Blank Power of Attorney Form

The Power of Attorney form serves as a crucial legal document that grants one individual the authority to act on behalf of another in various matters, including financial, medical, and legal decisions. This form can be tailored to meet specific needs, allowing the principal—the person granting authority—to designate an agent who will manage their affairs when they are unable to do so. The scope of authority can vary widely, ranging from limited powers for specific tasks to broad powers covering a wide array of responsibilities. Importantly, the form must be executed in accordance with state laws, often requiring signatures and notarization to ensure its validity. Additionally, the principal retains the right to revoke or modify the Power of Attorney at any time, provided they are mentally competent. Understanding the nuances of this document is essential, as it not only protects the interests of the principal but also clarifies the responsibilities of the agent, thereby minimizing potential conflicts and misunderstandings.

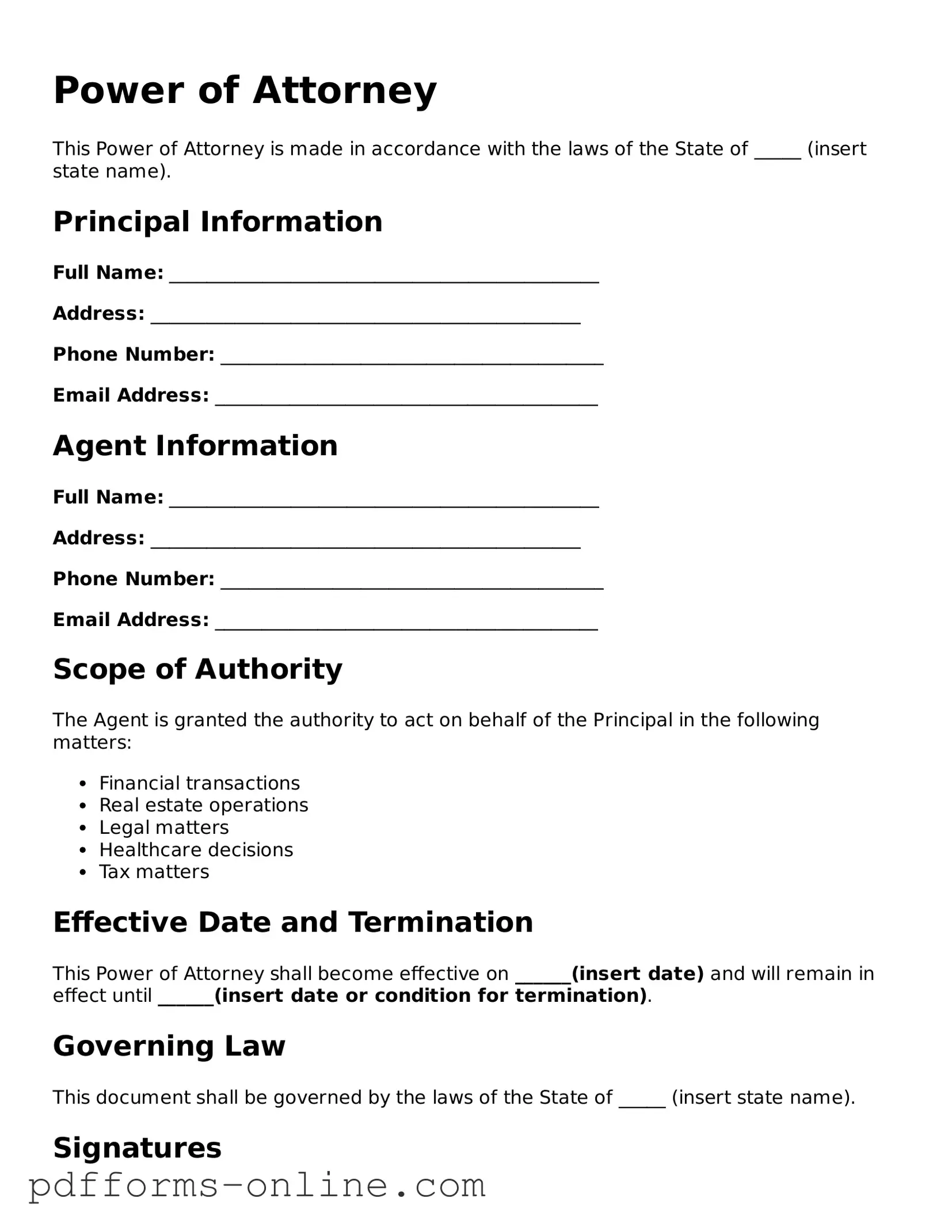

Document Example

Power of Attorney

This Power of Attorney is made in accordance with the laws of the State of _____ (insert state name).

Principal Information

Full Name: ______________________________________________

Address: ______________________________________________

Phone Number: _________________________________________

Email Address: _________________________________________

Agent Information

Full Name: ______________________________________________

Address: ______________________________________________

Phone Number: _________________________________________

Email Address: _________________________________________

Scope of Authority

The Agent is granted the authority to act on behalf of the Principal in the following matters:

- Financial transactions

- Real estate operations

- Legal matters

- Healthcare decisions

- Tax matters

Effective Date and Termination

This Power of Attorney shall become effective on ______(insert date) and will remain in effect until ______(insert date or condition for termination).

Governing Law

This document shall be governed by the laws of the State of _____ (insert state name).

Signatures

IN WITNESS WHEREOF, the Principal has executed this Power of Attorney.

Principal Signature: ___________________________________________

Date: _____________________________________

Agent Signature: _____________________________________________

Date: _____________________________________

Witness Information

- Witness Name: ______________________________________

- Witness Signature: _____________________________________

- Date: _____________________________________

Ensure that your Power of Attorney is executed in compliance with local laws and ideally, consult with a legal professional for validation.

State-specific Guides for Power of Attorney Documents

Power of Attorney Form Types

Frequently Asked Questions

-

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person (the principal) to give another person (the agent or attorney-in-fact) the authority to make decisions on their behalf. This can include financial matters, medical decisions, or other legal affairs. The principal can specify what powers the agent has and can also set limits on their authority.

-

Why would someone need a Power of Attorney?

People often use a Power of Attorney to ensure that their affairs are managed according to their wishes if they become unable to make decisions due to illness, injury, or absence. It provides peace of mind, knowing that someone trusted can handle important matters when necessary.

-

What types of Power of Attorney are there?

- Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated.

- Springing Power of Attorney: Only takes effect under specific conditions, usually when the principal becomes incapacitated.

- Medical Power of Attorney: Specifically grants the agent authority to make healthcare decisions for the principal.

- Financial Power of Attorney: Allows the agent to manage financial matters, such as paying bills or managing investments.

-

How do I create a Power of Attorney?

Creating a Power of Attorney involves several steps. First, you need to choose a trusted person to act as your agent. Next, you should complete a Power of Attorney form, which can often be found online or through legal offices. It's important to clearly outline the powers you are granting. After signing the document, it may need to be notarized or witnessed, depending on state laws.

-

Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a revocation document and notify your agent and any institutions or individuals who may have relied on the original POA. It's a good idea to keep a copy of the revocation for your records.

-

What happens if I don’t have a Power of Attorney?

If you do not have a Power of Attorney and become unable to make decisions, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy, costly, and may not reflect your wishes. Having a POA in place can help avoid this situation.

-

Can I use a Power of Attorney for my business?

Yes, you can use a Power of Attorney for business purposes. This is often referred to as a business Power of Attorney. It allows someone to handle business transactions, sign contracts, or manage business affairs on your behalf. Be sure to specify the powers you are granting in the document.

-

Is a Power of Attorney valid in all states?

While a Power of Attorney is generally recognized across the United States, laws can vary by state. It’s important to ensure that your POA complies with the laws of the state where it will be used. Consulting with a legal professional can help ensure that your document is valid and meets your needs.

Misconceptions

There are several misconceptions surrounding the Power of Attorney (POA) form that can lead to confusion. Understanding these misconceptions is important for individuals considering this legal document.

- Misconception 1: A Power of Attorney is only for elderly individuals.

- Misconception 2: A Power of Attorney grants unlimited power to the agent.

- Misconception 3: A Power of Attorney is permanent and cannot be revoked.

- Misconception 4: A Power of Attorney is only necessary for financial matters.

- Misconception 5: Once a Power of Attorney is signed, the principal loses control.

- Misconception 6: A Power of Attorney is the same as a living will.

This is not true. People of all ages can benefit from a POA, especially in situations where they may be unable to make decisions due to illness, travel, or other circumstances.

While a POA does give the agent authority to act on behalf of the principal, the scope of that authority can be limited. The principal can specify which powers are granted and which are not.

This is incorrect. A principal can revoke a POA at any time, as long as they are mentally competent. Revocation must be done in writing and communicated to the agent.

While financial decisions are a common use for a POA, it can also cover health care decisions and other personal matters, depending on the type of POA established.

This is a misunderstanding. The principal retains control over their decisions and can continue to make choices for themselves as long as they are capable.

A POA and a living will serve different purposes. A living will outlines medical preferences in end-of-life situations, while a POA designates someone to make decisions on behalf of the principal.

Common mistakes

-

Not specifying the powers granted: Many individuals fail to clearly outline the specific powers they are granting. This can lead to confusion and disputes later on.

-

Not choosing the right agent: Selecting an agent who does not understand your wishes or who may not act in your best interest can undermine the purpose of the Power of Attorney.

-

Ignoring state-specific requirements: Each state has its own rules regarding Power of Attorney forms. Failing to adhere to these can render the document invalid.

-

Not signing the document properly: Many people overlook the importance of proper signatures. Ensure that all required parties sign the document in the presence of a notary or witnesses, if needed.

-

Neglecting to date the form: A common mistake is not including a date. Without a date, it can be difficult to determine when the powers take effect.

-

Failing to review the document periodically: Life circumstances change. Failing to update your Power of Attorney can lead to outdated information and unintended consequences.

-

Not discussing your wishes with your agent: It’s crucial to have a conversation with your chosen agent about your preferences and expectations. Without this discussion, your agent may not act in alignment with your wishes.

Popular Templates

What Is Required on a Prescription Label - This form is used for documenting prescriptions accurately.

Create Gift Certificate - An effective Gift Letter emphasizes the generosity and intention of the donor to support the recipient.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) form allows one person to authorize another to act on their behalf in legal or financial matters. |

| Types | There are several types of POA, including General, Durable, and Limited, each serving different purposes and scopes of authority. |

| State-Specific Forms | Each state has its own requirements for POA forms, governed by state laws such as the Uniform Power of Attorney Act. |

| Revocation | A POA can be revoked at any time by the principal, provided they are mentally competent to do so. |

| Legal Implications | Using a POA carries significant legal implications; it is crucial to choose a trustworthy agent to avoid potential misuse. |

Similar forms

A Living Will is a document that outlines an individual’s preferences regarding medical treatment in the event they become unable to communicate their wishes. Similar to a Power of Attorney, a Living Will allows individuals to express their desires about end-of-life care. While the Power of Attorney designates someone to make decisions on behalf of the individual, a Living Will specifies what those decisions should be regarding medical interventions, such as resuscitation or life support. Both documents are essential for ensuring that personal wishes are respected during critical times.

A Healthcare Proxy serves a similar purpose to a Power of Attorney but is specifically focused on medical decisions. This document appoints someone to make healthcare choices when an individual cannot do so. Like a Power of Attorney, a Healthcare Proxy ensures that a trusted person is in charge of making decisions that align with the individual’s values and preferences. The main difference lies in the scope; while a Power of Attorney can cover financial and legal matters, a Healthcare Proxy is solely concerned with health-related issues.

A Durable Power of Attorney is a variation of the standard Power of Attorney that remains effective even if the individual becomes incapacitated. This document is crucial for ensuring that a designated agent can continue to manage the individual’s affairs when they are no longer able to do so themselves. Like the standard Power of Attorney, a Durable Power of Attorney allows for the delegation of financial and legal responsibilities, but its durability makes it particularly important for long-term planning.

A Financial Power of Attorney is another specific type of Power of Attorney that focuses solely on financial matters. This document allows an individual to appoint someone to handle their financial affairs, such as managing bank accounts, paying bills, and filing taxes. While it shares similarities with a general Power of Attorney, its exclusive focus on financial issues distinguishes it. Both documents empower a trusted individual to act on behalf of the principal, ensuring that financial responsibilities are managed appropriately.

A Trust is a legal arrangement that allows one party to hold assets for the benefit of another. Although it serves a different purpose than a Power of Attorney, both documents facilitate the management of an individual’s affairs. A Power of Attorney grants authority to an agent to make decisions on behalf of the individual, while a Trust involves transferring assets to a trustee who manages them according to the terms set by the individual. Both documents can be crucial in estate planning and asset management.

A Will is a document that outlines how an individual’s assets should be distributed after their death. While a Power of Attorney is effective during a person’s lifetime, a Will only takes effect after death. Both documents are vital for ensuring that an individual’s wishes are carried out, but they operate at different times. The Power of Attorney allows for decision-making while the individual is alive, whereas the Will governs the distribution of assets once they have passed away.

An Advance Directive is a broader category that includes both Living Wills and Healthcare Proxies. It allows individuals to express their healthcare preferences and appoint someone to make decisions on their behalf. Like a Power of Attorney, an Advance Directive ensures that personal wishes regarding medical care are followed. Both documents empower individuals to take control over their healthcare decisions, especially during times when they may be unable to communicate their desires.

A Guardianship document establishes a legal relationship in which one person is appointed to make decisions for another, typically a minor or someone unable to care for themselves. This is similar to a Power of Attorney in that it grants authority to an agent to act on behalf of another. However, Guardianship is often court-appointed and can be more restrictive, while a Power of Attorney is created by the individual without court involvement. Both serve to protect the interests of those who cannot manage their own affairs.

An Authorization to Release Health Information allows individuals to designate who can access their medical records. This document is similar to a Power of Attorney in that it grants authority to another person, but it is specifically focused on health information. Both documents empower a trusted individual to act on behalf of the principal, ensuring that their personal and medical information is handled according to their wishes.

A Business Power of Attorney is tailored for individuals who need to manage business affairs. This document allows someone to act on behalf of a business owner in financial or legal matters. Similar to a general Power of Attorney, it grants authority to an agent, but its specific focus on business transactions sets it apart. Both documents provide a mechanism for delegating authority, ensuring that important decisions can be made even when the principal is unavailable.