Blank Release of Promissory Note Form

The Release of Promissory Note form plays a crucial role in the financial landscape, serving as a formal acknowledgment that a borrower has fulfilled their obligations under a promissory note. This document is essential for both lenders and borrowers, as it provides clarity and assurance that the debt has been settled. Typically, the form includes key details such as the names of the parties involved, the original amount of the loan, and the date of repayment. Additionally, it may outline any relevant conditions or stipulations that were part of the original agreement. By signing this form, the lender relinquishes any claim to the debt, offering peace of mind to the borrower. The release not only signifies the end of the financial relationship but also serves as a protective measure, ensuring that the borrower is free from any future claims related to the note. Understanding the importance of this form is vital for anyone engaged in lending or borrowing, as it encapsulates the conclusion of a significant financial commitment.

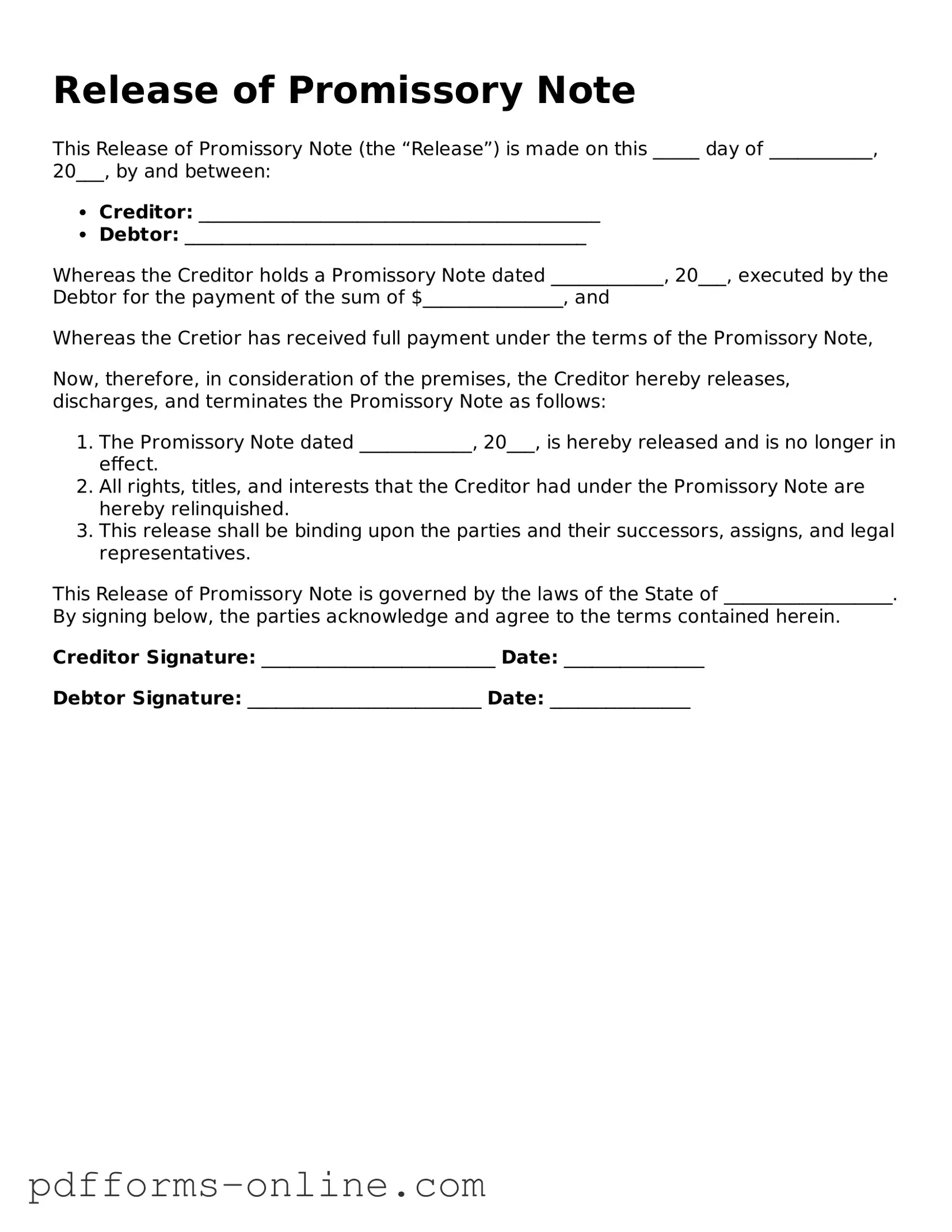

Document Example

Release of Promissory Note

This Release of Promissory Note (the “Release”) is made on this _____ day of ___________, 20___, by and between:

- Creditor: ___________________________________________

- Debtor: ___________________________________________

Whereas the Creditor holds a Promissory Note dated ____________, 20___, executed by the Debtor for the payment of the sum of $_______________, and

Whereas the Cretior has received full payment under the terms of the Promissory Note,

Now, therefore, in consideration of the premises, the Creditor hereby releases, discharges, and terminates the Promissory Note as follows:

- The Promissory Note dated ____________, 20___, is hereby released and is no longer in effect.

- All rights, titles, and interests that the Creditor had under the Promissory Note are hereby relinquished.

- This release shall be binding upon the parties and their successors, assigns, and legal representatives.

This Release of Promissory Note is governed by the laws of the State of __________________. By signing below, the parties acknowledge and agree to the terms contained herein.

Creditor Signature: _________________________ Date: _______________

Debtor Signature: _________________________ Date: _______________

Frequently Asked Questions

-

What is a Release of Promissory Note form?

The Release of Promissory Note form is a legal document that formally acknowledges the repayment of a loan or debt. It signifies that the borrower has fulfilled their obligation to the lender, and the lender agrees to release any claims against the borrower regarding that specific promissory note.

-

Why is it important to have a Release of Promissory Note?

This document is essential for both parties involved. For the borrower, it serves as proof that the debt has been satisfied, which can be important for credit history and future financial transactions. For the lender, it provides a record that they have received full payment and no longer hold any interest in the debt.

-

Who should sign the Release of Promissory Note?

Both the lender and the borrower must sign the form. The lender confirms that they have received the payment, while the borrower acknowledges that the debt has been cleared. In some cases, a witness or notary public may also be required to validate the document.

-

When should a Release of Promissory Note be completed?

The form should be completed immediately after the borrower has made the final payment on the promissory note. This ensures that both parties have a clear understanding of the debt status and that the lender formally acknowledges the repayment.

-

What information is typically included in the form?

The form usually includes the names and addresses of both the lender and the borrower, the date of the release, details of the original promissory note (such as the amount and date of the loan), and a statement confirming that the debt has been paid in full.

-

Is a Release of Promissory Note legally binding?

Yes, once signed by both parties, the Release of Promissory Note is a legally binding document. It serves as evidence that the debt has been paid and releases the borrower from any further obligations related to that specific loan.

-

What happens if the Release of Promissory Note is not completed?

If the release is not completed, the borrower may still be considered liable for the debt, even if they have made the final payment. This can lead to complications in future financial dealings and may affect the borrower’s credit score.

-

Can a Release of Promissory Note be revoked?

Generally, a Release of Promissory Note cannot be revoked once it has been signed and delivered, as it is a confirmation of payment. However, if there was a mistake or fraud involved in the transaction, legal action may be necessary to address the situation.

-

Where can I obtain a Release of Promissory Note form?

Release of Promissory Note forms can be obtained from various sources, including legal document websites, local law offices, or financial institutions. It is important to ensure that the form complies with state laws and regulations.

Misconceptions

Understanding the Release of Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- It is the same as a loan agreement. Many believe that the release form is just another name for the loan agreement. In reality, the release form signifies that the debt has been paid off and the lender no longer has a claim to the borrower's assets.

- It is not necessary if the loan is paid in full. Some think that once they pay off a loan, they don’t need to do anything else. However, obtaining a release is important for legal protection and to clear any claims on the borrower's credit report.

- The lender automatically provides a release. It is a common belief that lenders will automatically issue a release when a loan is paid off. In truth, borrowers must often request this document to ensure their records are clear.

- It can be verbal. Some assume that a verbal confirmation from the lender suffices. This is incorrect; a written release is essential to provide formal proof of the debt's discharge.

- Only large loans require a release. Many think that only significant loans need a release form. In fact, any promissory note, regardless of the amount, should be formally released to avoid future disputes.

- It is not legally binding. There is a misconception that a release form is just a formality and holds no legal weight. In reality, it is a legally binding document that protects both parties involved.

- It can be ignored after issuance. Some believe that once they receive a release, they can forget about it. However, it’s wise to keep this document safe, as it may be needed for future reference or disputes.

- It is only for personal loans. Many think that release forms are only relevant for personal loans. However, they are also crucial in business transactions and any situation involving promissory notes.

Clearing up these misconceptions can help ensure that both borrowers and lenders understand their rights and responsibilities. Always consult with a legal professional if you have questions about the release of a promissory note.

Common mistakes

-

Failing to provide accurate information about the parties involved. Each party's name and address must be clearly stated to avoid confusion.

-

Not including the correct date of the release. The date is crucial for establishing the timeline of the transaction.

-

Omitting the details of the original promissory note. This includes the note's date, amount, and any relevant identification numbers.

-

Using vague language. Clear and specific terms should be used to outline the release of obligations.

-

Neglecting to sign the document. Both parties must sign to validate the release, and signatures should be dated.

-

Not having the document notarized, if required. Some jurisdictions may require notarization to make the release legally binding.

-

Forgetting to provide copies to all parties involved. Each party should receive a signed copy for their records.

-

Failing to review the form for errors before submission. Typos or incorrect information can lead to complications.

-

Not consulting a professional when uncertain. Seeking guidance can help avoid mistakes and ensure compliance with local laws.

Fill out Common Types of Release of Promissory Note Forms

Create a Promissory Note - Helps buyers manage their budgets with fixed monthly payments.

When considering a loan in Florida, it's essential to understand the significance of a Promissory Note form. This document serves to clearly outline the responsibilities of both the lender and the borrower, detailing the loan terms including amounts and interest rates. For those seeking a reliable template, resources such as All Florida Forms can provide the necessary documentation to facilitate this agreement.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Release of Promissory Note form is used to formally acknowledge the repayment of a loan and release the borrower from any further obligations. |

| Governing Law | The governing law for promissory notes varies by state. For example, in California, it falls under the California Commercial Code. |

| Signatures Required | Both the lender and the borrower must sign the form to make it legally binding. |

| Record Keeping | It is essential to keep a copy of the signed Release of Promissory Note for future reference, as it serves as proof of payment and release. |

Similar forms

The first document similar to the Release of Promissory Note is a Satisfaction of Mortgage. This document indicates that a mortgage has been paid in full. Like the Release of Promissory Note, it serves to formally acknowledge that a debt has been settled, thereby clearing the borrower’s obligation. Both documents provide a sense of closure and assurance to the borrower, confirming that they are no longer liable for the debt in question.

Understanding the various types of documents related to financial obligations is essential for anyone involved in lending or borrowing. For instance, a California Promissory Note form is instrumental in creating a clear agreement between parties. Utilizing resources found at formcalifornia.com/editable-promissory-note-form/ can aid in drafting these important agreements, ensuring that all necessary terms and conditions are appropriately outlined and agreed upon.

Another comparable document is a Release of Lien. This document is used to remove a lien from a property once a debt has been satisfied. Similar to the Release of Promissory Note, it signifies that the creditor relinquishes their claim on the asset. Both documents protect the borrower’s rights and ensure that their financial obligations are fully resolved, allowing for clearer ownership of the property or asset involved.

The third document is a Debt Settlement Agreement. This agreement outlines the terms under which a debtor settles their debt for less than the full amount owed. Like the Release of Promissory Note, it represents a resolution of financial obligations. Both documents provide clarity and mutual agreement between the debtor and creditor, ensuring that the terms of the settlement are understood and accepted by both parties.

A fourth document is a Cancellation of Lease. This document indicates that a lease agreement has been terminated. Similar to the Release of Promissory Note, it signifies the end of a financial obligation between the parties involved. Both documents provide legal clarity and protection, ensuring that all parties are aware that their commitments have been fulfilled or canceled.

Finally, a Termination Agreement is akin to the Release of Promissory Note. This document formally ends a contract between parties. It shares the same purpose of confirming that all obligations under the contract have been met or waived. Both documents serve to clarify the end of a financial relationship, providing peace of mind to all involved parties that their obligations are resolved.