Valid Pennsylvania Last Will and Testament Template

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In Pennsylvania, this legal document outlines how your assets will be distributed, who will serve as your executor, and who will care for any minor children. It is essential to understand that this form must be signed in the presence of two witnesses to be considered valid. Additionally, the will can be revoked or amended at any time while you are still alive, allowing for flexibility as your circumstances change. Clarity and specificity are vital in this document; vague language can lead to disputes among heirs. By taking the time to prepare a comprehensive Last Will and Testament, you provide peace of mind for yourself and your loved ones, ensuring that your final wishes are respected and followed. Understanding the requirements and implications of this form can help you navigate the often complex landscape of estate planning in Pennsylvania.

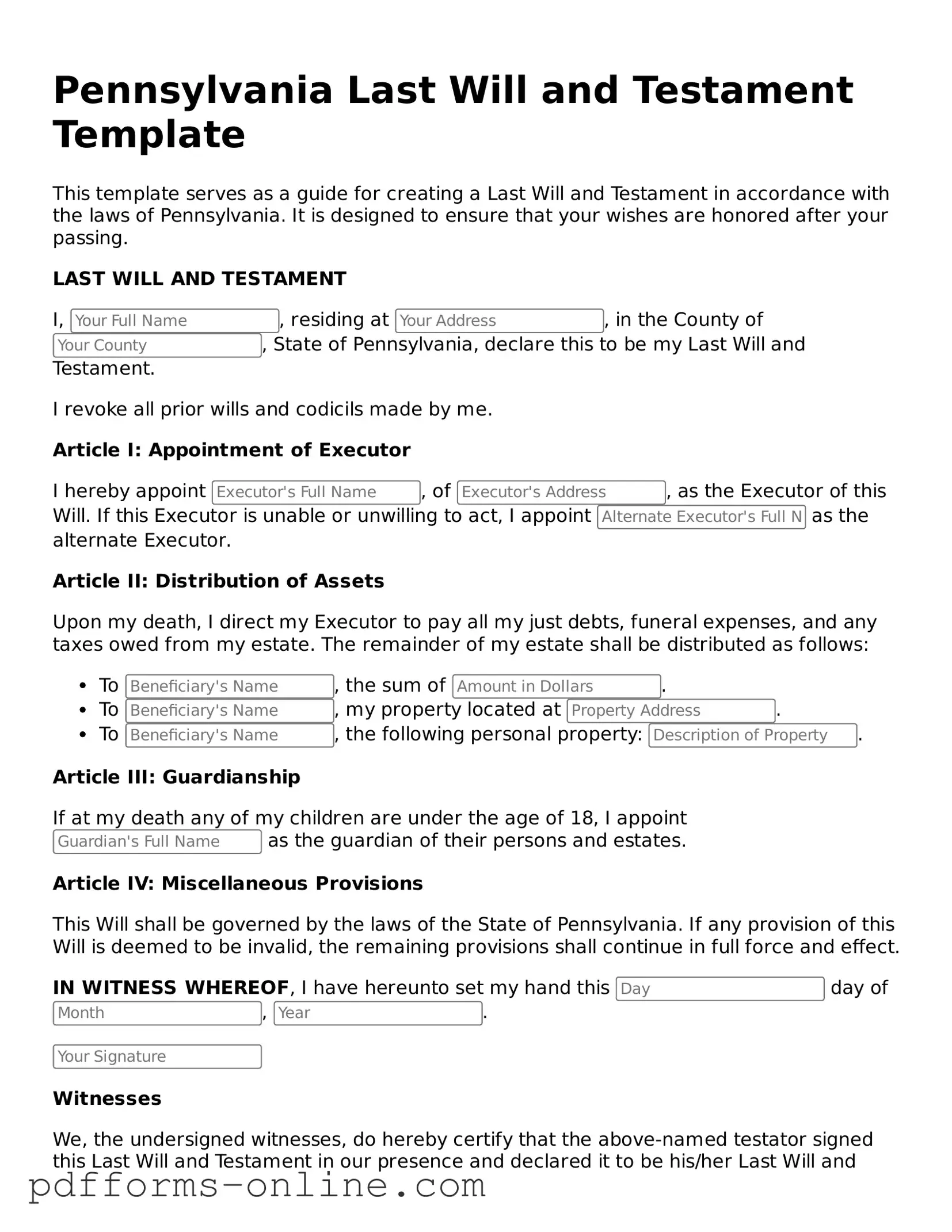

Document Example

Pennsylvania Last Will and Testament Template

This template serves as a guide for creating a Last Will and Testament in accordance with the laws of Pennsylvania. It is designed to ensure that your wishes are honored after your passing.

LAST WILL AND TESTAMENT

I, , residing at , in the County of , State of Pennsylvania, declare this to be my Last Will and Testament.

I revoke all prior wills and codicils made by me.

Article I: Appointment of Executor

I hereby appoint , of , as the Executor of this Will. If this Executor is unable or unwilling to act, I appoint as the alternate Executor.

Article II: Distribution of Assets

Upon my death, I direct my Executor to pay all my just debts, funeral expenses, and any taxes owed from my estate. The remainder of my estate shall be distributed as follows:

- To , the sum of .

- To , my property located at .

- To , the following personal property: .

Article III: Guardianship

If at my death any of my children are under the age of 18, I appoint as the guardian of their persons and estates.

Article IV: Miscellaneous Provisions

This Will shall be governed by the laws of the State of Pennsylvania. If any provision of this Will is deemed to be invalid, the remaining provisions shall continue in full force and effect.

IN WITNESS WHEREOF, I have hereunto set my hand this day of , .

Witnesses

We, the undersigned witnesses, do hereby certify that the above-named testator signed this Last Will and Testament in our presence and declared it to be his/her Last Will and Testament. We affirm that we are not named as beneficiaries in this Will.

- , residing at .

- , residing at .

This Last Will and Testament is duly executed on the date indicated above.

Frequently Asked Questions

-

What is a Last Will and Testament in Pennsylvania?

A Last Will and Testament is a legal document that outlines how a person's assets and property will be distributed after their death. In Pennsylvania, this document can also designate guardians for minor children and appoint an executor to manage the estate. It serves to ensure that your wishes are followed and can help prevent disputes among family members.

-

Who can create a Last Will and Testament in Pennsylvania?

In Pennsylvania, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. It is important that the person understands the nature of their assets and the implications of their decisions. Additionally, the will must be signed and witnessed according to state laws to be valid.

-

What are the requirements for a valid will in Pennsylvania?

For a will to be valid in Pennsylvania, it must meet several requirements:

- The testator (the person making the will) must be at least 18 years old.

- The will must be in writing.

- The testator must sign the will or have someone sign it on their behalf in their presence.

- At least two witnesses must sign the will, attesting to the testator's signature and mental capacity.

Failure to meet these requirements can result in the will being deemed invalid.

-

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive and of sound mind. To make changes, you can create a new will or add a codicil, which is an amendment to the existing will. If you wish to revoke a will, you can do so by destroying it or by creating a new will that explicitly states the previous will is revoked.

-

What happens if I die without a will in Pennsylvania?

If you die without a will, your estate will be distributed according to Pennsylvania's intestacy laws. This means that the state will determine how your assets are divided, which may not align with your wishes. Typically, your assets will be distributed to your closest relatives, such as your spouse, children, or parents. Having a will allows you to have control over this process and ensure your assets are distributed according to your preferences.

Misconceptions

- Misconception 1: A handwritten will is not valid in Pennsylvania.

- Misconception 2: You can change your will anytime without any formalities.

- Misconception 3: You don’t need witnesses for your will to be valid.

- Misconception 4: Only a lawyer can create a valid will.

- Misconception 5: If you are married, your spouse automatically inherits everything.

- Misconception 6: A will can take effect while you are still alive.

- Misconception 7: All assets must go through probate if there is a will.

This is incorrect. Pennsylvania allows handwritten wills, known as holographic wills, as long as they are signed and dated by the person making the will. However, it is advisable to follow the formal requirements for clarity and to avoid disputes.

While you can change your will, it is important to follow the proper procedures. In Pennsylvania, any changes should be made through a formal amendment called a codicil or by creating a new will that explicitly revokes the old one.

This is false. In Pennsylvania, a will must be signed by the person making the will and witnessed by at least two individuals. These witnesses must be present at the same time when the will is signed.

Although it is beneficial to consult a lawyer, individuals can create a valid will on their own, provided they meet the state's legal requirements. However, legal advice can help ensure that the will accurately reflects your wishes.

This is not entirely true. While spouses have certain rights, the distribution of assets can depend on the contents of the will and whether there are any children or other beneficiaries named in it.

This is incorrect. A will only takes effect after the death of the person who created it. Until that time, the individual can alter or revoke the will as desired.

Not all assets go through probate. Certain assets, like those held in trust or accounts with designated beneficiaries, can pass directly to heirs without going through the probate process.

Common mistakes

-

Not naming an executor. Failing to designate a trusted person to manage the estate can lead to complications after your passing.

-

Inadequate witness signatures. Pennsylvania law requires two witnesses. If this step is overlooked, the will may be deemed invalid.

-

Using unclear language. Ambiguous terms can create confusion about your intentions. Be specific about who receives what.

-

Not updating the will. Life changes, such as marriage, divorce, or the birth of children, necessitate revisions. An outdated will may not reflect your current wishes.

-

Failing to sign the document. A will must be signed to be valid. Without your signature, the document holds no legal weight.

-

Ignoring state-specific requirements. Each state has its own rules regarding wills. Make sure to follow Pennsylvania's guidelines to ensure compliance.

Find Some Other Last Will and Testament Forms for Specific States

Last Will and Testament Template Texas - Can be revoked or amended as the individual's circumstances change.

For those considering a motorcycle transaction in Florida, obtaining a reliable Motorcycle Bill of Sale form is crucial to ensure a legal transfer of ownership. This document facilitates the sale process while safeguarding both parties involved. You may find a helpful resource at the essential Florida Motorcycle Bill of Sale form to assist you.

Illinois Will Template - Simple to create, but critically important for future peace of mind.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Last Will and Testament is governed by the Pennsylvania Probate, Estates and Fiduciaries Code, specifically Title 20 of the Pennsylvania Consolidated Statutes. |

| Requirements | In Pennsylvania, a valid Last Will and Testament must be in writing, signed by the testator, and witnessed by at least two individuals who are present at the same time. |

| Revocation | A will can be revoked in Pennsylvania by creating a new will or by physically destroying the existing will with the intent to revoke it. |

| Self-Proving Wills | Pennsylvania allows for self-proving wills, which means that the will can be accompanied by a notarized affidavit from the witnesses, simplifying the probate process. |

Similar forms

The Pennsylvania Last Will and Testament is similar to a Living Will. A Living Will outlines an individual's wishes regarding medical treatment in the event they become incapacitated. While a Last Will and Testament primarily deals with the distribution of assets after death, a Living Will focuses on healthcare decisions. Both documents serve to express the individual's preferences and provide guidance to loved ones and medical professionals in critical situations.

An Advance Healthcare Directive is another document that shares similarities with the Last Will and Testament. This directive combines elements of a Living Will and a Durable Power of Attorney for healthcare. It allows individuals to appoint someone to make medical decisions on their behalf if they are unable to do so. Like a Last Will, it ensures that a person's wishes are respected, but it specifically addresses healthcare rather than asset distribution.

The Durable Power of Attorney is also comparable to the Last Will and Testament. This document allows a person to appoint someone to manage their financial affairs while they are still alive. While the Last Will takes effect after death, the Durable Power of Attorney is active during the person's lifetime. Both documents empower individuals to choose who will make decisions on their behalf, ensuring their preferences are honored.

A Trust Agreement shares similarities with the Last Will and Testament in terms of asset distribution. A trust allows individuals to place their assets into a trust during their lifetime, specifying how those assets should be managed and distributed. Unlike a Last Will, which only takes effect after death, a trust can provide benefits during a person's lifetime and can help avoid probate. Both documents aim to protect the individual's wishes regarding their assets.

In situations where property transfers are involved, understanding the necessary documents is key, and one important form is a Quitclaim Deed. This document allows for the transfer of property rights without warranties, making it a popular choice among family members or for resolving title issues. For those interested in learning more about how to effectively use a Quitclaim Deed in Texas, resources like OnlineLawDocs.com provide valuable information and guidance.

Finally, the Declaration of Trust is similar to the Last Will and Testament in that it outlines how a person's assets will be managed and distributed. This document can be established during a person's lifetime and can serve as an alternative to a will. Like a Last Will, it provides clarity on asset distribution but can also offer benefits such as avoiding probate and providing for the management of assets in case of incapacity.