Valid Pennsylvania Operating Agreement Template

In the realm of business formation, particularly for limited liability companies (LLCs) in Pennsylvania, the Operating Agreement form plays a crucial role in establishing the internal framework of the organization. This document outlines the management structure, defines the roles and responsibilities of members, and delineates the procedures for decision-making and profit distribution. By detailing how the company will operate, the Operating Agreement not only protects the interests of its members but also helps to prevent conflicts and misunderstandings down the line. It serves as a guide for day-to-day operations and can address various scenarios, such as the addition of new members, the process for member withdrawal, and the dissolution of the company. Ensuring that this form is comprehensive and tailored to the specific needs of the business is essential for long-term success and stability. As such, understanding the significance of the Pennsylvania Operating Agreement form cannot be overstated—it is a foundational document that lays the groundwork for a well-functioning LLC.

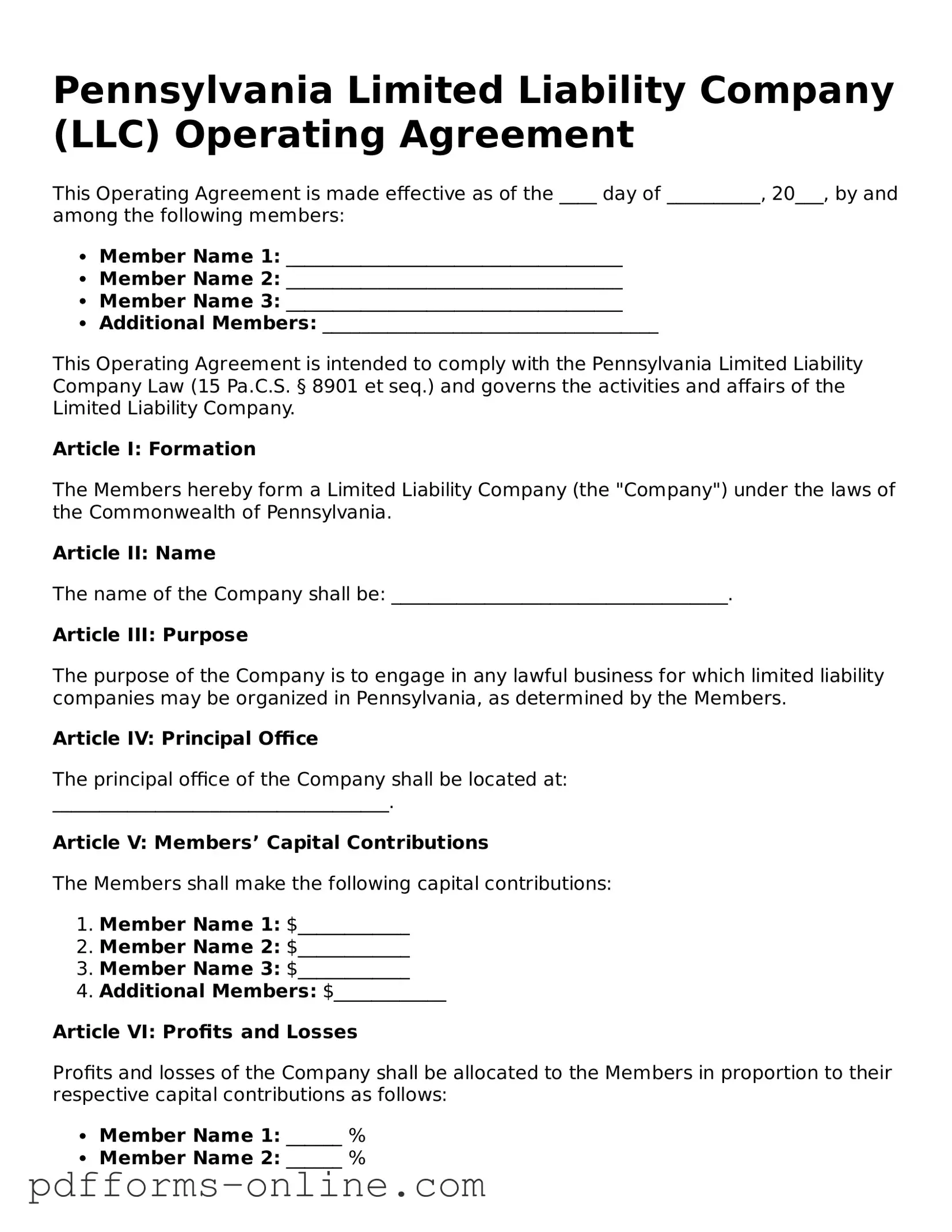

Document Example

Pennsylvania Limited Liability Company (LLC) Operating Agreement

This Operating Agreement is made effective as of the ____ day of __________, 20___, by and among the following members:

- Member Name 1: ____________________________________

- Member Name 2: ____________________________________

- Member Name 3: ____________________________________

- Additional Members: ____________________________________

This Operating Agreement is intended to comply with the Pennsylvania Limited Liability Company Law (15 Pa.C.S. § 8901 et seq.) and governs the activities and affairs of the Limited Liability Company.

Article I: Formation

The Members hereby form a Limited Liability Company (the "Company") under the laws of the Commonwealth of Pennsylvania.

Article II: Name

The name of the Company shall be: ____________________________________.

Article III: Purpose

The purpose of the Company is to engage in any lawful business for which limited liability companies may be organized in Pennsylvania, as determined by the Members.

Article IV: Principal Office

The principal office of the Company shall be located at: ____________________________________.

Article V: Members’ Capital Contributions

The Members shall make the following capital contributions:

- Member Name 1: $____________

- Member Name 2: $____________

- Member Name 3: $____________

- Additional Members: $____________

Article VI: Profits and Losses

Profits and losses of the Company shall be allocated to the Members in proportion to their respective capital contributions as follows:

- Member Name 1: ______ %

- Member Name 2: ______ %

- Member Name 3: ______ %

- Additional Members: ______ %

Article VII: Management

The Company shall be managed by its Members. Each Member shall have equal rights in the management of the Company.

Article VIII: Meetings

Annual meetings of the Members shall be held at a time and place determined by the Members. Special meetings may be called by any Member.

Article IX: Amendment

This Agreement may be amended only by a written agreement signed by all Members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

IN WITNESS WHEREOF, the undersigned Members have executed this Operating Agreement as of the date first above written.

Member Signatures:

- ____________________________________ (Member Name 1)

- ____________________________________ (Member Name 2)

- ____________________________________ (Member Name 3)

- ____________________________________ (Additional Members)

Frequently Asked Questions

-

What is a Pennsylvania Operating Agreement?

A Pennsylvania Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Pennsylvania. It serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the operational framework of the business.

-

Is an Operating Agreement required in Pennsylvania?

No, Pennsylvania law does not require LLCs to have an Operating Agreement. However, having one is highly recommended as it helps prevent misunderstandings among members and provides a clear framework for resolving disputes.

-

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC or a legal professional. It is advisable to seek legal assistance to ensure that the document meets all legal requirements and adequately reflects the intentions of the members.

-

What key elements should be included in the Operating Agreement?

The Operating Agreement should include:

- The name and address of the LLC

- The purpose of the LLC

- The names and addresses of the members

- Management structure (member-managed or manager-managed)

- Voting rights and decision-making processes

- Profit and loss distribution

- Procedures for adding or removing members

- Dispute resolution methods

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. Members must agree on the changes, and the amendments should be documented in writing. This ensures that all members are aware of and consent to the modifications made.

-

How does an Operating Agreement protect members?

An Operating Agreement protects members by clearly defining their roles and responsibilities, as well as the procedures for decision-making and profit distribution. It can also help shield members from personal liability for business debts and obligations, as long as the LLC is properly maintained.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, Pennsylvania's default laws will govern the operations of the business. This may not align with the members' intentions and can lead to disputes or complications in management and profit distribution.

-

How is the Operating Agreement executed?

The Operating Agreement is executed by having all members sign the document. It is advisable to keep a copy of the signed agreement with the LLC's records. While notarization is not required, it can add an extra layer of authenticity.

-

Where can I find a template for the Operating Agreement?

Templates for Operating Agreements can be found online through legal websites, or they may be available through local business resources. It is important to ensure that any template used is compliant with Pennsylvania laws and tailored to the specific needs of the LLC.

Misconceptions

Understanding the Pennsylvania Operating Agreement form is crucial for anyone involved in a business partnership or limited liability company (LLC). However, several misconceptions can lead to confusion. Here are five common misconceptions about this important document:

- All LLCs are required to have an Operating Agreement. While it is highly recommended, Pennsylvania does not legally require LLCs to have an Operating Agreement. However, having one can help clarify the roles and responsibilities of members.

- Operating Agreements are only necessary for large businesses. This is not true. Even small businesses benefit from an Operating Agreement. It helps establish clear guidelines and can prevent disputes among members.

- Once an Operating Agreement is created, it cannot be changed. This misconception is incorrect. An Operating Agreement can be amended as needed, allowing members to adapt to changing circumstances or business needs.

- Operating Agreements are the same as Articles of Organization. These two documents serve different purposes. Articles of Organization are filed with the state to form an LLC, while the Operating Agreement outlines the internal management structure and rules.

- Operating Agreements are only for multi-member LLCs. Even single-member LLCs can benefit from having an Operating Agreement. It provides clarity on management and can help separate personal and business liabilities.

By addressing these misconceptions, individuals can better understand the importance and functionality of the Pennsylvania Operating Agreement form.

Common mistakes

-

Not including all members: It’s crucial to list every member involved in the business. Omitting a member can lead to disputes down the line.

-

Failing to define roles and responsibilities: Each member should have clearly defined roles. This clarity helps prevent misunderstandings and ensures everyone knows their duties.

-

Ignoring the profit-sharing structure: Specify how profits and losses will be distributed among members. Without this, disagreements may arise when it’s time to divide earnings.

-

Not addressing decision-making processes: Outline how decisions will be made. Will it require a majority vote, or will some decisions need unanimous consent? Clarity here is vital.

-

Overlooking dispute resolution methods: Include a plan for resolving conflicts. This could involve mediation or arbitration, which can save time and money compared to litigation.

-

Neglecting to update the agreement: Life changes, and so do businesses. Regularly review and update the Operating Agreement to reflect any changes in membership or structure.

-

Using vague language: Be specific in your wording. Ambiguous terms can lead to different interpretations and potential conflicts among members.

-

Not consulting a legal professional: It’s wise to seek legal advice before finalizing the agreement. A professional can help ensure that all necessary components are included and compliant with Pennsylvania law.

Find Some Other Operating Agreement Forms for Specific States

Nc Operating Agreement Template - It serves as a reference point for both new and existing members.

When selling or purchasing a vehicle in Ohio, it's essential to use the appropriate documentation to ensure a smooth transition of ownership. The Ohio Motor Vehicle Bill of Sale not only legitimizes the transaction but also includes vital details about the vehicle and both parties. For more information and to access the form, you can visit https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale, which will guide you through the requirements needed for this important document.

Single Member Llc Operating Agreement Illinois - This document clarifies the rights and responsibilities of each member in the LLC.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Pennsylvania Operating Agreement outlines the management structure and operational guidelines for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Pennsylvania Limited Liability Company Law (15 Pa.C.S. § 8811). |

| Members' Rights | It details the rights and responsibilities of each member within the LLC. |

| Flexibility | The agreement allows for flexibility in management, including member-managed or manager-managed structures. |

| Profit Distribution | It specifies how profits and losses will be distributed among members. |

| Amendments | Members can outline the process for making amendments to the agreement. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members, such as mediation or arbitration. |

Similar forms

The Pennsylvania Operating Agreement form shares similarities with the LLC Membership Agreement. Both documents outline the rights and responsibilities of members within a limited liability company. They serve as foundational documents that govern the internal operations of the LLC. While the Operating Agreement focuses on the management structure and operational procedures, the Membership Agreement emphasizes the relationship between members, detailing aspects such as ownership percentages, voting rights, and profit distribution. This ensures clarity and minimizes disputes among members.

Another document akin to the Pennsylvania Operating Agreement is the Partnership Agreement. This agreement is used by partnerships to define the roles, responsibilities, and profit-sharing arrangements among partners. Like the Operating Agreement, it establishes the framework for decision-making and conflict resolution. However, the Partnership Agreement is tailored to partnerships, which can include different types of business structures, while the Operating Agreement is specific to LLCs.

The Corporate Bylaws document is also comparable to the Pennsylvania Operating Agreement. Corporate Bylaws govern the operations of a corporation, outlining the roles of directors and officers, meeting procedures, and shareholder rights. While the Operating Agreement addresses LLC-specific issues, both documents aim to create a structured environment for governance and management, ensuring that all parties understand their rights and obligations.

The Shareholders' Agreement is another document that shares characteristics with the Pennsylvania Operating Agreement. This agreement is utilized by corporations to outline the rights and responsibilities of shareholders. Similar to the Operating Agreement, it addresses issues such as voting rights, share transfer restrictions, and procedures for resolving disputes. Both documents are essential for maintaining order and clarity within their respective business structures.

The Joint Venture Agreement also resembles the Pennsylvania Operating Agreement in its purpose of outlining the terms of collaboration between two or more parties. This agreement specifies the contributions, responsibilities, and profit-sharing arrangements of each party involved in the joint venture. While the Operating Agreement focuses on a single LLC, the Joint Venture Agreement is designed for temporary partnerships formed for specific projects or objectives.

The Employment Agreement bears similarity to the Pennsylvania Operating Agreement in that it outlines the terms of employment between an employer and an employee. Both documents define roles, responsibilities, and expectations, although the Employment Agreement is more focused on individual roles within a company. It may include provisions related to compensation, benefits, and termination, ensuring that both parties are clear on their commitments.

When dealing with immigration processes, the USCIS I-134 form, commonly known as the Affidavit of Support, is crucial as it ensures financial support for foreign visitors, preventing them from becoming a public charge. For more detailed guidance on this form, you can refer to OnlineLawDocs.com.

The Non-Disclosure Agreement (NDA) can also be compared to the Pennsylvania Operating Agreement. An NDA protects confidential information shared between parties, ensuring that sensitive business information remains private. While the Operating Agreement governs the internal workings of an LLC, an NDA is crucial for safeguarding proprietary information, especially when members or employees have access to trade secrets or sensitive data.

Lastly, the Business Plan shares some common elements with the Pennsylvania Operating Agreement. A Business Plan outlines the vision, mission, and operational strategy of a business. While the Operating Agreement focuses on governance and member relations, both documents are essential for establishing a clear direction for the business. They help ensure that all stakeholders understand the goals and operational framework, contributing to the overall success of the organization.