Valid Pennsylvania Quitclaim Deed Template

The Pennsylvania Quitclaim Deed form serves as a crucial legal document in real estate transactions, allowing property owners to transfer their interest in a property to another party without making any guarantees about the title. This form is particularly useful when the transfer occurs between family members or in situations where the seller may not be certain of the property’s title status. Unlike warranty deeds, which provide assurances regarding the ownership and any potential claims against the property, a quitclaim deed simply conveys whatever interest the grantor has at the time of the transfer. It is important to note that this form does not protect the grantee from any existing liens or encumbrances on the property. In Pennsylvania, the quitclaim deed must be properly executed, notarized, and recorded with the county’s recorder of deeds to ensure its validity and to provide public notice of the ownership change. Understanding the implications of using a quitclaim deed is essential for both parties involved, as it affects their rights and responsibilities concerning the property. Whether you are transferring ownership as part of a divorce settlement, estate planning, or simply gifting property, knowing how to correctly utilize this form can help facilitate a smooth transaction.

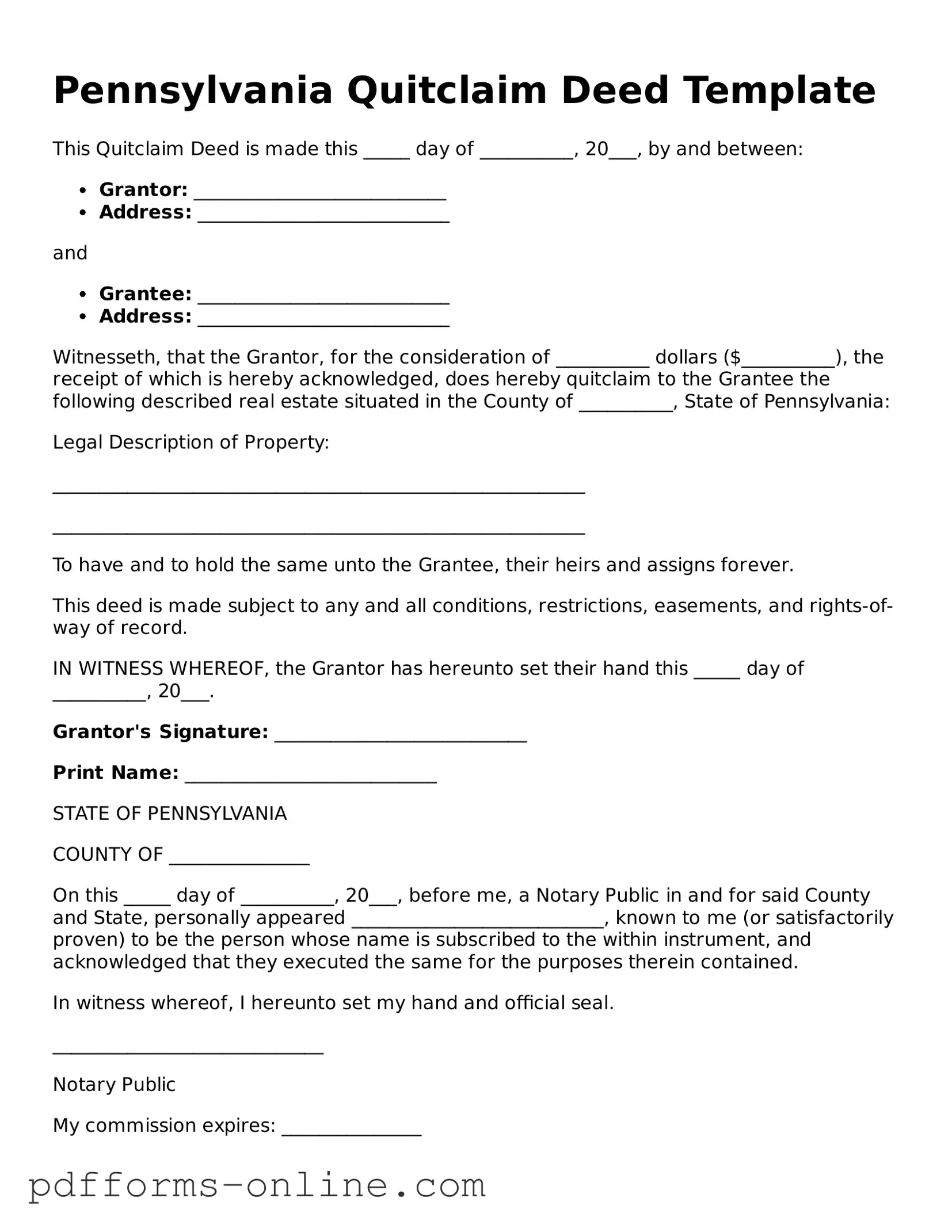

Document Example

Pennsylvania Quitclaim Deed Template

This Quitclaim Deed is made this _____ day of __________, 20___, by and between:

- Grantor: ___________________________

- Address: ___________________________

and

- Grantee: ___________________________

- Address: ___________________________

Witnesseth, that the Grantor, for the consideration of __________ dollars ($__________), the receipt of which is hereby acknowledged, does hereby quitclaim to the Grantee the following described real estate situated in the County of __________, State of Pennsylvania:

Legal Description of Property:

_________________________________________________________

_________________________________________________________

To have and to hold the same unto the Grantee, their heirs and assigns forever.

This deed is made subject to any and all conditions, restrictions, easements, and rights-of-way of record.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this _____ day of __________, 20___.

Grantor's Signature: ___________________________

Print Name: ___________________________

STATE OF PENNSYLVANIA

COUNTY OF _______________

On this _____ day of __________, 20___, before me, a Notary Public in and for said County and State, personally appeared ___________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_____________________________

Notary Public

My commission expires: _______________

Frequently Asked Questions

-

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the title. In Pennsylvania, it is often used among family members or in situations where the grantor does not want to be liable for any title issues that may arise after the transfer. This type of deed conveys whatever interest the grantor has in the property, if any, but does not ensure that the title is clear.

-

When should I use a Quitclaim Deed?

A Quitclaim Deed is commonly used in various situations, including:

- Transferring property between family members, such as from parents to children.

- Clearing up title issues, such as adding or removing a spouse after marriage or divorce.

- Transferring property into a trust.

- Settling disputes over property ownership.

However, it is not advisable for use in transactions involving a sale or purchase, as it does not provide any assurances about the property’s title.

-

How do I complete a Quitclaim Deed in Pennsylvania?

To complete a Quitclaim Deed in Pennsylvania, follow these steps:

- Obtain a Quitclaim Deed form, which can be found online or at local legal supply stores.

- Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Include a legal description of the property being transferred, which can usually be found on the property’s deed or tax records.

- Sign the document in the presence of a notary public to make it legally binding.

Once completed, the deed should be filed with the local county recorder of deeds to ensure the transfer is officially recorded.

-

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are fees involved in filing a Quitclaim Deed in Pennsylvania. These fees can vary by county but typically include a recording fee. It is important to check with the local county recorder’s office for the exact amount. Additionally, if you are transferring property that has a mortgage, there may be other costs associated with the transfer.

-

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is often advisable. An attorney can ensure that the deed is properly drafted and executed, minimizing the risk of future disputes or issues with the title. If you are unsure about the process or the implications of transferring property, consulting with a legal professional can provide valuable guidance.

-

What happens after I file a Quitclaim Deed?

After filing a Quitclaim Deed, the county recorder’s office will officially record the document. This action updates public records to reflect the new ownership of the property. It is essential to keep a copy of the recorded deed for your records. The new owner should also be aware that they may need to update property tax information and insurance policies following the transfer.

Misconceptions

When it comes to the Pennsylvania Quitclaim Deed form, several misconceptions often arise. Understanding these can help individuals navigate property transfers more effectively. Here are ten common misunderstandings:

- It transfers ownership of the property. A quitclaim deed does not guarantee ownership. It simply transfers whatever interest the grantor has in the property, if any.

- It eliminates all liens on the property. A quitclaim deed does not remove any existing liens or encumbrances. Buyers should conduct thorough title searches before proceeding.

- It's only for family members. While often used among family, quitclaim deeds can be used by anyone transferring property, regardless of their relationship.

- It's the same as a warranty deed. Unlike a warranty deed, a quitclaim deed offers no warranties or guarantees about the property’s title.

- It requires a notary public to be valid. While notarization is common and recommended, it is not strictly required for a quitclaim deed to be legally binding in Pennsylvania.

- It can be used to transfer property with a mortgage. A quitclaim deed can transfer property with a mortgage, but the mortgage remains the responsibility of the original borrower.

- It’s a complex legal document. The quitclaim deed form is relatively straightforward and can often be completed without legal assistance, though guidance is always helpful.

- It’s only for real estate. Quitclaim deeds are primarily used for real estate, but they can also be used for other types of property interests.

- It’s only valid if filed with the county. While filing with the county provides public notice, the deed is valid upon execution, even if not filed immediately.

- All quitclaim deeds are the same. Different states may have varying requirements and formats for quitclaim deeds, so it’s important to use the correct form for Pennsylvania.

By addressing these misconceptions, individuals can approach property transactions with greater confidence and clarity.

Common mistakes

-

Failing to include the correct names of the grantor and grantee. It’s essential that the names match exactly as they appear on legal documents.

-

Not providing a complete and accurate property description. A vague or incomplete description can lead to disputes later on.

-

Forgetting to sign the document. The grantor's signature is a crucial element for the deed to be valid.

-

Neglecting to have the deed notarized. A notary’s acknowledgment is often required to ensure the deed is legally binding.

-

Omitting the date of execution. Including the date helps establish when the transfer took place, which can be important for legal purposes.

-

Using the wrong form. Pennsylvania has specific requirements for quitclaim deeds, and using an incorrect version can invalidate the transfer.

-

Not checking for existing liens or encumbrances on the property. It’s wise to ensure there are no outstanding debts attached to the property before proceeding.

-

Failing to provide a proper consideration amount. Even if the transfer is a gift, stating a nominal amount can clarify the intent of the transaction.

-

Ignoring local recording requirements. Each county may have specific rules for how and where to file the deed.

-

Not keeping copies of the completed deed. Retaining a copy is important for personal records and may be needed for future reference.

Find Some Other Quitclaim Deed Forms for Specific States

Quit Claim Deed Florida - It's advisable to consult with an attorney before using a Quitclaim Deed.

To facilitate a smoother rental process, understanding the importance of a comprehensive Rental Application form is crucial for both landlords and tenants. This form serves to collect vital information regarding a candidate's rental history and financial stability, ensuring that landlords are well-informed before making leasing decisions. For more detailed guidance on how to complete the document, refer to our complete Rental Application process overview.

Quit Claim Deed Sample - This form can be crucial in resolving disputes over estate inheritances.

Quit Claim Deed Form Michigan Pdf - The form can be particularly useful in clearing up title issues, as it helps clarify ownership rights.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties. |

| Governing Law | The Pennsylvania Quitclaim Deed is governed by Title 21, Chapter 35 of the Pennsylvania Consolidated Statutes. |

| Purpose | This form is typically used to transfer property between family members or to clear up title issues. |

| No Guarantees | The grantor makes no guarantees about the property’s title, meaning the grantee accepts it "as is." |

| Signature Requirement | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To be effective against third parties, the quitclaim deed must be recorded in the county where the property is located. |

| Consideration | While a nominal consideration is often stated, it is not required for the deed to be valid. |

| Property Description | A clear legal description of the property must be included in the deed to avoid confusion. |

| Tax Implications | Transfer taxes may apply, depending on the county and specific circumstances of the transfer. |

| Limitations | A quitclaim deed does not protect the grantee from any liens or claims against the property. |

Similar forms

A Warranty Deed is a document that transfers ownership of property while providing a guarantee that the title is clear. Unlike a Quitclaim Deed, which offers no warranties about the title, a Warranty Deed assures the buyer that the seller has the legal right to transfer the property and that there are no undisclosed encumbrances. This added layer of protection makes Warranty Deeds a preferred choice for most real estate transactions, especially when buyers seek assurance regarding the property's legal standing.

A Special Warranty Deed is similar to a Warranty Deed but with a key distinction. It guarantees that the seller has not caused any title issues during their ownership of the property. However, it does not cover any problems that may have existed before the seller acquired the property. This type of deed is often used in commercial transactions, providing some level of assurance to buyers without the full protection of a Warranty Deed.

Understanding the various types of deeds is essential for anyone involved in real estate transactions, especially in Arizona. From Warranty Deeds to Quitclaim Deeds, each document serves a unique purpose in the transfer of property ownership. For comprehensive guidance, you may want to refer to All Arizona Forms, which can provide valuable resources and templates to ensure that all legal requirements are met.

A Bargain and Sale Deed transfers property without any warranties against encumbrances. It implies that the seller has the right to sell the property but does not guarantee a clear title. This type of deed is often used in foreclosure sales or tax sales, where the seller may not have full knowledge of the property's title history, similar to a Quitclaim Deed in its lack of guarantees.

A Deed of Trust is a document used in real estate transactions that involves three parties: the borrower, the lender, and a trustee. It secures a loan by transferring the property title to the trustee until the borrower repays the loan. While it serves a different purpose than a Quitclaim Deed, both documents involve the transfer of property rights, albeit in different contexts and with different implications for ownership and liability.

An Easement Deed grants a right to use a portion of another person's property for a specific purpose, such as access or utilities. While it does not transfer ownership, it conveys a legal right similar to how a Quitclaim Deed transfers ownership rights. Both documents can be used to clarify property rights and responsibilities between parties.

A Lease Agreement is a contract that allows one party to use another party's property for a specified time in exchange for payment. While it does not transfer ownership like a Quitclaim Deed, it creates a legal relationship regarding property use. Both documents establish rights, but a Lease Agreement focuses on temporary possession rather than permanent ownership.

A Life Estate Deed allows a person to retain ownership of a property for their lifetime, after which the property passes to another party. This document is similar to a Quitclaim Deed in that it transfers property rights but does so with specific conditions attached. The life tenant has the right to use the property during their lifetime, while the remainderman receives the property after the life tenant's death.

A Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding probate. While it does not transfer ownership during the owner's lifetime, it is similar to a Quitclaim Deed in that it facilitates the transfer of property rights without the need for a formal sale. Both documents simplify the process of transferring property to heirs or designated parties.