Blank Single-Member Operating Agreement Form

The Single-Member Operating Agreement is a crucial document for individuals who own a single-member limited liability company (LLC). This form outlines the structure, management, and operational guidelines of the LLC, providing clarity and protection for the owner. It typically includes essential elements such as the purpose of the LLC, the owner's rights and responsibilities, and the procedures for handling financial matters. Additionally, it addresses how profits and losses will be allocated and outlines the process for making decisions. By having a well-drafted operating agreement, a single-member LLC can establish its legitimacy and safeguard the owner's personal assets from business liabilities. Furthermore, this document serves as a reference point in case of disputes or changes in the business structure, ensuring that the owner has a clear framework to follow. Overall, the Single-Member Operating Agreement is not just a formality; it is an essential tool for effective business management and legal protection.

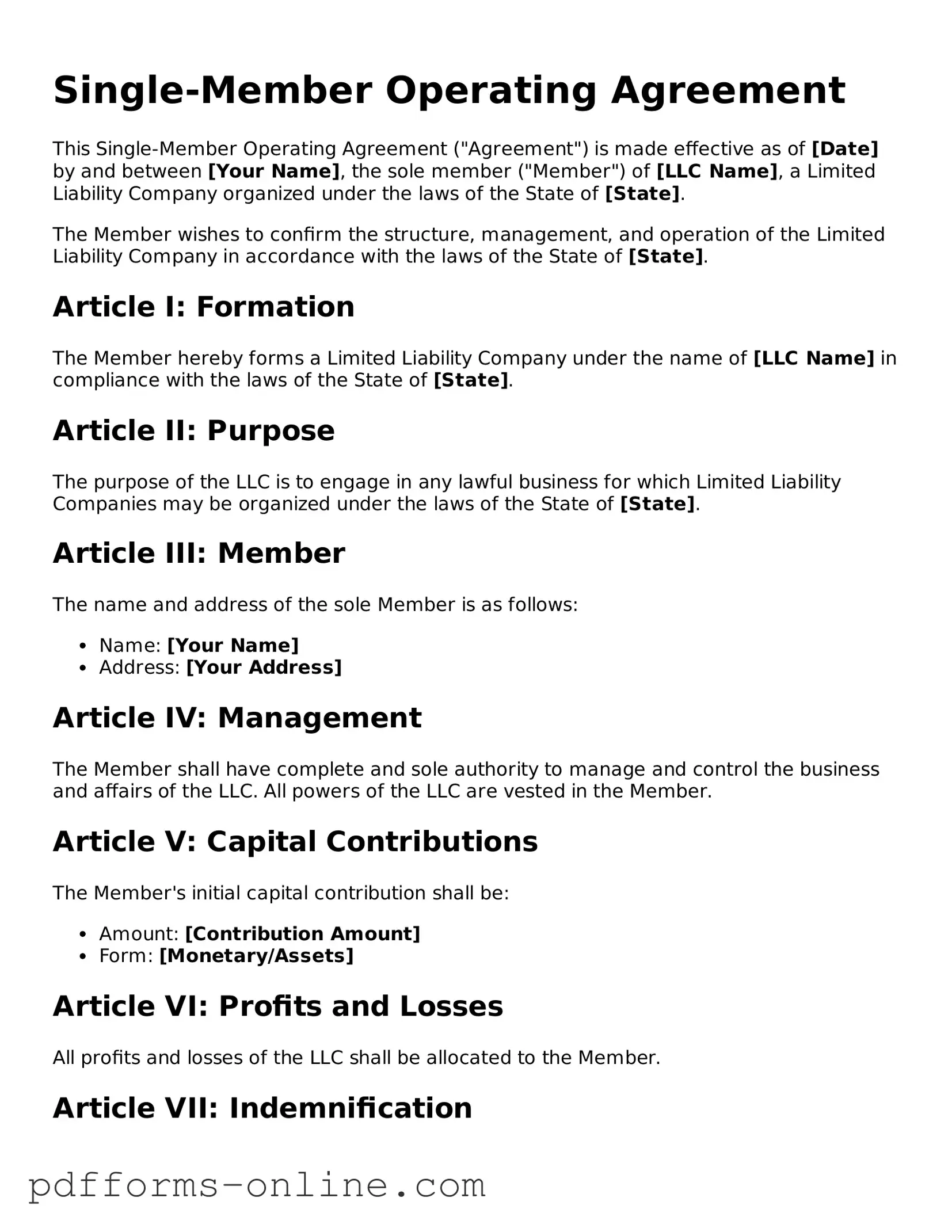

Document Example

Single-Member Operating Agreement

This Single-Member Operating Agreement ("Agreement") is made effective as of [Date] by and between [Your Name], the sole member ("Member") of [LLC Name], a Limited Liability Company organized under the laws of the State of [State].

The Member wishes to confirm the structure, management, and operation of the Limited Liability Company in accordance with the laws of the State of [State].

Article I: Formation

The Member hereby forms a Limited Liability Company under the name of [LLC Name] in compliance with the laws of the State of [State].

Article II: Purpose

The purpose of the LLC is to engage in any lawful business for which Limited Liability Companies may be organized under the laws of the State of [State].

Article III: Member

The name and address of the sole Member is as follows:

- Name: [Your Name]

- Address: [Your Address]

Article IV: Management

The Member shall have complete and sole authority to manage and control the business and affairs of the LLC. All powers of the LLC are vested in the Member.

Article V: Capital Contributions

The Member's initial capital contribution shall be:

- Amount: [Contribution Amount]

- Form: [Monetary/Assets]

Article VI: Profits and Losses

All profits and losses of the LLC shall be allocated to the Member.

Article VII: Indemnification

The LLC shall indemnify the Member for any actions taken in good faith in the course of managing the LLC’s business.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by the Member.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

IN WITNESS WHEREOF

The Member has executed this Operating Agreement as of the date first above written.

__________________________

[Your Name], Sole Member

Frequently Asked Questions

-

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operational procedures for a single-member limited liability company (LLC). This agreement serves as an internal guide for the owner, detailing how the business will be run, how profits and losses will be handled, and what happens in various situations, such as the sale of the business or the owner's death.

-

Why do I need a Single-Member Operating Agreement?

Even as a sole owner, having an Operating Agreement is crucial. It helps protect your personal assets by reinforcing the limited liability status of your LLC. This document can also clarify your business's operational procedures, making it easier to manage and potentially preventing disputes in the future. Additionally, some banks and investors may require this agreement before they will do business with you.

-

What should be included in my Single-Member Operating Agreement?

Your agreement should cover several key areas, including:

- The name and address of the LLC.

- The purpose of the business.

- The management structure, including the powers and responsibilities of the owner.

- How profits and losses will be allocated.

- Procedures for adding new members, if applicable.

- What happens if the owner wants to sell the business or passes away.

-

Is a Single-Member Operating Agreement legally required?

While it is not legally required in all states, having a Single-Member Operating Agreement is highly recommended. Some states may not mandate it, but having one can help establish your LLC as a separate legal entity, which is essential for maintaining limited liability protection. It’s always a good idea to check your state’s specific requirements.

-

Can I create my own Single-Member Operating Agreement?

Yes, you can create your own Single-Member Operating Agreement. There are templates available online that can guide you through the process. However, it’s essential to ensure that your agreement complies with your state’s laws and reflects your specific business needs. If you have any doubts, consulting a legal professional can provide peace of mind.

-

How often should I update my Single-Member Operating Agreement?

It’s wise to review and update your Operating Agreement regularly, especially when significant changes occur in your business. This could include changes in ownership, alterations in business structure, or shifts in operational procedures. Keeping your agreement current ensures that it accurately reflects your business’s needs and protects your interests.

Misconceptions

When it comes to the Single-Member Operating Agreement, many people hold misconceptions that can lead to confusion or missteps in their business practices. Here are six common misconceptions:

- It’s not necessary for single-member LLCs. Some believe that a single-member LLC doesn’t need an operating agreement. However, having one can help clarify the structure and operations of your business, even if you are the only owner.

- It’s just a formality. While it may seem like a simple document, the operating agreement serves important legal purposes. It outlines the rules of your business and can protect your personal assets.

- It can’t be changed. Many think that once an operating agreement is created, it’s set in stone. In reality, you can modify it as your business grows or changes. Flexibility is key.

- It’s only for tax purposes. Some assume that the agreement is solely for tax benefits. While it can help with tax classification, its primary role is to define how your business operates.

- It doesn’t need to be written down. A verbal agreement may seem sufficient, but having a written document is crucial. It provides a clear reference point and can prevent disputes in the future.

- It’s only relevant at the start of the business. Many people think that the operating agreement is only important when the business is first established. However, it should be reviewed and updated regularly to reflect any changes in your business or personal circumstances.

Understanding these misconceptions can help ensure that your Single-Member Operating Agreement serves its intended purpose and supports your business effectively.

Common mistakes

-

Leaving out essential information: It’s crucial to include all necessary details, such as the name of the LLC, the address, and the owner's name. Omitting any of this information can lead to confusion or legal issues down the line.

-

Not specifying the purpose of the LLC: Clearly stating the business purpose is important. This helps define the scope of your operations and can protect you in case of disputes.

-

Failing to outline management structure: Even as a single-member LLC, it’s vital to clarify how the business will be managed. This includes decision-making processes and any powers granted to the owner.

-

Ignoring tax implications: Some people overlook the importance of discussing how the LLC will be taxed. Understanding whether it will be treated as a sole proprietorship or a corporation can significantly affect your finances.

-

Not including provisions for changes: Life can be unpredictable. Failing to include provisions for how to handle changes in ownership or management can lead to complications later on.

-

Skipping the signature: It may seem obvious, but forgetting to sign the agreement can render it invalid. Always ensure that you have signed and dated the document.

-

Overlooking state-specific requirements: Each state has its own rules regarding LLCs. Not checking for specific requirements in your state can result in non-compliance.

-

Neglecting to keep the agreement updated: As your business grows or changes, your operating agreement should reflect those changes. Failing to update it can lead to misunderstandings or disputes.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operational guidelines for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to establish the rights and responsibilities of the sole member, helping to protect personal assets from business liabilities. |

| Governing Law | The governing law for Single-Member Operating Agreements varies by state, with each state having its own LLC statutes that dictate the formation and operation of LLCs. |

| Flexibility | The agreement allows for flexibility in management and can be customized to suit the specific needs of the member, including provisions for profit distribution and decision-making processes. |

Similar forms

A Single-Member Operating Agreement is similar to a Partnership Agreement in that both documents outline the structure and operational guidelines of a business entity. While a Partnership Agreement focuses on the relationship and responsibilities between two or more partners, a Single-Member Operating Agreement serves a sole owner. It defines how the business will be managed, how profits and losses will be distributed, and what happens if the owner decides to sell or transfer ownership. Both agreements aim to clarify expectations and provide a framework for resolving disputes, ensuring that all parties are on the same page regarding their roles and responsibilities.

In addition to the various agreements outlined, understanding the framework of these legal documents is vital for any business structure, including the significance of the Arizona Operating Agreement. This agreement not only clarifies the operational procedures of an LLC but also helps mitigate conflicts among members. For more detailed information on the forms needed in Arizona, you can refer to All Arizona Forms, which can assist in the preparation and understanding of your operational needs.

Another document akin to the Single-Member Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing how decisions are made, how meetings are conducted, and the roles of officers and directors. Similarly, a Single-Member Operating Agreement establishes the operational rules for a single-member LLC. Both documents serve to create a clear understanding of governance, ensuring that the entity operates smoothly and in compliance with applicable laws. They provide structure and clarity, which can be crucial for avoiding conflicts down the line.

The Articles of Organization also share similarities with a Single-Member Operating Agreement. Articles of Organization are the foundational documents filed with the state to legally establish an LLC. While they primarily focus on the basic details of the business, such as its name, address, and purpose, the Single-Member Operating Agreement elaborates on the internal workings of the LLC. Together, these documents create a comprehensive framework for the business, with the Articles of Organization establishing its existence and the Operating Agreement detailing how it will function on a day-to-day basis.

Additionally, a Shareholder Agreement can be compared to a Single-Member Operating Agreement, particularly in the context of a single shareholder corporation. A Shareholder Agreement outlines the rights and obligations of shareholders, including how shares can be transferred and how decisions are made. In contrast, a Single-Member Operating Agreement specifies the rights and responsibilities of a sole owner. Both documents aim to protect the interests of the business and its owners, providing clarity on governance and operational procedures.

Finally, a Business Plan can also be viewed as a document similar to a Single-Member Operating Agreement. While a Business Plan outlines the strategic vision, goals, and financial projections for a business, the Operating Agreement focuses on the operational aspects. Both documents are essential for a successful business venture, as they provide direction and clarity. A Business Plan may help secure funding or partnerships, while a Single-Member Operating Agreement ensures that the owner has a clear understanding of how to manage the business effectively.