Blank Promissory Note for a Car Form

The Promissory Note for a Car form serves as a critical document in the financing of an automobile purchase. It outlines the borrower's commitment to repay the loan amount, detailing the terms and conditions under which the loan is provided. This form typically includes essential information such as the principal amount borrowed, the interest rate, the payment schedule, and the maturity date. Additionally, it may specify any penalties for late payments and the rights of the lender in the event of default. By clearly articulating these terms, the Promissory Note protects both the lender and the borrower, ensuring that both parties understand their obligations and rights. It is a legally binding agreement that can be enforced in a court of law, making its accuracy and completeness vital to the transaction. Understanding the nuances of this form is essential for anyone involved in financing a vehicle, as it lays the foundation for a successful financial arrangement.

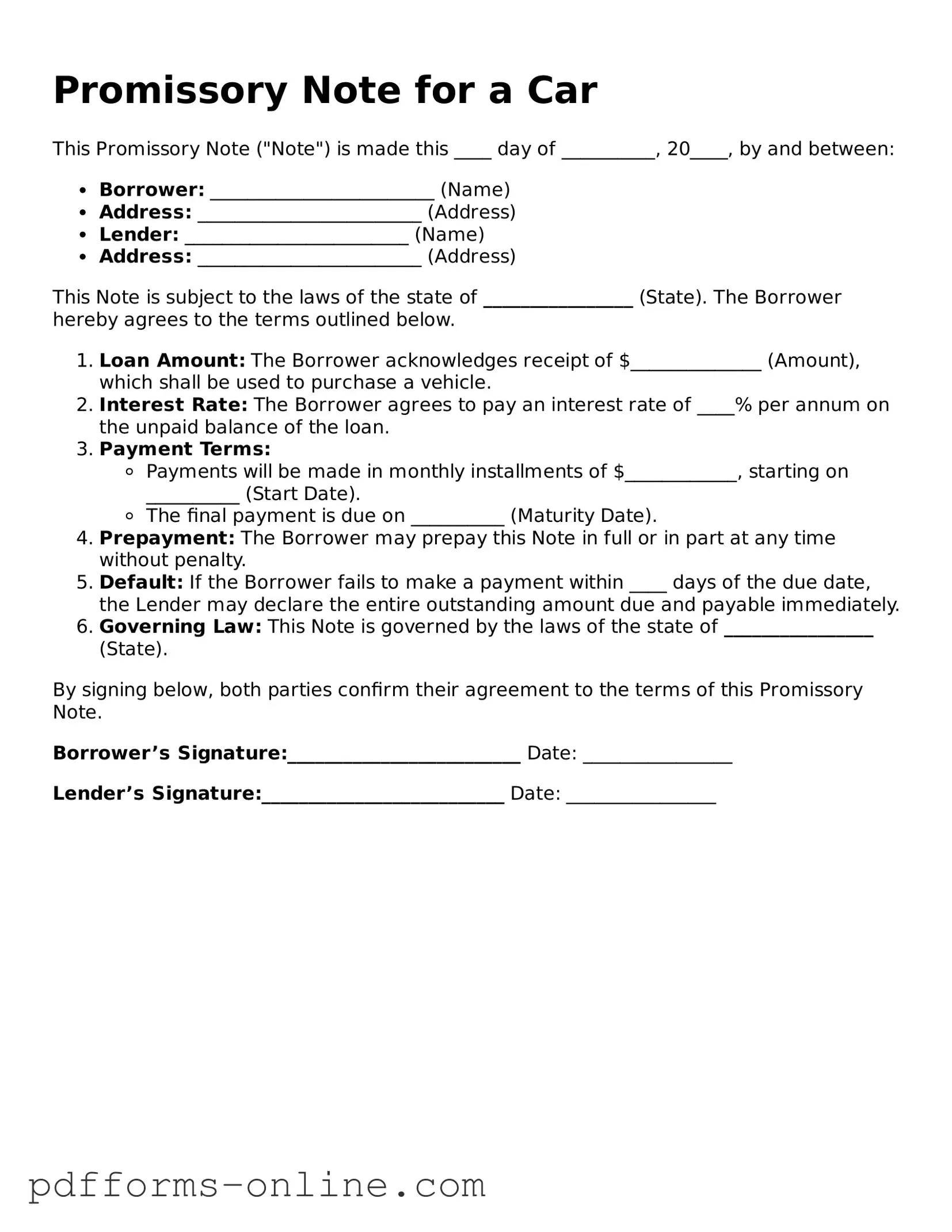

Document Example

Promissory Note for a Car

This Promissory Note ("Note") is made this ____ day of __________, 20____, by and between:

- Borrower: ________________________ (Name)

- Address: ________________________ (Address)

- Lender: ________________________ (Name)

- Address: ________________________ (Address)

This Note is subject to the laws of the state of ________________ (State). The Borrower hereby agrees to the terms outlined below.

- Loan Amount: The Borrower acknowledges receipt of $______________ (Amount), which shall be used to purchase a vehicle.

- Interest Rate: The Borrower agrees to pay an interest rate of ____% per annum on the unpaid balance of the loan.

- Payment Terms:

- Payments will be made in monthly installments of $____________, starting on __________ (Start Date).

- The final payment is due on __________ (Maturity Date).

- Prepayment: The Borrower may prepay this Note in full or in part at any time without penalty.

- Default: If the Borrower fails to make a payment within ____ days of the due date, the Lender may declare the entire outstanding amount due and payable immediately.

- Governing Law: This Note is governed by the laws of the state of ________________ (State).

By signing below, both parties confirm their agreement to the terms of this Promissory Note.

Borrower’s Signature:_________________________ Date: ________________

Lender’s Signature:__________________________ Date: ________________

Frequently Asked Questions

-

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines a borrower's promise to repay a loan used to purchase a vehicle. This note includes details such as the loan amount, interest rate, repayment schedule, and consequences of default.

-

Who needs a Promissory Note for a Car?

This document is essential for anyone who borrows money to buy a car, whether from a bank, credit union, or an individual. It protects both the lender and the borrower by clearly stating the terms of the loan.

-

What information is included in a Promissory Note for a Car?

The note typically includes:

- The names and addresses of the borrower and lender

- The loan amount

- The interest rate

- The repayment schedule

- Consequences of late payments or default

- Any collateral involved, such as the car itself

-

Is a Promissory Note for a Car legally binding?

Yes, once signed by both parties, the Promissory Note is a legally binding contract. This means that both the borrower and lender must adhere to the terms outlined in the document.

-

What happens if the borrower defaults on the loan?

If the borrower fails to make payments as agreed, the lender may take legal action to recover the owed amount. This can include repossessing the car or pursuing a court judgment to collect the debt.

-

Can the terms of the Promissory Note be changed?

Yes, both parties can agree to modify the terms of the Promissory Note. Any changes must be documented in writing and signed by both the borrower and the lender to be enforceable.

-

Where can I obtain a Promissory Note for a Car form?

Promissory Note forms can be found online through legal document services, at office supply stores, or through financial institutions. Ensure that the form you choose complies with your state’s laws.

Misconceptions

Understanding the Promissory Note for a Car form is essential for both buyers and sellers in a vehicle transaction. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important document.

- A Promissory Note is the same as a car title. A promissory note is a financial instrument that outlines the borrower's promise to repay a loan, while a car title proves ownership of the vehicle.

- Only banks can issue a Promissory Note. Individuals can create and sign promissory notes for personal loans, including those for car purchases, without involving a bank.

- A Promissory Note does not require a witness or notarization. While it is not legally required in every state, having a witness or notarization can add an extra layer of protection and authenticity.

- The terms of a Promissory Note are set in stone. The terms can be negotiated between the buyer and seller before signing, allowing for flexibility in repayment schedules and interest rates.

- A Promissory Note guarantees the buyer will receive the car. The note is a promise to pay, but it does not guarantee the transfer of the vehicle until payment is completed and the title is signed over.

- Once signed, a Promissory Note cannot be changed. Amendments can be made if both parties agree, and these changes should be documented in writing.

- A Promissory Note is not legally binding. A properly executed promissory note is a legally binding contract, and failure to comply with its terms can lead to legal consequences.

- Only one copy of a Promissory Note is needed. It is advisable for both the borrower and lender to keep a signed copy for their records to ensure clarity and accountability.

- A Promissory Note does not affect credit scores. If the borrower defaults on the loan, it can negatively impact their credit score, as lenders may report the default to credit bureaus.

Clarifying these misconceptions can help individuals navigate the complexities of vehicle financing and ensure a smoother transaction process.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the borrower’s full name, address, and contact information, can lead to confusion and potential legal issues.

-

Incorrect Loan Amount: Entering the wrong amount for the loan can result in discrepancies later. Double-check the figures to ensure accuracy.

-

Missing Signatures: Both the borrower and lender must sign the document. Omitting a signature can invalidate the note.

-

Failure to Specify Interest Rate: Not including the interest rate or leaving it blank can create misunderstandings about repayment terms.

-

Ignoring Payment Schedule: Neglecting to outline the payment schedule, including due dates and amounts, can lead to missed payments and financial strain.

-

Not Including Default Terms: Failing to specify what happens in the event of default can leave both parties unprotected. Clearly outline consequences for missed payments.

-

Using Ambiguous Language: Vague terms can lead to different interpretations. Use clear and straightforward language to avoid confusion.

Fill out Common Types of Promissory Note for a Car Forms

Release of Promissory Note - Serves as an official record that a promissory note has been discharged.

When preparing to enter into a financial agreement, it is essential to utilize the appropriate documentation to ensure all parties understand their rights and responsibilities. A crucial tool for this purpose is the Florida Promissory Note form, which sets forth clear conditions under which a loan is made, including payment terms and interest rates. For more detailed templates and resources, you can refer to All Florida Forms, which provides a comprehensive selection of legal forms necessary for various transactions in Florida.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money to the lender for the purchase of a vehicle. |

| Parties Involved | The note involves two main parties: the borrower (car buyer) and the lender (financial institution or individual). |

| Governing Law | Each state has specific laws governing promissory notes. For example, in California, the Uniform Commercial Code (UCC) applies. |

| Interest Rates | The note may specify an interest rate, which can be fixed or variable, affecting the total amount paid over time. |

| Payment Terms | Payment terms outline how and when payments are to be made, including due dates and methods of payment. |

| Default Consequences | If the borrower fails to make payments, the lender may have the right to repossess the vehicle. |

| Signatures Required | Both parties must sign the note for it to be legally binding, demonstrating their agreement to the terms outlined. |

Similar forms

The Promissory Note for a Car form is similar to a standard Promissory Note. Both documents serve as written promises to pay a specific amount of money to a lender. The key difference lies in the context; while a standard Promissory Note can apply to various loans, the car-specific version includes details about the vehicle being financed. This includes the make, model, and vehicle identification number (VIN), ensuring clarity about the collateral involved in the transaction.

A Loan Agreement shares similarities with the Promissory Note for a Car. Both documents outline the terms of the loan, including the amount borrowed, interest rate, and repayment schedule. However, a Loan Agreement often provides more comprehensive details, such as the obligations of both parties and potential consequences of default. It is a more extensive document that can cover various aspects of the lending relationship.

Understanding how to complete a comprehensive Promissory Note template is essential for both borrowers and lenders. This document solidifies the promise to repay the borrowed amount, outlining specific terms to ensure clarity in the financial transaction. For more detailed guidance on the structure and components of this influential document, visit this Promissory Note form resource.

The Retail Installment Sales Contract is another document closely related to the Promissory Note for a Car. This contract is commonly used in vehicle sales transactions, where the buyer agrees to pay for the car over time. Like the Promissory Note, it includes payment terms and interest rates. However, it also typically outlines the rights and responsibilities of both the buyer and seller, making it a more detailed agreement.

A Security Agreement is also comparable, as it establishes the lender's rights to the collateral—in this case, the car. While the Promissory Note for a Car serves as a promise to repay, the Security Agreement explicitly states that the vehicle serves as collateral for the loan. If the borrower defaults, the lender has the right to reclaim the vehicle, providing additional protection for the lender.

The Bill of Sale is another relevant document. It serves as proof of the transfer of ownership of the vehicle from the seller to the buyer. While the Promissory Note for a Car focuses on the financial aspect of the transaction, the Bill of Sale confirms that the buyer has acquired the vehicle. It may also include details about the sale price, making it an essential document for both parties.

The Loan Application form is similar in that it initiates the borrowing process. This document collects information about the borrower’s financial status, credit history, and other relevant details. While the Promissory Note for a Car finalizes the loan agreement, the Loan Application is the first step that helps lenders assess the risk associated with lending to the applicant.

The Title is another important document that relates to the Promissory Note for a Car. The Title serves as legal proof of ownership of the vehicle. When a car is financed, the lender often holds the Title until the loan is paid off. This ensures that the lender has a claim to the vehicle until the borrower fulfills their repayment obligations, linking ownership and financial responsibility.

Lastly, the Credit Disclosure Statement is similar because it provides essential information about the loan's terms and costs. This document outlines the annual percentage rate (APR), total finance charges, and payment schedule. It ensures transparency for the borrower, much like the Promissory Note for a Car, which also aims to clearly communicate the financial obligations involved in the loan.