Valid Texas Deed Template

The Texas Deed form serves as a crucial document in real estate transactions, facilitating the transfer of property ownership from one party to another. This form outlines essential details, including the names of the grantor and grantee, the legal description of the property, and any relevant covenants or restrictions. It is important to accurately complete the form to ensure that the transfer is legally binding and recognized by local authorities. Additionally, the Texas Deed may include provisions for warranties, which provide assurances regarding the title's validity. Understanding the nuances of this form is vital for both buyers and sellers, as it plays a significant role in establishing clear property rights and responsibilities. By adhering to the specific requirements set forth by Texas law, parties can avoid potential disputes and ensure a smooth transaction process.

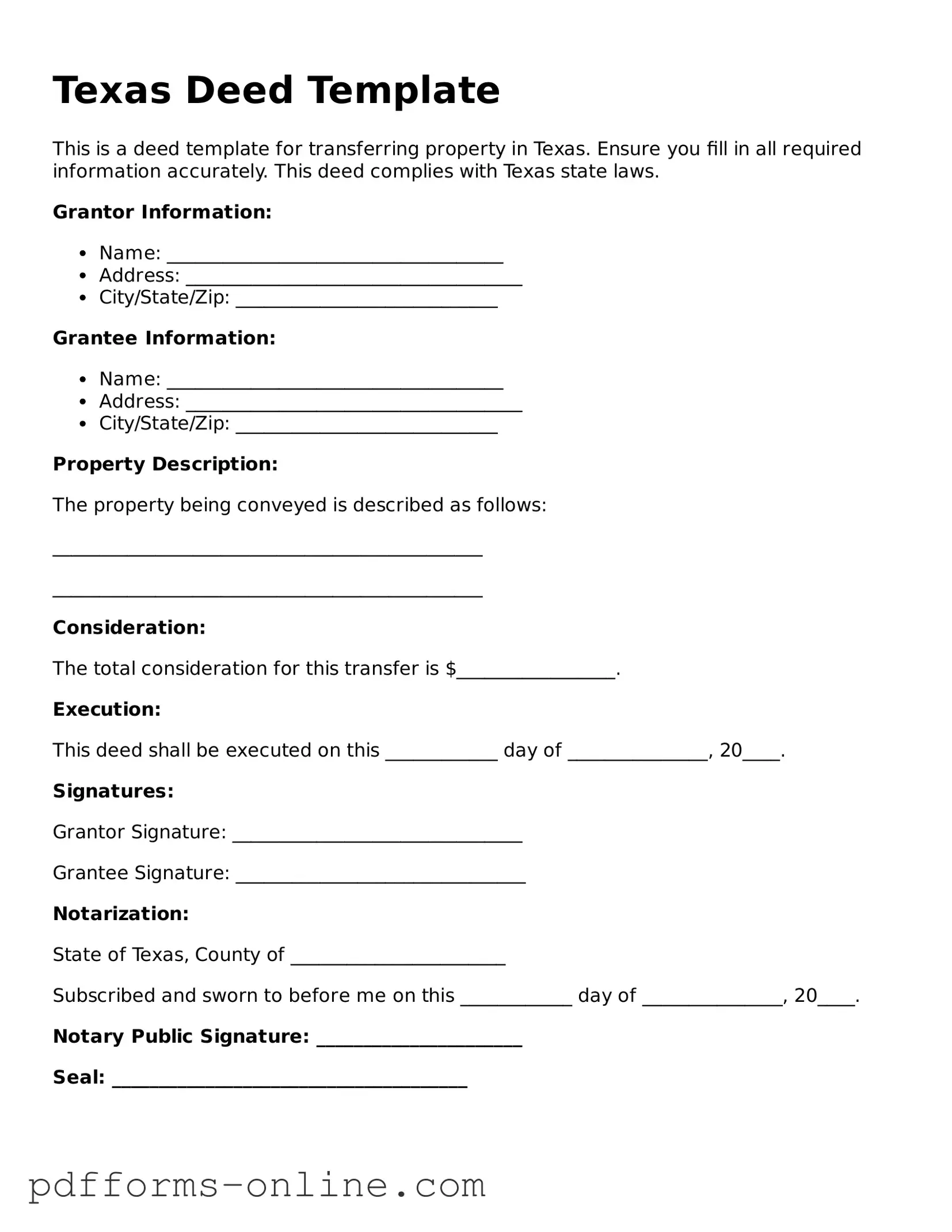

Document Example

Texas Deed Template

This is a deed template for transferring property in Texas. Ensure you fill in all required information accurately. This deed complies with Texas state laws.

Grantor Information:

- Name: ____________________________________

- Address: ____________________________________

- City/State/Zip: ____________________________

Grantee Information:

- Name: ____________________________________

- Address: ____________________________________

- City/State/Zip: ____________________________

Property Description:

The property being conveyed is described as follows:

______________________________________________

______________________________________________

Consideration:

The total consideration for this transfer is $_________________.

Execution:

This deed shall be executed on this ____________ day of _______________, 20____.

Signatures:

Grantor Signature: _______________________________

Grantee Signature: _______________________________

Notarization:

State of Texas, County of _______________________

Subscribed and sworn to before me on this ____________ day of _______________, 20____.

Notary Public Signature: ______________________

Seal: ______________________________________

Frequently Asked Questions

-

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real property in the state of Texas. It outlines the details of the transfer, including the names of the grantor (seller) and grantee (buyer), a description of the property, and any conditions or restrictions associated with the transfer.

-

What types of Deed forms are available in Texas?

There are several types of Deed forms commonly used in Texas, including:

- General Warranty Deed: Offers the highest level of protection to the grantee, guaranteeing that the grantor holds clear title to the property.

- Special Warranty Deed: Provides limited warranties, only covering the time the grantor owned the property.

- Quitclaim Deed: Transfers whatever interest the grantor has in the property without any warranties.

- Deed of Trust: Used in financing, where the property serves as collateral for a loan.

-

How do I fill out a Texas Deed form?

To fill out a Texas Deed form, start by entering the names of the grantor and grantee. Next, provide a legal description of the property, which can usually be found in the property's existing deed or title report. Include the date of the transfer and any special conditions. Finally, ensure that the deed is signed by the grantor and notarized to make it legally binding.

-

Is a Texas Deed form required to be recorded?

While recording a Texas Deed form is not mandatory, it is highly recommended. Recording the deed provides public notice of the ownership transfer and protects the grantee's interest in the property. This can be crucial in disputes over property ownership or when dealing with future transactions.

-

What are the costs associated with filing a Texas Deed form?

The costs for filing a Texas Deed form can vary by county. Typically, there is a filing fee that ranges from $10 to $30. Additionally, if you require a title search or legal assistance, those services will incur extra costs. It is advisable to check with the local county clerk's office for specific fee schedules.

-

Can I use a Texas Deed form for transferring property to a trust?

Yes, a Texas Deed form can be used to transfer property into a trust. The grantor must specify the trust as the grantee and provide the trust's name and details. It is essential to ensure that the trust is properly established and that the deed complies with any specific requirements related to trusts.

Misconceptions

Understanding the Texas Deed form is essential for anyone involved in real estate transactions in Texas. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- All Deeds Are the Same: Many people believe that all deed forms are interchangeable. In reality, different types of deeds serve specific purposes. For example, a warranty deed offers more protection to the buyer than a quitclaim deed.

- Deeds Do Not Need to Be Recorded: Some individuals think that once a deed is signed, it does not need to be filed with the county clerk. Recording the deed is crucial, as it provides public notice of ownership and protects against future claims.

- Only Lawyers Can Prepare Deeds: While legal assistance can be beneficial, it is not mandatory to have a lawyer draft a deed. Many individuals use templates or online resources to create their own deeds, provided they follow Texas law.

- Signatures Are the Only Requirement: A common belief is that merely signing a deed makes it valid. However, a deed must also meet specific legal requirements, such as being notarized and containing a proper description of the property.

- Once a Deed is Signed, It Cannot Be Changed: Some assume that a signed deed is final and unchangeable. In fact, a deed can be amended or revoked, but this process must be done legally and typically requires additional documentation.

- All Deeds Transfer Ownership Immediately: Many people think that signing a deed automatically transfers ownership. While the deed serves as evidence of transfer, the actual change in ownership may depend on other factors, such as the terms of the sale or any outstanding liens.

Clarifying these misconceptions can help individuals navigate the complexities of real estate transactions in Texas more effectively.

Common mistakes

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion and disputes. Make sure to include the full legal description, which can be found in the property's existing deed or tax records.

-

Missing Signatures: All required parties must sign the deed. If a spouse is involved, their signature may also be necessary, even if they are not on the title.

-

Not Notarizing the Document: A deed must be notarized to be valid. Skipping this step can render the deed unenforceable.

-

Improper Date: Entering the wrong date can create issues with the validity of the deed. Ensure that the date of execution is accurate.

-

Omitting Grantee Information: The grantee's name and address must be clearly stated. Failing to provide this information can lead to problems with property transfer.

-

Not Recording the Deed: After filling out the deed, it must be filed with the county clerk's office. Neglecting to do this means the transfer may not be recognized legally.

Find Some Other Deed Forms for Specific States

How Long Does It Take to Record a Deed in Florida - Investors should retain professional help when drafting a Deed.

Creating a comprehensive and legally binding document like a Texas Last Will and Testament form is essential for anyone looking to ensure their wishes are fulfilled after they pass. This form details the distribution of assets, providing vital clarity for family members and executors, thereby minimizing disputes. For those seeking assistance in drafting such a document, valuable resources can be found at OnlineLawDocs.com, which offers guidance and templates tailored to Texas law.

Property Deed Form - A method for individuals to pass property to heirs.

Michigan Property Transfer Affidavit - Certain events, like marriage or divorce, may necessitate updating a deed.

Who Has the Deed to My House - Some households use Deeds to formalize family property gifts.

PDF Attributes

| Fact Name | Description |

|---|---|

| Type of Deed | The Texas Deed form can be a General Warranty Deed, Special Warranty Deed, or Quitclaim Deed, depending on the needs of the parties involved. |

| Governing Law | The Texas Property Code governs the use and execution of deeds in Texas, ensuring compliance with state regulations. |

| Required Signatures | For the deed to be valid, it must be signed by the grantor (the person transferring the property) and acknowledged before a notary public. |

| Recording | To provide public notice and protect the interests of the parties, the deed should be recorded in the county where the property is located. |

Similar forms

The Texas Deed form is similar to a Warranty Deed. A Warranty Deed provides a guarantee that the seller has clear title to the property and the right to sell it. This document protects the buyer against any claims that may arise regarding the ownership of the property. It ensures that the seller is responsible for any issues related to the title, offering peace of mind to the buyer.

Another document akin to the Texas Deed is the Quitclaim Deed. Unlike a Warranty Deed, a Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. This means that if the seller does not have clear title, the buyer may not have any recourse. It is often used among family members or in situations where the parties trust each other.

The Special Warranty Deed is also similar. This type of deed guarantees that the seller has not encumbered the property during their ownership. However, it does not provide any guarantees about prior ownership. Buyers receive some protection, but it is limited compared to a Warranty Deed. This document is often used in commercial real estate transactions.

In situations where individuals wish to delegate healthcare decision-making, obtaining a comprehensive Medical Power of Attorney form is crucial. This document enables the appointed agent to make informed medical choices that align with the individual’s preferences, thus safeguarding their healthcare options when they are unable to voice them themselves.

A Bargain and Sale Deed shares similarities as well. This deed implies that the seller has the right to sell the property but does not guarantee clear title. It is commonly used in foreclosure sales and tax lien sales. Buyers should be aware that they may assume risks related to title issues when using this type of deed.

The Grant Deed is another document that resembles the Texas Deed. A Grant Deed conveys property from one person to another and typically includes some assurances regarding the title. However, it does not provide the same level of protection as a Warranty Deed. Buyers can expect that the seller has not sold the property to someone else, but they should still conduct due diligence.

Lastly, the Deed of Trust is related but serves a different purpose. This document secures a loan with real property as collateral. It involves three parties: the borrower, the lender, and a trustee. While it does not transfer ownership, it establishes the lender's rights in case of default. Understanding this document is essential for anyone financing a property purchase.