay a specific amount of money to another party (the lender) at a defined time or on demand. This document outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payment.

-

What are the key components of a Texas Promissory Note?

The essential components of a Texas Promissory Note include:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties.

-

Is a Texas Promissory Note legally binding?

Yes, a properly executed Texas Promissory Note is legally binding. Once both parties sign the document, it creates an enforceable obligation. If the borrower fails to repay the loan as agreed, the lender may take legal action to recover the owed amount.

-

Do I need a lawyer to create a Texas Promissory Note?

While it is not mandatory to hire a lawyer to draft a Texas Promissory Note, it can be beneficial. A legal professional can ensure that the document complies with Texas laws and adequately protects the interests of both parties.

-

Can a Texas Promissory Note be modified?

Yes, a Texas Promissory Note can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended agreement to maintain its enforceability.

-

What happens if the borrower defaults on the Texas Promissory Note?

If the borrower defaults, the lender has several options. They may initiate legal proceedings to recover the owed amount, potentially leading to a court judgment. Additionally, the lender may charge late fees as outlined in the note.

-

Are there any specific state laws that apply to Texas Promissory Notes?

Yes, Texas has specific laws governing promissory notes. These laws outline the rights and responsibilities of both lenders and borrowers. It is advisable to familiarize oneself with these regulations to ensure compliance and protect one’s interests.

Misconceptions

Understanding the Texas Promissory Note form is essential for anyone involved in lending or borrowing money in Texas. However, several misconceptions can lead to confusion. Below is a list of common misconceptions along with clarifications.

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, they can vary significantly based on state laws, terms, and specific agreements between the parties involved.

- A Promissory Note Does Not Need to Be Written: Some think a verbal agreement suffices. While verbal agreements can be enforceable, having a written promissory note provides clear evidence of the terms and is generally recommended.

- Only Banks Use Promissory Notes: It is a common misconception that only financial institutions utilize promissory notes. Individuals and businesses frequently use them for personal loans, business transactions, and other financial arrangements.

- Promissory Notes Are Non-Enforceable: Some believe that promissory notes lack legal standing. In fact, when properly executed, they are enforceable contracts that can be upheld in court.

- All Promissory Notes Must Be Notarized: While notarization can add credibility, it is not a requirement for all promissory notes in Texas. However, notarizing can help prevent disputes regarding the authenticity of the document.

- Interest Rates Are Fixed: There is a belief that interest rates on promissory notes cannot be changed. In reality, the interest rate can be negotiated and specified in the note, allowing flexibility based on the agreement.

- Promissory Notes Are Only for Large Amounts: Many assume that promissory notes are only used for significant loans. However, they can be used for any amount, regardless of size, making them versatile for various financial situations.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes and ensure their agreements are clear and enforceable.

Common mistakes

-

Incomplete Borrower Information: Failing to provide full names, addresses, and contact details of all borrowers can lead to confusion and delays.

-

Incorrect Loan Amount: Entering the wrong amount can create legal issues. Ensure the figure matches the agreed terms.

-

Missing Interest Rate: Not specifying an interest rate or leaving it blank can result in misunderstandings about repayment obligations.

-

Improper Payment Schedule: Failing to outline the payment schedule clearly can lead to missed payments and disputes.

-

Neglecting to Include Late Fees: Omitting details about late fees can complicate enforcement of the agreement if payments are delayed.

-

Not Signing the Document: A common oversight is neglecting to sign the note. Without signatures, the document may not be legally binding.

-

Ignoring Witness or Notary Requirements: Depending on the situation, failing to have the document witnessed or notarized can affect its validity.

-

Ambiguous Language: Using vague terms can create confusion. Clear and concise language is essential for all parties involved.

-

Not Retaining Copies: After signing, failing to keep copies of the promissory note can lead to disputes over the terms later on.

-

Overlooking State-Specific Requirements: Each state may have unique regulations. Ignoring Texas-specific requirements can invalidate the note.

Find Some Other Promissory Note Forms for Specific States

How to Write a Promissory Note Example - It can be customized to fit the unique needs of any lending scenario.

The process of filing the Arizona Articles of Incorporation is essential for anyone looking to create a corporation in Arizona. This form not only outlines your corporation's foundational details, such as its name and purpose, but it's also a gateway to ensuring your business is legally recognized. To access necessary resources and streamline your application, you can refer to All Arizona Forms, which provide valuable information to assist you on this journey.

Loan Note Template - Using this form can streamline the lending process and make terms explicit.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Texas Business and Commerce Code governs promissory notes in Texas. |

| Key Components | Essential components include the amount to be paid, interest rate, payment schedule, and signatures of the parties involved. |

| Types | Promissory notes can be secured or unsecured. Secured notes are backed by collateral. |

| Enforceability | For a promissory note to be enforceable, it must be clear, signed by the borrower, and include all essential terms. |

| Default Consequences | If the borrower defaults, the lender has the right to pursue legal action to recover the owed amount. |

Similar forms

The Texas Promissory Note is similar to a Loan Agreement. Both documents outline the terms under which money is borrowed and repaid. A Loan Agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. While a Promissory Note serves as a promise to repay the borrowed amount, a Loan Agreement often provides a more comprehensive framework for the transaction, including the rights and obligations of both parties involved.

Another document that shares similarities with the Texas Promissory Note is the Mortgage. A Mortgage is a legal agreement that secures a loan with real property as collateral. While a Promissory Note represents the borrower's commitment to repay the loan, the Mortgage provides the lender with a legal claim to the property in case of default. Both documents work together to facilitate the lending process, ensuring that the lender has recourse if the borrower fails to meet their obligations.

The Texas Promissory Note is also akin to a Secured Note. A Secured Note is a type of promissory note backed by collateral, which can be personal property or real estate. This document specifies the terms of the loan while also detailing what collateral is being used to secure the debt. Like the Texas Promissory Note, a Secured Note establishes the borrower's promise to repay the loan, but it adds an additional layer of security for the lender through the collateral agreement.

Another related document is the Personal Guarantee. A Personal Guarantee is a promise made by an individual to repay a loan if the borrowing entity defaults. While the Texas Promissory Note is a direct promise from the borrower, a Personal Guarantee adds an extra level of assurance for the lender by holding an individual accountable. This document is particularly common in business loans where the business itself may lack sufficient credit history.

In navigating financial obligations, it's essential to understand the importance of a Hold Harmless Agreement, a legal tool that protects parties from liability during various interactions, similar to how promissory notes and other financial documents function. For comprehensive insights on this agreement, one can refer to resources like onlinelawdocs.com, which provide valuable information to help individuals safeguard their interests effectively.

A further similar document is the Loan Disclosure Statement. This statement is typically provided to borrowers before they sign a loan agreement or promissory note. It outlines the key terms of the loan, including the interest rate, fees, and total repayment amount. While the Texas Promissory Note serves as the formal promise to repay, the Loan Disclosure Statement ensures that borrowers are fully informed about the terms of their loan before committing.

Lastly, the Texas Promissory Note can be compared to a Forbearance Agreement. This document is used when a borrower is unable to make payments as originally agreed. A Forbearance Agreement allows the borrower to temporarily pause or reduce payments without defaulting on the loan. While a Promissory Note establishes the original repayment terms, a Forbearance Agreement modifies those terms to accommodate the borrower's current financial situation, providing flexibility and support during challenging times.