Valid Pennsylvania Power of Attorney Template

In Pennsylvania, the Power of Attorney (POA) form serves as a vital legal tool that allows individuals to appoint someone they trust to manage their financial and legal affairs. This document can be particularly important for those who may become incapacitated or wish to delegate responsibilities for any reason. The form outlines specific powers granted to the agent, which can range from handling banking transactions to making healthcare decisions, depending on the type of POA established. Pennsylvania recognizes both general and limited powers of attorney, providing flexibility to tailor the authority to the principal's needs. Additionally, the form requires proper execution, including signatures and notarization, to ensure its validity. Understanding the nuances of this form can empower individuals to make informed decisions about their personal and financial well-being.

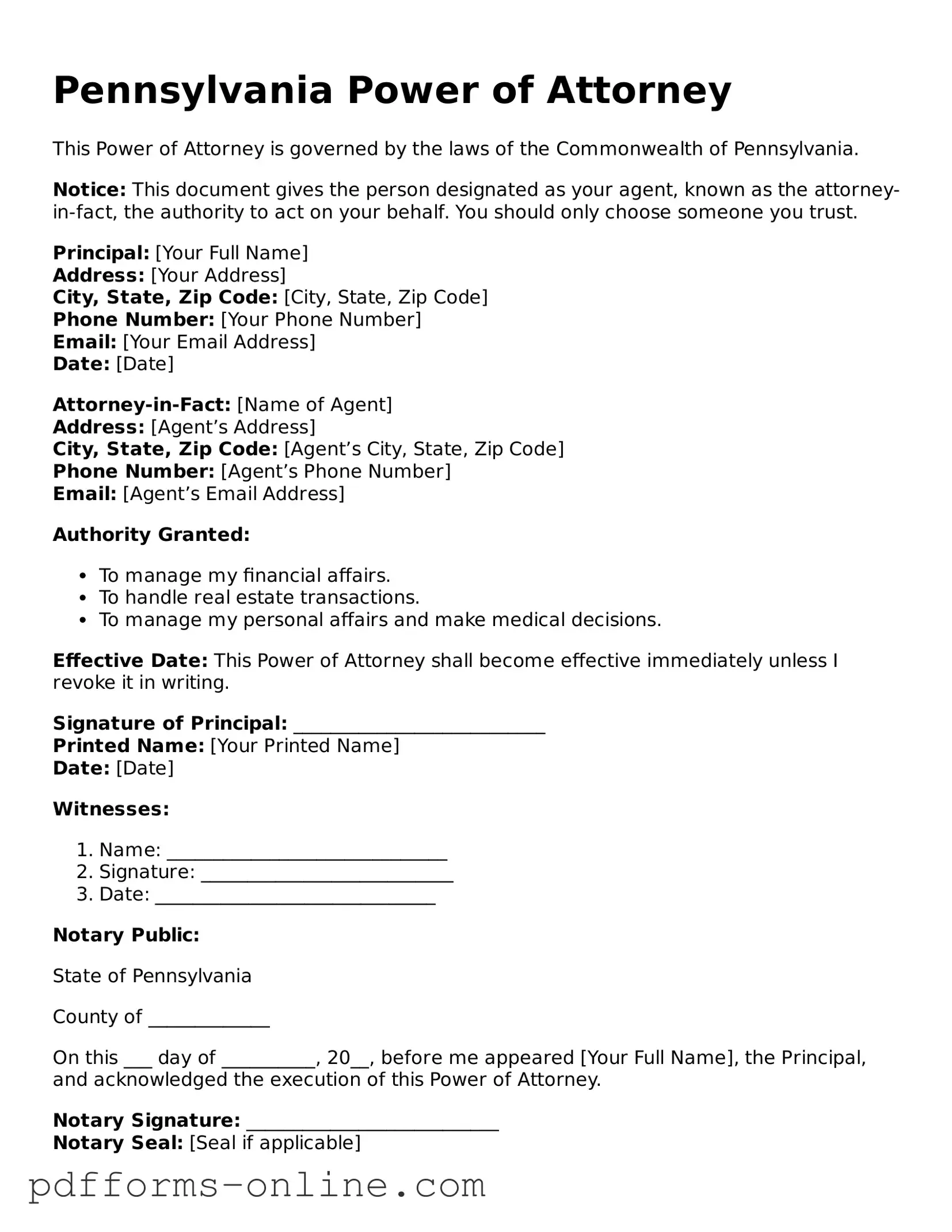

Document Example

Pennsylvania Power of Attorney

This Power of Attorney is governed by the laws of the Commonwealth of Pennsylvania.

Notice: This document gives the person designated as your agent, known as the attorney-in-fact, the authority to act on your behalf. You should only choose someone you trust.

Principal: [Your Full Name]

Address: [Your Address]

City, State, Zip Code: [City, State, Zip Code]

Phone Number: [Your Phone Number]

Email: [Your Email Address]

Date: [Date]

Attorney-in-Fact: [Name of Agent]

Address: [Agent’s Address]

City, State, Zip Code: [Agent’s City, State, Zip Code]

Phone Number: [Agent’s Phone Number]

Email: [Agent’s Email Address]

Authority Granted:

- To manage my financial affairs.

- To handle real estate transactions.

- To manage my personal affairs and make medical decisions.

Effective Date: This Power of Attorney shall become effective immediately unless I revoke it in writing.

Signature of Principal: ___________________________

Printed Name: [Your Printed Name]

Date: [Date]

Witnesses:

- Name: ______________________________

- Signature: ___________________________

- Date: ______________________________

Notary Public:

State of Pennsylvania

County of _____________

On this ___ day of __________, 20__, before me appeared [Your Full Name], the Principal, and acknowledged the execution of this Power of Attorney.

Notary Signature: ___________________________

Notary Seal: [Seal if applicable]

Frequently Asked Questions

-

What is a Power of Attorney (POA) in Pennsylvania?

A Power of Attorney is a legal document that allows one person (the principal) to appoint another person (the agent or attorney-in-fact) to make decisions on their behalf. In Pennsylvania, this can cover a wide range of decisions, including financial matters, medical decisions, and property management.

-

Why should I consider creating a Power of Attorney?

Creating a Power of Attorney can provide peace of mind. If you become unable to make decisions for yourself due to illness or injury, your designated agent can step in and manage your affairs. This can help ensure that your wishes are respected and that your financial and medical needs are met.

-

What types of Powers of Attorney are available in Pennsylvania?

In Pennsylvania, there are generally two main types of Power of Attorney:

- Durable Power of Attorney: This remains effective even if the principal becomes incapacitated.

- Springing Power of Attorney: This only becomes effective under specific conditions, such as the principal's incapacity.

-

How do I create a Power of Attorney in Pennsylvania?

To create a Power of Attorney, you must complete a form that meets Pennsylvania's legal requirements. This form should clearly state your intentions, identify the agent, and be signed by you. Additionally, it must be notarized to be legally binding. Consulting with a legal professional can help ensure that the document is properly executed.

-

Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any relevant institutions or individuals who may have relied on the original document.

-

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, a court may need to appoint a guardian to manage your affairs. This process can be lengthy, costly, and may not align with your personal wishes.

-

Can I specify what powers my agent has?

Absolutely! When creating your Power of Attorney, you can specify the powers you wish to grant your agent. This can include financial transactions, real estate management, or healthcare decisions. Be clear about your preferences to avoid any confusion later.

-

Is there a specific age requirement to be an agent?

In Pennsylvania, an agent must be at least 18 years old and mentally competent. This ensures that the person you designate can legally make decisions on your behalf.

-

Do I need a lawyer to create a Power of Attorney?

While it is not legally required to have a lawyer, consulting one can provide valuable guidance. A legal professional can help you understand your options, ensure that the document meets legal standards, and tailor it to your specific needs.

Misconceptions

Understanding the Pennsylvania Power of Attorney form is important for making informed decisions. However, several misconceptions exist that can lead to confusion. Here are eight common misconceptions:

-

It only applies to financial matters.

Many people think a Power of Attorney is only for handling financial decisions. In reality, it can also cover medical and legal decisions, depending on how it is set up.

-

It is permanent and cannot be revoked.

This is not true. A Power of Attorney can be revoked at any time, as long as the person who created it is still competent.

-

Anyone can be a Power of Attorney agent.

While most adults can serve in this role, it is important to choose someone trustworthy and responsible. Certain individuals, such as those with felony convictions, may be disqualified.

-

It must be notarized to be valid.

While notarization is highly recommended, it is not always required. The form can still be valid if it meets other legal criteria.

-

It takes effect immediately.

Some Powers of Attorney are "springing," meaning they only take effect under certain conditions, such as the principal becoming incapacitated.

-

It can be used after death.

A Power of Attorney ceases to be effective upon the death of the person who created it. After death, other legal documents, like a will, come into play.

-

It is only for older adults.

People of all ages can benefit from having a Power of Attorney. Unexpected events can happen at any time, making it wise for anyone to consider.

-

It is the same as a living will.

A Power of Attorney and a living will serve different purposes. A living will outlines wishes for medical treatment, while a Power of Attorney grants someone authority to make decisions on your behalf.

Addressing these misconceptions can help individuals make better choices regarding their legal and medical decisions. It is always advisable to seek guidance from a qualified professional when creating or managing a Power of Attorney.

Common mistakes

-

Neglecting to Specify Powers: One common mistake is failing to clearly outline the specific powers granted to the agent. Without detailed instructions, the agent may not have the authority needed to act on behalf of the principal, leading to confusion and potential legal issues.

-

Not Choosing the Right Agent: Selecting an agent who is not trustworthy or lacks the necessary skills can have serious consequences. It's crucial to choose someone who understands your wishes and can handle your affairs responsibly.

-

Forgetting to Sign and Date: A Power of Attorney form is not valid unless it is properly signed and dated. Many individuals overlook this critical step, rendering the document ineffective and leaving their affairs unprotected.

-

Ignoring Witness and Notary Requirements: Pennsylvania law requires that the Power of Attorney be signed in the presence of a notary public. Failing to meet this requirement can invalidate the document, leaving the principal without the necessary legal support.

Find Some Other Power of Attorney Forms for Specific States

Power of Attorney Form Texas - This document can help manage your real estate and financial matters easily.

When dealing with real estate transactions in Arizona, understanding the implications of a Deed form is crucial, as it facilitates the legal transfer of property ownership and protects the rights of the new owner. For those looking to complete a property transfer, click the button below to fill out your form accurately and securely, and for additional resources, refer to All Arizona Forms.

How to Get Power of Attorney in Michigan - Healthcare Powers of Attorney prioritize medical decisions for someone who cannot voice their wishes.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Pennsylvania Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. |

| Governing Law | This form is governed by the Pennsylvania Consolidated Statutes, Title 20, Chapter 56. |

| Durability | The power of attorney can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| Agent's Authority | The form can specify the extent of the agent's authority, which can range from limited to broad powers. |

| Witness Requirements | In Pennsylvania, the form must be signed in the presence of two witnesses or a notary public to be valid. |

| Healthcare Decisions | A separate document, known as an Advance Healthcare Directive, is recommended for healthcare decisions, although the power of attorney can include such provisions. |

Similar forms

The Pennsylvania Power of Attorney form is similar to the Durable Power of Attorney, which allows an individual to designate someone to make decisions on their behalf even if they become incapacitated. This type of document remains effective until the principal revokes it or passes away. The key difference lies in its durability; while a standard Power of Attorney may become void if the principal is unable to make decisions, the Durable Power of Attorney specifically addresses this concern, ensuring that the designated agent can continue to act even in times of crisis.

Another document that shares similarities with the Pennsylvania Power of Attorney is the Medical Power of Attorney. This form specifically focuses on healthcare decisions, granting authority to an agent to make medical choices when the principal is unable to do so. While the general Power of Attorney can cover a wide range of financial and legal matters, the Medical Power of Attorney is tailored to healthcare situations, ensuring that the principal's medical preferences are honored even when they cannot communicate them.

The Living Will is another related document, though it differs in scope. A Living Will outlines an individual's wishes regarding medical treatment in end-of-life situations. Unlike a Power of Attorney, which appoints someone to make decisions, a Living Will provides specific instructions about what types of medical interventions the individual does or does not want. This document complements a Medical Power of Attorney by providing clear guidance to the appointed agent about the principal’s healthcare preferences.

The Revocable Trust is also comparable to the Pennsylvania Power of Attorney, particularly regarding asset management. A Revocable Trust allows individuals to transfer their assets into a trust, which they can manage during their lifetime and modify as needed. Upon their passing, the assets in the trust can be distributed according to their wishes without going through probate. While the Power of Attorney allows someone to manage assets on behalf of the principal, the Revocable Trust provides a more structured way to handle and distribute those assets.

Next, the Advance Healthcare Directive encompasses both the Medical Power of Attorney and the Living Will. It combines these two documents into one comprehensive directive that outlines healthcare preferences and appoints an agent for medical decisions. This holistic approach ensures that an individual's wishes regarding treatment and decision-making are clearly communicated and legally binding, much like the Power of Attorney does for financial matters.

The Guardianship document is another related legal instrument. In situations where an individual is deemed incapable of managing their affairs, a court may appoint a guardian to make decisions on their behalf. This process is typically more complex and requires court involvement, unlike the Power of Attorney, which allows individuals to choose their own agents without court intervention. Guardianship can be seen as a more drastic measure compared to the voluntary and flexible nature of a Power of Attorney.

Next, the Financial Power of Attorney is a specific type of Power of Attorney that focuses solely on financial matters. It allows an agent to handle banking, investments, and other financial transactions for the principal. While the general Power of Attorney can include various types of authority, the Financial Power of Attorney is explicitly designed to manage financial affairs, providing clarity and specificity in the agent's powers.

The Ohio Residential Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and tenant for renting residential property in Ohio. This form serves to protect the rights and responsibilities of both parties, ensuring a clear understanding of the rental arrangement. Understanding this agreement is essential for fostering a positive landlord-tenant relationship and ensuring compliance with state laws. For more information and to access the document, visit https://documentonline.org/blank-ohio-residential-lease-agreement.

The Special Power of Attorney is another variant that limits the authority granted to an agent for specific tasks or a defined period. For instance, a principal may appoint someone to handle a real estate transaction or manage a single financial account. This document is similar to the Pennsylvania Power of Attorney but narrows the scope of authority, making it suitable for particular situations where full power is not necessary.

Lastly, the Business Power of Attorney is tailored for business owners who need someone to manage their business affairs. This document allows an agent to make decisions regarding business operations, sign contracts, and handle financial transactions on behalf of the business owner. While the Pennsylvania Power of Attorney can be used for personal matters, the Business Power of Attorney specifically addresses the unique needs of business management, ensuring that operations can continue smoothly in the owner's absence.