Valid Texas Durable Power of Attorney Template

In Texas, a Durable Power of Attorney (DPOA) is a vital legal document that empowers an individual, known as the agent or attorney-in-fact, to make decisions on behalf of another person, referred to as the principal. This form remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters are managed seamlessly during challenging times. It covers a wide range of powers, from handling bank transactions and managing real estate to making healthcare decisions, depending on the specific authority granted. Importantly, the DPOA can be tailored to meet the unique needs of the principal, allowing for both broad and limited powers. It is crucial to choose a trustworthy agent, as this person will have significant control over important aspects of the principal's life. Understanding the implications and responsibilities that come with this form is essential for anyone considering its use. By setting up a Durable Power of Attorney, individuals can secure peace of mind, knowing that their affairs will be managed according to their wishes, even when they are unable to do so themselves.

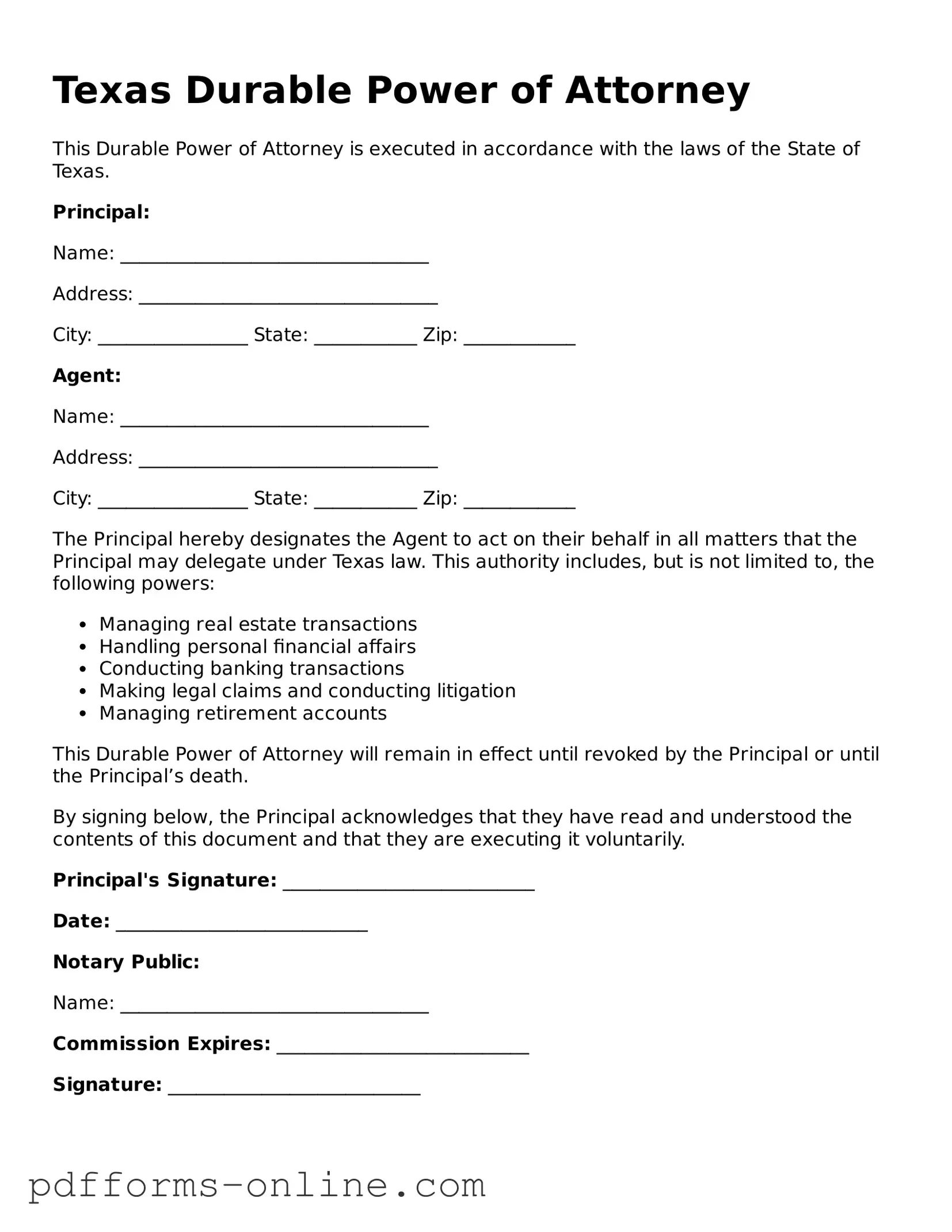

Document Example

Texas Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the State of Texas.

Principal:

Name: _________________________________

Address: ________________________________

City: ________________ State: ___________ Zip: ____________

Agent:

Name: _________________________________

Address: ________________________________

City: ________________ State: ___________ Zip: ____________

The Principal hereby designates the Agent to act on their behalf in all matters that the Principal may delegate under Texas law. This authority includes, but is not limited to, the following powers:

- Managing real estate transactions

- Handling personal financial affairs

- Conducting banking transactions

- Making legal claims and conducting litigation

- Managing retirement accounts

This Durable Power of Attorney will remain in effect until revoked by the Principal or until the Principal’s death.

By signing below, the Principal acknowledges that they have read and understood the contents of this document and that they are executing it voluntarily.

Principal's Signature: ___________________________

Date: ___________________________

Notary Public:

Name: _________________________________

Commission Expires: ___________________________

Signature: ___________________________

Frequently Asked Questions

-

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, called an agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters can be managed without interruption.

-

What powers can be granted to the agent?

The principal can grant a wide range of powers to the agent. These may include managing bank accounts, paying bills, buying or selling property, and making investment decisions. It is essential for the principal to clearly outline the specific powers they wish to confer, as this will guide the agent in their decision-making process.

-

How do I create a Durable Power of Attorney in Texas?

To create a Durable Power of Attorney in Texas, the principal must complete a written form that complies with state laws. This form should clearly state the powers being granted and be signed by the principal in the presence of a notary public. It's advisable to discuss the document with legal counsel to ensure that it meets all necessary requirements and reflects the principal's intentions.

-

Can I revoke a Durable Power of Attorney?

Yes, a principal has the right to revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To revoke the document, the principal should provide written notice to the agent and any institutions or individuals that were relying on the power of attorney. It’s wise to create a new document if the principal wishes to appoint a different agent or change the powers granted.

-

What happens if the agent cannot serve?

If the appointed agent is unable or unwilling to serve, the Durable Power of Attorney may include alternate agents. If no alternates are specified, the principal may need to revoke the existing document and create a new one with a different agent. This highlights the importance of selecting a reliable and willing individual as the agent.

-

Is a Durable Power of Attorney the same as a Medical Power of Attorney?

No, a Durable Power of Attorney primarily deals with financial and legal matters, while a Medical Power of Attorney focuses on healthcare decisions. Although both documents allow someone to act on behalf of the principal, they serve different purposes. It is often advisable for individuals to have both documents in place to ensure comprehensive coverage of their needs.

Misconceptions

Understanding the Texas Durable Power of Attorney form is crucial for anyone looking to manage their financial and legal affairs effectively. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- It only applies to financial matters. Many people believe that a Durable Power of Attorney (DPOA) is limited to financial decisions. In reality, it can also cover healthcare decisions if specified.

- It becomes effective only when I become incapacitated. A DPOA can be effective immediately upon signing, unless the document specifies otherwise. This allows the agent to act on your behalf right away.

- It is the same as a regular Power of Attorney. While both documents grant authority to an agent, a Durable Power of Attorney remains valid even if you become incapacitated, unlike a regular Power of Attorney.

- My agent can do anything they want with my assets. An agent is required to act in your best interest and according to your wishes. They cannot make decisions that contradict your specified instructions.

- Once I sign it, I cannot change it. You can revoke or modify your Durable Power of Attorney at any time, as long as you are mentally competent.

- It must be notarized to be valid. In Texas, a Durable Power of Attorney must be signed by you and can be witnessed or notarized, but notarization is not strictly required for validity.

- My spouse automatically has power of attorney. Unless you have specifically designated your spouse as your agent through a DPOA, they do not have automatic authority to make decisions on your behalf.

- It expires after a certain period. A Durable Power of Attorney does not have an expiration date unless specified in the document. It remains in effect until revoked or until your death.

- Only lawyers can create a Durable Power of Attorney. While it’s advisable to consult a lawyer, individuals can create a DPOA using templates and forms available online, as long as they meet state requirements.

- My agent can make medical decisions without my consent. Your agent can only make medical decisions if the DPOA explicitly grants them that authority. Otherwise, they cannot override your wishes.

By addressing these misconceptions, individuals can better understand the importance and functionality of a Texas Durable Power of Attorney, ensuring their wishes are respected and their affairs are managed appropriately.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the powers granted to the agent. Individuals often use vague language or assume that the agent will know what to do. This can lead to confusion and potential disputes later on.

-

Neglecting to Sign and Date: A Durable Power of Attorney is not valid unless it is signed and dated by the principal. Some people forget this crucial step, rendering the document ineffective. Always double-check that all required signatures are present.

-

Forgetting to Choose Alternate Agents: It’s wise to designate alternate agents in case the primary agent is unable or unwilling to act. Many individuals overlook this option, which can leave them without representation when it’s needed most.

-

Failing to Update the Document: Life circumstances change, and so do relationships. People often forget to update their Durable Power of Attorney when significant changes occur, such as a divorce or the death of an agent. Regular reviews of the document are essential to ensure it reflects current wishes.

Find Some Other Durable Power of Attorney Forms for Specific States

How to Get Power of Attorney in Nc - Ensure your wishes are respected with a Durable Power of Attorney.

Power of Attorney Michigan - This form must be signed and dated to be legally binding.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Texas Durable Power of Attorney is a legal document that allows one person to grant another the authority to make financial and legal decisions on their behalf. |

| Durability | This document remains effective even if the person who created it becomes incapacitated, unlike a regular power of attorney. |

| Governing Law | The Texas Durable Power of Attorney is governed by the Texas Estates Code, specifically Title 2, Chapter 752. |

| Principal and Agent | The person who creates the document is called the principal, while the person designated to act on their behalf is known as the agent or attorney-in-fact. |

| Scope of Authority | The authority granted can be broad or limited, depending on the specific wishes of the principal as outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Signing Requirements | The document must be signed by the principal in the presence of a notary public or two witnesses to be valid. |

Similar forms

The Texas Medical Power of Attorney is similar to the Durable Power of Attorney in that both documents allow individuals to appoint someone to make decisions on their behalf. However, the Medical Power of Attorney specifically focuses on health care decisions. In the event that a person becomes incapacitated, the appointed agent can make medical choices, ensuring that the individual’s health care preferences are respected. This document is crucial for those who want to maintain control over their medical treatment even when they are unable to communicate their wishes directly.

The Living Will, or Advance Directive, shares similarities with the Durable Power of Attorney in that both deal with end-of-life decisions. A Living Will outlines a person's wishes regarding life-sustaining treatment in situations where they are unable to express their preferences. While the Durable Power of Attorney allows an agent to make various decisions, including financial and legal matters, the Living Will is strictly focused on health care decisions at the end of life. Together, these documents ensure comprehensive planning for both health care and financial matters.

The Revocable Trust is another document that bears resemblance to the Durable Power of Attorney. A Revocable Trust allows an individual to manage their assets during their lifetime and designate how those assets will be distributed after death. While a Durable Power of Attorney grants authority to an agent to act on behalf of the principal, a Revocable Trust allows the individual to retain control over their assets while providing a clear plan for asset management. Both documents serve to streamline decision-making and asset distribution but do so in different contexts.

The Guardianship document is also similar to the Durable Power of Attorney, as both involve the appointment of someone to act on behalf of another person. A Guardianship is a legal relationship established by a court when an individual is deemed unable to manage their personal affairs. This can include decisions about health care, finances, and living arrangements. In contrast, a Durable Power of Attorney is created voluntarily and does not require court intervention. Both documents aim to protect individuals who cannot make decisions for themselves, but the processes and implications differ significantly.