Valid Texas Deed in Lieu of Foreclosure Template

In the state of Texas, homeowners facing the threat of foreclosure often seek alternatives to protect their financial futures. One such alternative is the Deed in Lieu of Foreclosure, a legal instrument that allows a homeowner to voluntarily transfer the title of their property back to the lender in exchange for the cancellation of their mortgage debt. This process can offer significant benefits, including the opportunity to avoid the lengthy and often stressful foreclosure process. By executing this deed, homeowners can potentially preserve their credit scores and lessen the emotional toll associated with losing their home. The form itself typically outlines essential details such as the property description, the parties involved, and any agreements regarding the condition of the property upon transfer. It’s important for homeowners to understand the implications of this decision, as it involves relinquishing ownership and may have tax consequences. Overall, the Deed in Lieu of Foreclosure can serve as a practical solution for those looking to navigate their financial challenges with greater control and dignity.

Document Example

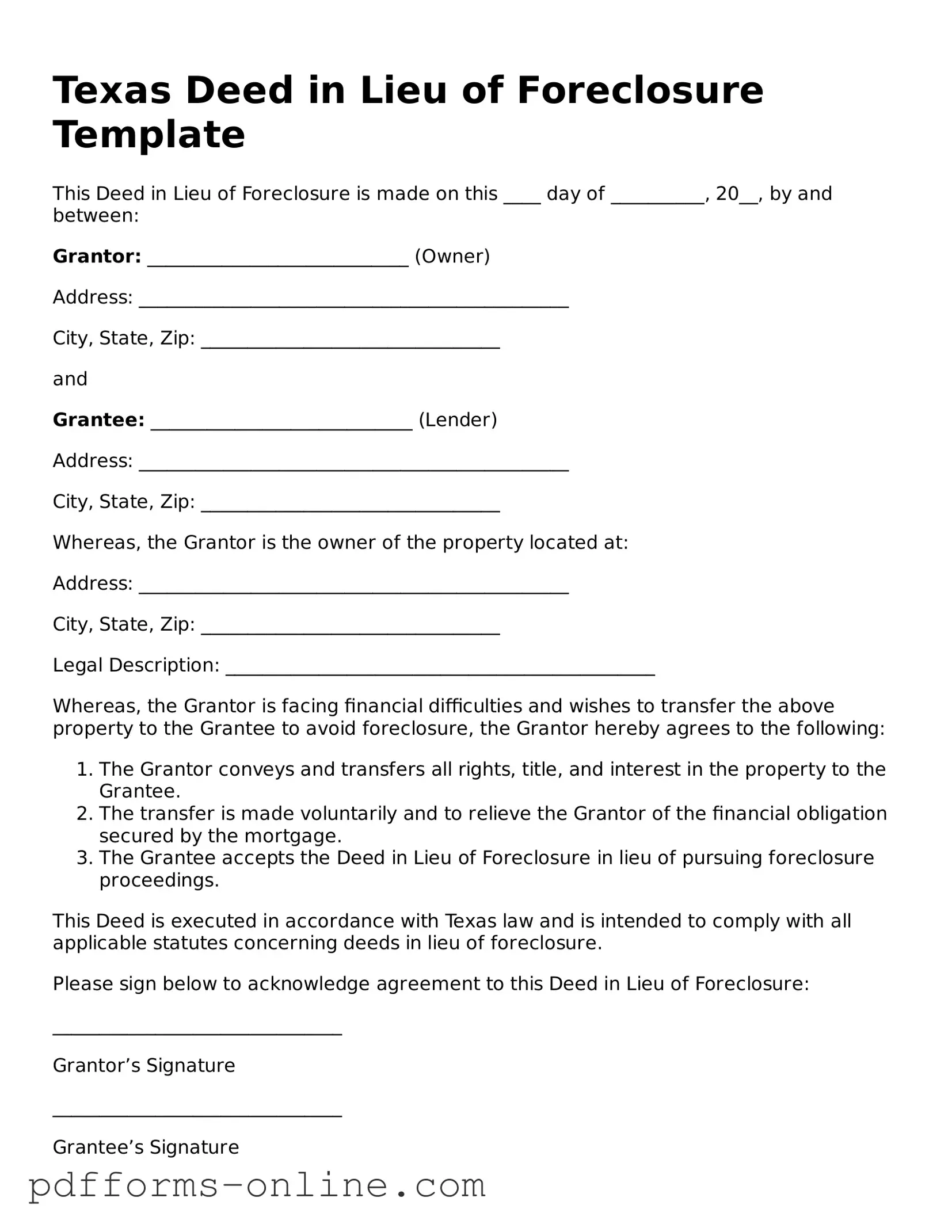

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on this ____ day of __________, 20__, by and between:

Grantor: ____________________________ (Owner)

Address: ______________________________________________

City, State, Zip: ________________________________

and

Grantee: ____________________________ (Lender)

Address: ______________________________________________

City, State, Zip: ________________________________

Whereas, the Grantor is the owner of the property located at:

Address: ______________________________________________

City, State, Zip: ________________________________

Legal Description: ______________________________________________

Whereas, the Grantor is facing financial difficulties and wishes to transfer the above property to the Grantee to avoid foreclosure, the Grantor hereby agrees to the following:

- The Grantor conveys and transfers all rights, title, and interest in the property to the Grantee.

- The transfer is made voluntarily and to relieve the Grantor of the financial obligation secured by the mortgage.

- The Grantee accepts the Deed in Lieu of Foreclosure in lieu of pursuing foreclosure proceedings.

This Deed is executed in accordance with Texas law and is intended to comply with all applicable statutes concerning deeds in lieu of foreclosure.

Please sign below to acknowledge agreement to this Deed in Lieu of Foreclosure:

_______________________________

Grantor’s Signature

_______________________________

Grantee’s Signature

Witnessed by:

_______________________________

Signature of Witness

Date: ________________________

_______________________________

Name of Witness (Printed)

Date: ________________________

State of Texas

County of ___________________

Before me, the undersigned authority, on this day personally appeared ____________________________, known to me (or proven to me on the oath of _____________________) to be the person whose name is subscribed to the above instrument, and acknowledged to me that he/she executed the same for the purposes and consideration therein expressed.

Given under my hand and seal this ____ day of __________, 20__.

_______________________________

Notary Public, State of Texas

My commission expires: ___________________

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers the ownership of their property to the lender to avoid foreclosure. This option is often pursued when the homeowner is unable to keep up with mortgage payments and wants to mitigate the negative impact of foreclosure on their credit history.

-

How does a Deed in Lieu of Foreclosure work?

The process begins when the homeowner contacts their lender to discuss the possibility of a Deed in Lieu of Foreclosure. If both parties agree, the homeowner signs the deed, which transfers ownership of the property to the lender. In exchange, the lender typically agrees to release the homeowner from the mortgage debt, although terms can vary.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several benefits to consider. First, it can significantly reduce the impact on your credit score compared to a foreclosure. Second, it allows for a smoother transition out of the property, as the homeowner can avoid the lengthy and often stressful foreclosure process. Lastly, it may provide the homeowner with some financial relief, as they can walk away without the burden of the mortgage debt.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential drawbacks. One significant concern is that the homeowner may still be liable for any deficiency judgment if the property's value is less than the mortgage balance, unless the lender explicitly waives this right. Additionally, some lenders may not offer this option or may require the homeowner to demonstrate financial hardship.

-

Can I negotiate terms with my lender?

Absolutely. Homeowners are encouraged to negotiate terms that work for both parties. This could include discussing the release of liability for the remaining mortgage balance or potential relocation assistance. Being open and honest about your situation can lead to more favorable terms.

-

What happens to my credit score after a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure will still impact your credit score, it is generally less damaging than a foreclosure. The exact impact will depend on your overall credit profile and the scoring model used. However, many homeowners find that they can rebuild their credit more quickly after a Deed in Lieu.

-

Is a Deed in Lieu of Foreclosure the right choice for everyone?

Not necessarily. Each homeowner's situation is unique. Factors such as the amount owed on the mortgage, the property’s current value, and personal financial circumstances should all be considered. Consulting with a financial advisor or housing counselor can help determine if this option is the best fit.

-

How do I start the process of obtaining a Deed in Lieu of Foreclosure?

The first step is to contact your lender to express your interest in this option. Be prepared to provide information about your financial situation and the reasons for your inability to continue making mortgage payments. It may also be helpful to gather any relevant documentation, such as income statements and expenses, to support your case.

Misconceptions

Understanding the Texas Deed in Lieu of Foreclosure can help homeowners navigate their options during financial distress. However, several misconceptions can cloud the decision-making process. Here are eight common misconceptions:

- A Deed in Lieu of Foreclosure is the same as a foreclosure. Many believe that both processes are identical, but they are different. A deed in lieu allows the homeowner to voluntarily transfer the property to the lender to avoid foreclosure proceedings.

- It eliminates all debt associated with the mortgage. This is not always true. While the homeowner may no longer be responsible for the property, they could still owe money if the sale of the home does not cover the full amount of the mortgage.

- It will not affect my credit score. A deed in lieu will impact credit scores, though typically less severely than a foreclosure. However, it will still be noted on the homeowner's credit report.

- Homeowners can choose to stay in the property after signing. Once the deed is transferred, the homeowner must vacate the property. Remaining in the home could lead to legal issues.

- It is a quick and easy process. While a deed in lieu can be faster than foreclosure, it still involves paperwork and negotiations with the lender. The process can take time and may require the lender's approval.

- All lenders accept a deed in lieu of foreclosure. Not all lenders offer this option. Homeowners should confirm with their lender if a deed in lieu is a possibility for their situation.

- I can only use a deed in lieu if I am behind on my mortgage payments. Homeowners do not have to be in default to pursue this option. However, lenders may prefer it when payments are already delinquent.

- A deed in lieu is free of any tax implications. Homeowners may face tax consequences, particularly if the lender forgives a portion of the mortgage debt. Consulting a tax professional is advisable.

Addressing these misconceptions can lead to more informed decisions regarding the Texas Deed in Lieu of Foreclosure. Homeowners should seek guidance and understand the implications before proceeding.

Common mistakes

-

Failing to provide accurate property information. Ensure the property address and legal description are correct.

-

Not including all necessary parties. All owners of the property must sign the deed.

-

Overlooking the requirement for notarization. A notary public must witness the signatures for the deed to be valid.

-

Ignoring the implications of the deed. Understand that this action may impact credit scores and future borrowing capabilities.

-

Neglecting to consult with a legal professional. Seek guidance to ensure all aspects of the deed are understood.

-

Not checking for existing liens. Verify that there are no additional claims against the property that could complicate the process.

-

Failing to provide a clear explanation of the reasons for the deed in lieu. This can affect the lender's willingness to accept the deed.

-

Submitting the form without a cover letter. A brief letter can clarify intentions and provide context for the lender.

-

Not retaining copies of all documents. Keep copies of the signed deed and any correspondence for your records.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - In some cases, lenders may require a relocation assistance payment as part of the Deed in Lieu of Foreclosure agreement.

For anyone navigating a separation, having a clear understanding of a Marital Separation Agreement is crucial; this document not only outlines the specifics of the separation but also helps in managing expectations and responsibilities. You can find more information in the comprehensive guide on the Marital Separation Agreement form.

Foreclosure Process in Georgia - It represents a strategic move for borrowers looking to avoid lengthy court battles and fees.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | This process is governed by Texas Property Code, specifically Chapter 51, which outlines the procedures for foreclosure and related actions. |

| Eligibility | Homeowners facing financial difficulties may qualify for a Deed in Lieu of Foreclosure, provided they have exhausted other options like loan modifications. |

| Benefits | This option can help borrowers avoid the negative impact of foreclosure on their credit score and can expedite the transition out of the property. |

| Process | To initiate, the borrower must contact the lender, negotiate terms, and complete the necessary paperwork, including the deed itself. |

| Potential Risks | Borrowers should be aware that agreeing to a Deed in Lieu may not absolve them of all financial obligations, such as potential tax implications. |

Similar forms

A Deed in Lieu of Foreclosure is often compared to a Short Sale. In a Short Sale, a homeowner sells their property for less than the amount owed on the mortgage, with the lender's approval. Both options allow homeowners to avoid the lengthy and costly process of foreclosure. However, in a Short Sale, the homeowner remains on the hook for any remaining mortgage balance unless the lender agrees to forgive the debt, whereas a Deed in Lieu transfers ownership to the lender, potentially relieving the homeowner of further obligations.

Another document similar to the Deed in Lieu of Foreclosure is a Mortgage Modification Agreement. This agreement alters the terms of an existing mortgage, potentially lowering monthly payments or extending the loan term. While a Deed in Lieu of Foreclosure relinquishes ownership of the property, a Mortgage Modification keeps the homeowner in possession. Both documents aim to assist homeowners facing financial hardship, but they do so through different means.

A Forebearance Agreement is also relevant in this context. This document allows homeowners to temporarily pause or reduce their mortgage payments during financial difficulties. Unlike a Deed in Lieu, which results in the homeowner giving up the property, a Forbearance Agreement aims to keep the homeowner in their home while they regain financial stability. Both documents are strategies to prevent foreclosure, but they offer different pathways based on the homeowner's situation.

The Loan Assumption Agreement shares similarities with a Deed in Lieu of Foreclosure as well. In this agreement, a new buyer takes over the existing mortgage from the seller. This can relieve the original homeowner of their mortgage obligations, much like a Deed in Lieu. However, in a Loan Assumption, the property is sold to a new buyer, while a Deed in Lieu involves the lender taking back the property directly from the homeowner.

In addition to the aforementioned documents, understanding the legal aspects surrounding them is crucial. For those navigating these complexities, resources such as OnlineLawDocs.com can provide valuable guidance in managing financial affairs and ensuring that necessary legal documents are completed correctly, thereby safeguarding one's interests in times of financial uncertainty.

A Quitclaim Deed is another document that can be compared to a Deed in Lieu of Foreclosure. This legal instrument allows a property owner to transfer their interest in a property to another party without any guarantees about the title. While a Quitclaim Deed can be used in various situations, including transferring property between family members, it can also be used in the context of foreclosure to relinquish ownership. However, unlike a Deed in Lieu, a Quitclaim Deed does not typically involve a lender's acceptance or agreement.

In some cases, a Bankruptcy Filing can be similar to a Deed in Lieu of Foreclosure. When individuals file for bankruptcy, they may include their mortgage debts in the filing, which can lead to the discharge of those debts. This can prevent foreclosure, similar to how a Deed in Lieu transfers ownership and potentially relieves the homeowner of their mortgage obligations. However, bankruptcy involves a court process and can have long-lasting effects on credit, whereas a Deed in Lieu is a more straightforward transaction.

Lastly, a Release of Lien can be related to a Deed in Lieu of Foreclosure. This document is used to remove a lien from a property, often after a debt has been paid or settled. In the case of a Deed in Lieu, the lien is effectively released when the property is transferred back to the lender. While both documents deal with the ownership and financial obligations tied to a property, a Release of Lien does not involve the transfer of ownership, making it a different approach to resolving debt issues.