Blank Promissory Note Form

When navigating the world of financial agreements, the Promissory Note stands out as a fundamental tool that facilitates lending and borrowing between parties. This document serves as a written promise, where one party, the borrower, commits to repaying a specified sum of money to another party, the lender, within a designated timeframe. Essential elements of a Promissory Note include the principal amount, interest rate, repayment schedule, and any applicable fees or penalties for late payments. Additionally, it often outlines the consequences of default, ensuring that both parties understand their rights and obligations. By providing clarity and structure, the Promissory Note not only safeguards the interests of the lender but also offers the borrower a clear path to fulfilling their financial commitment. Understanding this form is crucial for anyone involved in a loan agreement, whether it be for personal, business, or real estate purposes, as it lays the groundwork for a transparent and enforceable financial relationship.

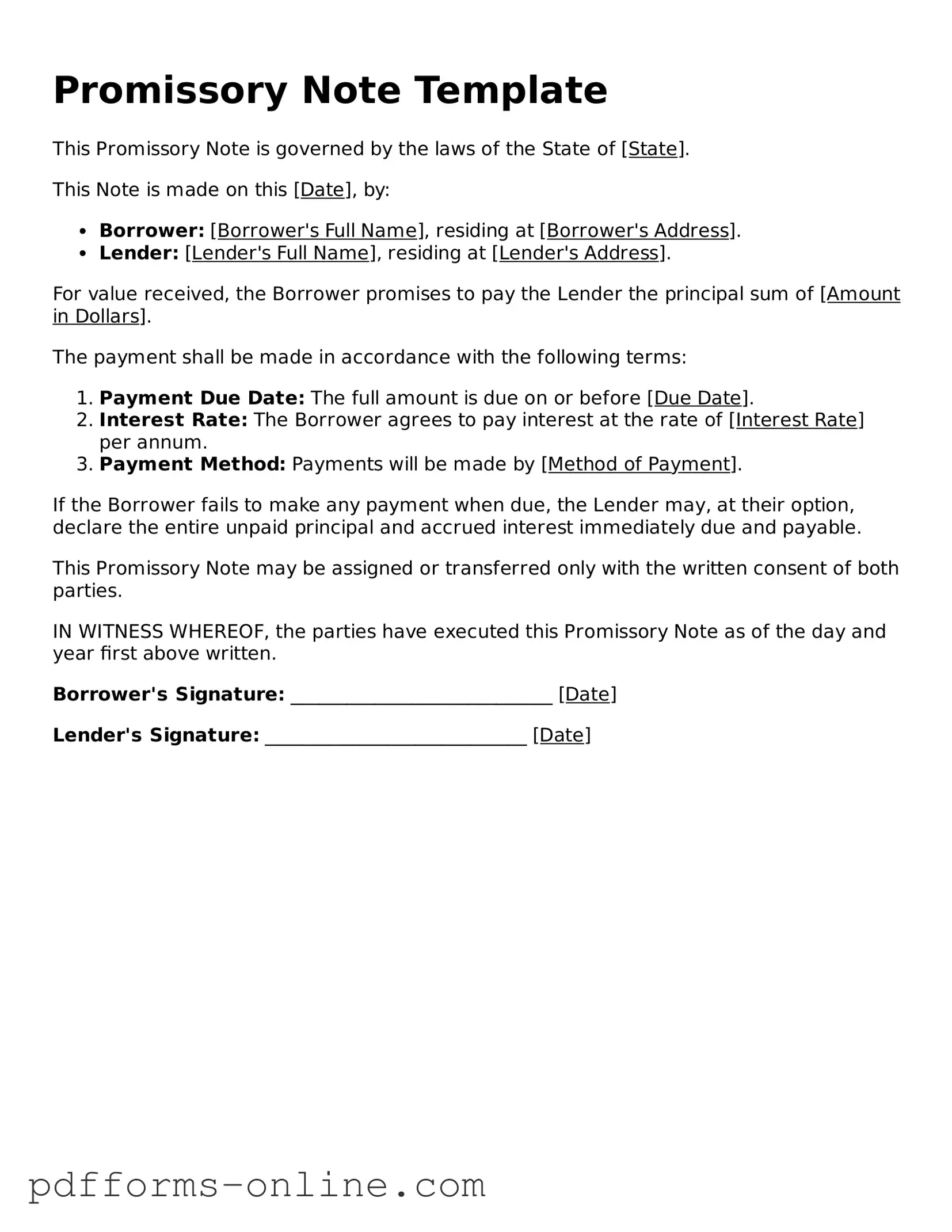

Document Example

Promissory Note Template

This Promissory Note is governed by the laws of the State of [State].

This Note is made on this [Date], by:

- Borrower: [Borrower's Full Name], residing at [Borrower's Address].

- Lender: [Lender's Full Name], residing at [Lender's Address].

For value received, the Borrower promises to pay the Lender the principal sum of [Amount in Dollars].

The payment shall be made in accordance with the following terms:

- Payment Due Date: The full amount is due on or before [Due Date].

- Interest Rate: The Borrower agrees to pay interest at the rate of [Interest Rate] per annum.

- Payment Method: Payments will be made by [Method of Payment].

If the Borrower fails to make any payment when due, the Lender may, at their option, declare the entire unpaid principal and accrued interest immediately due and payable.

This Promissory Note may be assigned or transferred only with the written consent of both parties.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the day and year first above written.

Borrower's Signature: ____________________________ [Date]

Lender's Signature: ____________________________ [Date]

State-specific Guides for Promissory Note Documents

Promissory Note Form Types

Frequently Asked Questions

-

What is a Promissory Note?

A Promissory Note is a written promise made by one party (the borrower) to pay a specified sum of money to another party (the lender) at a designated time or on demand. This document outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a legal record of the debt and can be enforced in court if necessary.

-

What are the essential components of a Promissory Note?

Several key elements should be included in a Promissory Note to ensure its validity:

- Names of the parties: Clearly identify the borrower and lender.

- Principal amount: State the amount of money being borrowed.

- Interest rate: Specify the interest rate, if applicable.

- Repayment terms: Outline when and how the borrower will repay the loan.

- Signatures: Both parties must sign the document to make it legally binding.

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding document as long as it meets certain criteria. The parties involved must have the legal capacity to enter into a contract, the agreement must be made voluntarily, and it must contain clear terms. If any party fails to uphold their end of the agreement, the other party can take legal action to enforce the terms of the note.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement. This ensures clarity and helps prevent disputes in the future.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They may choose to negotiate a new repayment plan, pursue collection efforts, or take legal action to recover the owed amount. The specifics will depend on the terms outlined in the Promissory Note and the applicable laws in the jurisdiction.

Misconceptions

Promissory notes are important financial documents, but many people have misunderstandings about them. Here are seven common misconceptions:

- All promissory notes are the same. Many believe that all promissory notes have a standard format. In reality, the terms and conditions can vary widely based on the agreement between the parties involved.

- Promissory notes are only for loans. While they are often used for loans, promissory notes can also be used in other transactions, such as for payment for services or goods.

- A verbal agreement is enough. Some think that a verbal promise to pay is sufficient. However, having a written promissory note provides clear evidence of the agreement and protects both parties.

- Promissory notes do not need to be signed. A common misconception is that a promissory note can be valid without a signature. In fact, a signature is crucial for the note to be enforceable.

- Interest rates are always included. Many assume that all promissory notes must include an interest rate. While most do, it is not a requirement; some notes can be interest-free.

- They are only used in personal transactions. Some people think promissory notes are only for personal loans between friends or family. Businesses also frequently use them for various financial agreements.

- Once signed, they cannot be changed. There is a belief that a promissory note is set in stone once signed. However, parties can agree to modify the terms, as long as the changes are documented properly.

Understanding these misconceptions can help individuals navigate their financial agreements more effectively.

Common mistakes

When filling out a Promissory Note form, it's important to be thorough and accurate. Here are four common mistakes that people often make:

-

Omitting Key Information:

Many individuals forget to include essential details such as the names of the borrower and lender, the loan amount, and the interest rate. Missing this information can lead to confusion or disputes later on.

-

Incorrectly Calculating Interest:

Some people miscalculate the interest owed. It's crucial to understand whether the interest is simple or compound and to ensure that the calculations reflect the terms agreed upon. A small error can significantly impact the total amount due.

-

Failing to Sign and Date:

A common oversight is neglecting to sign and date the document. Without signatures, the note may not be legally binding. Both parties should review the document and ensure that all necessary signatures are present.

-

Not Specifying Repayment Terms:

Some individuals do not clearly outline the repayment schedule. It is vital to specify when payments are due, the payment method, and any penalties for late payments. Clarity in these terms helps prevent misunderstandings.

By avoiding these mistakes, individuals can create a more effective and enforceable Promissory Note, ensuring a smoother lending process for both parties involved.

Popular Templates

Dnd 5e Fillable Character Sheet - A brave warrior skilled in hand-to-hand combat.

In conjunction with completing the Arizona Articles of Incorporation form, it is essential to familiarize yourself with the various requirements and resources available for business formation in the state, including All Arizona Forms, which can assist you in ensuring your application is thorough and compliant.

Make a Fake Insurance Card - Keep this card in your vehicle at all times.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a certain time. |

| Parties Involved | The two main parties are the maker (the person who promises to pay) and the payee (the person who receives the payment). |

| Governing Law | In the U.S., promissory notes are generally governed by the Uniform Commercial Code (UCC), specifically Article 3. |

| Types of Notes | Promissory notes can be secured or unsecured, depending on whether collateral backs the loan. |

| Interest Rates | Promissory notes often specify an interest rate, which can be fixed or variable. |

| State-Specific Forms | Each state may have its own specific requirements for promissory notes, so it's essential to check local laws. |

| Enforceability | A properly executed promissory note is legally enforceable, meaning the payee can take legal action if the maker defaults. |

| Transferability | Promissory notes can typically be transferred to another party, making them negotiable instruments. |

| Default Consequences | If the maker fails to pay, the payee may have the right to seek repayment through legal channels. |

| Documentation | It is crucial to document all terms clearly in the promissory note to avoid misunderstandings later. |

Similar forms

A loan agreement is a formal document outlining the terms and conditions of a loan between a lender and a borrower. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement typically includes additional clauses covering default, collateral, and other legal obligations, providing a more comprehensive framework for the transaction.

A mortgage is another document similar to a promissory note, as it secures a loan with real property. When a borrower takes out a mortgage, they sign a promissory note to promise repayment and a mortgage document to give the lender a claim against the property. This dual approach ensures that the lender has recourse in case of default, protecting their investment.

An IOU, or "I Owe You," is an informal document acknowledging a debt. While a promissory note is a legally binding contract with specific terms, an IOU serves as a simple acknowledgment of a debt. It does not usually contain detailed repayment terms or interest rates, making it less formal but still a recognition of the borrower's obligation to repay.

A credit agreement is similar to a promissory note in that it outlines the terms of borrowing. This document often applies to revolving credit accounts, such as credit cards or lines of credit. It details the credit limit, interest rates, and repayment terms, just like a promissory note, but it is typically more complex due to the nature of revolving credit.

A lease agreement shares similarities with a promissory note when it comes to payment obligations. In a lease, the tenant agrees to pay rent to the landlord over a specified period. The lease outlines the payment amount and schedule, akin to the repayment terms in a promissory note. However, a lease also includes additional terms regarding property use and responsibilities.

A personal guarantee is a document that an individual signs to assume responsibility for a debt or obligation of a business or another person. It is similar to a promissory note in that it establishes a commitment to repay a debt. However, a personal guarantee often accompanies a loan agreement or credit application, providing additional security for the lender.

Filling out a comprehensive Rental Application form is a crucial step for tenants seeking to secure a rental property. This document allows landlords to assess an applicant’s suitability based on their rental history and personal financial information.

An installment agreement is a payment plan that allows borrowers to pay off a debt in smaller, manageable amounts over time. Like a promissory note, it specifies the total amount owed and the repayment terms. However, installment agreements often include provisions for late payments and other penalties, which are not typically detailed in a standard promissory note.

A bond is a formal debt security issued by a borrower, typically a government or corporation, to raise funds. Like a promissory note, a bond represents a promise to repay borrowed money with interest. However, bonds are usually issued in larger amounts and traded on financial markets, making them more complex than a typical promissory note.

A letter of credit is a financial document issued by a bank guaranteeing a buyer's payment to a seller. It is similar to a promissory note in that it assures the seller of payment. However, a letter of credit involves a third party (the bank) and is often used in international trade, adding layers of complexity to the transaction.

A purchase agreement is a contract between a buyer and seller outlining the terms of a sale. While it primarily focuses on the sale of goods or property, it can include payment terms similar to those found in a promissory note. This agreement ensures both parties understand their obligations, including payment timelines and conditions for delivery.