Valid Texas Articles of Incorporation Template

In the realm of business formation, the Texas Articles of Incorporation form serves as a crucial document for individuals looking to establish a corporation in the Lone Star State. This form outlines essential details about the corporation, including its name, purpose, and duration. It also requires information about the registered agent, who acts as the corporation's official point of contact for legal matters. Additionally, the form necessitates the listing of the initial directors, providing transparency about who will govern the corporation at its inception. By carefully completing this form, entrepreneurs can ensure compliance with state regulations and lay a solid foundation for their business endeavors. Understanding the nuances of the Texas Articles of Incorporation is vital for anyone aiming to navigate the complexities of corporate law while embarking on their entrepreneurial journey.

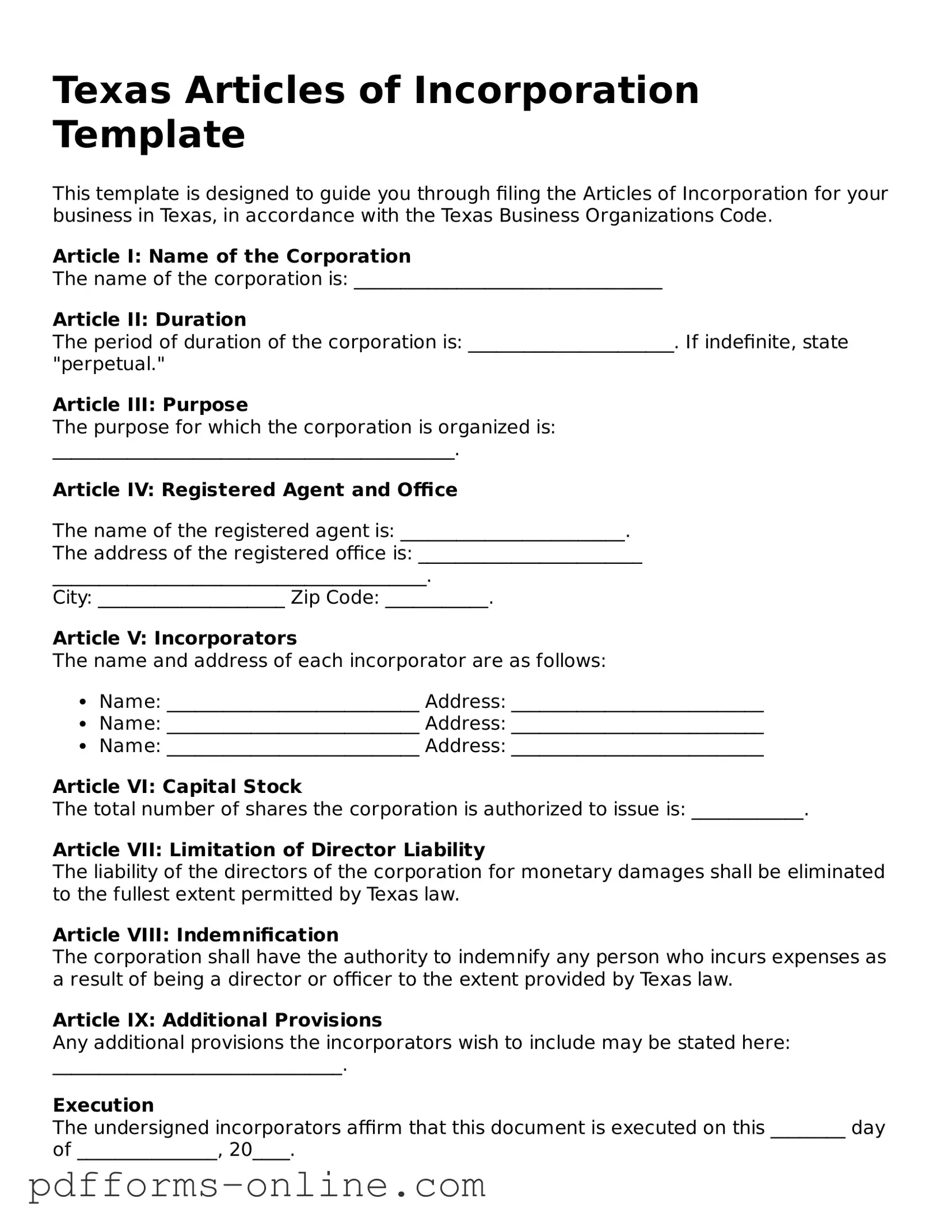

Document Example

Texas Articles of Incorporation Template

This template is designed to guide you through filing the Articles of Incorporation for your business in Texas, in accordance with the Texas Business Organizations Code.

Article I: Name of the Corporation

The name of the corporation is: _________________________________

Article II: Duration

The period of duration of the corporation is: ______________________.

If indefinite, state "perpetual."

Article III: Purpose

The purpose for which the corporation is organized is: ___________________________________________.

Article IV: Registered Agent and Office

The name of the registered agent is: ________________________.

The address of the registered office is: ________________________

________________________________________.

City: ____________________ Zip Code: ___________.

Article V: Incorporators

The name and address of each incorporator are as follows:

- Name: ___________________________ Address: ___________________________

- Name: ___________________________ Address: ___________________________

- Name: ___________________________ Address: ___________________________

Article VI: Capital Stock

The total number of shares the corporation is authorized to issue is: ____________.

Article VII: Limitation of Director Liability

The liability of the directors of the corporation for monetary damages shall be eliminated to the fullest extent permitted by Texas law.

Article VIII: Indemnification

The corporation shall have the authority to indemnify any person who incurs expenses as a result of being a director or officer to the extent provided by Texas law.

Article IX: Additional Provisions

Any additional provisions the incorporators wish to include may be stated here: _______________________________.

Execution

The undersigned incorporators affirm that this document is executed on this ________ day of _______________, 20____.

- Incorporator Signature: ___________________________

- Incorporator Signature: ___________________________

- Incorporator Signature: ___________________________

Once completed, this form should be submitted to the Texas Secretary of State along with the appropriate filing fee.

Frequently Asked Questions

-

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document that establishes a corporation in the state of Texas. It outlines the basic information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is a crucial first step in forming a corporation.

-

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in Texas must file the Articles of Incorporation. This includes individuals or groups wanting to create a business entity that provides limited liability protection to its owners. It's important to note that different types of corporations, such as nonprofit or for-profit, may have different requirements.

-

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in Texas, you can complete the form online or submit a paper application. The Texas Secretary of State’s website provides the necessary forms and guidelines. You will need to provide specific information, pay a filing fee, and submit the application to the Secretary of State. Ensure that all information is accurate to avoid delays in processing.

-

What information is required in the Articles of Incorporation?

Key information required includes:

- The name of the corporation, which must be unique and comply with Texas naming requirements.

- The purpose of the corporation, stating what it will do.

- The registered agent's name and address, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue.

- The names and addresses of the initial directors.

Providing complete and accurate information is essential for a smooth filing process.

-

What happens after I file the Articles of Incorporation?

Once the Articles of Incorporation are filed and approved, the corporation is officially formed. You will receive a certificate of incorporation from the Texas Secretary of State. This document serves as proof of your corporation's existence. After incorporation, you will need to comply with additional requirements, such as obtaining an Employer Identification Number (EIN) and setting up corporate bylaws.

Misconceptions

The Texas Articles of Incorporation form is essential for anyone looking to start a corporation in Texas. However, several misconceptions surround this document. Here are ten common misunderstandings:

-

Filing the form is optional.

This is incorrect. Filing the Articles of Incorporation is mandatory to legally establish a corporation in Texas.

-

All corporations must have a board of directors listed.

While most corporations will have a board of directors, the form does not require you to list them at the time of filing.

-

You cannot change the Articles once filed.

This is a misconception. You can amend the Articles of Incorporation after filing, but it requires a formal process.

-

The form is the same for all types of corporations.

This is misleading. Different types of corporations, such as nonprofit or for-profit, may have different requirements in their Articles.

-

You must have a physical office in Texas to file.

While you need a registered agent in Texas, you do not need a physical office to file the Articles of Incorporation.

-

Filing fees are the same for all corporations.

This is not true. Fees can vary based on the type of corporation and its structure.

-

Once filed, the corporation is automatically active.

This is incorrect. You may need to complete additional steps, such as obtaining an EIN or business licenses, for the corporation to operate.

-

Anyone can file the Articles of Incorporation.

While individuals can file, the person must be authorized to act on behalf of the corporation.

-

The Articles of Incorporation do not affect taxes.

This is misleading. The structure you choose can have significant tax implications for the corporation.

-

Once filed, the information is never public.

This is false. The Articles of Incorporation become public records and can be accessed by anyone.

Common mistakes

-

Incorrect Business Name: One of the most common mistakes is failing to choose a unique name for the corporation. The name must not be similar to any existing business in Texas. Before submitting the form, it is essential to check the Texas Secretary of State’s database for name availability.

-

Omitting Required Information: Some individuals forget to provide all necessary details, such as the principal office address or the registered agent's information. Each section of the form must be completed accurately to avoid delays in processing.

-

Improperly Designating the Registered Agent: The registered agent must be a person or a business entity authorized to conduct business in Texas. Failing to designate a proper registered agent can lead to legal complications and hinder the corporation's ability to receive important documents.

-

Choosing the Wrong Type of Corporation: There are different types of corporations, such as for-profit and non-profit. Misidentifying the type can result in compliance issues down the line. It’s crucial to understand the implications of each type before making a selection.

-

Neglecting to Sign the Document: All incorporators must sign the Articles of Incorporation. A missing signature can render the document invalid. It is advisable to double-check for signatures before submission.

-

Failure to Include Initial Directors: The form requires the names and addresses of the initial directors. Omitting this information can lead to the rejection of the filing. Ensure that this section is filled out completely and accurately.

Find Some Other Articles of Incorporation Forms for Specific States

Llc Application Ohio - Offers information on amending the Articles in the future.

Incorporate Nc - It ensures that the corporation operates as a separate entity.

Creating an effective Operating Agreement is vital for ensuring clarity and compliance within an Arizona LLC, as it outlines essential details about member roles and business procedures; for further guidance and resources, you can explore All Arizona Forms.

Pa Division of Corporations - It can contain indemnification clauses for corporate officers.

PDF Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to establish a corporation in Texas. |

| Governing Law | The form is governed by the Texas Business Organizations Code. |

| Filing Requirement | Filing the Articles of Incorporation is required to legally create a corporation in Texas. |

| Information Needed | Key information includes the corporation's name, registered agent, and purpose. |

| Filing Fee | A filing fee must be paid when submitting the Articles of Incorporation to the state. |

Similar forms

The Texas Articles of Incorporation serve as a foundational document for establishing a corporation in the state. Similarly, the Certificate of Formation is another essential document required for business formation in Texas. While the Articles of Incorporation outline the basic structure and purpose of the corporation, the Certificate of Formation provides additional details such as the registered agent, the duration of the corporation, and the number of shares authorized. Both documents serve to formally register a business entity with the state, ensuring compliance with state regulations.

The Bylaws are another document closely related to the Articles of Incorporation. While the Articles establish the corporation's existence, the Bylaws govern the internal operations and management of the corporation. They detail the roles and responsibilities of directors and officers, outline procedures for meetings, and set rules for voting. Essentially, while the Articles of Incorporation create the entity, the Bylaws provide the operational framework necessary for the corporation to function effectively.

Another document that shares similarities with the Articles of Incorporation is the Operating Agreement, particularly for Limited Liability Companies (LLCs). Like the Articles, the Operating Agreement outlines the structure of the business entity, detailing ownership percentages, management roles, and operational procedures. Both documents serve to clarify the relationship between the owners and the entity, ensuring that all parties understand their rights and responsibilities from the outset.

The Partnership Agreement is another document that resembles the Articles of Incorporation in its purpose of defining a business structure. This agreement is used for partnerships and outlines the roles, responsibilities, and profit-sharing arrangements among partners. Just as the Articles of Incorporation establish the framework for a corporation, the Partnership Agreement lays the groundwork for how the partnership will operate, including decision-making processes and dispute resolution mechanisms.

For those looking to secure a rental space, understanding the Florida Room Rental Agreement terms is vital. This document not only outlines the respective obligations of landlords and tenants but also provides clarity on expectations and rights during the rental term.

Lastly, the Certificate of Good Standing is a document that, while not foundational like the Articles of Incorporation, is related in that it confirms a corporation’s compliance with state regulations. This certificate verifies that the corporation has filed all necessary documents and paid required fees, thereby affirming its legal status. It is often required when seeking loans or entering contracts, serving as proof that the corporation is recognized and in good standing with the state, much like how the Articles of Incorporation initially establish that legal recognition.