Valid Texas Lady Bird Deed Template

In the realm of estate planning, the Texas Lady Bird Deed stands out as a powerful tool for property owners seeking to manage their real estate while ensuring a smooth transition of ownership upon their passing. This unique deed allows individuals to transfer property to their beneficiaries without the need for probate, significantly simplifying the process. By retaining a life estate, the property owner maintains control over the property during their lifetime, allowing for continued use and enjoyment. Upon their death, the property automatically transfers to the designated beneficiaries, bypassing the often lengthy and costly probate process. This can be particularly beneficial for families, as it helps to avoid disputes and provides clarity regarding property ownership. Additionally, the Lady Bird Deed can offer tax advantages and protect assets from potential creditors. Understanding the nuances of this deed is crucial for anyone considering their estate planning options in Texas.

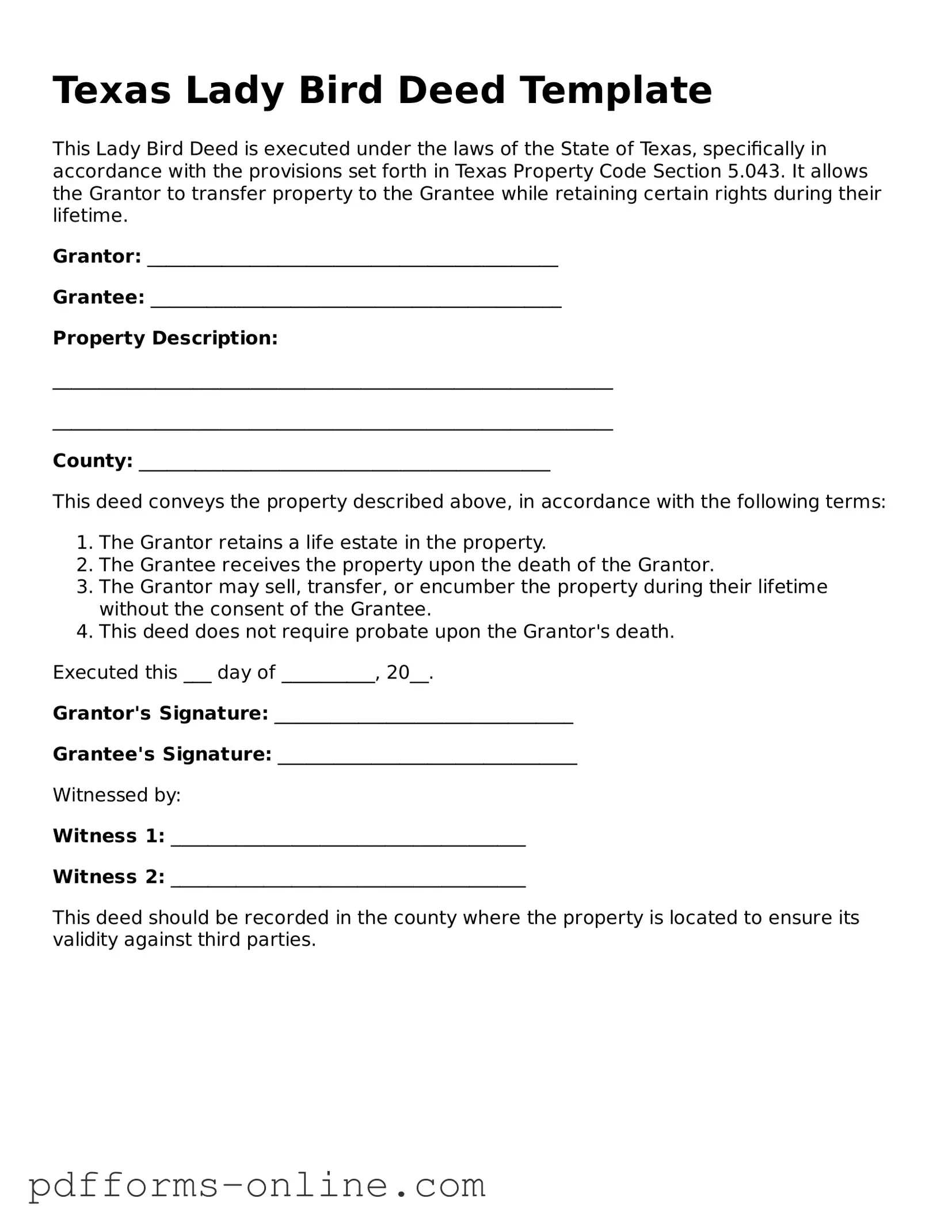

Document Example

Texas Lady Bird Deed Template

This Lady Bird Deed is executed under the laws of the State of Texas, specifically in accordance with the provisions set forth in Texas Property Code Section 5.043. It allows the Grantor to transfer property to the Grantee while retaining certain rights during their lifetime.

Grantor: ____________________________________________

Grantee: ____________________________________________

Property Description:

____________________________________________________________

____________________________________________________________

County: ____________________________________________

This deed conveys the property described above, in accordance with the following terms:

- The Grantor retains a life estate in the property.

- The Grantee receives the property upon the death of the Grantor.

- The Grantor may sell, transfer, or encumber the property during their lifetime without the consent of the Grantee.

- This deed does not require probate upon the Grantor's death.

Executed this ___ day of __________, 20__.

Grantor's Signature: ________________________________

Grantee's Signature: ________________________________

Witnessed by:

Witness 1: ______________________________________

Witness 2: ______________________________________

This deed should be recorded in the county where the property is located to ensure its validity against third parties.

Frequently Asked Questions

-

What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a legal document that allows a property owner to transfer their property to a beneficiary while retaining certain rights during their lifetime. This type of deed is often used to avoid probate and facilitate the transfer of property upon the owner's death.

-

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains the right to live in and use the property for as long as they wish. Upon the owner's death, the property automatically transfers to the designated beneficiary without going through probate. This simplifies the transfer process and can save time and money.

-

What are the benefits of using a Lady Bird Deed?

- Avoids probate, which can be a lengthy and costly process.

- Allows the property owner to retain control over the property during their lifetime.

- Provides a clear and straightforward transfer of property to beneficiaries.

- Can help in Medicaid planning by protecting the property from being counted as an asset.

-

Are there any drawbacks to a Lady Bird Deed?

While there are many benefits, there are also potential drawbacks. For instance, if the property owner incurs debt or legal issues, the property may still be subject to claims. Additionally, it may not be recognized in all states, so it is essential to consider the laws in the relevant jurisdiction.

-

Who can create a Lady Bird Deed?

Any individual who owns property in Texas can create a Lady Bird Deed. This includes homeowners, landowners, and other property holders. It is advisable to consult with a legal professional to ensure that the deed is properly drafted and executed.

-

What information is needed to complete a Lady Bird Deed?

To complete a Lady Bird Deed, the property owner will need to provide information about the property, such as its legal description, the names of the beneficiaries, and the specific rights being retained. Accurate and complete information is crucial for the deed to be valid.

-

How is a Lady Bird Deed executed?

The execution of a Lady Bird Deed typically involves signing the document in the presence of a notary public. After signing, the deed must be filed with the county clerk's office where the property is located to make it official and enforceable.

-

Can a Lady Bird Deed be revoked or changed?

Yes, a property owner can revoke or change a Lady Bird Deed at any time during their lifetime. This can be done by executing a new deed that explicitly revokes the previous one. It is important to follow proper legal procedures to ensure the changes are valid.

Misconceptions

The Texas Lady Bird Deed is a popular estate planning tool, but several misconceptions surround it. Understanding these misconceptions can help individuals make informed decisions about their property and estate planning. Here are four common misunderstandings:

-

It avoids probate entirely.

While the Lady Bird Deed can simplify the transfer of property upon death, it does not completely avoid probate in all situations. If there are other assets that require probate or if the deed is not properly executed, probate may still be necessary.

-

It is only for married couples.

This deed can be utilized by individuals regardless of their marital status. Single individuals, widows, and widowers can all benefit from using a Lady Bird Deed to manage their property.

-

It cannot be changed once executed.

Contrary to this belief, a Lady Bird Deed can be revoked or modified at any time during the grantor's lifetime. This flexibility allows individuals to adapt their estate plans as their circumstances change.

-

It only applies to residential property.

The Lady Bird Deed can be used for various types of real estate, not just residential properties. This includes commercial properties, land, and other forms of real estate ownership.

By clearing up these misconceptions, individuals can better understand how a Texas Lady Bird Deed may fit into their overall estate planning strategy.

Common mistakes

-

Failing to include all property owners: It's essential to list every owner of the property on the deed. Omitting an owner can lead to complications later.

-

Not specifying the correct legal description: The legal description of the property must be accurate. A vague or incorrect description can invalidate the deed.

-

Using outdated forms: Always ensure that you are using the most current version of the Lady Bird Deed form. Laws and requirements can change, and outdated forms may not be accepted.

-

Overlooking witness signatures: The deed typically requires at least one witness to sign. Neglecting this step can result in the deed being challenged.

-

Not notarizing the document: A Lady Bird Deed must be notarized to be legally binding. Skipping this step can render the deed ineffective.

-

Failing to record the deed: After filling out the form, it’s crucial to file it with the county clerk’s office. If you don’t record it, the deed may not be recognized.

-

Inaccurate beneficiary information: Make sure to provide complete and correct information about beneficiaries. Errors can lead to disputes or unintended consequences.

-

Not understanding the implications: Many people fill out the deed without fully understanding the legal and tax implications. It's wise to consult with a professional if unsure.

-

Ignoring state-specific requirements: Texas has specific rules regarding Lady Bird Deeds. Ensure compliance with all state requirements to avoid issues.

-

Rushing the process: Take your time when completing the form. Hasty mistakes can lead to costly corrections or delays in the future.

Find Some Other Lady Bird Deed Forms for Specific States

What States Allow Lady Bird Deeds - This deed provides a clearer path for asset distribution in line with the grantor's wishes.

The New York Operating Agreement form is a legal document that outlines the management and operational procedures of a limited liability company (LLC) in New York. This agreement is crucial for defining the roles and responsibilities of members, ensuring clarity and protection for all parties involved. Understanding this form can help business owners navigate the complexities of LLC operations effectively, and for further guidance, you can visit documentonline.org/blank-new-york-operating-agreement/.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | A Lady Bird Deed allows property owners in Texas to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, specifically Section 13.001. |

| Retained Control | Property owners can sell, mortgage, or change the deed without the beneficiaries' consent. |

| Tax Benefits | The deed may allow for a step-up in basis for tax purposes, potentially reducing capital gains tax for heirs. |

| Medicaid Protection | Assets transferred via a Lady Bird Deed may not be counted as part of the estate for Medicaid eligibility. |

| Revocability | Property owners can revoke or modify the deed at any time before their death. |

| Beneficiary Designation | Owners can designate multiple beneficiaries and specify how the property will be divided among them. |

Similar forms

The Texas Lady Bird Deed is often compared to a traditional warranty deed. Both documents serve the purpose of transferring property ownership. However, a warranty deed provides a guarantee that the seller holds clear title to the property and is responsible for any claims against it. In contrast, the Lady Bird Deed allows the property owner to retain certain rights, such as the ability to live on the property for life and the right to sell or mortgage it without needing the consent of the beneficiary. This flexibility makes the Lady Bird Deed a unique option for estate planning.

Understanding the various estate planning documents, including the Texas Hold Harmless Agreement, is crucial for safeguarding your interests. Such agreements are designed to alleviate concerns regarding liabilities that may arise during property transactions or other activities. For further details on this important legal tool, visit OnlineLawDocs.com, where you can find additional resources and information about the implications of hold harmless agreements in Texas.

An additional document similar to the Lady Bird Deed is the transfer-on-death (TOD) deed. Like the Lady Bird Deed, a TOD deed allows property to pass directly to a designated beneficiary upon the owner's death, avoiding probate. The key difference lies in the rights retained by the owner during their lifetime. With a TOD deed, the owner does not maintain the same level of control over the property as they would with a Lady Bird Deed, which allows for greater flexibility in managing the property while still alive.

Lastly, a general power of attorney can be compared to the Lady Bird Deed in terms of control over property. A general power of attorney grants someone the authority to make decisions and manage assets on behalf of another person. While the Lady Bird Deed allows the property owner to retain control over their property, a power of attorney can enable another person to act on the owner’s behalf, including selling or managing the property. This distinction is important for individuals who want to maintain direct control over their assets while also planning for potential future incapacity.