Valid Texas Gift Deed Template

The Texas Gift Deed form serves as a vital tool for individuals wishing to transfer property without the exchange of money. This legal document allows a property owner, known as the grantor, to convey ownership to another individual, referred to as the grantee, as a gift. The process is straightforward yet requires careful attention to detail. The form typically includes essential information such as the names and addresses of both parties, a description of the property being gifted, and any conditions attached to the transfer. Importantly, the Texas Gift Deed must be signed by the grantor in the presence of a notary public to ensure its validity. Once executed, the deed must be filed with the county clerk's office where the property is located, making the transfer official and public. Understanding the nuances of this form is crucial for anyone considering gifting real estate in Texas, as it not only simplifies the transfer process but also helps avoid potential legal complications in the future.

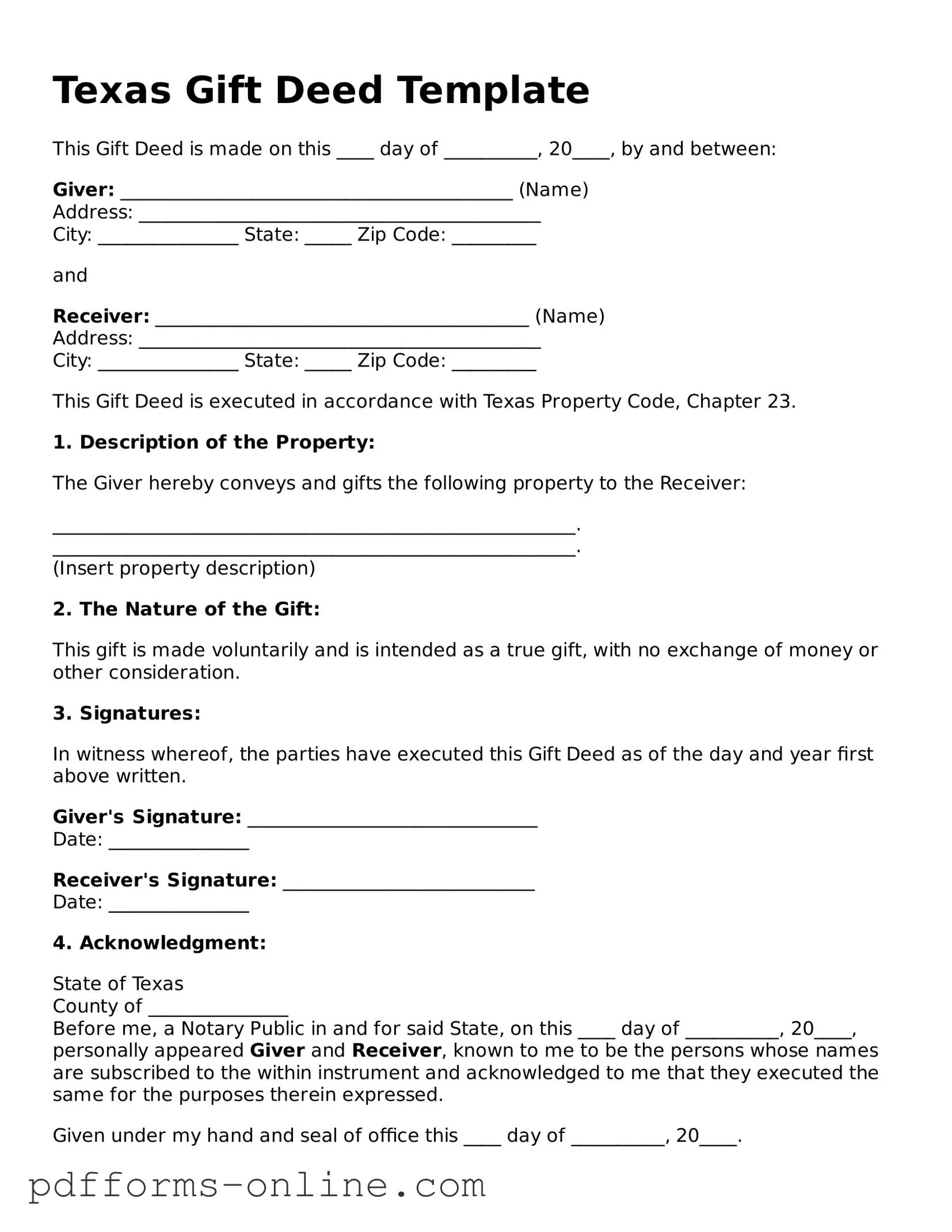

Document Example

Texas Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20____, by and between:

Giver: __________________________________________ (Name)

Address: ___________________________________________

City: _______________ State: _____ Zip Code: _________

and

Receiver: ________________________________________ (Name)

Address: ___________________________________________

City: _______________ State: _____ Zip Code: _________

This Gift Deed is executed in accordance with Texas Property Code, Chapter 23.

1. Description of the Property:

The Giver hereby conveys and gifts the following property to the Receiver:

________________________________________________________.

________________________________________________________.

(Insert property description)

2. The Nature of the Gift:

This gift is made voluntarily and is intended as a true gift, with no exchange of money or other consideration.

3. Signatures:

In witness whereof, the parties have executed this Gift Deed as of the day and year first above written.

Giver's Signature: _______________________________

Date: _______________

Receiver's Signature: ___________________________

Date: _______________

4. Acknowledgment:

State of Texas

County of _______________

Before me, a Notary Public in and for said State, on this ____ day of __________, 20____, personally appeared Giver and Receiver, known to me to be the persons whose names are subscribed to the within instrument and acknowledged to me that they executed the same for the purposes therein expressed.

Given under my hand and seal of office this ____ day of __________, 20____.

Notary Public: ____________________________________

My commission expires: _______________

Frequently Asked Questions

-

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is often utilized when a property owner wishes to give their property to a family member or friend as a gift.

-

What are the requirements to create a valid Gift Deed in Texas?

To create a valid Gift Deed in Texas, the following requirements must be met:

- The deed must be in writing.

- It must clearly identify the donor (the person giving the gift) and the recipient (the person receiving the gift).

- A legal description of the property being gifted must be included.

- The deed must be signed by the donor.

- It must be acknowledged before a notary public.

- Finally, the deed should be filed with the county clerk's office where the property is located.

-

Is there any tax implication for the donor or the recipient?

While a Gift Deed does not involve a sale, there may still be tax implications. The donor may need to consider federal gift tax rules. In 2023, gifts exceeding a certain annual exclusion amount may require the donor to file a gift tax return. The recipient generally does not have to pay taxes on the value of the gift at the time of transfer. However, they may need to consider potential capital gains taxes if they later sell the property.

-

Can a Gift Deed be revoked or changed?

Once a Gift Deed is executed and delivered, it is generally considered irrevocable. This means that the donor cannot change their mind and take back the gift. However, if the donor retains certain rights, such as the right to live on the property, it may complicate the situation. It is advisable to consult with a legal professional for specific guidance.

-

What happens if the donor dies after executing the Gift Deed?

If the donor passes away after executing the Gift Deed, the property will belong to the recipient, as the transfer has already occurred. The deed should be recorded to ensure that the recipient’s ownership is recognized and protected. If the deed was not recorded, it may lead to complications in proving ownership.

-

Can a Gift Deed be contested?

Yes, a Gift Deed can be contested, typically on the grounds of lack of capacity, undue influence, or fraud. If someone believes that the donor was not in a sound state of mind when executing the deed or was pressured into making the gift, they may challenge the validity of the deed in court.

-

Do I need a lawyer to create a Gift Deed?

While it is not legally required to hire a lawyer to create a Gift Deed, it is highly recommended. A legal professional can help ensure that the deed is correctly drafted, all necessary information is included, and that it complies with Texas laws. This can help prevent future disputes and complications.

-

Where should I file the Gift Deed?

The Gift Deed should be filed with the county clerk's office in the county where the property is located. Filing the deed is important for public record and helps protect the recipient's ownership rights. It is advisable to keep a copy of the filed deed for personal records.

Misconceptions

-

Misconception 1: A Gift Deed is only for transferring property to family members.

This is not true. While many people use Gift Deeds to transfer property to relatives, they can also be used for friends or charitable organizations. The key factor is the intent to make a gift, not the relationship between the parties.

-

Misconception 2: A Gift Deed does not require any formalities.

This is misleading. Although a Gift Deed is generally simpler than a sale, it still requires proper execution. This includes being in writing, signed by the donor, and often notarized. Failure to follow these steps can lead to disputes or invalidation.

-

Misconception 3: A Gift Deed eliminates all tax implications.

This is incorrect. While a Gift Deed may not involve immediate taxation, it can have implications for gift taxes or future capital gains taxes. Donors should consult a tax professional to understand potential liabilities.

-

Misconception 4: Once a Gift Deed is executed, the donor cannot change their mind.

This is not entirely accurate. While a Gift Deed is intended to be irrevocable, there may be circumstances under which a donor can reclaim the property, especially if there was fraud or undue influence involved. Understanding these nuances is crucial.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. The form asks for specific information about both the giver and the recipient. Omitting names, addresses, or other essential data can lead to complications.

-

Incorrect Property Description: The property being gifted must be accurately described. Vague descriptions or incorrect property details can create confusion and may invalidate the deed.

-

Not Including Consideration: While a gift deed typically involves no monetary exchange, it is important to state that the transfer is a gift. Failing to clarify this can lead to misunderstandings about the nature of the transaction.

-

Signature Issues: Both the giver and, in some cases, the recipient must sign the deed. Neglecting to sign or having signatures that do not match the names provided can render the deed ineffective.

-

Not Notarizing the Document: Many states, including Texas, require that the gift deed be notarized. Skipping this step can lead to challenges in proving the deed's authenticity later on.

-

Failure to Record the Deed: After completing the gift deed, it is crucial to file it with the appropriate county office. If this step is overlooked, the deed may not be recognized in legal matters, potentially leading to disputes.

Find Some Other Gift Deed Forms for Specific States

How to Add Name to House Title in California - It requires the signature of the donor and, in some cases, witnesses to validate the transfer.

A Straight Bill of Lading form is a key document used in the shipping industry. It serves as a contract between a shipper and carrier for the transportation of goods. This document specifies the particulars of the cargo, ensuring both parties have clear details about the shipment. For more information on the Straight Bill of Lading, you can visit OnlineLawDocs.com.

Transfer Deed - The property being transferred must be describable and identifiable for the Gift Deed.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by Texas Property Code, Chapter 5. |

| Requirements | The deed must be in writing, signed by the donor, and must identify the property being gifted. |

| Notarization | While notarization is not mandatory, it is highly recommended to avoid disputes regarding authenticity. |

| Tax Implications | Gift tax may apply if the value of the property exceeds the annual exclusion limit set by the IRS. |

| Recording | To ensure public notice of the gift, the deed should be recorded in the county where the property is located. |

| Revocation | A gift deed cannot be revoked once executed, unless specific conditions are included in the deed itself. |

Similar forms

A Quitclaim Deed is similar to a Gift Deed in that it transfers ownership of property without guaranteeing the title. When someone uses a Quitclaim Deed, they essentially relinquish any claim they may have to the property. Like a Gift Deed, it is often used in informal situations, such as transferring property between family members or friends. However, unlike a Gift Deed, a Quitclaim Deed does not require any payment or consideration to be valid.

A Warranty Deed offers a stronger guarantee than a Gift Deed. It ensures that the grantor has a clear title to the property and has the right to transfer it. While a Gift Deed transfers property without payment, a Warranty Deed protects the buyer against any future claims. If issues arise regarding the property’s title, the grantor is responsible for resolving them. This makes a Warranty Deed a safer option for those looking to buy property.

An Affidavit of Heirship is often used in situations where a property owner has died without a will. This document helps establish who the rightful heirs are. While it doesn’t transfer property like a Gift Deed, it serves a similar purpose by clarifying ownership. Both documents can be used to simplify the transfer process, especially among family members. However, an Affidavit of Heirship typically requires court involvement to validate the heirs.

The New York Motorcycle Bill of Sale form is an important document used to record the sale and transfer of ownership of a motorcycle. It serves as proof of purchase for both the buyer and the seller. Having this form completed accurately can help prevent disputes and ensure a smooth transaction. For more information and to access the form, visit https://documentonline.org/blank-new-york-motorcycle-bill-of-sale/.

A Deed of Trust is somewhat different but still related. It involves three parties: the borrower, the lender, and a trustee. This document secures a loan by using property as collateral. While a Gift Deed transfers property without any exchange, a Deed of Trust is tied to a financial transaction. Both documents require careful handling to ensure that the intentions of the parties are clear.

A Lease Agreement is another document that can be compared to a Gift Deed. It allows one party to use another's property for a specified period in exchange for rent. Unlike a Gift Deed, which is a permanent transfer, a Lease Agreement is temporary. However, both documents involve the use of property and require the consent of the property owner. They also outline the rights and responsibilities of each party.

A Bill of Sale is similar in that it transfers ownership, but it typically applies to personal property rather than real estate. When someone uses a Bill of Sale, they are formally documenting the sale of items like vehicles or furniture. While a Gift Deed is used to give away real estate without payment, a Bill of Sale can also be used to transfer items as a gift. Both documents provide proof of the transfer and can help avoid disputes later on.

An Easement Agreement allows one party to use another's property for a specific purpose, like accessing a road or utility lines. While it doesn’t transfer ownership like a Gift Deed, it grants rights related to the property. Both documents require the agreement of the property owner and can be essential in maintaining good relationships between neighbors. They clarify the terms under which one party can use another's land.

Lastly, a Power of Attorney can be compared to a Gift Deed in that it allows one person to act on behalf of another. While a Gift Deed transfers property ownership, a Power of Attorney gives someone the authority to manage another's affairs, including property transactions. Both documents require trust between the parties involved and are often used in family situations. They help simplify processes that might otherwise be complicated or require legal intervention.