Blank Stock Transfer Ledger Template

The Stock Transfer Ledger form serves as a crucial tool for corporations to maintain accurate records of stock issuance and transfers. This form captures essential information, including the name of the corporation and stockholders, which helps in tracking ownership changes. Each entry details the certificates issued, including their corresponding numbers and the dates on which shares were transferred. It also identifies the parties involved in each transaction, whether it's an original issue or a transfer from one shareholder to another. Additionally, the ledger records the amount paid for the shares, ensuring transparency in financial transactions. By documenting the certificates surrendered and the balance of shares held, this form provides a clear snapshot of a corporation's stock distribution at any given time. Overall, the Stock Transfer Ledger is vital for effective corporate governance and compliance with regulatory requirements.

Document Example

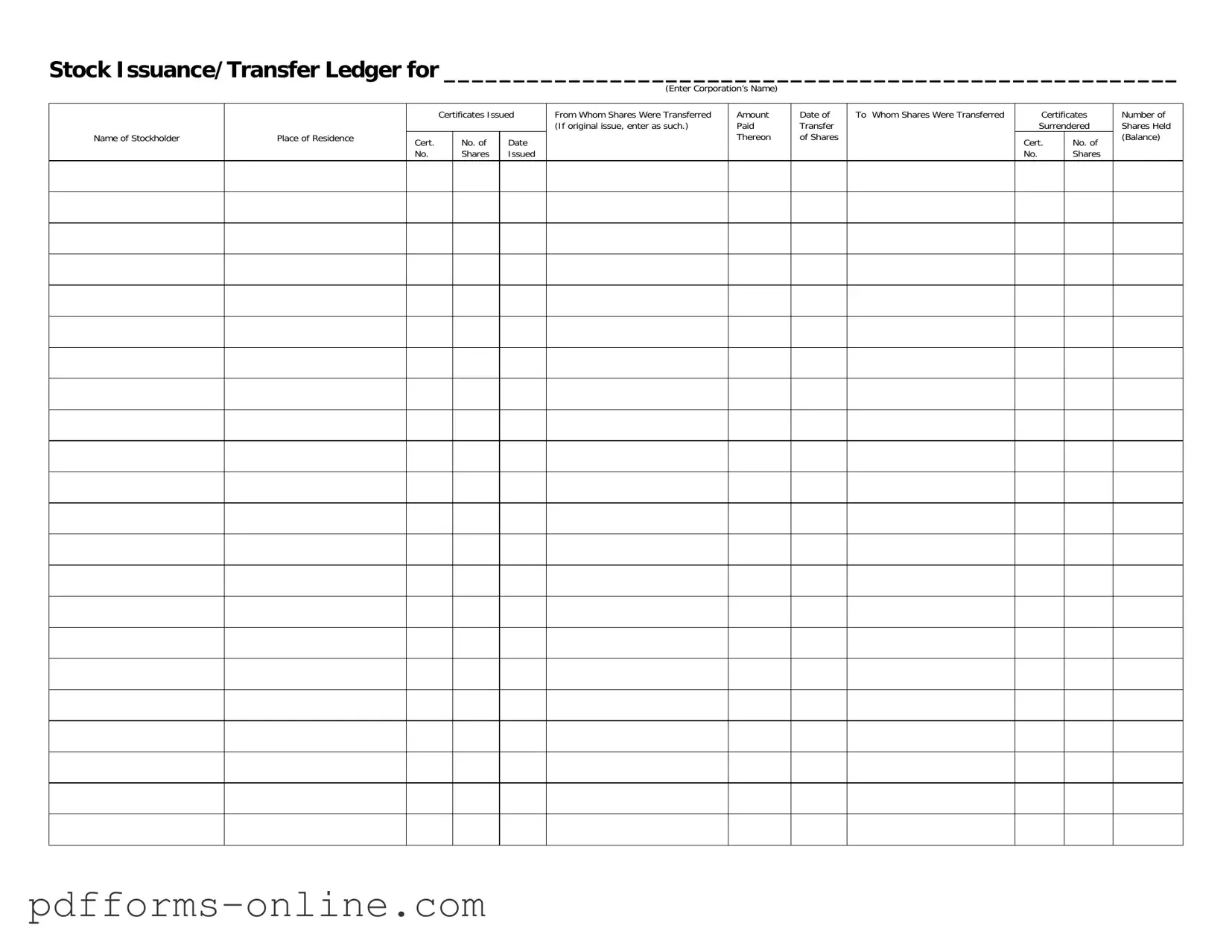

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Frequently Asked Questions

-

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form is used to document the issuance and transfer of shares within a corporation. It provides a clear record of stockholder details, including the number of shares issued, transferred, and the corresponding certificate numbers. This form is crucial for maintaining accurate ownership records and ensuring compliance with corporate governance.

-

Who should complete the Stock Transfer Ledger form?

The form should be completed by the corporation’s secretary or another designated officer responsible for managing stock records. It is important that the information is accurate and up-to-date to reflect the current ownership of shares. Stockholders may also need to provide necessary details when shares are being transferred.

-

What information is required on the form?

The Stock Transfer Ledger form requires several key pieces of information:

- The name of the corporation

- The name of the stockholder

- The place of residence of the stockholder

- The certificates issued, including certificate numbers

- The number of shares issued

- The amount paid for the shares

- The date of transfer

- The name of the person to whom shares were transferred

- The certificate numbers of surrendered certificates

- The number of shares held after the transfer

-

How should the form be submitted once completed?

Once the Stock Transfer Ledger form is completed, it should be filed with the corporation’s official records. It is advisable to keep both a physical and a digital copy for your records. This ensures that all transactions are documented properly and can be referenced in the future if needed.

Misconceptions

The Stock Transfer Ledger form is an important document for corporations, particularly in managing stock issuance and transfers. However, several misconceptions exist about its purpose and usage. Below are some common misunderstandings:

- Misconception 1: The Stock Transfer Ledger is only necessary for large corporations.

- Misconception 2: The form is only required when shares are transferred.

- Misconception 3: The Stock Transfer Ledger is the same as the corporate stock certificate.

- Misconception 4: Once shares are issued, they do not need to be tracked.

- Misconception 5: Only the corporate secretary needs to fill out the Stock Transfer Ledger.

- Misconception 6: The ledger can be maintained in any format.

- Misconception 7: The Stock Transfer Ledger is not subject to audits.

- Misconception 8: Once a transfer is recorded, it cannot be changed.

This is incorrect. All corporations, regardless of size, should maintain a Stock Transfer Ledger to accurately track stock ownership and transfers.

In reality, the ledger should be updated for every stock issuance, not just during transfers. This ensures that all transactions are recorded accurately.

These are different documents. The Stock Transfer Ledger records the details of stock transactions, while stock certificates serve as physical proof of ownership.

This is a misunderstanding. Continuous tracking of shares is essential for maintaining accurate records of ownership and for legal compliance.

While the corporate secretary often manages this document, it is a collaborative effort. Shareholders and transfer agents may also need to provide information.

While flexibility exists in format, it is crucial that the ledger contains all required information as specified in the form to ensure compliance and clarity.

In fact, this document can be audited. Proper maintenance of the ledger is necessary to demonstrate compliance with corporate governance and regulatory requirements.

Although changes can be made, they must be documented properly. Corrections should be noted clearly to maintain transparency and accuracy.

Common mistakes

-

Incomplete Corporation Name: Failing to enter the full name of the corporation can lead to confusion and potential legal issues. Ensure that the name matches the official registration.

-

Missing Stockholder Information: Omitting the name and place of residence of the stockholder can result in difficulties when identifying ownership. Always provide accurate and complete details.

-

Incorrect Certificate Numbers: Entering wrong certificate numbers can create discrepancies in the records. Double-check each number for accuracy before submission.

-

Failure to Specify Share Amounts: Not clearly stating the number of shares issued or transferred can lead to misunderstandings. Always specify the exact number of shares involved in the transaction.

-

Neglecting to Record Transfer Dates: Omitting the date of transfer can complicate tracking ownership changes. Always include the date to maintain a clear timeline.

-

Not Indicating the Transferor and Transferee: Failing to identify who the shares were transferred from and to can create ownership disputes. Clearly state both parties’ names to avoid future conflicts.

-

Overlooking Certificate Surrender Details: Not noting the certificates surrendered can lead to confusion about which shares are still outstanding. Always indicate the certificate numbers and the number of shares surrendered.

Additional PDF Templates

Profits or Loss From Business - Schedule C helps self-employed individuals determine their net profit or loss for the year.

When entering a rental agreement, both landlords and tenants should familiarize themselves with the New York Residential Lease Agreement, which serves as a vital framework for understanding their rights and obligations. For more information and to access a template for this important document, visit https://documentonline.org/blank-new-york-residential-lease-agreement/.

Ucc 1308 All Rights Reserved - UCC 1-308 is a safeguard against being bound by hidden contracts.

Best Lease Purchase Trucking Companies 2023 - Injuries or losses occurring during transit will result in the Owner Operator being held accountable for damages.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form tracks the issuance and transfer of stock shares within a corporation. |

| Corporation Name | The form requires the name of the corporation for which the stock is being issued or transferred. |

| Stockholder Information | It captures the name and place of residence of each stockholder involved in the transaction. |

| Certificate Details | Stock certificates issued are documented, including their certificate numbers and the date issued. |

| Transferor Information | Details about who originally issued the shares must be provided. If it’s the original issue, that should be noted. |

| Payment Information | The amount paid for the shares must be recorded to ensure transparency in transactions. |

| Transfer Date | The date when the shares were transferred to the new stockholder is a crucial entry in the ledger. |

| Transferee Details | The name of the person or entity receiving the shares must be included in the form. |

| Certificate Surrender | Any surrendered certificates must be noted, including their certificate numbers and the number of shares involved. |

| Balance of Shares | The form concludes with a record of the total number of shares held by the stockholder after the transfer. |

Similar forms

The Stock Transfer Ledger form is similar to a Shareholder Register. This document records the names and addresses of shareholders, along with the number of shares they own. It serves as an official record for the corporation, ensuring that ownership is accurately tracked. Both documents provide essential information for managing stock ownership and are critical for corporate governance.

Another document that parallels the Stock Transfer Ledger is the Stock Certificate. This physical document represents ownership of shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the corporation's name. While the Stock Transfer Ledger tracks transfers and issuances, the Stock Certificate serves as proof of ownership.

The Stock Purchase Agreement is also similar. This legal document outlines the terms and conditions under which shares are bought and sold. It includes details like the purchase price and the number of shares involved. Like the Stock Transfer Ledger, it is crucial for documenting the transfer of ownership and ensuring compliance with corporate policies.

The Corporate Bylaws often share similarities with the Stock Transfer Ledger. Bylaws govern the internal management of a corporation and include provisions for issuing and transferring shares. Both documents play a role in defining how stock transactions should be conducted, ensuring clarity and consistency in corporate operations.

A Stock Option Agreement can be compared to the Stock Transfer Ledger as well. This agreement grants individuals the right to purchase shares at a predetermined price. It outlines the terms under which options can be exercised and shares transferred. Both documents are essential for managing stock ownership and employee incentives within a corporation.

The Securities Purchase Agreement is another related document. This agreement details the sale of securities, including stocks, between parties. It outlines the terms of the transaction, similar to how the Stock Transfer Ledger records the transfer of shares. Both documents are vital for ensuring that stock transactions are conducted legally and transparently.

The Annual Report often contains information that mirrors the Stock Transfer Ledger. This report provides a comprehensive overview of a corporation's financial performance, including details about stock ownership and transfers. While the Stock Transfer Ledger focuses on specific transactions, the Annual Report offers a broader view of shareholder equity and corporate health.

When considering estate planning, obtaining a Texas Last Will and Testament form can be vital. This document not only delineates how an individual's assets are to be distributed after their passing, but it can also prevent potential disputes among beneficiaries. Understanding this process can be facilitated by resources such as OnlineLawDocs.com, which offer guidance on the importance of having a clear and legally binding will in place.

Finally, the Form 10-K filed with the SEC is similar in that it provides detailed information about a corporation’s financial status, including stock ownership. This document is required for publicly traded companies and includes disclosures about stock transactions. Both the Form 10-K and the Stock Transfer Ledger serve to keep stakeholders informed about the company’s equity structure and ownership changes.