Valid Texas Loan Agreement Template

When engaging in a loan transaction in Texas, having a clear and comprehensive Loan Agreement form is essential for both lenders and borrowers. This document serves as a legally binding contract that outlines the specific terms and conditions of the loan, ensuring that both parties understand their rights and obligations. Key components typically include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the agreement may address default conditions, late fees, and the process for resolving disputes. By detailing these important aspects, the Texas Loan Agreement form helps to minimize misunderstandings and provides a framework for a successful lending relationship. Understanding these elements is crucial for anyone considering entering into a loan agreement in Texas, as it protects both the lender's investment and the borrower's financial interests.

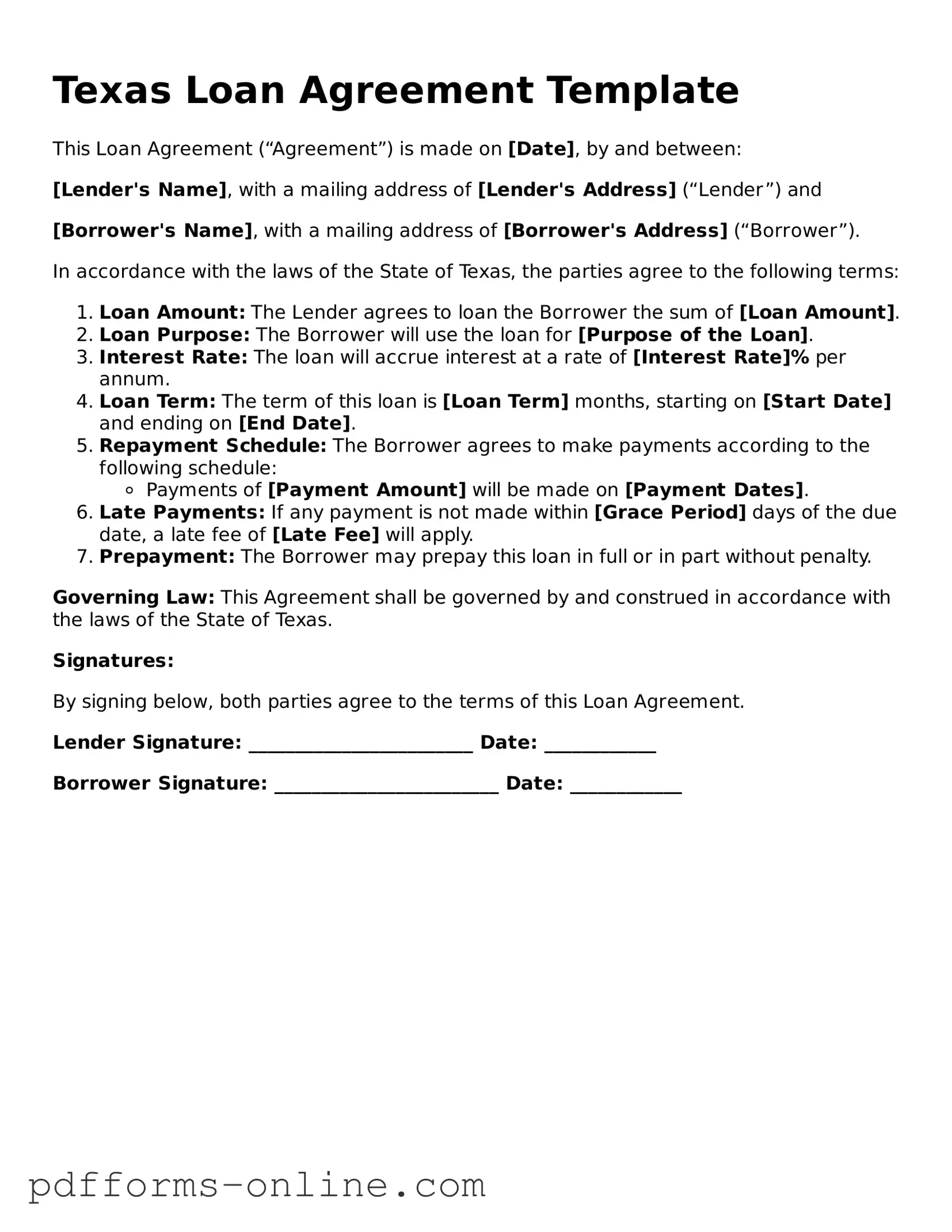

Document Example

Texas Loan Agreement Template

This Loan Agreement (“Agreement”) is made on [Date], by and between:

[Lender's Name], with a mailing address of [Lender's Address] (“Lender”) and

[Borrower's Name], with a mailing address of [Borrower's Address] (“Borrower”).

In accordance with the laws of the State of Texas, the parties agree to the following terms:

- Loan Amount: The Lender agrees to loan the Borrower the sum of [Loan Amount].

- Loan Purpose: The Borrower will use the loan for [Purpose of the Loan].

- Interest Rate: The loan will accrue interest at a rate of [Interest Rate]% per annum.

- Loan Term: The term of this loan is [Loan Term] months, starting on [Start Date] and ending on [End Date].

- Repayment Schedule: The Borrower agrees to make payments according to the following schedule:

- Payments of [Payment Amount] will be made on [Payment Dates].

- Late Payments: If any payment is not made within [Grace Period] days of the due date, a late fee of [Late Fee] will apply.

- Prepayment: The Borrower may prepay this loan in full or in part without penalty.

Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

Signatures:

By signing below, both parties agree to the terms of this Loan Agreement.

Lender Signature: ________________________ Date: ____________

Borrower Signature: ________________________ Date: ____________

Frequently Asked Questions

-

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. It specifies the loan amount, interest rate, repayment schedule, and any other relevant terms. This form helps protect both parties by clearly defining their rights and responsibilities.

-

Who needs a Texas Loan Agreement?

Anyone who is lending or borrowing money in Texas should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Having a written agreement is crucial to avoid misunderstandings and disputes in the future. It ensures that both parties are on the same page regarding the loan terms.

-

What should be included in the Texas Loan Agreement?

The Texas Loan Agreement should include the following key elements:

- The names and contact information of both the lender and the borrower.

- The principal amount of the loan.

- The interest rate and how it will be calculated.

- The repayment schedule, including due dates and payment methods.

- Any collateral that secures the loan, if applicable.

- Terms regarding late payments and default.

Including these details helps to ensure clarity and protect the interests of both parties.

-

Is the Texas Loan Agreement legally binding?

Yes, a properly executed Texas Loan Agreement is legally binding. Once both parties sign the document, they are obligated to adhere to its terms. If either party fails to comply, the other party may have legal grounds to seek enforcement or damages. It’s essential to ensure that the agreement is clear and complete to avoid any potential issues.

-

Can I modify the Texas Loan Agreement after it has been signed?

Yes, modifications to a Texas Loan Agreement can be made after it has been signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the amended agreement. This helps maintain clarity and ensures that all parties are aware of the new terms.

Misconceptions

When it comes to the Texas Loan Agreement form, there are several misconceptions that can lead to confusion. Here are six common misunderstandings:

-

All loan agreements are the same.

Many people think that all loan agreements, including the Texas Loan Agreement, are identical. In reality, each agreement can have specific terms and conditions that vary based on the lender and the type of loan.

-

You don’t need to read the fine print.

Some borrowers assume that the main points of the loan are enough to understand the agreement. However, the fine print often contains crucial details about fees, penalties, and repayment terms that should not be overlooked.

-

Signing the agreement means you fully understand it.

Just because someone signs the Texas Loan Agreement does not mean they comprehend all its implications. It’s important to ask questions and seek clarification on any terms that are unclear.

-

The lender will automatically provide support.

Some borrowers believe that lenders will explain everything about the loan agreement. While lenders are there to help, it’s ultimately the borrower’s responsibility to ensure they understand the agreement.

-

Once signed, the agreement cannot be changed.

Many think that once the Texas Loan Agreement is signed, it’s set in stone. However, in some cases, terms can be negotiated before signing, or amendments can be made later if both parties agree.

-

All loans require collateral.

Not every loan agreement requires collateral. While some loans, like secured loans, do require collateral, others, such as unsecured loans, do not. Understanding the type of loan is essential.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide correct names, addresses, or Social Security numbers. Double-checking this information is crucial.

-

Missing Signatures: Some applicants overlook the requirement for signatures. Without a signature, the agreement is not valid.

-

Incorrect Loan Amount: Entering the wrong loan amount can lead to serious issues. Ensure the amount matches the agreed terms.

-

Failure to Read Terms: Not reviewing the terms and conditions can result in misunderstandings later. Take the time to read everything carefully.

-

Omitting Required Documentation: Applicants often forget to attach necessary documents, such as proof of income or identification. This can delay the process.

-

Ignoring Interest Rates: Some people neglect to check the interest rates outlined in the agreement. Understand how these rates will affect repayment.

-

Inconsistent Information: Providing information that does not match other documents can raise red flags. Ensure consistency across all forms.

-

Not Understanding Repayment Terms: Failing to grasp the repayment schedule can lead to missed payments. Clarify any confusion before signing.

-

Leaving Blank Spaces: Some individuals leave sections blank, thinking they are optional. Every section must be filled out unless specified otherwise.

-

Neglecting to Keep Copies: After submitting the form, not keeping a copy can be a mistake. Always retain a copy for your records.

Find Some Other Loan Agreement Forms for Specific States

Promissory Note Template Georgia - A document stating the terms of a loan between a lender and a borrower.

Promissory Note Florida - The length of the loan term should be clearly indicated in the document.

A Loan Agreement form is a legally binding document between a borrower and a lender that outlines the terms and conditions of a loan. This form specifies the amount of the loan, interest rates, repayment schedule, and the consequences of non-repayment. It serves as a formal record to ensure both parties understand their obligations and rights, and for further information, you can visit https://onlinelawdocs.com.

Illinois Promissory Note - Force majeure clauses may be included to account for unforeseen circumstances.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Loan Agreement form outlines the terms and conditions under which a loan is provided between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Texas, specifically under Title 5 of the Texas Business and Commerce Code. |

| Parties Involved | The form identifies the lender and borrower, ensuring clarity on who is entering into the agreement. |

| Loan Amount | The agreement specifies the exact amount of money being loaned, which is crucial for both parties. |

| Interest Rate | The interest rate is clearly stated, indicating how much the borrower will pay in addition to the principal amount. |

| Repayment Terms | Details about how and when the loan will be repaid are included, which helps in managing expectations. |

| Default Consequences | The form outlines what happens in case of default, protecting the lender's interests while informing the borrower of potential risks. |

Similar forms

The Texas Loan Agreement form shares similarities with a Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a lender under agreed-upon terms. Like the Loan Agreement, it outlines the loan amount, interest rate, and repayment schedule. However, a Promissory Note typically focuses solely on the borrower's promise to repay, while a Loan Agreement may include additional terms and conditions governing the relationship between the borrower and lender.

For those interested in further understanding leasing arrangements, the https://documentonline.org/blank-new-york-residential-lease-agreement provides a comprehensive template that can help clarify the necessary components required in a lease deal, ensuring both landlords and tenants are on the same page regarding rental terms and responsibilities.

A Security Agreement is another document comparable to the Texas Loan Agreement. This document is used when a borrower pledges collateral to secure a loan. Both documents detail the obligations of the borrower and the lender, but the Security Agreement specifically addresses the collateral involved and the rights of the lender in the event of default. The Loan Agreement may reference the Security Agreement if collateral is involved in the transaction.

A Loan Disclosure Statement is another document that bears resemblance to the Texas Loan Agreement. This statement provides borrowers with important information about the terms and costs of a loan before they agree to it. Both documents aim to ensure that borrowers understand their financial obligations. While the Loan Agreement formalizes the loan terms, the Loan Disclosure Statement serves as an informative tool, highlighting key elements like the Annual Percentage Rate (APR) and any fees associated with the loan.

The Texas Loan Agreement can also be compared to a Loan Modification Agreement. This document is used when a borrower and lender agree to change the terms of an existing loan. Similar to the Loan Agreement, it outlines the new terms, such as interest rates and repayment schedules. However, a Loan Modification Agreement specifically addresses changes to an existing loan, whereas the Texas Loan Agreement typically pertains to a new loan arrangement.

Lastly, a Personal Loan Agreement is akin to the Texas Loan Agreement. This type of agreement is used for loans that are not secured by collateral. Both documents outline the terms of the loan, including the amount borrowed, interest rates, and repayment terms. The key difference lies in the nature of the loans; Personal Loan Agreements usually involve unsecured loans, while the Texas Loan Agreement may involve secured loans or other specific terms relevant to Texas law.