Valid Texas Last Will and Testament Template

In the state of Texas, a Last Will and Testament serves as a crucial legal document that outlines an individual’s final wishes regarding the distribution of their assets after passing. This form allows a person, often referred to as the testator, to specify who will inherit their property, including real estate, personal belongings, and financial accounts. It also provides the opportunity to appoint an executor, someone responsible for ensuring that the terms of the will are carried out as intended. Additionally, the Texas Last Will and Testament form can include provisions for guardianship of minor children, ensuring their care is entrusted to a chosen individual. The document must be signed in the presence of at least two witnesses, who must also sign to validate the will. This requirement emphasizes the importance of having a clear and legally binding record of one's intentions, offering peace of mind to both the testator and their loved ones during a challenging time. Understanding the components and requirements of this form is essential for anyone looking to establish their wishes and protect their family's future.

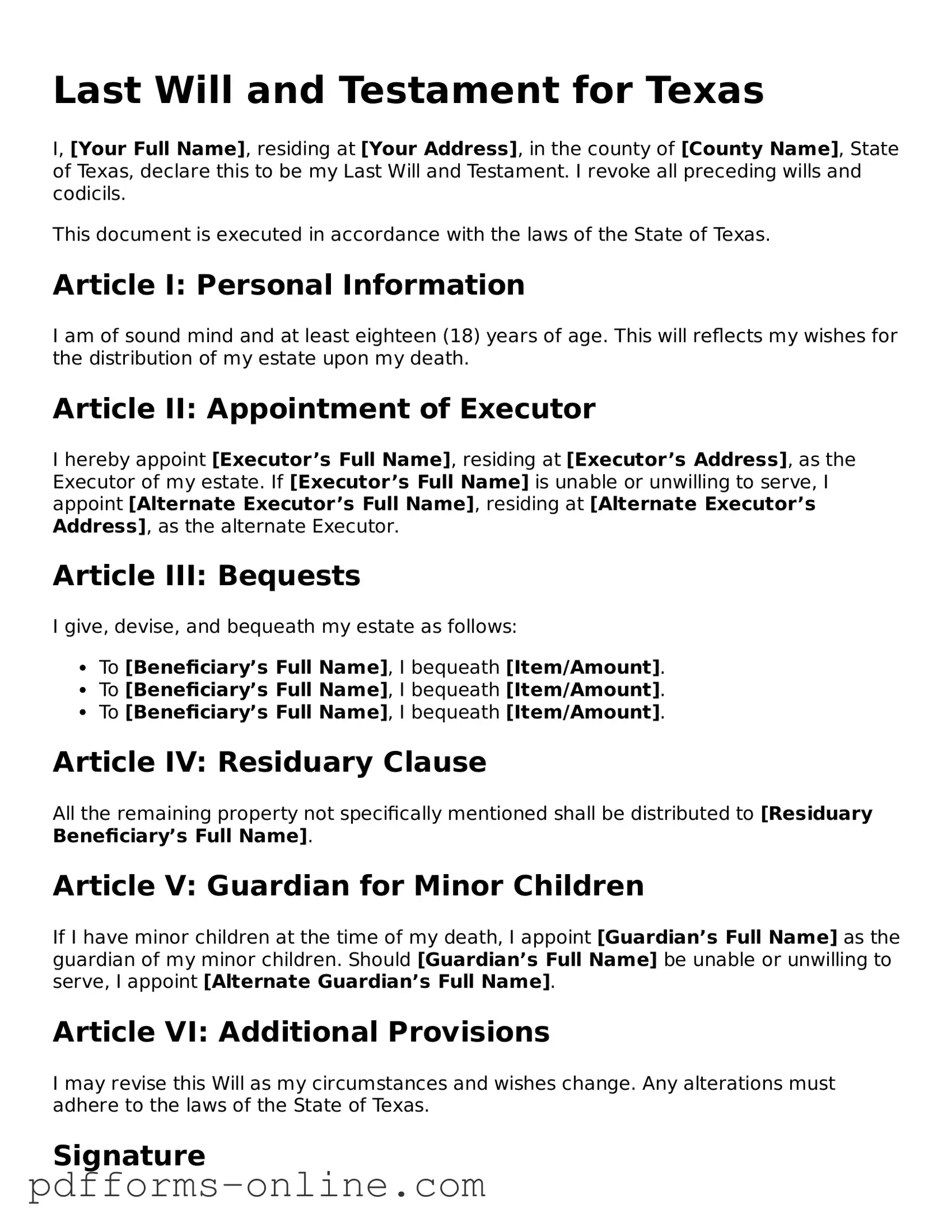

Document Example

Last Will and Testament for Texas

I, [Your Full Name], residing at [Your Address], in the county of [County Name], State of Texas, declare this to be my Last Will and Testament. I revoke all preceding wills and codicils.

This document is executed in accordance with the laws of the State of Texas.

Article I: Personal Information

I am of sound mind and at least eighteen (18) years of age. This will reflects my wishes for the distribution of my estate upon my death.

Article II: Appointment of Executor

I hereby appoint [Executor’s Full Name], residing at [Executor’s Address], as the Executor of my estate. If [Executor’s Full Name] is unable or unwilling to serve, I appoint [Alternate Executor’s Full Name], residing at [Alternate Executor’s Address], as the alternate Executor.

Article III: Bequests

I give, devise, and bequeath my estate as follows:

- To [Beneficiary’s Full Name], I bequeath [Item/Amount].

- To [Beneficiary’s Full Name], I bequeath [Item/Amount].

- To [Beneficiary’s Full Name], I bequeath [Item/Amount].

Article IV: Residuary Clause

All the remaining property not specifically mentioned shall be distributed to [Residuary Beneficiary’s Full Name].

Article V: Guardian for Minor Children

If I have minor children at the time of my death, I appoint [Guardian’s Full Name] as the guardian of my minor children. Should [Guardian’s Full Name] be unable or unwilling to serve, I appoint [Alternate Guardian’s Full Name].

Article VI: Additional Provisions

I may revise this Will as my circumstances and wishes change. Any alterations must adhere to the laws of the State of Texas.

Signature

In witness whereof, I have hereunto subscribed my name this [Day] of [Month], [Year].

____________________

Signature: [Your Full Name]

Witnesses

This will was signed in our presence by the above-named testator, who at that time appeared to be of sound mind and body.

- ____________________

Signature of Witness 1: [Witness 1 Name] - Date: [Date]

- ____________________

Signature of Witness 2: [Witness 2 Name] - Date: [Date]

This Will may be witnessed by any individuals who are over the age of 14 and of sound mind, and who do not stand to benefit from its provisions.

Frequently Asked Questions

-

What is a Last Will and Testament in Texas?

A Last Will and Testament is a legal document that outlines how a person's assets and property will be distributed after their death. In Texas, this document also allows you to name guardians for minor children and designate an executor to manage your estate.

-

Who can create a Last Will and Testament in Texas?

Any person who is at least 18 years old and of sound mind can create a Last Will and Testament in Texas. Additionally, individuals who are married or serving in the military may also be eligible to create a will, regardless of age.

-

What are the requirements for a valid Last Will and Testament in Texas?

To be valid, a Last Will and Testament in Texas must be in writing and signed by the testator (the person making the will). It should also be signed by at least two witnesses who are at least 14 years old and not beneficiaries of the will. Additionally, the will must be executed voluntarily and without undue influence.

-

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time. This can be done by creating a new will or by making a codicil, which is an amendment to the existing will. Ensure that any changes comply with Texas laws to maintain the document's validity.

-

What happens if I die without a Last Will and Testament in Texas?

If you die without a will, your estate will be distributed according to Texas intestacy laws. This means that your assets will be divided among your heirs based on a predetermined formula, which may not align with your wishes. To avoid this outcome, it is crucial to have a valid will in place.

-

Can I use a template for my Last Will and Testament in Texas?

Using a template can be a starting point, but it is essential to ensure that the document meets Texas legal requirements. Customizing the template to reflect your specific wishes and circumstances is vital. Consulting with a legal professional is advisable to avoid potential issues.

-

How should I store my Last Will and Testament?

Store your Last Will and Testament in a safe and accessible location. Consider giving copies to your executor and trusted family members. You may also choose to store it in a safe deposit box or with an attorney. Make sure that your loved ones know where to find it when needed.

-

Is it necessary to have an attorney to create a Last Will and Testament in Texas?

While it is not legally required to have an attorney, consulting one is highly recommended. An attorney can help ensure that your will complies with Texas laws, accurately reflects your wishes, and addresses any complex issues that may arise.

-

How can I ensure my Last Will and Testament is executed properly?

To ensure proper execution, follow Texas law regarding the signing and witnessing of the will. Keep the document in a safe place, inform your executor of its location, and consider discussing your wishes with family members. Regularly review and update your will as needed to reflect any changes in your life circumstances.

Misconceptions

Understanding the Texas Last Will and Testament can be challenging, especially with common misconceptions surrounding it. Here are nine misconceptions that often arise:

-

Anyone can create a will without legal guidance.

While it is possible to draft a will without professional help, consulting a legal expert ensures that the document meets all legal requirements and accurately reflects your wishes.

-

All wills must be notarized to be valid.

In Texas, a will does not need to be notarized to be valid, but having it notarized can simplify the probate process.

-

Verbal wills are legally binding.

Texas law does not recognize verbal wills, also known as nuncupative wills, except in very limited circumstances, such as for service members on active duty.

-

A will can distribute property that is not owned by the deceased.

A will only governs property that the deceased owned at the time of their death. It cannot distribute property that the deceased did not legally own.

-

All debts must be paid before any assets are distributed.

While debts are typically settled before distributions are made, the order and method of payment can vary based on specific circumstances and the estate's assets.

-

Creating a will means avoiding probate.

A will must go through probate, which is the legal process of validating the will and distributing the estate. However, certain strategies can help minimize the probate process.

-

Only wealthy individuals need a will.

Everyone, regardless of wealth, should consider having a will. It ensures that your wishes are followed and can help avoid family disputes.

-

Wills are only for older adults.

Wills are important for individuals of all ages. Unexpected events can happen at any time, making it essential to have a plan in place.

-

Once created, a will cannot be changed.

A will can be amended or revoked at any time while the testator is alive, provided they have the mental capacity to do so.

Understanding these misconceptions can help individuals make informed decisions about their estate planning needs in Texas.

Common mistakes

-

Not including all assets: Many individuals forget to list all their assets in the will. This can lead to confusion and disputes among heirs. Make sure to include real estate, bank accounts, investments, and personal belongings.

-

Forgetting to name an executor: An executor is responsible for carrying out the terms of the will. Failing to name one can create delays and complications during the probate process. Choose someone trustworthy and capable.

-

Not signing the will properly: In Texas, a will must be signed by the testator (the person making the will) and should ideally be witnessed by at least two individuals. A will that is not signed correctly may be deemed invalid.

-

Neglecting to update the will: Life changes such as marriage, divorce, or the birth of children can affect your wishes. Failing to update your will can lead to unintended consequences. Regularly review and amend your will as necessary.

-

Using outdated forms: Legal requirements can change over time. Using an old version of the Texas Last Will and Testament form may not comply with current laws. Always ensure you have the most recent form.

Find Some Other Last Will and Testament Forms for Specific States

Georgia Will Template - Let's you express sentiments to loved ones through personal messages.

Illinois Will Template - Defines terms and conditions surrounding the distribution of assets clearly.

Last Will and Testament Template New York Pdf - A Last Will and Testament can simplify the transition process for surviving family members.

Handwritten Will California - Can be amended using a codicil if changes to the estate arise.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Last Will and Testament is governed by the Texas Estates Code, primarily under Title 2, Chapter 251. |

| Requirements | To be valid, a will in Texas must be in writing, signed by the testator, and either witnessed by two witnesses or notarized. |

| Age Requirement | Individuals must be at least 18 years old to create a valid will in Texas, unless they are legally married or in the military. |

| Revocation | A will can be revoked in Texas by creating a new will or by physically destroying the existing will with the intent to revoke it. |

| Holographic Wills | Texas recognizes holographic wills, which are handwritten and do not require witnesses, as long as they are signed by the testator. |

| Executor Appointment | Testators can appoint an executor in their will, who will be responsible for managing the estate and ensuring the will's instructions are followed. |

| Probate Process | After death, the will must be submitted to probate in a Texas court, which validates the will and oversees the distribution of assets. |

Similar forms

A Living Will is a document that outlines a person's wishes regarding medical treatment in situations where they cannot communicate their preferences. Like a Last Will and Testament, it serves to express individual desires, but it focuses specifically on healthcare decisions. Both documents reflect a person's values and intentions, ensuring that their choices are honored even when they are unable to voice them.

A Durable Power of Attorney is another important legal document that allows someone to designate another person to make decisions on their behalf. This can include financial or healthcare decisions. Similar to a Last Will, it provides clarity and direction regarding a person's wishes. However, while a Last Will takes effect after death, a Durable Power of Attorney is effective during a person’s lifetime.

A Healthcare Proxy is a document that appoints someone to make medical decisions for an individual if they become incapacitated. This is akin to a Last Will in that both documents ensure that a person's wishes are followed. The key difference lies in the timing; a Healthcare Proxy is activated during a person's lifetime, whereas a Last Will comes into play after death.

A Trust is a legal arrangement where one party holds property for the benefit of another. Trusts can be used to manage assets during a person’s life and after their death. Similar to a Last Will, a Trust can dictate how assets are distributed. However, a Trust can help avoid probate, allowing for a smoother transition of assets compared to a Last Will, which typically requires court involvement.

An Advance Directive combines a Living Will and a Healthcare Proxy. It provides guidance on medical treatment preferences while also designating someone to make decisions. This document shares similarities with a Last Will, as both aim to ensure that a person's wishes are respected. The Advance Directive, however, is focused on health care, while a Last Will addresses the distribution of assets after death.

A Codicil is an amendment to an existing Last Will and Testament. It allows individuals to make changes without drafting an entirely new will. This document is similar to a Last Will in that it must be executed with the same formalities. Both documents serve to clarify and express a person's final wishes, ensuring that their intent is clear.

A Letter of Instruction is not a legally binding document but serves as a guide for loved ones regarding personal wishes and preferences. It can complement a Last Will by providing additional context about funeral arrangements, asset distribution, or personal messages. While a Last Will is a formal legal document, a Letter of Instruction is more informal and can help ease the burden on survivors.

A Prenuptial Agreement is a contract made before marriage that outlines how assets will be divided in the event of divorce or death. While it differs from a Last Will in terms of timing and purpose, both documents serve to protect individual interests. They provide clarity and direction regarding financial matters, ensuring that personal wishes are respected in different life circumstances.