Valid Pennsylvania Prenuptial Agreement Template

When couples in Pennsylvania consider tying the knot, discussions about finances and assets often emerge, leading many to explore the benefits of a prenuptial agreement. This legal document serves as a roadmap for managing property and financial responsibilities during marriage and in the event of a divorce. The Pennsylvania Prenuptial Agreement form is designed to outline the rights and obligations of each partner, helping to clarify issues such as asset division, debt responsibility, and spousal support. By addressing these matters upfront, couples can foster open communication and reduce potential conflicts down the line. This agreement can also include provisions for future financial decisions, ensuring that both parties feel secure and respected. While it may seem daunting to draft such a document, understanding its components can empower couples to create a tailored agreement that reflects their unique relationship and financial situation.

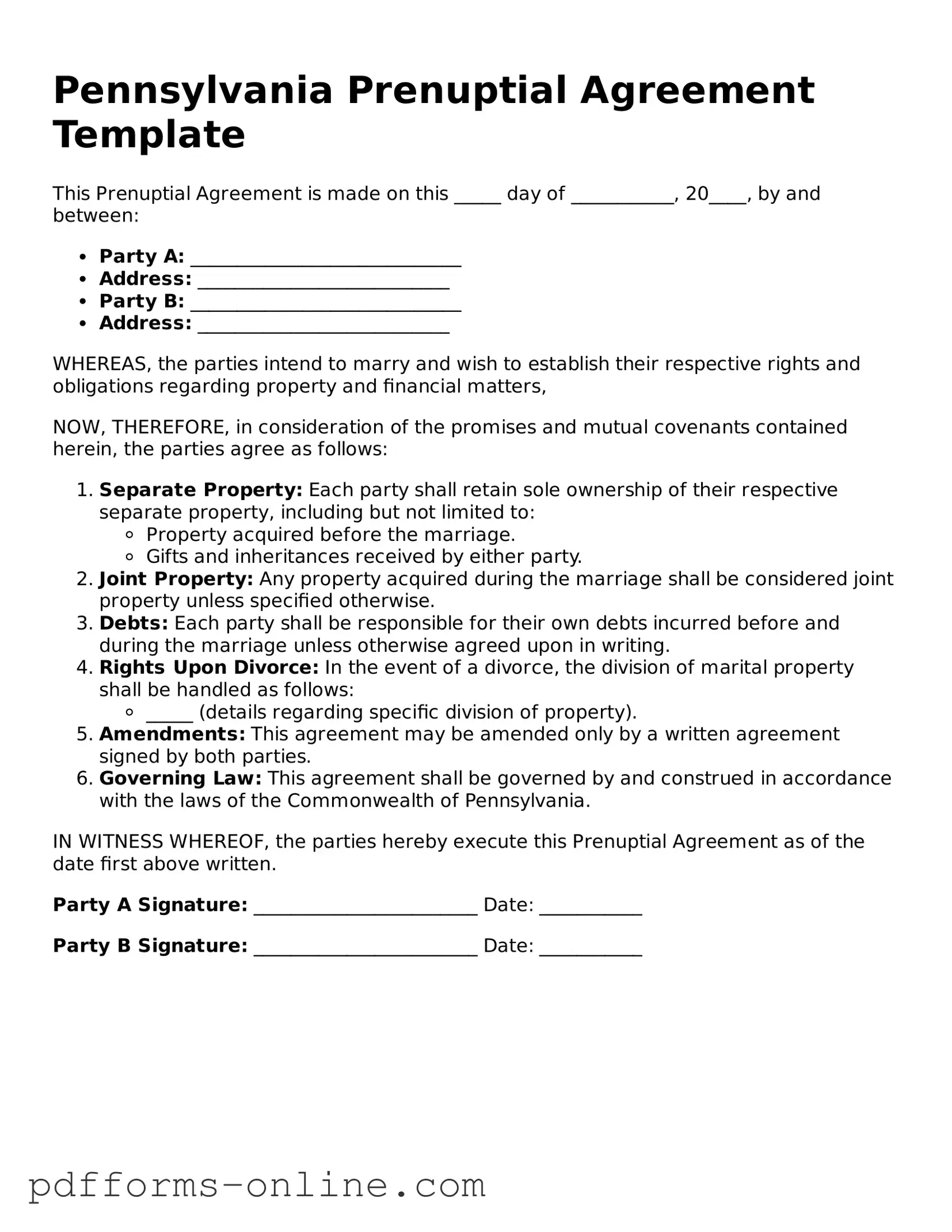

Document Example

Pennsylvania Prenuptial Agreement Template

This Prenuptial Agreement is made on this _____ day of ___________, 20____, by and between:

- Party A: _____________________________

- Address: ___________________________

- Party B: _____________________________

- Address: ___________________________

WHEREAS, the parties intend to marry and wish to establish their respective rights and obligations regarding property and financial matters,

NOW, THEREFORE, in consideration of the promises and mutual covenants contained herein, the parties agree as follows:

- Separate Property: Each party shall retain sole ownership of their respective separate property, including but not limited to:

- Property acquired before the marriage.

- Gifts and inheritances received by either party.

- Joint Property: Any property acquired during the marriage shall be considered joint property unless specified otherwise.

- Debts: Each party shall be responsible for their own debts incurred before and during the marriage unless otherwise agreed upon in writing.

- Rights Upon Divorce: In the event of a divorce, the division of marital property shall be handled as follows:

- _____ (details regarding specific division of property).

- Amendments: This agreement may be amended only by a written agreement signed by both parties.

- Governing Law: This agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

IN WITNESS WHEREOF, the parties hereby execute this Prenuptial Agreement as of the date first above written.

Party A Signature: ________________________ Date: ___________

Party B Signature: ________________________ Date: ___________

Frequently Asked Questions

-

What is a prenuptial agreement?

A prenuptial agreement, often called a prenup, is a legal document created by two individuals before they get married. It outlines how assets and debts will be divided in the event of divorce or separation. This agreement can also address other matters such as spousal support and property rights.

-

Why should I consider a prenuptial agreement?

Many couples choose to create a prenup to protect their individual assets, clarify financial responsibilities, and reduce potential conflicts in the future. It can be particularly important if one or both parties have significant assets, children from previous relationships, or if there are expectations about inheritance.

-

What can be included in a Pennsylvania prenuptial agreement?

In Pennsylvania, a prenuptial agreement can cover a wide range of topics, including:

- Division of property and assets

- Debt responsibilities

- Spousal support or alimony

- Management of finances during the marriage

- Inheritance rights

However, it cannot include provisions related to child custody or child support, as these issues are determined based on the best interests of the child at the time of divorce.

-

How do I create a prenuptial agreement in Pennsylvania?

To create a valid prenuptial agreement in Pennsylvania, both parties should:

- Discuss their financial situations openly.

- Draft the agreement in writing.

- Sign the agreement voluntarily, without coercion.

- Consider having the agreement notarized.

- Consult with separate legal counsel to ensure fairness and understanding.

Taking these steps helps ensure that the agreement is legally binding and enforceable.

-

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified or revoked after marriage. Both parties must agree to the changes, and it is advisable to document any modifications in writing. Just like the original agreement, any changes should be signed by both parties and ideally reviewed by legal counsel.

-

What happens if we don’t have a prenuptial agreement?

If a couple does not have a prenuptial agreement and later decides to divorce, the division of assets and debts will be determined by Pennsylvania law. This can lead to disputes and uncertainty, as the court will make decisions based on what it deems fair, which may not align with either party’s expectations.

-

Is a prenuptial agreement enforceable in Pennsylvania?

Yes, prenuptial agreements are generally enforceable in Pennsylvania, provided they meet certain legal requirements. The agreement must be in writing, signed by both parties, and entered into voluntarily. If either party can prove that the agreement was signed under duress or was fundamentally unfair, it may be challenged in court.

-

How can I ensure my prenuptial agreement is fair?

To ensure fairness in a prenuptial agreement, both parties should:

- Disclose all assets and debts fully.

- Seek independent legal advice.

- Negotiate terms openly and honestly.

- Consider the future needs of both parties.

This collaborative approach can help create an agreement that respects both individuals’ interests.

Misconceptions

When considering a prenuptial agreement in Pennsylvania, many people harbor misconceptions that can lead to confusion or misinformed decisions. Below are eight common misunderstandings about the Pennsylvania Prenuptial Agreement form.

- Prenuptial agreements are only for the wealthy. Many believe that only those with substantial assets need a prenup. In reality, anyone can benefit from a prenup, regardless of financial status. It can help clarify financial responsibilities and expectations.

- Prenups are unromantic. Some view prenuptial agreements as a sign of distrust. However, discussing and planning for the future can actually strengthen a relationship. It encourages open communication about finances.

- Prenuptial agreements are not enforceable in Pennsylvania. This is a common myth. In fact, if properly drafted and executed, prenuptial agreements are enforceable in Pennsylvania courts, provided they meet legal requirements.

- A prenup can cover child custody and support. Many people think they can include child-related issues in a prenup. However, courts typically do not enforce these provisions, as they prioritize the best interests of the child at the time of divorce.

- Prenups are only useful for divorce situations. While they are often associated with divorce, prenuptial agreements can also serve as a planning tool during marriage. They can help manage financial expectations and protect assets.

- Once signed, a prenup cannot be changed. Some believe that a prenuptial agreement is permanent and cannot be modified. In fact, couples can renegotiate and amend their prenup if both parties agree to the changes.

- Prenups are only necessary for second marriages. Many think that only those entering a second marriage need a prenup. However, first-time marriages can also benefit from the clarity and protection a prenup provides.

- All prenups are the same. This misconception leads to the belief that a one-size-fits-all approach is sufficient. In reality, each prenuptial agreement should be tailored to the specific circumstances and needs of the couple involved.

Understanding these misconceptions can help couples navigate the prenuptial agreement process more effectively and ensure that their financial futures are well-protected.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This includes not listing all assets, debts, and income sources. Omitting important information can lead to disputes later.

-

Not Seeking Legal Advice: Some people fill out the form without consulting a lawyer. Legal guidance is crucial to ensure that the agreement complies with Pennsylvania law and protects both parties' interests.

-

Failing to Update the Agreement: Life changes, such as acquiring new assets or having children, require updates to the prenup. Neglecting to revise the agreement can render it outdated and ineffective.

-

Signing Under Duress: Signing the agreement without adequate time for consideration or under pressure can invalidate it. Both parties should feel comfortable and have the opportunity to review the terms thoroughly.

Find Some Other Prenuptial Agreement Forms for Specific States

New York Prenup Contract - Helps couples plan for retirement and future investments together.

If you're looking to ensure your healthcare decisions are respected, using a Medical Power of Attorney can be crucial. For those needing resources, check out this guide on the necessary medical power of attorney documentation to facilitate your planning effectively. You can find more information at this relevant resource.

California Prenup Contract - A prenuptial agreement can strengthen relationships through clear agreements.

Michigan Prenup Contract - A prenuptial agreement may include provisions for how an estate plan will be affected by marriage or divorce.

Florida Prenup Contract - The document can define responsibilities related to children’s expenses.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement in Pennsylvania is a contract made by two individuals before marriage, outlining the division of assets and financial responsibilities in the event of divorce or separation. |

| Governing Law | Pennsylvania's Uniform Premarital Agreement Act governs prenuptial agreements, providing a legal framework for their enforcement and interpretation. |

| Requirements | For a prenuptial agreement to be enforceable in Pennsylvania, it must be in writing and signed by both parties before the marriage. |

| Full Disclosure | Both parties are required to fully disclose their assets and liabilities. Failure to do so may render the agreement unenforceable. |

| Voluntary Agreement | The agreement must be entered into voluntarily, without coercion or undue influence from either party. |

| Modification and Revocation | Parties can modify or revoke the agreement after marriage, but any changes must also be in writing and signed by both parties. |

Similar forms

A Pennsylvania Prenuptial Agreement is akin to a Cohabitation Agreement. Both documents are designed to outline the rights and responsibilities of individuals living together, whether married or not. A Cohabitation Agreement can cover property ownership, financial responsibilities, and even the division of assets should the relationship end. Like a prenuptial agreement, it seeks to clarify expectations and protect both parties, making it a useful tool for couples who choose to live together without the formalities of marriage.

Another similar document is the Postnuptial Agreement. While a Prenuptial Agreement is created before marriage, a Postnuptial Agreement is drafted after the wedding. Both agreements serve to define how assets will be divided in the event of a divorce. They can address similar issues, such as debt management and property rights, providing couples with peace of mind and a clear understanding of their financial arrangements, regardless of when they are signed.

The Marital Settlement Agreement also shares similarities with a Prenuptial Agreement. This document is typically used during divorce proceedings to outline how assets, debts, and custody arrangements will be handled. Like a prenuptial agreement, it aims to minimize conflict by setting clear terms. Both agreements focus on protecting individual interests and can help streamline the divorce process by providing a clear framework for asset division.

A Separation Agreement is another document that resembles a Prenuptial Agreement. It is often used when a couple decides to live apart, whether temporarily or permanently. This agreement can detail the division of property, financial responsibilities, and child custody arrangements. Similar to a prenuptial agreement, it helps to clarify expectations and responsibilities, reducing potential disputes during the separation period.

The Financial Power of Attorney is a legal document that can be compared to a Prenuptial Agreement in terms of financial planning. While a prenuptial agreement focuses on asset division in the event of divorce, a Financial Power of Attorney designates someone to make financial decisions on your behalf if you become incapacitated. Both documents emphasize the importance of financial clarity and protection, ensuring that your wishes are respected, whether in marriage or in times of need.

The Texas Operating Agreement form is essential for businesses, especially limited liability companies (LLCs), as it delineates the operational structure and the rights of the members involved. To avoid any ambiguities, it’s crucial for Texas-based LLCs to have this document in place, and for further details on how to obtain it, you can visit OnlineLawDocs.com, which provides valuable resources for drafting and understanding the importance of the Operating Agreement.

Lastly, the Will has parallels with a Prenuptial Agreement, particularly regarding asset distribution. A Will outlines how a person's assets will be distributed after their death, while a prenuptial agreement specifies how assets will be divided in the event of divorce. Both documents aim to provide clarity and prevent disputes among heirs or former spouses. They serve as essential tools for individuals to ensure their wishes are honored, whether in life or after passing.