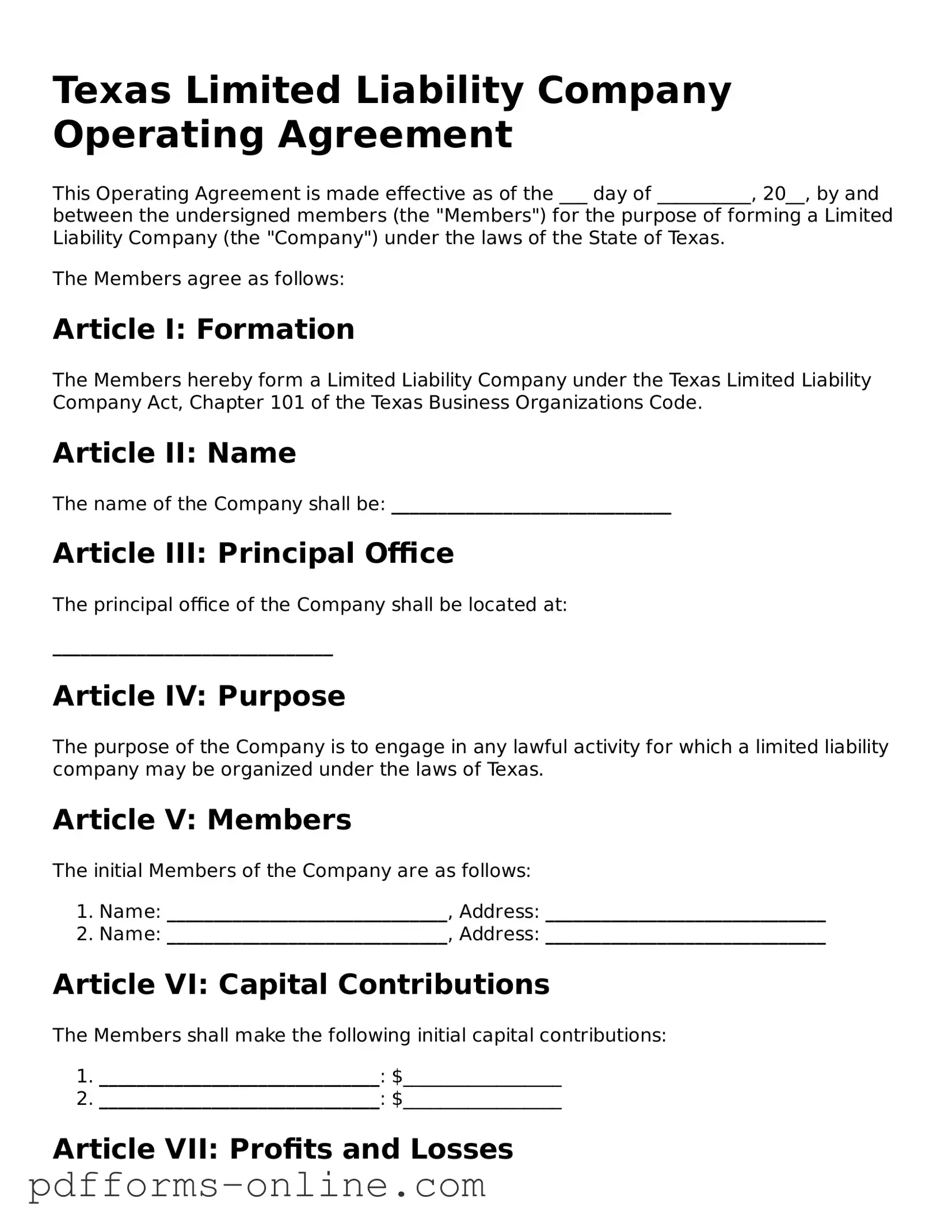

Texas Limited Liability Company Operating Agreement

This Operating Agreement is made effective as of the ___ day of __________, 20__, by and between the undersigned members (the "Members") for the purpose of forming a Limited Liability Company (the "Company") under the laws of the State of Texas.

The Members agree as follows:

Article I: Formation

The Members hereby form a Limited Liability Company under the Texas Limited Liability Company Act, Chapter 101 of the Texas Business Organizations Code.

Article II: Name

The name of the Company shall be: ______________________________

Article III: Principal Office

The principal office of the Company shall be located at:

______________________________

Article IV: Purpose

The purpose of the Company is to engage in any lawful activity for which a limited liability company may be organized under the laws of Texas.

Article V: Members

The initial Members of the Company are as follows:

- Name: ______________________________, Address: ______________________________

- Name: ______________________________, Address: ______________________________

Article VI: Capital Contributions

The Members shall make the following initial capital contributions:

- ______________________________: $_________________

- ______________________________: $_________________

Article VII: Profits and Losses

Profits and losses shall be allocated to the Members in proportion to their respective percentage interests in the Company, as follows:

- ______________________________: ___%

- ______________________________: ___%

Article VIII: Management

The Company shall be managed by its Members. Decisions shall be made by a majority vote of the Members.

Article IX: Indemnification

The Company shall indemnify any Member against expenses and liabilities incurred in connection with the Company to the extent permitted by Texas law.

Article X: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement on the day and year first above written.

Member Signature: _______________________________ Date: ___________

Member Signature: _______________________________ Date: ___________