Valid Texas Bill of Sale Template

When it comes to transferring ownership of personal property in Texas, the Bill of Sale form plays a crucial role in ensuring a smooth and legal transaction. This document serves as proof of the sale and outlines essential details such as the buyer's and seller's names, the date of the transaction, and a description of the item being sold. It can apply to various types of property, from vehicles to furniture, making it a versatile tool for both individuals and businesses. Importantly, the Bill of Sale not only protects the interests of both parties but also provides a record that can be referenced in case of disputes. In Texas, while the form is not always legally required, having one can simplify the process and help avoid complications down the road. Understanding the components of this document can empower both buyers and sellers to engage in transactions with confidence.

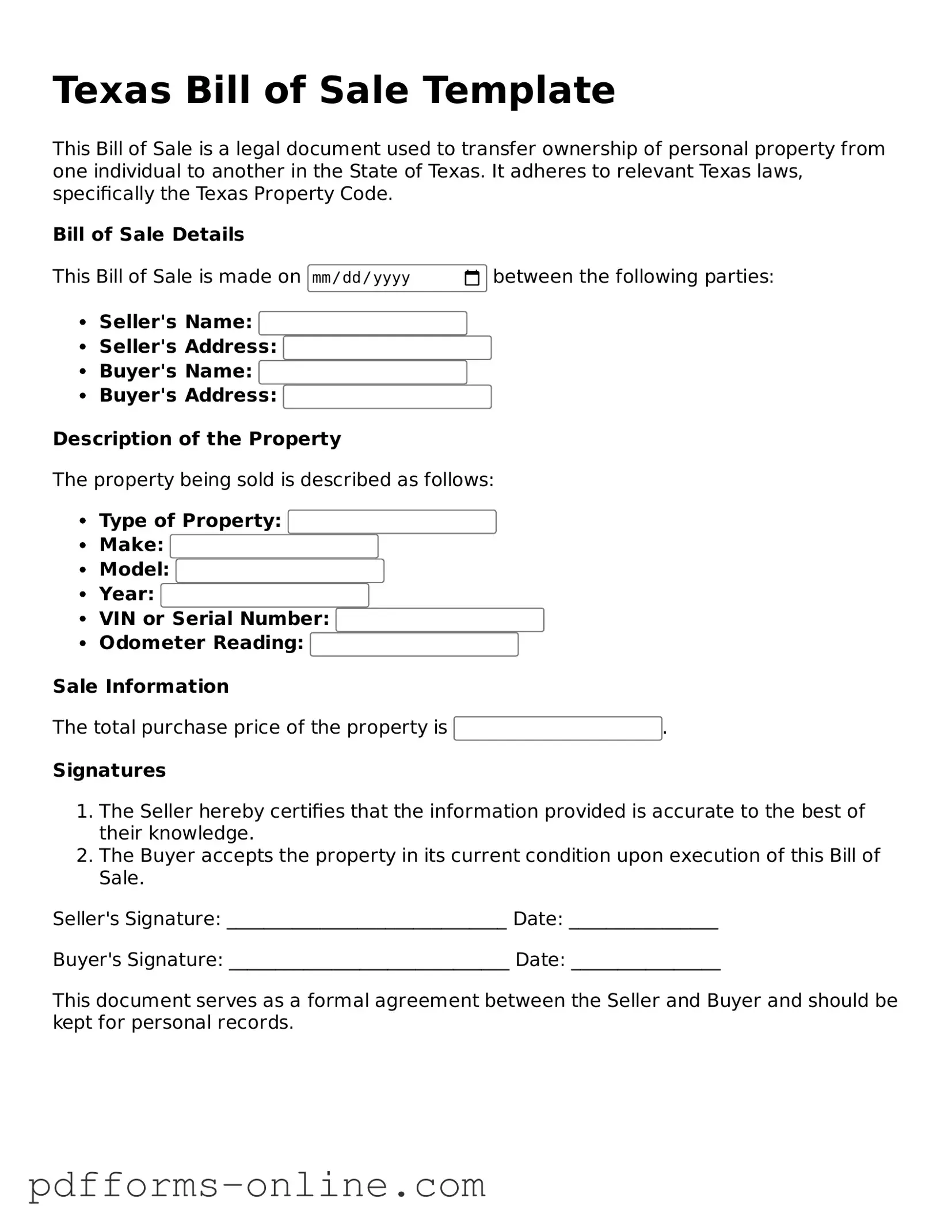

Document Example

Texas Bill of Sale Template

This Bill of Sale is a legal document used to transfer ownership of personal property from one individual to another in the State of Texas. It adheres to relevant Texas laws, specifically the Texas Property Code.

Bill of Sale Details

This Bill of Sale is made on between the following parties:

- Seller's Name:

- Seller's Address:

- Buyer's Name:

- Buyer's Address:

Description of the Property

The property being sold is described as follows:

- Type of Property:

- Make:

- Model:

- Year:

- VIN or Serial Number:

- Odometer Reading:

Sale Information

The total purchase price of the property is .

Signatures

- The Seller hereby certifies that the information provided is accurate to the best of their knowledge.

- The Buyer accepts the property in its current condition upon execution of this Bill of Sale.

Seller's Signature: ______________________________ Date: ________________

Buyer's Signature: ______________________________ Date: ________________

This document serves as a formal agreement between the Seller and Buyer and should be kept for personal records.

Frequently Asked Questions

-

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. It outlines the details of the transaction, including the buyer, seller, and a description of the item being sold.

-

When do I need a Bill of Sale in Texas?

You typically need a Bill of Sale when selling or purchasing personal property, such as vehicles, boats, or trailers. While not always legally required, having one is a good practice to protect both the buyer and seller in the transaction.

-

What information should be included in a Texas Bill of Sale?

A comprehensive Texas Bill of Sale should include:

- The names and addresses of both the buyer and seller

- A detailed description of the item being sold, including make, model, year, and VIN for vehicles

- The purchase price

- The date of the transaction

- Any warranties or guarantees, if applicable

-

Is a Bill of Sale required for vehicle sales in Texas?

Yes, a Bill of Sale is required for vehicle sales in Texas. It helps to document the transfer of ownership and is often needed when registering the vehicle with the Texas Department of Motor Vehicles (DMV).

-

Do I need to have the Bill of Sale notarized?

In Texas, notarization of a Bill of Sale is not typically required. However, having it notarized can provide an extra layer of protection and authenticity, especially for high-value items.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale in Texas. As long as it includes all the necessary information, it is valid. There are also many templates available online that can help guide you in drafting one.

-

What if the item sold is damaged or not as described?

If the item sold is damaged or not as described, the buyer may have legal recourse against the seller. It’s important for both parties to be honest and transparent about the condition of the item to avoid disputes.

-

How long should I keep a Bill of Sale?

It is advisable to keep a Bill of Sale for at least three years after the sale. This allows both parties to have a record of the transaction in case any issues arise later.

-

Where can I find a Texas Bill of Sale template?

You can find Texas Bill of Sale templates online through various legal websites, or you can consult with a local attorney for assistance. Many templates are free and easy to fill out.

Misconceptions

When dealing with the Texas Bill of Sale form, several misconceptions can lead to confusion for buyers and sellers alike. Here are six common misunderstandings:

- A Bill of Sale is only necessary for vehicles. Many people believe that a Bill of Sale is required solely for the transfer of vehicle ownership. In reality, this document is useful for a variety of transactions, including the sale of personal property, boats, and even livestock.

- The Bill of Sale must be notarized. Some individuals think that notarization is a mandatory step for a Bill of Sale to be valid. While notarization can add an extra layer of security and authenticity, it is not a requirement for the document to be legally binding in Texas.

- All Bills of Sale are the same. There is a misconception that a generic Bill of Sale template can be used for any transaction. However, the specifics of the sale—such as the type of item, condition, and terms—can vary significantly, making it essential to tailor the document to fit the particular situation.

- A Bill of Sale serves as a warranty. Some people mistakenly believe that a Bill of Sale guarantees the quality or condition of the item sold. In truth, unless explicitly stated in the document, a Bill of Sale typically serves only as proof of the transaction and does not imply any warranties.

- You can’t sell an item without a Bill of Sale. There’s a common belief that a Bill of Sale is required for any sale to be legal. While it is advisable to have one for record-keeping and to protect both parties, many transactions can still be valid without this document, especially in informal settings.

- Once signed, a Bill of Sale cannot be revoked. Some individuals think that once a Bill of Sale is signed, it is final and cannot be undone. However, under certain circumstances, such as fraud or misrepresentation, it may be possible to contest the sale, although this can be complex and may require legal assistance.

Understanding these misconceptions can help individuals navigate the process of buying or selling items in Texas more effectively, ensuring that all parties are aware of their rights and responsibilities.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. It’s crucial to provide complete details about the buyer, seller, and the item being sold. Missing information can lead to confusion or disputes later on.

-

Incorrect Item Description: A common mistake is failing to accurately describe the item. This includes not specifying the make, model, year, and condition. An unclear description may result in misunderstandings between parties.

-

Omitting Signatures: Both the buyer and seller must sign the Bill of Sale. Neglecting to do so can invalidate the document. Ensure that both parties have signed before considering the transaction complete.

-

Not Including the Date: Forgetting to write the date of the transaction can create issues, especially if disputes arise later. Always include the date to establish a clear timeline of the sale.

-

Failing to Notarize: While notarization is not always required, some buyers or sellers may prefer it for added security. Notarizing the document can help verify the identities of the parties involved.

-

Ignoring State-Specific Requirements: Each state may have specific rules regarding Bill of Sale forms. Failing to adhere to Texas regulations could lead to complications. Always check for any state-specific requirements before finalizing the document.

-

Not Keeping Copies: After completing the Bill of Sale, it’s essential to keep copies for both the buyer and seller. This ensures that both parties have proof of the transaction, which can be helpful in case of future disputes.

Find Some Other Bill of Sale Forms for Specific States

Free Bill of Sale Georgia - This form can be customized to fit specific transaction needs between parties.

Nc Car Bill of Sale - Buyers can use the Bill of Sale to register their new purchase or for future resale.

Bill of Sale Michigan Template - This document serves to reduce the likelihood of fraud by documenting the exchange of goods.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Texas Bill of Sale form is used to document the sale of personal property between a buyer and a seller. |

| Governing Law | This form is governed by Texas Business and Commerce Code, Chapter 2, which addresses the sale of goods. |

| Property Types | It can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Buyer's Information | The form requires the buyer's full name and address to establish ownership. |

| Seller's Information | It also requires the seller's full name and address, ensuring both parties are identified. |

| Consideration | The form must state the consideration (purchase price) for the transaction to be valid. |

Similar forms

The Texas Bill of Sale is similar to a Vehicle Title Transfer document. Both documents serve to transfer ownership of a vehicle from one party to another. The Vehicle Title Transfer includes details about the vehicle, such as its identification number, make, and model. It also requires signatures from both the seller and buyer, ensuring that the transaction is legally recognized. This document is crucial for registering the vehicle in the new owner’s name.

Another document that resembles the Texas Bill of Sale is the Purchase Agreement. This agreement outlines the terms of a sale between a buyer and a seller. It specifies the items being sold, the price, and the payment terms. Like the Bill of Sale, it requires signatures from both parties to confirm their agreement. This document is often used for more complex transactions involving multiple items or services.

The Rental Agreement is also similar to the Texas Bill of Sale. While it pertains to the rental of property rather than a sale, it serves to establish a legal relationship between the landlord and tenant. It details the terms of the rental, including duration, payment, and responsibilities of both parties. Like the Bill of Sale, it requires signatures to make it binding.

The Warranty Deed is another document that shares similarities with the Texas Bill of Sale. This deed is used to transfer ownership of real estate. It provides a guarantee that the seller has the right to sell the property and that the title is clear. Both documents require specific details about the property and the parties involved, ensuring a smooth transfer of ownership.

The Promissory Note is akin to the Texas Bill of Sale in that it involves a financial transaction. This document outlines a borrower’s promise to repay a loan to the lender. It includes details such as the loan amount, interest rate, and repayment schedule. Both documents require the signatures of the involved parties to validate the agreement.

The Power of Attorney document is similar in that it allows one person to act on behalf of another. This can include signing a Bill of Sale for someone who cannot be present. The Power of Attorney must be executed properly to ensure that the authority granted is legally recognized. Both documents require clear identification of the parties involved and their intentions.

The Affidavit of Ownership is another document that shares characteristics with the Texas Bill of Sale. This affidavit is often used to declare ownership of personal property when a Bill of Sale is not available. It provides a sworn statement of ownership and can be used in legal matters to prove that someone has the right to sell or transfer the property.

Lastly, the Release of Liability form is similar to the Texas Bill of Sale in that it protects one party from future claims. When a Bill of Sale is executed, the seller typically releases any liability associated with the item sold. The Release of Liability formally documents this transfer of responsibility, ensuring that the buyer cannot hold the seller accountable for issues arising after the sale.