Blank Real Estate Purchase Agreement Form

When embarking on the journey of buying or selling a home, the Real Estate Purchase Agreement form becomes a crucial document that lays the foundation for the transaction. This form captures essential details such as the purchase price, the property description, and the closing date, ensuring that both parties are on the same page. It outlines the terms and conditions under which the sale will occur, including contingencies that may affect the deal, such as financing or inspections. The agreement also specifies the earnest money deposit, a sign of good faith from the buyer, and addresses the responsibilities of both the buyer and seller during the process. Understanding this form is vital, as it not only protects the interests of each party but also helps to prevent misunderstandings and disputes down the line. With clear communication and comprehensive details, the Real Estate Purchase Agreement serves as a roadmap for a successful real estate transaction.

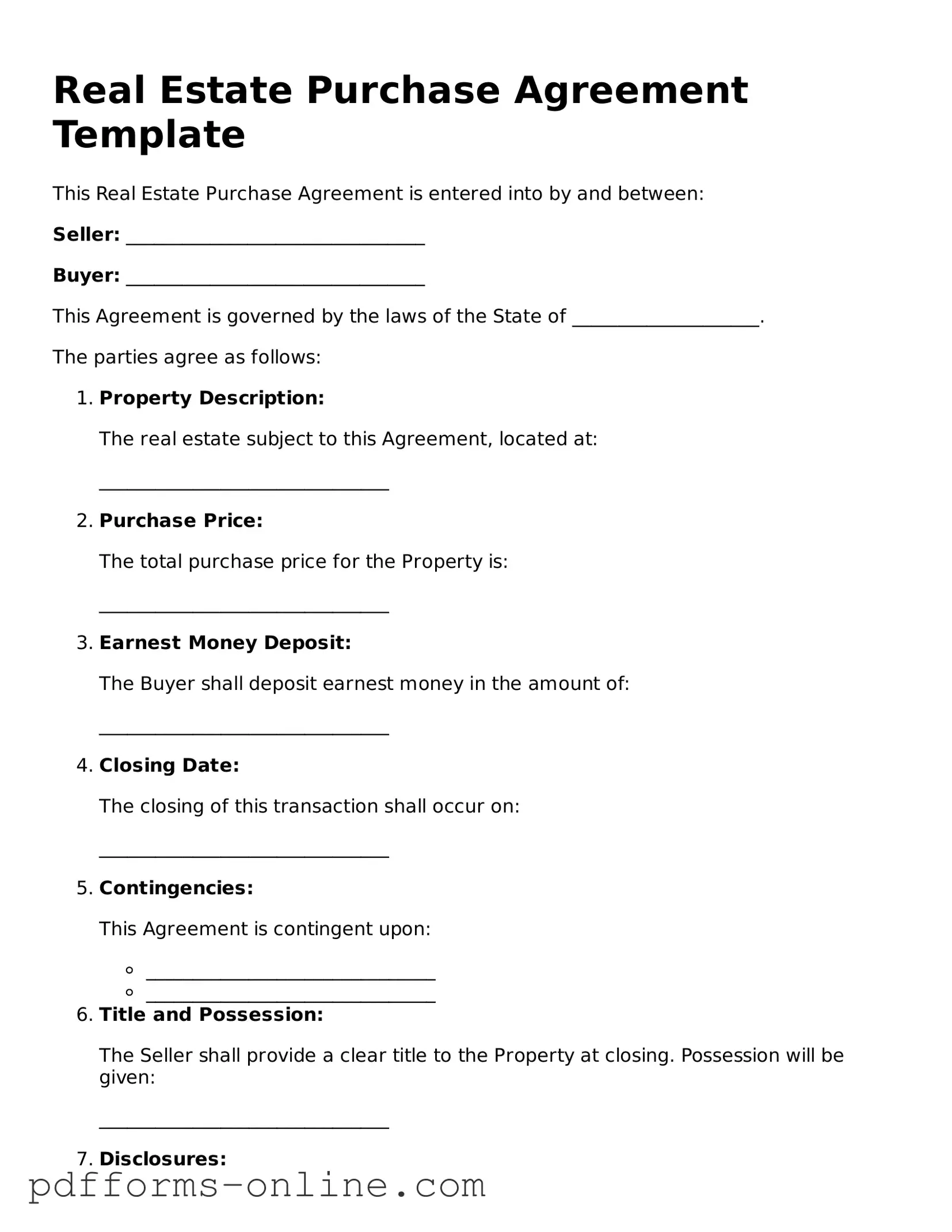

Document Example

Real Estate Purchase Agreement Template

This Real Estate Purchase Agreement is entered into by and between:

Seller: ________________________________

Buyer: ________________________________

This Agreement is governed by the laws of the State of ____________________.

The parties agree as follows:

- Property Description:

- Purchase Price:

- Earnest Money Deposit:

- Closing Date:

- Contingencies:

- _______________________________

- _______________________________

- Title and Possession:

- Disclosures:

- _______________________________

- _______________________________

- Governing Law:

The real estate subject to this Agreement, located at:

_______________________________

The total purchase price for the Property is:

_______________________________

The Buyer shall deposit earnest money in the amount of:

_______________________________

The closing of this transaction shall occur on:

_______________________________

This Agreement is contingent upon:

The Seller shall provide a clear title to the Property at closing. Possession will be given:

_______________________________

The Seller informs the Buyer about:

This Agreement will be governed by the laws of the State of:

_______________________________

In witness whereof, the parties hereto have executed this Real Estate Purchase Agreement on this ______ day of __________, 20__.

Seller Signature: ________________________________

Buyer Signature: ________________________________

State-specific Guides for Real Estate Purchase Agreement Documents

Real Estate Purchase Agreement Form Types

Frequently Asked Questions

-

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement typically includes details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized.

-

What are the key components of a Real Estate Purchase Agreement?

Key components of this agreement include:

- Parties Involved: Names and contact information of the buyer and seller.

- Property Description: A detailed description of the property being sold, including its address and any identifying features.

- Purchase Price: The agreed-upon price for the property.

- Contingencies: Conditions that must be satisfied for the sale to proceed, such as financing approval or home inspections.

- Closing Date: The date when the transaction will be finalized and ownership will be transferred.

-

Why is it important to have a Real Estate Purchase Agreement?

This agreement serves as a safeguard for both buyers and sellers. It clearly outlines the expectations and responsibilities of each party, reducing the risk of misunderstandings. Having a written agreement helps to ensure that all parties are on the same page regarding the transaction.

-

Can a Real Estate Purchase Agreement be modified?

Yes, a Real Estate Purchase Agreement can be modified, but any changes must be agreed upon by both parties. It’s crucial to document these modifications in writing to avoid potential disputes later on.

-

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, the other party may have legal recourse. This could include seeking damages or enforcing the terms of the agreement in court. It’s important to consult with a legal professional if this situation arises.

-

Is it necessary to have a lawyer review the Real Estate Purchase Agreement?

While it’s not legally required, having a lawyer review the agreement is highly recommended. A legal professional can help ensure that the document is fair, comprehensive, and compliant with local laws. This extra step can provide peace of mind for both buyers and sellers.

-

How long does it take to complete a Real Estate Purchase Agreement?

The time it takes to complete a Real Estate Purchase Agreement can vary. Typically, once both parties agree on the terms, the document can be drafted and signed within a few days. However, the entire process from agreement to closing can take several weeks, depending on contingencies and local regulations.

-

What should I do if I have questions about the Real Estate Purchase Agreement?

If you have questions about the agreement, it’s best to reach out to a real estate agent or a lawyer who specializes in real estate transactions. They can provide clarity and guidance tailored to your specific situation.

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Here are five common misconceptions about the REPA, along with clarifications to help you navigate the process more effectively.

- Misconception 1: The REPA is a legally binding contract from the moment it is signed.

- Misconception 2: All Real Estate Purchase Agreements are the same.

- Misconception 3: The REPA only covers the sale price of the property.

- Misconception 4: Once the REPA is signed, there is no room for negotiation.

- Misconception 5: The REPA is only for residential properties.

This is not entirely accurate. While the REPA becomes legally binding once both parties sign, it often includes contingencies that must be met before the agreement is fully enforceable. These contingencies might involve inspections, financing, or other conditions.

In reality, REPA forms can vary significantly based on state laws and the specific terms negotiated between the buyer and seller. It's important to review the document carefully and tailor it to fit the unique aspects of the transaction.

While the sale price is a key component, the REPA encompasses much more. It includes details about the closing date, contingencies, and any personal property included in the sale, among other important terms.

This is a common misunderstanding. Even after signing, parties can negotiate terms before closing. If issues arise or circumstances change, discussions can lead to amendments that reflect the new agreement.

Many people believe that the REPA is exclusively for residential transactions. However, this form can also be utilized for commercial real estate transactions, with appropriate modifications to suit the context.

By addressing these misconceptions, individuals can approach the Real Estate Purchase Agreement with greater confidence and clarity. Understanding the nuances of this document will lead to a smoother transaction experience.

Common mistakes

-

Inaccurate Property Description: Failing to provide a detailed and accurate description of the property can lead to confusion or disputes later on. Ensure that the address, lot number, and any relevant details are correct.

-

Missing Signatures: All parties involved must sign the agreement. Omitting a signature can render the contract invalid. Double-check that everyone has signed before submission.

-

Incorrect Purchase Price: Listing an incorrect purchase price can create misunderstandings. Make sure the price reflects what was agreed upon and is clearly stated in the document.

-

Neglecting Contingencies: Failing to include important contingencies, such as financing or inspection clauses, can expose buyers or sellers to unnecessary risks. Always outline any conditions that must be met for the sale to proceed.

-

Ignoring Deadlines: Each step of the purchase process has specific deadlines. Missing these can jeopardize the transaction. Be aware of all relevant dates and ensure they are included in the agreement.

-

Not Reviewing Local Laws: Real estate laws can vary by state and locality. Not understanding these regulations can lead to mistakes. Research local requirements to ensure compliance with the law.

Popular Templates

Childcare Receipt Template - Capture your childcare expenditures in an organized and easy-to-read format.

Character Letter for Court Example - The reference speaks to the parent’s role as a positive role model in the child’s life.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale between a buyer and a seller. |

| Parties Involved | The agreement typically includes the buyer and seller, along with their respective legal representatives, if applicable. |

| Property Description | A detailed description of the property being sold is included, which may consist of the address, lot number, and any relevant property identifiers. |

| Purchase Price | The total purchase price is clearly stated, along with any deposit or earnest money required from the buyer. |

| Contingencies | Common contingencies, such as financing, inspections, and appraisals, are often included to protect the interests of both parties. |

| Closing Date | The agreement specifies a closing date, which is when the property transfer is finalized and ownership is officially transferred. |

| Governing Law | The agreement is governed by state laws, which can vary significantly. For example, California follows the California Civil Code, while New York adheres to its Real Property Law. |

| Disclosures | Disclosures regarding the condition of the property, such as known defects or hazards, are typically required to ensure transparency. |

| Signatures | Both parties must sign the agreement for it to be legally binding, often requiring witnesses or notarization depending on state requirements. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be enforceable. |

Similar forms

The Real Estate Purchase Agreement (REPA) is closely related to the Lease Agreement, which outlines the terms under which a tenant can occupy a property. While the REPA focuses on the sale of a property, the Lease Agreement governs the rental of a property for a specified period. Both documents detail the obligations of the parties involved, including payment terms, property descriptions, and conditions for termination. Understanding both agreements is crucial for anyone involved in real estate transactions, whether buying or renting.

Another document similar to the REPA is the Listing Agreement. This contract is between a property owner and a real estate agent, granting the agent the authority to market and sell the property. Like the REPA, it specifies terms such as the sale price, commission rates, and the duration of the agreement. Both documents are foundational in the real estate process, ensuring that all parties understand their rights and responsibilities.

The Purchase and Sale Agreement (PSA) is also comparable to the REPA. This document serves a similar purpose, outlining the terms of a property sale. The PSA may include additional details, such as contingencies and disclosures, which can be essential for both buyers and sellers. Both agreements aim to protect the interests of the parties involved while providing a clear framework for the transaction.

In addition, the Option to Purchase Agreement shares similarities with the REPA. This document gives a potential buyer the right to purchase a property within a specified timeframe, often for a predetermined price. While the REPA finalizes the sale, the Option to Purchase Agreement creates a pathway for the buyer to secure the property without an immediate commitment. Both documents require careful consideration of terms and conditions to ensure clarity and protect the parties’ interests.

The Seller's Disclosure Statement is another document that complements the REPA. This statement provides essential information about the property's condition, including any known issues or defects. While the REPA formalizes the sale, the Seller's Disclosure Statement serves to inform the buyer, ensuring transparency in the transaction. Both documents work together to promote a fair and informed buying process.

Additionally, the Title Report is relevant in the context of real estate transactions. This document outlines the ownership history of the property and identifies any liens or encumbrances. While the REPA focuses on the sale agreement, the Title Report ensures that the buyer is aware of any potential legal issues before the transaction is finalized. Both documents are critical in safeguarding the interests of the buyer and ensuring a smooth transfer of ownership.

Finally, the Closing Statement is similar to the REPA in that it summarizes the financial aspects of the transaction. This document details all costs associated with the sale, including closing costs, commissions, and any adjustments. While the REPA establishes the terms of the sale, the Closing Statement provides a final overview of the financial obligations, ensuring that both parties are clear on what to expect at closing. Both documents are essential for a successful real estate transaction, providing clarity and accountability.