Valid Texas Golf Cart Bill of Sale Template

In the vibrant state of Texas, where golf carts are not just a mode of transportation but a beloved pastime, understanding the Texas Golf Cart Bill of Sale form is essential for both buyers and sellers. This document serves as a crucial record of the transaction, providing clarity and protection for both parties involved. It typically includes vital details such as the names and addresses of the buyer and seller, a description of the golf cart, including its make, model, and Vehicle Identification Number (VIN), as well as the sale price. Additionally, the form often outlines any warranties or representations made by the seller, ensuring that the buyer is fully informed about the condition of the cart. By using this bill of sale, individuals can avoid potential disputes and ensure a smooth transfer of ownership. Whether you’re purchasing a golf cart for leisurely rides around the neighborhood or for use on the golf course, having this form in hand will help facilitate a transparent and secure transaction.

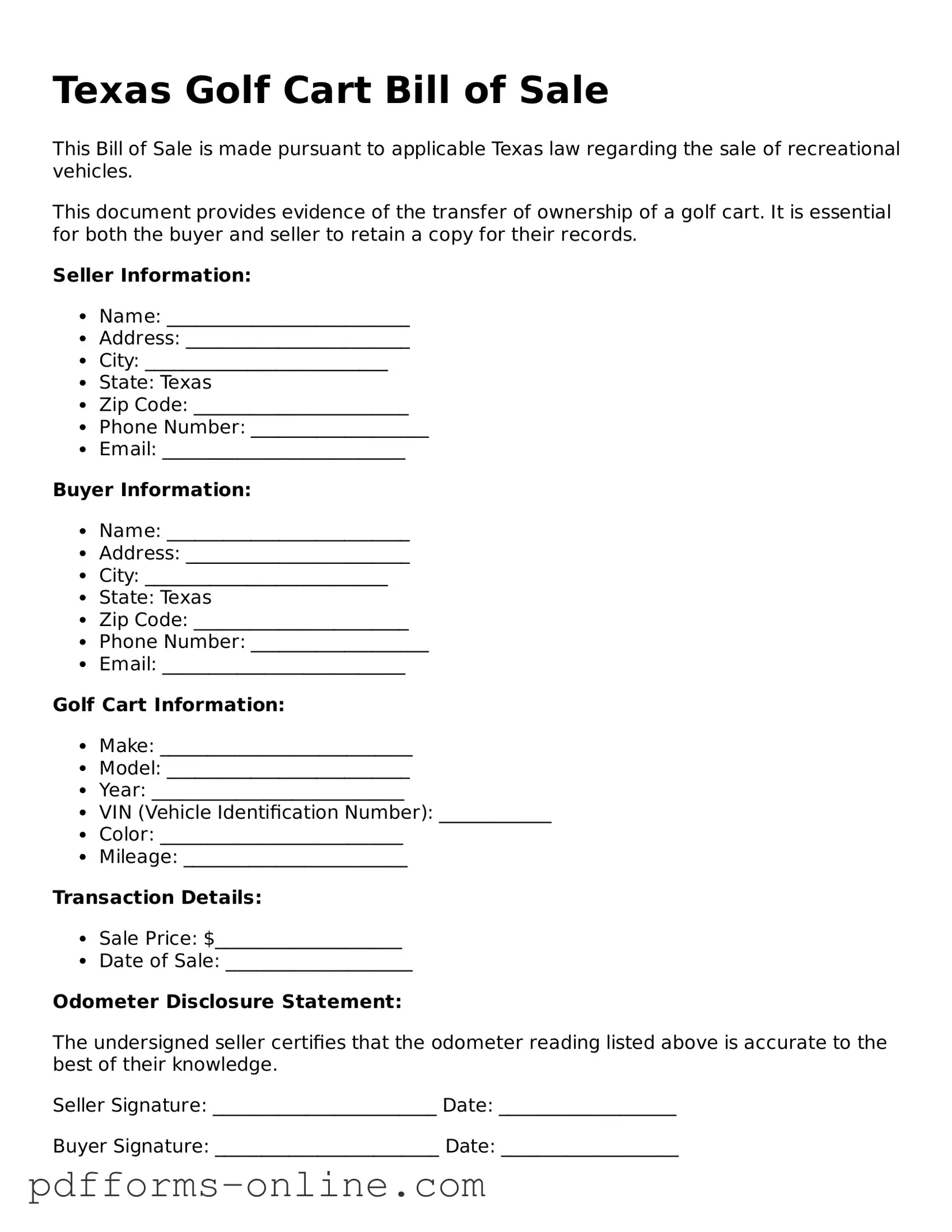

Document Example

Texas Golf Cart Bill of Sale

This Bill of Sale is made pursuant to applicable Texas law regarding the sale of recreational vehicles.

This document provides evidence of the transfer of ownership of a golf cart. It is essential for both the buyer and seller to retain a copy for their records.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: __________________________

- State: Texas

- Zip Code: _______________________

- Phone Number: ___________________

- Email: __________________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: __________________________

- State: Texas

- Zip Code: _______________________

- Phone Number: ___________________

- Email: __________________________

Golf Cart Information:

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): ____________

- Color: __________________________

- Mileage: ________________________

Transaction Details:

- Sale Price: $____________________

- Date of Sale: ____________________

Odometer Disclosure Statement:

The undersigned seller certifies that the odometer reading listed above is accurate to the best of their knowledge.

Seller Signature: ________________________ Date: ___________________

Buyer Signature: ________________________ Date: ___________________

This Bill of Sale is not valid unless signed by both parties involved in the transaction. It is recommended to keep a copy for future reference.

Frequently Asked Questions

-

What is a Texas Golf Cart Bill of Sale?

A Texas Golf Cart Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a golf cart between a seller and a buyer. This document outlines the details of the transaction, including the names of both parties, the description of the golf cart, and the sale price.

-

Is a Golf Cart Bill of Sale required in Texas?

While it is not legally mandated to have a Bill of Sale for golf carts in Texas, it is highly recommended. This document provides protection for both the buyer and the seller by documenting the transaction, which can be useful in case of disputes or for tax purposes.

-

What information should be included in the Bill of Sale?

A comprehensive Golf Cart Bill of Sale should include:

- The full names and addresses of the buyer and seller.

- A detailed description of the golf cart, including make, model, year, and Vehicle Identification Number (VIN).

- The sale price and payment method.

- The date of the sale.

- Any warranties or conditions of the sale, if applicable.

-

Do I need to notarize the Bill of Sale?

Notarization is not a requirement for a Golf Cart Bill of Sale in Texas. However, having the document notarized can add an extra layer of authenticity and may be beneficial if you ever need to prove the transaction in the future.

-

Can I use a generic Bill of Sale form?

Yes, you can use a generic Bill of Sale form for a golf cart, as long as it contains all the necessary information specific to your transaction. However, using a form specifically designed for golf carts can help ensure that you cover all relevant details.

-

What should I do after completing the Bill of Sale?

After completing the Golf Cart Bill of Sale, both the buyer and seller should retain a copy for their records. The buyer may also need to register the golf cart with their local authorities, depending on local regulations.

-

What if there are issues after the sale?

If disputes arise after the sale, having a Bill of Sale can be crucial. This document serves as evidence of the terms agreed upon by both parties. If issues persist, it may be advisable to consult with a legal professional to explore potential resolutions.

Misconceptions

The Texas Golf Cart Bill of Sale form is an important document for anyone buying or selling a golf cart in Texas. However, there are several misconceptions surrounding this form that can lead to confusion. Here are seven common misconceptions:

- Golf carts do not need a bill of sale. Many people believe that since golf carts are not classified as motor vehicles, a bill of sale is unnecessary. However, having a bill of sale provides proof of ownership and protects both the buyer and seller.

- The form is only required for new golf carts. Some think that only new golf cart purchases require a bill of sale. In reality, both new and used golf carts should have this documentation to ensure a clear transfer of ownership.

- Verbal agreements are sufficient. While a verbal agreement may seem convenient, it is not legally binding. A written bill of sale is essential for legal protection and clarity in the transaction.

- All golf carts are exempt from registration. Many assume that all golf carts are exempt from registration in Texas. However, certain golf carts, particularly those modified for street use, may require registration and insurance.

- The bill of sale does not need to be notarized. Some believe that notarization is not necessary for a bill of sale. While notarization is not required by law, having it notarized can add an extra layer of legitimacy to the document.

- Only the seller needs to keep a copy. A common misconception is that only the seller should retain a copy of the bill of sale. In fact, both the buyer and seller should keep copies for their records.

- There is a standard format for the bill of sale. Many think there is a one-size-fits-all template for the bill of sale. However, while there are common elements, the specifics can vary based on the transaction, so it’s important to include all relevant details.

Understanding these misconceptions can help ensure that the process of buying or selling a golf cart in Texas is smooth and legally sound.

Common mistakes

-

Failing to include the date of the sale. This is important for record-keeping and legal purposes.

-

Not providing the full name and contact information of both the seller and the buyer. This can lead to confusion later.

-

Omitting the description of the golf cart. Details like make, model, year, and VIN should be clearly stated.

-

Neglecting to state the purchase price. This information is essential for both parties and may be required for taxes.

-

Not signing the form. Both the seller and buyer must sign to validate the transaction.

-

Leaving out the witness signature if required. Some transactions may need a witness for added legitimacy.

-

Failing to make copies of the completed form. Keeping a copy for both parties can prevent future disputes.

-

Not checking for errors before submitting the form. Mistakes can lead to delays or issues down the line.

Find Some Other Golf Cart Bill of Sale Forms for Specific States

Golf Cart Bill of Sale - Documents the agreement between buyer and seller for a golf cart.

In order to create a well-defined framework for your business, utilizing the Texas Operating Agreement form is essential, as it helps delineate the specific roles and responsibilities of members within an LLC. For those looking for more information on this important document, resources can be found at OnlineLawDocs.com, which provides valuable insights into establishing effective operational guidelines.

Golf Cart Bill of Sale Texas - Sets the stage for the legal transfer of the golf cart.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Texas Golf Cart Bill of Sale form is used to document the sale and transfer of ownership of a golf cart between a buyer and a seller. |

| Governing Law | This form is governed by the Texas Transportation Code, specifically Chapter 551, which outlines regulations for golf carts and their operation. |

| Required Information | Essential details such as the names and addresses of both parties, the golf cart's make, model, year, and Vehicle Identification Number (VIN) must be included. |

| Notarization | While notarization is not mandatory, having the bill of sale notarized can provide an additional layer of protection for both parties involved in the transaction. |

Similar forms

The Texas Vehicle Bill of Sale is a document used when buying or selling a motor vehicle in Texas. Like the Golf Cart Bill of Sale, it serves as proof of the transaction between the buyer and seller. This document typically includes details such as the vehicle's make, model, year, and VIN, along with the sale price. Both forms help protect the interests of both parties and can be used for registration purposes.

The Boat Bill of Sale is another similar document. It is used when transferring ownership of a boat. Just like the Golf Cart Bill of Sale, it provides essential information about the boat, including its make, model, and hull identification number. This document ensures that the sale is legally recognized and can be useful for future registration and titling.

The ATV Bill of Sale is comparable to the Golf Cart Bill of Sale in that it is used for the sale of all-terrain vehicles. This form includes vital information about the ATV, such as its make, model, and VIN. Both documents are essential for establishing ownership and can help facilitate the registration process with state authorities.

The Trailer Bill of Sale is another document that shares similarities with the Golf Cart Bill of Sale. It is used when buying or selling a trailer, capturing information such as the trailer's make, model, and identification number. Both forms serve as proof of ownership transfer and can be beneficial for registration and titling purposes.

In relation to renting properties in New York, understanding the terms outlined in a lease agreement is vital for both landlords and tenants. For those looking for a standard template, the https://documentonline.org/blank-new-york-residential-lease-agreement/ provides a comprehensive overview that specifies the responsibilities of both parties, ensuring clarity and helping to prevent disputes during the duration of the rental period.

The Snowmobile Bill of Sale is also similar. This document is used to record the sale of a snowmobile and includes details like the make, model, and VIN. Just like the Golf Cart Bill of Sale, it provides a written record of the transaction, ensuring that both parties have a clear understanding of the sale.

The Personal Watercraft Bill of Sale is akin to the Golf Cart Bill of Sale as it pertains to the sale of personal watercraft, such as jet skis. This form captures key details about the watercraft, including its make, model, and hull identification number. Both documents help protect the buyer and seller by creating a formal record of the transaction.

The Farm Equipment Bill of Sale is another document that operates similarly. It is used when buying or selling agricultural machinery. Like the Golf Cart Bill of Sale, it includes important details about the equipment being sold and serves as proof of the transaction, which can be crucial for tax purposes and future ownership verification.

The Mobile Home Bill of Sale is also relevant. This document records the sale of a mobile home and includes specific details about the home, such as its make, model, and serial number. Both this form and the Golf Cart Bill of Sale provide a formal record of ownership transfer, which can be essential for registration and legal purposes.

Finally, the Livestock Bill of Sale is similar in that it documents the sale of livestock. It includes important details about the animals being sold, such as breed, age, and identification numbers. Both this document and the Golf Cart Bill of Sale serve to protect the interests of both the buyer and seller, ensuring that the transaction is clear and legally recognized.