Blank Quitclaim Deed Form

A Quitclaim Deed is an important legal document that facilitates the transfer of property ownership. It serves as a means for one party, known as the grantor, to relinquish any claim they may have to a property, thereby allowing another party, the grantee, to assume ownership. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property, nor does it provide any warranties regarding the property's condition or status. This form is often used in situations such as transferring property between family members, settling estate matters, or clearing up title issues. The simplicity of the Quitclaim Deed makes it a popular choice for quick transfers, but it is essential for both parties to understand the implications of using this form. Proper completion and recording of the deed are crucial to ensure that the transfer is legally recognized and enforceable. Therefore, while the Quitclaim Deed can be a straightforward solution for property transfers, it is vital to approach its use with care and consideration.

Document Example

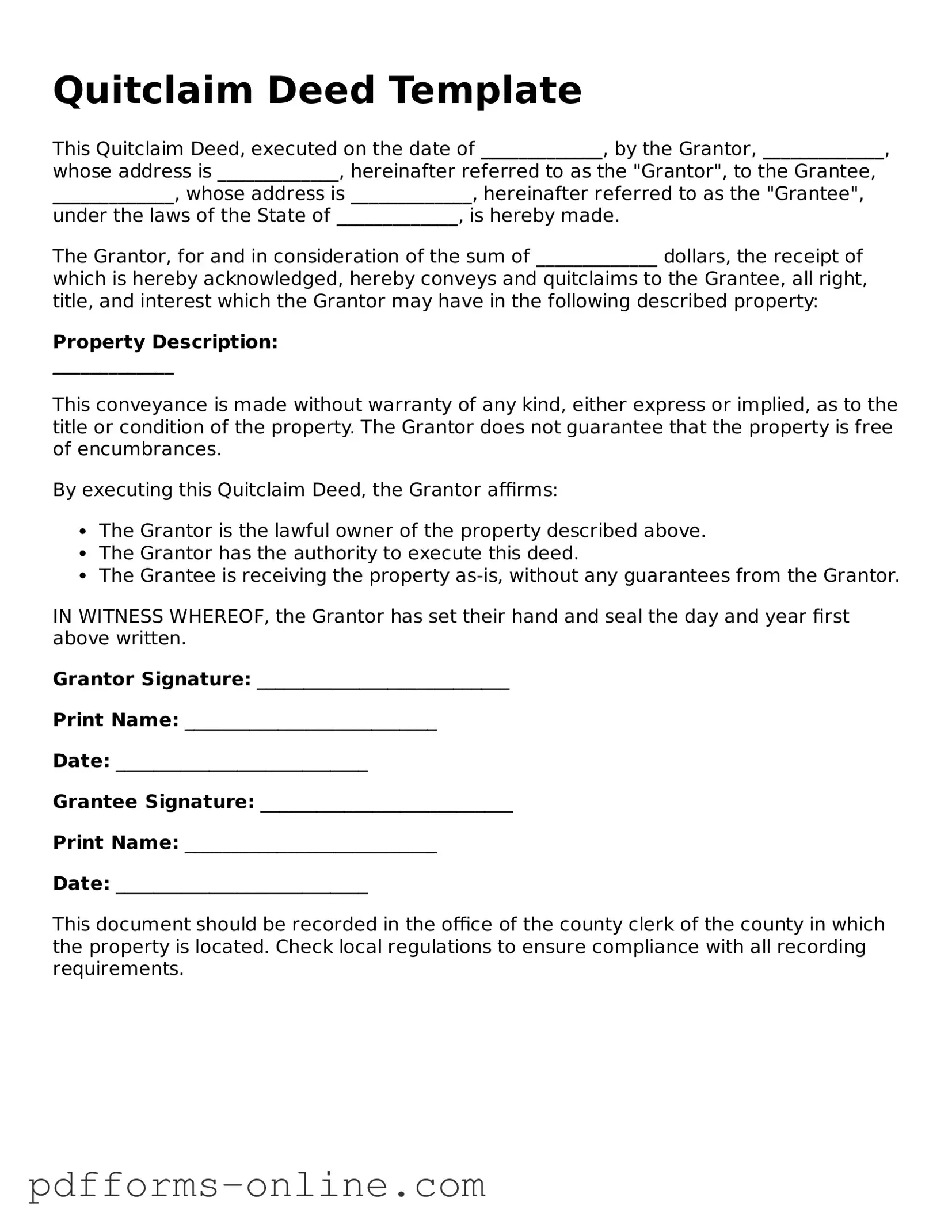

Quitclaim Deed Template

This Quitclaim Deed, executed on the date of _____________, by the Grantor, _____________, whose address is _____________, hereinafter referred to as the "Grantor", to the Grantee, _____________, whose address is _____________, hereinafter referred to as the "Grantee", under the laws of the State of _____________, is hereby made.

The Grantor, for and in consideration of the sum of _____________ dollars, the receipt of which is hereby acknowledged, hereby conveys and quitclaims to the Grantee, all right, title, and interest which the Grantor may have in the following described property:

Property Description:

_____________

This conveyance is made without warranty of any kind, either express or implied, as to the title or condition of the property. The Grantor does not guarantee that the property is free of encumbrances.

By executing this Quitclaim Deed, the Grantor affirms:

- The Grantor is the lawful owner of the property described above.

- The Grantor has the authority to execute this deed.

- The Grantee is receiving the property as-is, without any guarantees from the Grantor.

IN WITNESS WHEREOF, the Grantor has set their hand and seal the day and year first above written.

Grantor Signature: ___________________________

Print Name: ___________________________

Date: ___________________________

Grantee Signature: ___________________________

Print Name: ___________________________

Date: ___________________________

This document should be recorded in the office of the county clerk of the county in which the property is located. Check local regulations to ensure compliance with all recording requirements.

State-specific Guides for Quitclaim Deed Documents

Frequently Asked Questions

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other, such as transferring property between family members, in divorce settlements, or when adding or removing a name from a property title. They are also useful for clearing up title issues.

-

What are the advantages of using a Quitclaim Deed?

One of the main advantages is the simplicity and speed of the process. Quitclaim Deeds typically require less paperwork and can be executed quickly. They are also less expensive than other types of deeds. However, it’s important to note that they do not offer any warranties regarding the property’s title.

-

Are there any disadvantages to using a Quitclaim Deed?

Yes, the primary disadvantage is that a Quitclaim Deed does not provide any protection for the grantee (the person receiving the property). If the grantor (the person transferring the property) does not actually own the property or there are liens against it, the grantee may have no recourse. It’s essential to do your due diligence before accepting a Quitclaim Deed.

-

Do I need a lawyer to complete a Quitclaim Deed?

While it’s not legally required to have a lawyer, it is highly recommended. A legal professional can help ensure that the deed is filled out correctly and that all necessary steps are taken to properly transfer ownership. This can help avoid potential disputes in the future.

-

How do I fill out a Quitclaim Deed?

Filling out a Quitclaim Deed involves providing information such as the names of the grantor and grantee, a description of the property, and the date of the transfer. It’s crucial to ensure that all information is accurate. After completing the form, it must be signed in front of a notary public.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, they are not the same. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. This makes Warranty Deeds a safer option for buyers who want assurance about the property’s title.

-

How do I record a Quitclaim Deed?

To record a Quitclaim Deed, you need to take the signed and notarized document to the local county recorder's office where the property is located. There may be a small fee for recording the deed. Once recorded, the deed becomes part of the public record, providing legal proof of the transfer.

Misconceptions

When dealing with real estate transactions, the Quitclaim Deed form often raises questions and misconceptions. Here are eight common misunderstandings that can lead to confusion:

- Quitclaim Deeds Transfer Ownership Completely: Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only transfers the interest that the grantor has in the property, which may be none at all.

- Quitclaim Deeds Are Only for Family Transfers: While quitclaim deeds are frequently used among family members, they are not limited to such situations. They can be used in various transactions, including sales and transfers between strangers.

- Quitclaim Deeds Provide Title Insurance: Some think that using a quitclaim deed guarantees title insurance. However, title insurance is not automatically provided and must be purchased separately to protect against claims.

- Quitclaim Deeds Are the Same as Warranty Deeds: A common misconception is that quitclaim deeds offer the same protections as warranty deeds. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property.

- Quitclaim Deeds Are Irrevocable: Many people assume that once a quitclaim deed is signed, it cannot be undone. In fact, it can be revoked or modified under certain circumstances, depending on state laws.

- Quitclaim Deeds Are Only for Real Estate: While they are primarily used for real estate transactions, quitclaim deeds can also be used to transfer other types of property interests, such as personal property or business interests.

- Quitclaim Deeds Eliminate All Liability: Some believe that transferring property via a quitclaim deed absolves them of all liability related to that property. However, liabilities such as unpaid taxes or liens may still follow the property.

- Quitclaim Deeds Require Notarization: Although notarization is often recommended for validity, it is not always a legal requirement in every state. It is essential to check local laws to determine if notarization is necessary.

Understanding these misconceptions can help ensure that you make informed decisions regarding property transfers. Always consider consulting a legal professional for guidance tailored to your specific situation.

Common mistakes

Filling out a Quitclaim Deed can seem straightforward, but many people make common mistakes that can lead to complications later on. Here are eight mistakes to watch out for:

-

Not using the correct legal names: Ensure that all parties involved are listed with their full legal names. Nicknames or abbreviations can create confusion and may invalidate the deed.

-

Failing to include a legal description of the property: A vague or incomplete description can lead to disputes. Always include the exact legal description as it appears in the property records.

-

Not signing the deed: It may seem obvious, but forgetting to sign can render the deed ineffective. All grantors must sign the document in front of a notary.

-

Ignoring state-specific requirements: Each state has its own rules regarding Quitclaim Deeds. Failing to adhere to these can result in the deed being rejected.

-

Not having the deed notarized: A Quitclaim Deed typically needs to be notarized to be legally binding. Skipping this step can lead to issues with the validity of the deed.

-

Overlooking tax implications: Transferring property can have tax consequences. It's essential to consult with a tax professional to understand any potential liabilities.

-

Failing to record the deed: After completing the Quitclaim Deed, it should be filed with the appropriate county office. Not recording it can leave the transfer unprotected.

-

Assuming a Quitclaim Deed is a substitute for a warranty deed: A Quitclaim Deed offers no guarantees about the title. Understanding the differences between these types of deeds is crucial.

By being aware of these common pitfalls, you can ensure that your Quitclaim Deed is filled out correctly and serves its intended purpose. Take your time, double-check your work, and don’t hesitate to seek legal advice if needed.

Fill out Common Types of Quitclaim Deed Forms

Simple Deed of Gift Template - Timely filing of the Gift Deed can help secure the recipient's rights.

For those looking to facilitate a seamless transaction, understanding the importance of a Trailer Bill of Sale form is crucial. This document not only serves as a legal record of the sale but also protects both buyers and sellers by ensuring clarity about the details of the transaction. To access useful resources and templates related to this form, consider visiting OnlineLawDocs.com for more information.

Deed in Lieu of Foreclosure - Taking this route can also offer emotional relief in a challenging financial situation.

Correction Deed California - It plays a critical role in the real estate closing process when mistakes are identified.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real property from one party to another without any warranties or guarantees. |

| Use | Commonly used in situations such as divorce settlements, transferring property between family members, or clearing up title issues. |

| Governing Law | Each state has its own laws governing quitclaim deeds. For example, in California, it is governed by the California Civil Code Section 1092. |

| Warranties | Unlike a warranty deed, a quitclaim deed does not guarantee that the grantor has clear title to the property. |

| Consideration | Consideration (the value exchanged) is not always required, but it can be included to establish the transaction's legitimacy. |

| Filing Requirements | Most states require the quitclaim deed to be filed with the county recorder’s office to be effective against third parties. |

| Tax Implications | Transferring property via a quitclaim deed may have tax implications, including potential gift tax considerations. |

| Revocation | A quitclaim deed cannot be revoked once it is executed and recorded; the transfer is final unless both parties agree otherwise. |

Similar forms

A warranty deed is a legal document that transfers ownership of real property from one party to another. Unlike a quitclaim deed, which offers no guarantees about the title, a warranty deed provides a warranty that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding the ownership, the seller is responsible for resolving them. The warranty deed protects the buyer by ensuring that they receive a property free of liens or claims, making it a more secure option for transferring property rights.

The Ohio Lease Agreement form is essential for delineating the rights and responsibilities of landlords and tenants in rental situations throughout the state. By clearly outlining terms such as rental amount, duration of the lease, and obligations, this document helps prevent misunderstandings and ensures a fair relationship. For more information about the specifics of this vital form, you can visit https://documentonline.org/blank-ohio-lease-agreement/.

A grant deed is another document used in real estate transactions. Similar to a warranty deed, a grant deed conveys ownership of property from one party to another. However, it provides fewer guarantees than a warranty deed. A grant deed typically assures that the seller has not transferred the property to anyone else and that the property is free from encumbrances, except for those disclosed to the buyer. This makes it a middle ground between a quitclaim deed and a warranty deed, offering some level of protection to the buyer without the full assurances of a warranty deed.

A special warranty deed is a variation of the warranty deed. It also transfers ownership of real property but limits the seller's liability to the period during which they owned the property. This means that the seller guarantees that they have not caused any title issues during their ownership, but they do not provide assurances about any problems that may have existed before they acquired the property. This document is often used in commercial real estate transactions and provides a moderate level of protection for the buyer.

An affidavit of title is a sworn statement made by the seller regarding the ownership and condition of the property being sold. While it does not transfer ownership like a quitclaim deed, it serves a similar purpose by providing information about the title. The affidavit typically includes details about any liens, encumbrances, or other claims against the property. This document can be used in conjunction with other deeds to provide additional assurance to the buyer about the property's title status.