Valid Pennsylvania Transfer-on-Death Deed Template

The Pennsylvania Transfer-on-Death Deed (TODD) form offers a straightforward and efficient way for property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the often lengthy and costly probate process. This legal instrument allows individuals to retain full control of their property during their lifetime, ensuring that they can sell, mortgage, or otherwise manage their assets without interference. Upon the owner's death, the property automatically transfers to the named beneficiaries, provided the deed has been properly executed and recorded. Importantly, the form requires the owner's signature, as well as the signatures of two witnesses, to ensure its validity. Additionally, the TODD can be revoked or modified at any time before the owner's death, offering flexibility in estate planning. This deed is particularly beneficial for those looking to simplify the transfer of property to heirs while maintaining the ability to manage their assets without restriction. Understanding the nuances of this form can empower property owners in Pennsylvania to make informed decisions about their estate planning needs.

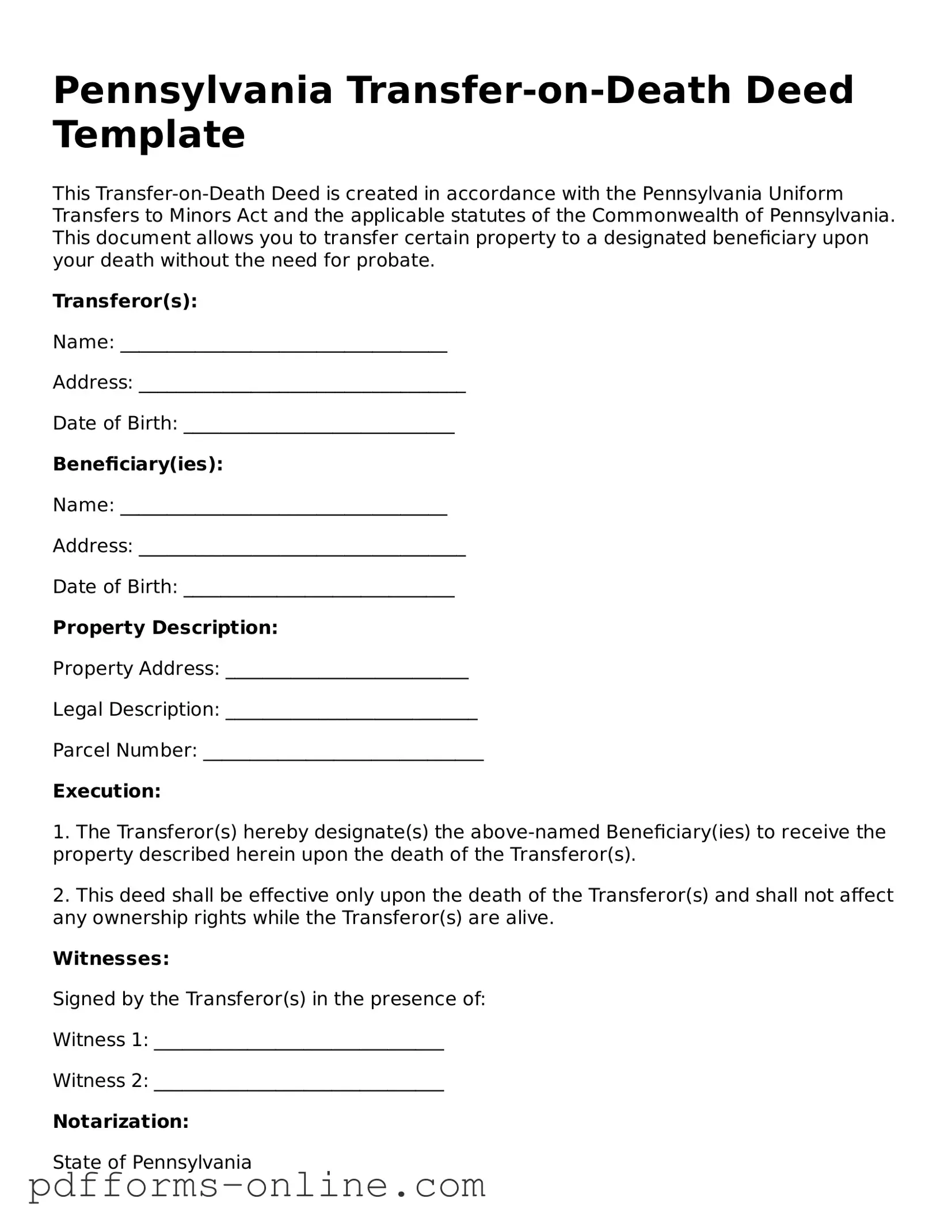

Document Example

Pennsylvania Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with the Pennsylvania Uniform Transfers to Minors Act and the applicable statutes of the Commonwealth of Pennsylvania. This document allows you to transfer certain property to a designated beneficiary upon your death without the need for probate.

Transferor(s):

Name: ___________________________________

Address: ___________________________________

Date of Birth: _____________________________

Beneficiary(ies):

Name: ___________________________________

Address: ___________________________________

Date of Birth: _____________________________

Property Description:

Property Address: __________________________

Legal Description: ___________________________

Parcel Number: ______________________________

Execution:

1. The Transferor(s) hereby designate(s) the above-named Beneficiary(ies) to receive the property described herein upon the death of the Transferor(s).

2. This deed shall be effective only upon the death of the Transferor(s) and shall not affect any ownership rights while the Transferor(s) are alive.

Witnesses:

Signed by the Transferor(s) in the presence of:

Witness 1: _______________________________

Witness 2: _______________________________

Notarization:

State of Pennsylvania

County of ______________________________

On this _____ day of _______________, 20____, before me, a notary public, personally appeared ________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof I hereunto set my hand and official seal.

Notary Public: _________________________

My commission expires: ________________

Frequently Asked Questions

-

What is a Transfer-on-Death Deed in Pennsylvania?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows you to transfer real estate to a designated beneficiary upon your death. This means that you can name someone to inherit your property without the need for probate, simplifying the process for your loved ones.

-

Who can use a Transfer-on-Death Deed?

Any property owner in Pennsylvania can use a TOD Deed. This includes individuals who own real estate solely or as joint tenants. However, it’s important to ensure that the property is eligible and that you follow the necessary steps to execute the deed correctly.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you need to fill out the form with the required information, including your name, the beneficiary’s name, and a legal description of the property. After completing the form, you must sign it in front of a notary public and then record it with the county recorder of deeds where the property is located.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time while you are still alive. To do this, you must create a new TOD Deed that specifies the changes or formally revoke the existing deed. It’s essential to record any changes or revocations with the county to ensure they are legally recognized.

-

What happens if the beneficiary predeceases me?

If your designated beneficiary passes away before you do, the TOD Deed will not transfer the property to them. Instead, the property will go to your estate. To avoid complications, consider naming an alternate beneficiary in your deed.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a TOD Deed does not trigger any immediate tax consequences. The property is transferred outside of probate, which can be beneficial. However, the beneficiary may be responsible for property taxes and potential capital gains taxes when they sell the property. Consulting a tax professional is advisable for personalized guidance.

-

Can I use a Transfer-on-Death Deed for all types of property?

A TOD Deed can only be used for real estate, such as land or buildings. It cannot be used for personal property like cars or bank accounts. For those assets, other estate planning tools may be more appropriate.

-

Is legal assistance necessary to create a Transfer-on-Death Deed?

While you can create a TOD Deed without legal help, consulting an attorney is a good idea. They can ensure that the deed is filled out correctly and meets all legal requirements. This can help prevent issues down the line.

-

Where can I find the Transfer-on-Death Deed form?

You can typically find the TOD Deed form on the official Pennsylvania government website or at your local county recorder of deeds office. Make sure to use the most current version of the form to ensure compliance with state laws.

Misconceptions

The Pennsylvania Transfer-on-Death Deed (TOD) form is a useful estate planning tool, but several misconceptions surround its use. Understanding these can help individuals make informed decisions.

- Misconception 1: The TOD deed avoids probate entirely.

- Misconception 2: A TOD deed can only be used for real estate.

- Misconception 3: Once a TOD deed is created, it cannot be changed.

- Misconception 4: Beneficiaries have immediate rights to the property.

While a TOD deed allows property to transfer directly to the named beneficiary upon the owner's death, it does not eliminate the need for probate in all cases. Other assets may still need to go through probate, depending on the overall estate.

Many people believe that the TOD deed is limited to real estate. However, it can also apply to certain types of financial accounts, such as bank accounts and securities, depending on state laws.

This is not true. The property owner retains the right to revoke or change the TOD deed at any time before their death. This flexibility allows for adjustments as circumstances change.

Beneficiaries do not gain immediate rights to the property upon the owner's death. They must wait until the owner has passed and the deed is properly executed to transfer ownership.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or rejection of the deed. Ensure that names, addresses, and property descriptions are fully and accurately filled out.

-

Incorrect Signatures: The deed must be signed by the property owner. If the signature is missing or does not match the name on the deed, it may not be valid. Always double-check signatures before submission.

-

Not Following Notarization Requirements: The deed must be notarized to be legally binding. Omitting this step can invalidate the transfer. Be sure to have the document signed in the presence of a notary public.

-

Failure to Record the Deed: After completing the deed, it must be recorded with the appropriate county office. Neglecting this step means the transfer may not be recognized. Always confirm that the deed has been properly recorded.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Can a Transfer on Death Account Be Contested - By using this document, you can ensure your loved ones are well taken care of after your passing.

Ladybird Deed Texas Form - Beneficiaries receive full ownership rights upon the owner's death.

Affidavit for Transfer Without Probate Ohio - A Transfer-on-Death Deed aids in the planning for the future, allowing for clarity on property distribution.

Taking control of your medical care is an important step, and understanding the significance of a Living Will form in Arizona can lead to more informed decisions. By utilizing this legal document, individuals can clearly express their wishes regarding healthcare treatments in situations where they cannot voice their decisions. For comprehensive resources on these essential documents, visit All Arizona Forms to learn more about ensuring your healthcare preferences are honored.

Transfer on Death Instrument - It is advisable to inform beneficiaries about the existence of the deed to avoid confusion in the future.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows individuals to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | In Pennsylvania, the Transfer-on-Death Deed is governed by 20 Pa.C.S. § tit. 20, § 6111.1. |

| Revocability | The deed can be revoked at any time before the death of the owner, allowing flexibility in estate planning. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, providing options for how the property is transferred. |

| Filing Requirements | The deed must be recorded in the county where the property is located to be effective, ensuring public notice of the transfer. |

Similar forms

The Pennsylvania Transfer-on-Death Deed (TODD) is similar to a will in that both documents allow individuals to dictate how their property will be distributed after their death. A will requires probate, which is a court process that validates the document and oversees the distribution of assets. In contrast, a TODD bypasses probate, allowing for a more straightforward transfer of property directly to the designated beneficiary upon the owner's death. This simplicity can save time and reduce costs for heirs, making the TODD an attractive alternative for estate planning.

Understanding the nuances of the various documents related to property transfer is essential for effective estate planning. For instance, the Georgia Lease Agreement form plays a crucial role in outlining the leasing terms and conditions, ensuring both landlords and tenants have clear expectations. For more information on different lease agreements and their uses, you can visit https://onlinelawdocs.com/.