Blank Texas Odometer Statement Template

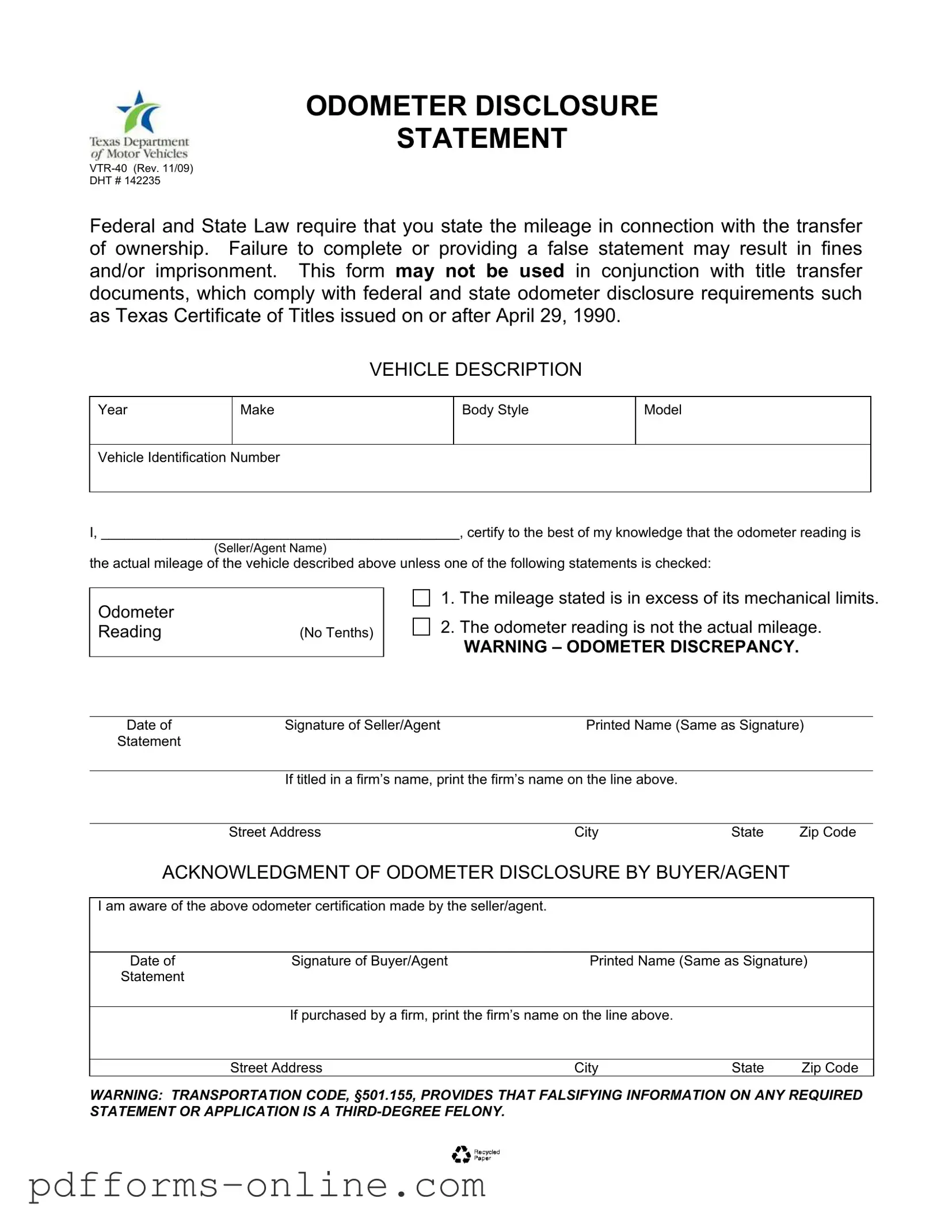

The Texas Odometer Statement form, known as VTR-40, plays a crucial role in the vehicle ownership transfer process within the state. This document is mandated by both federal and state laws, ensuring that the mileage of a vehicle is accurately disclosed during ownership transfers. It is essential for sellers and agents to complete this form accurately, as any failure to do so or provision of false information can lead to significant penalties, including fines and potential imprisonment. Notably, this form cannot be used alongside title transfer documents that already meet federal and state odometer disclosure requirements, such as the Texas Certificate of Title issued after April 29, 1990. The form requires detailed information about the vehicle, including its year, make, model, body style, and Vehicle Identification Number (VIN). Sellers must certify that the odometer reading reflects the true mileage, unless specific conditions apply, such as the mileage exceeding mechanical limits or discrepancies in the odometer reading. Additionally, buyers or their agents must acknowledge the odometer certification made by the seller. This acknowledgment is critical, as it reinforces the buyer's awareness of the vehicle's mileage status. The form also includes a stark warning about the serious consequences of falsifying information, underscoring the importance of transparency in vehicle transactions.

Document Example

ODOMETER DISCLOSURE

STATEMENT

DHT # 142235

Federal and State Law require that you state the mileage in connection with the transfer of ownership. Failure to complete or providing a false statement may result in fines and/or imprisonment. This form may not be used in conjunction with title transfer documents, which comply with federal and state odometer disclosure requirements such as Texas Certificate of Titles issued on or after April 29, 1990.

VEHICLE DESCRIPTION

Year

Make

Body Style

Model

Vehicle Identification Number

I, ______________________________________________, certify to the best of my knowledge that the odometer reading is

the actual mileage of the vehicle described above unless one of the following statements is checked:

Odometer

Reading |

(No Tenths) |

1.The mileage stated is in excess of its mechanical limits.

2.The odometer reading is not the actual mileage.

WARNING – ODOMETER DISCREPANCY.

Date ofSignature of Seller/AgentPrinted Name (Same as Signature) Statement

If titled in a firm’s name, print the firm’s name on the line above.

Street Address |

City |

State |

Zip Code |

ACKNOWLEDGMENT OF ODOMETER DISCLOSURE BY BUYER/AGENT

I am aware of the above odometer certification made by the seller/agent.

Date of |

Signature of Buyer/Agent |

Printed Name (Same as Signature) |

Statement |

|

|

If purchased by a firm, print the firm’s name on the line above.

Street Address |

City |

State |

Zip Code |

WARNING: TRANSPORTATION CODE, §501.155, PROVIDES THAT FALSIFYING INFORMATION ON ANY REQUIRED STATEMENT OR APPLICATION IS A

Frequently Asked Questions

-

What is the purpose of the Texas Odometer Statement form?

The Texas Odometer Statement form, officially known as VTR-40, is required during the transfer of vehicle ownership. It serves to disclose the vehicle's mileage at the time of sale. Both federal and state laws mandate this disclosure to prevent fraud and ensure accurate vehicle history records.

-

Who needs to complete the Odometer Statement?

The seller or their authorized agent must complete the Odometer Statement. This person certifies that the mileage stated on the form is accurate to the best of their knowledge. If the vehicle is owned by a business, a representative from that firm can also sign the form.

-

What happens if the Odometer Statement is not completed correctly?

Failing to complete the Odometer Statement accurately can lead to serious consequences. If the form is filled out incorrectly or if false information is provided, it may result in fines or even imprisonment. This emphasizes the importance of honesty and accuracy in the odometer disclosure process.

-

What should I do if the odometer reading is not accurate?

If the odometer reading is not the actual mileage, the seller must check the appropriate box on the form indicating that the odometer reading is not accurate. This ensures that the buyer is aware of the discrepancy. Transparency is crucial in maintaining trust in the transaction.

-

Are there any penalties for falsifying information on the Odometer Statement?

Yes, there are significant penalties for falsifying information on the Odometer Statement. According to Texas Transportation Code, §501.155, providing false information on this form is classified as a third-degree felony. This highlights the legal seriousness of accurate odometer disclosures in vehicle sales.

Misconceptions

There are several misconceptions about the Texas Odometer Statement form that can lead to confusion. Understanding these can help ensure compliance with the law and protect both buyers and sellers during vehicle transactions.

- Misconception 1: The form is optional for all vehicle sales.

- Misconception 2: The form can be used with any title transfer documents.

- Misconception 3: Providing false information on the form is a minor issue.

- Misconception 4: Only the seller needs to sign the form.

Many people believe that the Texas Odometer Statement is optional. In reality, federal and state laws require this form when transferring ownership of a vehicle. Failing to complete it can lead to serious consequences.

Some individuals think they can use the Odometer Statement with any title transfer. However, it is not valid for title transfers that comply with federal and state odometer disclosure requirements, such as the Texas Certificate of Title issued on or after April 29, 1990.

There is a belief that inaccuracies on the Odometer Statement are not serious. In truth, falsifying information can lead to severe penalties, including fines and imprisonment. This is classified as a third-degree felony under Texas law.

Some assume that only the seller's signature is necessary. In fact, both the seller and the buyer (or their agents) must acknowledge the odometer disclosure by signing the form. This ensures that both parties are aware of the odometer reading and any discrepancies.

Common mistakes

-

Neglecting to Provide Accurate Mileage: One common mistake is failing to accurately report the odometer reading. It is essential to provide the correct mileage, as inaccuracies can lead to legal issues.

-

Not Signing the Form: Some individuals forget to sign the Texas Odometer Statement. A missing signature can render the document invalid, complicating the transfer of ownership.

-

Ignoring the Odometer Discrepancy Warning: If the odometer reading is not the actual mileage or if it exceeds mechanical limits, the appropriate box must be checked. Failing to do so may lead to penalties.

-

Using the Form Incorrectly: The Texas Odometer Statement should not be used with title transfer documents that comply with federal and state requirements. Misusing the form can cause delays in the transfer process.

-

Omitting Buyer/Agent Acknowledgment: The buyer or agent must acknowledge the odometer disclosure. Forgetting this step can create confusion and may lead to disputes later on.

Additional PDF Templates

How to Create Payroll Checks - Helps maintain accurate payroll records.

Before signing, it's essential to review the New York Residential Lease Agreement, which is a legal document that clearly defines the terms between a landlord and a tenant for renting a residential property. Important details such as the duration of the lease, rental payments, and the responsibilities of both parties must be thoroughly understood. For more information, you can visit documentonline.org/blank-new-york-residential-lease-agreement, which provides a comprehensive guide to this essential form.

Navpers 1336 3 - Utilizing this form aids in maintaining duty effectiveness within the Navy.

Document Data

| Fact Name | Details |

|---|---|

| Form Title | The form is officially known as the Odometer Disclosure Statement, designated as VTR-40. |

| Governing Laws | This form is governed by federal and Texas state laws regarding odometer disclosures. |

| Purpose | The primary purpose of the form is to disclose the vehicle's mileage during the transfer of ownership. |

| Consequences of False Statements | Providing false information on the form may lead to fines and/or imprisonment. |

| Limitations | The form cannot be used with title transfer documents that comply with federal and state odometer disclosure requirements. |

| Odometer Reading | The form requires the odometer reading to be stated without tenths, ensuring clarity in mileage reporting. |

| Certification | The seller or agent must certify that the odometer reading reflects the actual mileage of the vehicle. |

| Legal Warning | According to Texas Transportation Code, §501.155, falsifying information is classified as a third-degree felony. |

Similar forms

The Texas Odometer Statement form shares similarities with the Bill of Sale, a document commonly used in vehicle transactions. Both forms serve as a record of the sale and include essential details about the vehicle, such as the make, model, and vehicle identification number (VIN). The Bill of Sale also includes the seller's and buyer's information, ensuring that both parties have a clear understanding of the transaction. However, while the Texas Odometer Statement specifically addresses the mileage disclosure, the Bill of Sale focuses more broadly on the terms of the sale, including the purchase price and any warranties or conditions related to the vehicle.

When preparing important legal documents, such as a Texas Last Will and Testament form, it is essential to ensure that all details are accurate and clearly articulated. This document, which specifies how one's estate should be handled after death, aligns with other critical forms in Texas law, like the OnlineLawDocs.com, that offer guidance and templates to facilitate the drafting process. Having a well-structured will can significantly reduce potential disputes and provide peace of mind for both the individual and their loved ones.

Another document akin to the Texas Odometer Statement is the Vehicle Title. This legal document proves ownership of the vehicle and is required for transferring ownership from one party to another. Like the Odometer Statement, the Vehicle Title includes the VIN and details about the vehicle. The key difference lies in the purpose; the Vehicle Title serves as proof of ownership, while the Odometer Statement specifically verifies the accuracy of the mileage at the time of sale. Both documents are essential for a smooth transfer of ownership, but they address different aspects of the transaction.

The Affidavit of Odometer Disclosure is yet another document that parallels the Texas Odometer Statement. This affidavit is often used when a vehicle is sold without a title or when the title has been lost. Similar to the Odometer Statement, it requires the seller to certify the accuracy of the odometer reading. The affidavit provides legal backing to the mileage claim, protecting both the seller and the buyer from potential disputes. While both documents aim to ensure transparency regarding mileage, the affidavit serves as a substitute when the traditional title is unavailable.

Lastly, the Application for Title is comparable to the Texas Odometer Statement in that it is part of the vehicle registration process. This application is submitted to the state to formally register the vehicle under the new owner's name. It typically includes information about the vehicle, such as the VIN and the odometer reading at the time of sale. While the Odometer Statement specifically focuses on the mileage disclosure, the Application for Title encompasses a broader range of information necessary for legal ownership and registration. Both documents are crucial for ensuring compliance with state regulations and protecting the interests of all parties involved in the transaction.