Blank Real Estate Power of Attorney Form

When navigating the complexities of real estate transactions, having the right tools at your disposal is essential. One such tool is the Real Estate Power of Attorney form, a crucial document that grants a designated individual the authority to act on your behalf in matters related to property. This form can be particularly beneficial when you are unable to be present for important decisions, such as buying, selling, or managing real estate. By using this document, you empower someone you trust to handle negotiations, sign contracts, and even manage property on your behalf. It's important to understand that the powers granted can be tailored to fit your specific needs, whether you want to limit the authority to a single transaction or provide broader powers for ongoing management. Additionally, the form must be executed with care, as it typically requires notarization to ensure its validity. Understanding these key aspects can help you make informed decisions and ensure that your real estate interests are protected.

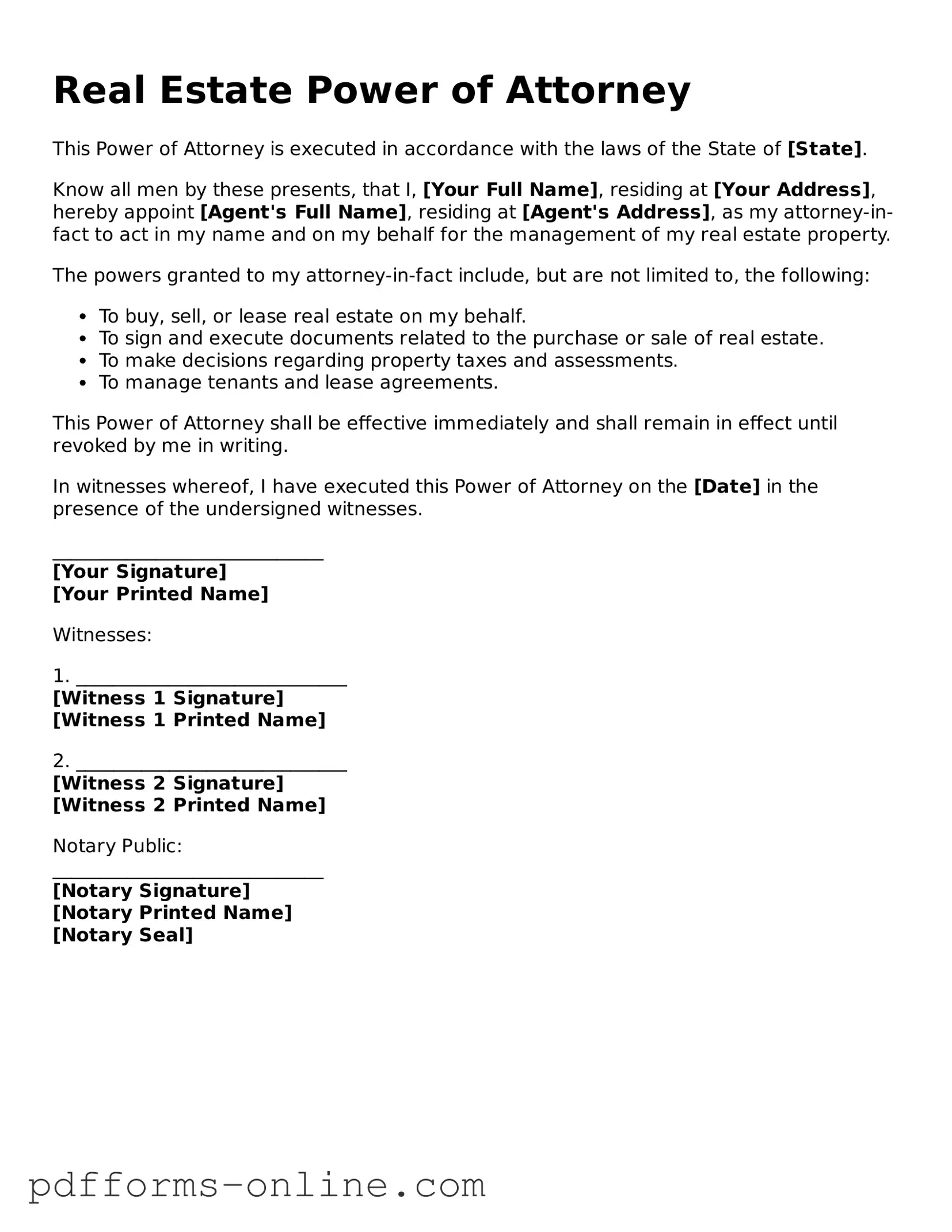

Document Example

Real Estate Power of Attorney

This Power of Attorney is executed in accordance with the laws of the State of [State].

Know all men by these presents, that I, [Your Full Name], residing at [Your Address], hereby appoint [Agent's Full Name], residing at [Agent's Address], as my attorney-in-fact to act in my name and on my behalf for the management of my real estate property.

The powers granted to my attorney-in-fact include, but are not limited to, the following:

- To buy, sell, or lease real estate on my behalf.

- To sign and execute documents related to the purchase or sale of real estate.

- To make decisions regarding property taxes and assessments.

- To manage tenants and lease agreements.

This Power of Attorney shall be effective immediately and shall remain in effect until revoked by me in writing.

In witnesses whereof, I have executed this Power of Attorney on the [Date] in the presence of the undersigned witnesses.

_____________________________

[Your Signature]

[Your Printed Name]

Witnesses:

1. _____________________________

[Witness 1 Signature]

[Witness 1 Printed Name]

2. _____________________________

[Witness 2 Signature]

[Witness 2 Printed Name]

Notary Public:

_____________________________

[Notary Signature]

[Notary Printed Name]

[Notary Seal]

Frequently Asked Questions

-

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, known as the principal, in real estate transactions. This can include buying, selling, or managing property.

-

Why would someone need a Real Estate Power of Attorney?

Individuals may need this document for various reasons. For instance, if a person is unable to attend a closing due to health issues or travel commitments, they can authorize someone else to handle the transaction. It ensures that their real estate matters can proceed smoothly without unnecessary delays.

-

Who can be appointed as an agent?

Any competent adult can be appointed as an agent. This could be a family member, friend, or a professional such as a lawyer or real estate agent. It is crucial to choose someone trustworthy, as they will have significant authority over your property decisions.

-

What powers does the agent have?

The powers granted to the agent can vary depending on the specific terms outlined in the document. Typically, the agent can sign documents, make decisions regarding the sale or purchase of property, and manage rental agreements. It’s essential to clearly define these powers to avoid misunderstandings.

-

How long does a Real Estate Power of Attorney last?

The duration of a Real Estate Power of Attorney can be specified in the document. It can be set for a specific time frame or remain effective until revoked by the principal. In some cases, it may also be designed to be effective only during a particular event, such as the principal’s incapacitation.

-

Can a Real Estate Power of Attorney be revoked?

Yes, a principal can revoke the Real Estate Power of Attorney at any time, as long as they are mentally competent. To do this, they should create a written revocation document and provide it to the agent and any relevant third parties to ensure that the change is recognized.

-

Is a Real Estate Power of Attorney the same as a general Power of Attorney?

No, a Real Estate Power of Attorney is specific to real estate transactions, while a general Power of Attorney grants broader powers over various financial and legal matters. If someone needs help with multiple areas, they might consider a general Power of Attorney instead.

-

Do I need to have the Real Estate Power of Attorney notarized?

In most cases, yes, the document should be notarized to ensure its legality. Some states may also require witnesses. It’s advisable to check local laws to confirm the specific requirements for notarization and witnessing.

-

Can I use a Real Estate Power of Attorney for transactions in another state?

Yes, a Real Estate Power of Attorney can be used for transactions in another state. However, it’s important to ensure that the document complies with the laws of that state. Consulting with a local attorney may be beneficial to ensure all legal requirements are met.

-

What should I consider before signing a Real Estate Power of Attorney?

Before signing, consider the trustworthiness and capability of the person you are appointing as your agent. Clearly outline the powers you wish to grant and understand the implications of giving someone else authority over your real estate decisions. It may also be wise to seek legal advice to ensure the document meets your needs.

Misconceptions

Understanding the Real Estate Power of Attorney (POA) can be challenging, especially with the many misconceptions surrounding it. Here’s a list of common misunderstandings that can lead to confusion:

- It can only be used for real estate transactions. Many believe that a Real Estate POA is limited to property dealings. In reality, it can also cover a variety of decisions related to property management, maintenance, and even leasing.

- It requires a lawyer to create. While having a lawyer can be beneficial, it is not mandatory. Individuals can draft a Real Estate POA themselves, provided they follow the required state laws.

- It gives away all control over the property. This is a common fear. In fact, the principal can specify the extent of authority granted, retaining significant control over their assets.

- It is only valid if notarized. Although notarization enhances credibility, some states allow a Real Estate POA to be valid without it, as long as it meets other legal requirements.

- It remains valid after the principal's death. This is a crucial point. A Real Estate POA ceases to be valid once the principal passes away, making it essential to have a will or estate plan in place.

- It cannot be revoked. On the contrary, a principal can revoke a Real Estate POA at any time, as long as they are mentally competent to do so.

- It is only for older adults. Many think that only seniors need a Real Estate POA. However, anyone can benefit from it, especially if they travel frequently or face health challenges.

- It automatically grants financial power. A Real Estate POA is specific to property matters. If financial authority is needed, a separate financial POA must be created.

- It can be used in any state without modification. Laws regarding POAs vary by state. It’s crucial to ensure that the form complies with the laws of the state where the property is located.

- All agents have the same responsibilities. The responsibilities of an agent can vary widely depending on the specific powers granted in the POA. It’s essential to clearly outline these responsibilities in the document.

Being informed about these misconceptions can help individuals make better decisions regarding their real estate affairs. It’s vital to approach the creation and use of a Real Estate Power of Attorney with clarity and understanding.

Common mistakes

-

Not specifying the powers granted: It is essential to clearly outline what powers are being granted to the agent. Failing to do so can lead to misunderstandings about what the agent can and cannot do on behalf of the principal.

-

Using vague language: Ambiguous terms can create confusion. Specificity is key to ensure that all parties understand the scope of authority.

-

Not including a durable clause: A durable power of attorney remains effective even if the principal becomes incapacitated. Omitting this clause may limit the agent's authority when it is most needed.

-

Neglecting to sign and date: A signature is crucial for the document's validity. Without it, the power of attorney may not be recognized.

-

Failing to have witnesses or notarization: Depending on state laws, having witnesses or a notary may be required. Not adhering to these requirements can invalidate the document.

-

Not reviewing state-specific requirements: Each state may have different laws governing power of attorney forms. It is important to ensure compliance with local regulations.

-

Ignoring the need for updates: Life circumstances change. Failing to update the power of attorney when necessary can lead to issues if the principal's wishes have evolved.

-

Not discussing with the agent: Communication is vital. Not discussing the responsibilities and expectations with the agent can lead to conflicts or misunderstandings.

-

Overlooking the importance of revocation: If the principal decides to revoke the power of attorney, they must do so formally. Failing to properly revoke can result in confusion about authority.

Fill out Common Types of Real Estate Power of Attorney Forms

Power of Attorney Dmv - It can be tailored to meet the unique needs of the vehicle owner, specifying the powers granted.

A Power of Attorney form is a legal document that allows one person to grant another individual the authority to act on their behalf in financial or legal matters. This form can be essential in situations where someone cannot manage their affairs due to absence or incapacity. Understanding how a Power of Attorney works can empower individuals to make informed decisions about their financial and health-related needs, and more information can be found at documentonline.org/blank-power-of-attorney/.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Power of Attorney form allows one person to authorize another to manage real estate transactions on their behalf. |

| Purpose | This form is primarily used to facilitate the buying, selling, or managing of real estate without the principal's direct involvement. |

| Principal and Agent | The person granting authority is called the principal, while the person receiving authority is known as the agent or attorney-in-fact. |

| State-Specific Forms | Each state may have its own specific form and requirements for a Real Estate Power of Attorney, governed by state law. |

| Revocation | The principal can revoke the Power of Attorney at any time, provided they are mentally competent. |

| Durability | A durable Power of Attorney remains effective even if the principal becomes incapacitated, unless stated otherwise. |

| Execution Requirements | Most states require the form to be signed in the presence of a notary public and may also need witnesses. |

| Limitations | Some actions, such as making a will or certain medical decisions, cannot be authorized through a Real Estate Power of Attorney. |

| Governing Laws | In California, for example, the governing law is the California Probate Code Sections 4000-4545. |

Similar forms

The Real Estate Power of Attorney form shares similarities with the General Power of Attorney. Both documents grant an individual the authority to act on behalf of another person. In the case of the General Power of Attorney, the scope of authority is broader, covering a variety of financial and legal matters. This allows the appointed agent to manage the principal’s affairs comprehensively, including real estate transactions, but it is not limited to property matters alone.

Another document akin to the Real Estate Power of Attorney is the Limited Power of Attorney. This form is similar in that it also permits one person to act on behalf of another. However, the Limited Power of Attorney restricts the agent’s authority to specific tasks or time frames. For instance, it may only allow the agent to sell a particular property, making it a more focused tool for certain situations.

The Durable Power of Attorney is another related document. Like the Real Estate Power of Attorney, it remains effective even if the principal becomes incapacitated. This characteristic ensures that the agent can continue to manage the principal's real estate and other affairs without interruption, providing peace of mind during challenging times.

The Healthcare Power of Attorney is also similar in that it allows one person to make decisions on behalf of another. While this document focuses on medical decisions rather than real estate, it reflects the same underlying principle of granting authority to an agent. Both forms require a high level of trust, as they empower someone to act in the best interests of the principal.

The Financial Power of Attorney bears resemblance to the Real Estate Power of Attorney as well. This document specifically grants authority to manage financial matters, which can include real estate transactions. While the Financial Power of Attorney may cover a broader range of financial issues, it can also be tailored to include real estate dealings, thus overlapping with the intent of the Real Estate Power of Attorney.

A Will is another document that, while serving a different purpose, shares some similarities with the Real Estate Power of Attorney. Both documents involve the management of property and assets. A Will dictates how a person’s property should be distributed after their death, while the Real Estate Power of Attorney allows an agent to manage property during the principal's lifetime. Both require careful consideration and planning.

In the realm of estate planning, understanding the various legal documents is crucial, and one resourceful option is the OnlineLawDocs.com, which provides valuable information regarding the Power of Attorney form in Texas. This document not only facilitates decision-making on behalf of a principal but also provides a means to manage affairs effectively during times of need.

The Trust Agreement is also comparable. It allows for the management and distribution of assets, including real estate. Like the Real Estate Power of Attorney, a Trust Agreement can designate a trustee to handle property matters. However, a Trust Agreement is typically established to provide long-term management and can continue beyond the principal’s lifetime.

The Quitclaim Deed shares a functional relationship with the Real Estate Power of Attorney. This document is used to transfer ownership of real estate from one party to another. When a Real Estate Power of Attorney is in place, the agent may execute a Quitclaim Deed on behalf of the principal, facilitating the transfer of property without the need for the principal’s direct involvement.

The Assignment of Lease is another document that resembles the Real Estate Power of Attorney. This form allows one party to transfer their rights and obligations under a lease agreement to another party. Similar to the Real Estate Power of Attorney, it requires the consent of the original party and can be executed by an agent acting under a power of attorney, thus allowing for seamless management of real estate interests.

Finally, the Real Estate Purchase Agreement can be considered similar. This document outlines the terms and conditions under which a property will be bought or sold. While it is a specific agreement rather than a power of attorney, an agent authorized by a Real Estate Power of Attorney can enter into such agreements on behalf of the principal, effectively facilitating real estate transactions.