Valid Pennsylvania Promissory Note Template

In Pennsylvania, a promissory note serves as a vital financial instrument that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This straightforward document typically includes essential details such as the principal amount, interest rate, repayment schedule, and any applicable late fees or penalties. Importantly, the note may also specify whether the loan is secured or unsecured, impacting the lender's rights in case of default. Both parties must understand their obligations, as the promissory note acts as a legally binding contract that can be enforced in court. Clarity is paramount; therefore, the language used should be precise to avoid misunderstandings. Additionally, the form often requires signatures from both the borrower and lender, signifying their mutual agreement to the terms laid out. Understanding these components is crucial for anyone involved in lending or borrowing money in Pennsylvania, as it helps ensure that both parties are protected and aware of their rights and responsibilities.

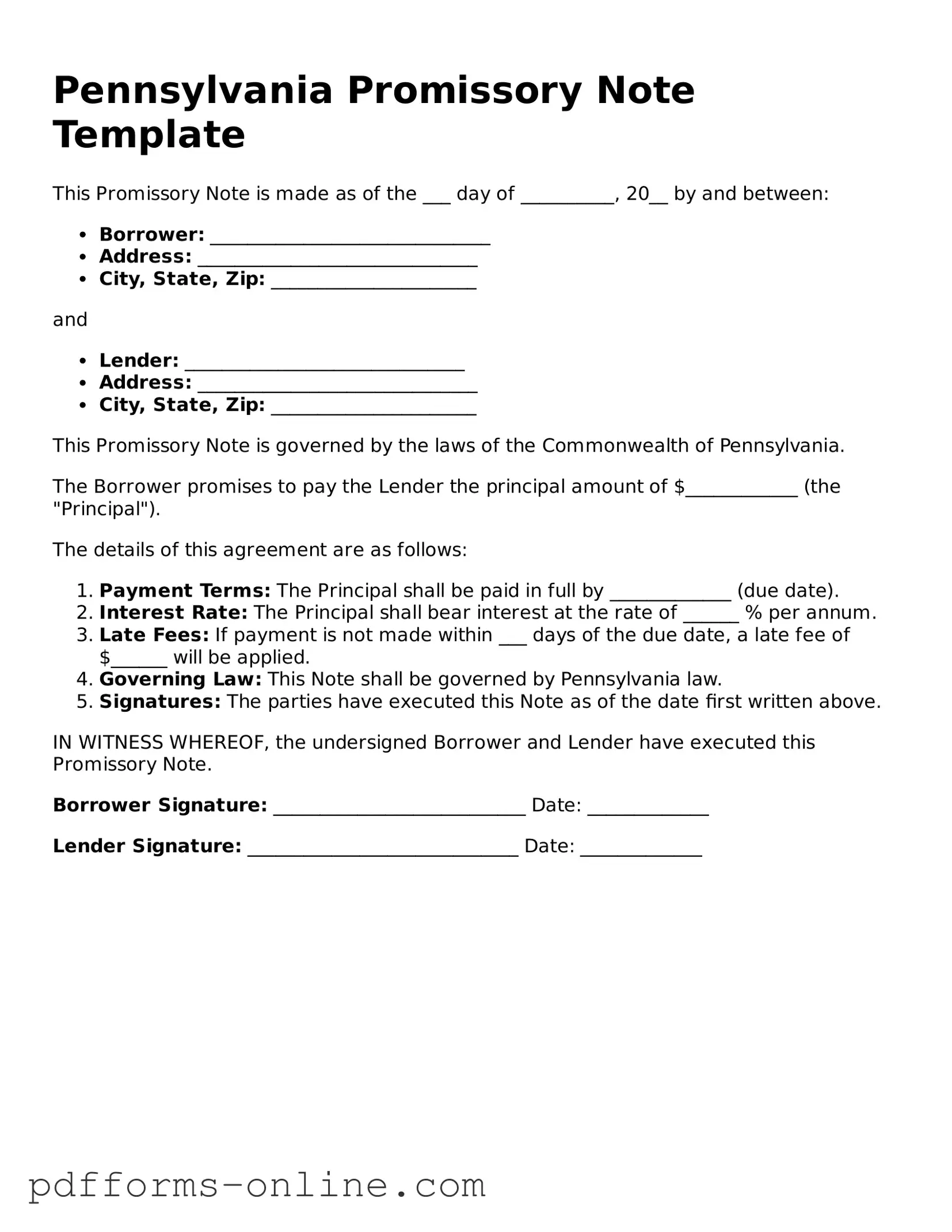

Document Example

Pennsylvania Promissory Note Template

This Promissory Note is made as of the ___ day of __________, 20__ by and between:

- Borrower: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________

and

- Lender: ______________________________

- Address: ______________________________

- City, State, Zip: ______________________

This Promissory Note is governed by the laws of the Commonwealth of Pennsylvania.

The Borrower promises to pay the Lender the principal amount of $____________ (the "Principal").

The details of this agreement are as follows:

- Payment Terms: The Principal shall be paid in full by _____________ (due date).

- Interest Rate: The Principal shall bear interest at the rate of ______ % per annum.

- Late Fees: If payment is not made within ___ days of the due date, a late fee of $______ will be applied.

- Governing Law: This Note shall be governed by Pennsylvania law.

- Signatures: The parties have executed this Note as of the date first written above.

IN WITNESS WHEREOF, the undersigned Borrower and Lender have executed this Promissory Note.

Borrower Signature: ___________________________ Date: _____________

Lender Signature: _____________________________ Date: _____________

Frequently Asked Questions

-

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. This document outlines the terms of the loan, including the interest rate, payment schedule, and consequences for failure to pay. It serves as a legal record of the agreement between the borrower and the lender.

-

Who can use a Promissory Note in Pennsylvania?

Anyone can use a Promissory Note in Pennsylvania, including individuals, businesses, and organizations. It is commonly used for personal loans, business loans, or any situation where one party lends money to another. Both the lender and borrower should clearly understand the terms to avoid disputes later.

-

What information should be included in a Promissory Note?

A complete Promissory Note should include the following key details:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

Including these details helps ensure that both parties are on the same page regarding the loan terms.

-

Is a Promissory Note legally binding in Pennsylvania?

Yes, a Promissory Note is legally binding in Pennsylvania as long as it meets certain requirements. Both parties must agree to the terms, and the document should be signed by both the borrower and the lender. Having a witness or notarization can strengthen the document's enforceability, but it is not always necessary. If the terms are clear and both parties understand their obligations, the note can be enforced in court if needed.

Misconceptions

Understanding the Pennsylvania Promissory Note form is essential for anyone looking to lend or borrow money. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about this important document:

- It must be notarized. Many believe that a promissory note must be notarized to be valid. In Pennsylvania, notarization is not required, although it can add an extra layer of credibility.

- Only banks can issue promissory notes. This is false. Individuals can create and sign promissory notes just as easily as financial institutions can.

- Promissory notes are only for large loans. People often think these documents are only necessary for significant amounts of money. In reality, they can be used for any loan amount, big or small.

- Verbal agreements are just as good. Some assume that a verbal agreement suffices. However, having a written promissory note provides clear evidence of the terms agreed upon.

- They are only for personal loans. Many think promissory notes are limited to personal transactions. They can also be used in business dealings, making them versatile tools.

- All promissory notes are the same. This is a misconception. Promissory notes can vary significantly in terms, conditions, and legal requirements, depending on the situation.

- They are difficult to enforce. Some believe that enforcing a promissory note is complicated. In fact, if properly drafted, they can be straightforward to enforce in court.

- Interest rates are fixed by law. Many think that interest rates on promissory notes must adhere to strict legal limits. While there are usury laws, parties can generally agree on their own rates.

- Once signed, they cannot be modified. It’s a common belief that a promissory note is set in stone after signing. However, parties can agree to modify the terms, but it's best to document any changes in writing.

Being aware of these misconceptions can help ensure that you use the Pennsylvania Promissory Note form correctly and effectively.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to delays or disputes. Ensure that all sections are completed, including names, addresses, and loan amounts.

-

Incorrect Dates: Writing the wrong date can cause confusion about the loan's terms. Double-check that the date of signing and any payment due dates are accurate.

-

Missing Signatures: Both the borrower and lender must sign the note. Omitting a signature can render the document invalid.

-

Ambiguous Terms: Vague language regarding payment terms, interest rates, or penalties can lead to misunderstandings. Clearly define all terms to avoid future issues.

-

Improper Witnessing: Some notes may require a witness or notarization. Failing to follow these requirements can affect the enforceability of the note.

-

Ignoring State Laws: Each state has specific laws governing promissory notes. Not adhering to Pennsylvania's regulations can invalidate the agreement.

-

Not Keeping Copies: Failing to retain copies of the signed note can lead to disputes later. Both parties should keep a copy for their records.

-

Assuming Standard Terms Apply: Using a generic template without adjusting it to fit the specific agreement can lead to misinterpretations. Customize the note to reflect the unique circumstances of the loan.

Find Some Other Promissory Note Forms for Specific States

Texas Promissory Note - Interest rates should comply with state usury laws to avoid legal issues.

For anyone entering into a rental arrangement, having a clear and thorough understanding of the Ohio Residential Lease Agreement is crucial. This legal document not only protects the interests of both landlords and tenants but also sets forth the expectations for the tenancy. To assist in navigating these agreements, you can access the form here: https://documentonline.org/blank-ohio-residential-lease-agreement, which provides a comprehensive framework for a successful rental experience.

Promissory Note Template Illinois - Clear terms within the promissory note help protect both parties' interests.

Promissory Note for Personal Loan - This financial agreement is straightforward in design, focusing on clarity and enforceability.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC), specifically Article 3, governs promissory notes in Pennsylvania. |

| Essential Elements | To be valid, a promissory note must include the amount owed, the interest rate (if any), the payment date, and the signatures of the parties involved. |

| Types of Promissory Notes | In Pennsylvania, promissory notes can be secured or unsecured. A secured note is backed by collateral, while an unsecured note is not. |

| Enforceability | Promissory notes are generally enforceable in court, provided they meet all legal requirements and are executed properly. |

| Default Consequences | If a borrower defaults on a promissory note, the lender may pursue legal action to recover the owed amount, including potential collection costs. |

Similar forms

A loan agreement is similar to a promissory note in that it outlines the terms of a loan between a borrower and a lender. Both documents specify the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional clauses regarding collateral, default, and other legal obligations, making it a more comprehensive document.

A personal guarantee is another document that shares similarities with a promissory note. It is a promise made by an individual to take responsibility for another person's debt if that person defaults. Like a promissory note, it creates a legal obligation to pay, but it focuses on the guarantor's liability rather than the borrower's terms.

A mortgage agreement is closely related to a promissory note, especially when real estate is involved. The mortgage secures the loan with the property as collateral. While the promissory note outlines the repayment terms, the mortgage agreement details the rights of the lender to take possession of the property if the borrower fails to repay the loan.

A secured loan agreement also resembles a promissory note. In this case, the borrower provides collateral to secure the loan, reducing the lender's risk. Both documents specify the loan amount and repayment terms, but the secured loan agreement includes details about the collateral and the lender's rights in case of default.

A lease agreement may seem different but shares the core concept of payment obligations. It outlines the terms under which one party rents property from another. While a promissory note focuses on a loan, a lease agreement specifies monthly payments for the use of property, including duration and conditions for termination.

An installment agreement is similar to a promissory note in that it allows for payments to be made over time. This document details the total amount owed, the payment schedule, and any interest charges. Both documents create a structured plan for repayment, ensuring that both parties understand their obligations.

A debt settlement agreement also shares common ground with a promissory note. This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. While a promissory note is a promise to pay the full amount, a debt settlement agreement may involve negotiation for a lower payment, but both documents aim to resolve financial obligations.

A credit agreement is another document that aligns with a promissory note. It establishes the terms under which a lender extends credit to a borrower. This agreement details the credit limit, interest rates, and repayment terms, similar to a promissory note, but it may also include provisions for fees and penalties.

A forbearance agreement is relevant when a borrower is unable to make payments temporarily. This document outlines the terms under which the lender agrees to delay or reduce payments. While a promissory note establishes the original repayment plan, a forbearance agreement modifies it to accommodate the borrower’s financial situation.

When dealing with property transactions in Arizona, it is important to understand the various legal documents involved. One such document is crucial in ensuring the proper transfer of real estate ownership, thereby protecting the rights of both parties. For those actively looking to complete real estate transactions, it is advisable to check out the various forms available, including All Arizona Forms, to ensure compliance with state regulations and a smooth process.

Finally, a business loan agreement is akin to a promissory note when a business borrows funds. This document specifies the loan amount, interest rate, and repayment terms, similar to a personal promissory note. However, it often includes additional clauses that address the unique needs and risks associated with business financing.