Valid Pennsylvania Durable Power of Attorney Template

The Pennsylvania Durable Power of Attorney form is a vital legal document that empowers individuals to appoint someone they trust to manage their financial and legal affairs in the event they become incapacitated. This form ensures that decisions regarding healthcare, property, and finances can continue seamlessly, reflecting the wishes of the individual. It covers a range of powers, from handling bank transactions to managing real estate, and can be tailored to suit specific needs. Importantly, the form remains effective even if the principal becomes mentally incompetent, making it a critical tool for long-term planning. Understanding the nuances of this document can help individuals make informed choices about their future and the care of their affairs. By taking the time to create a Durable Power of Attorney, individuals not only safeguard their interests but also provide peace of mind for themselves and their loved ones.

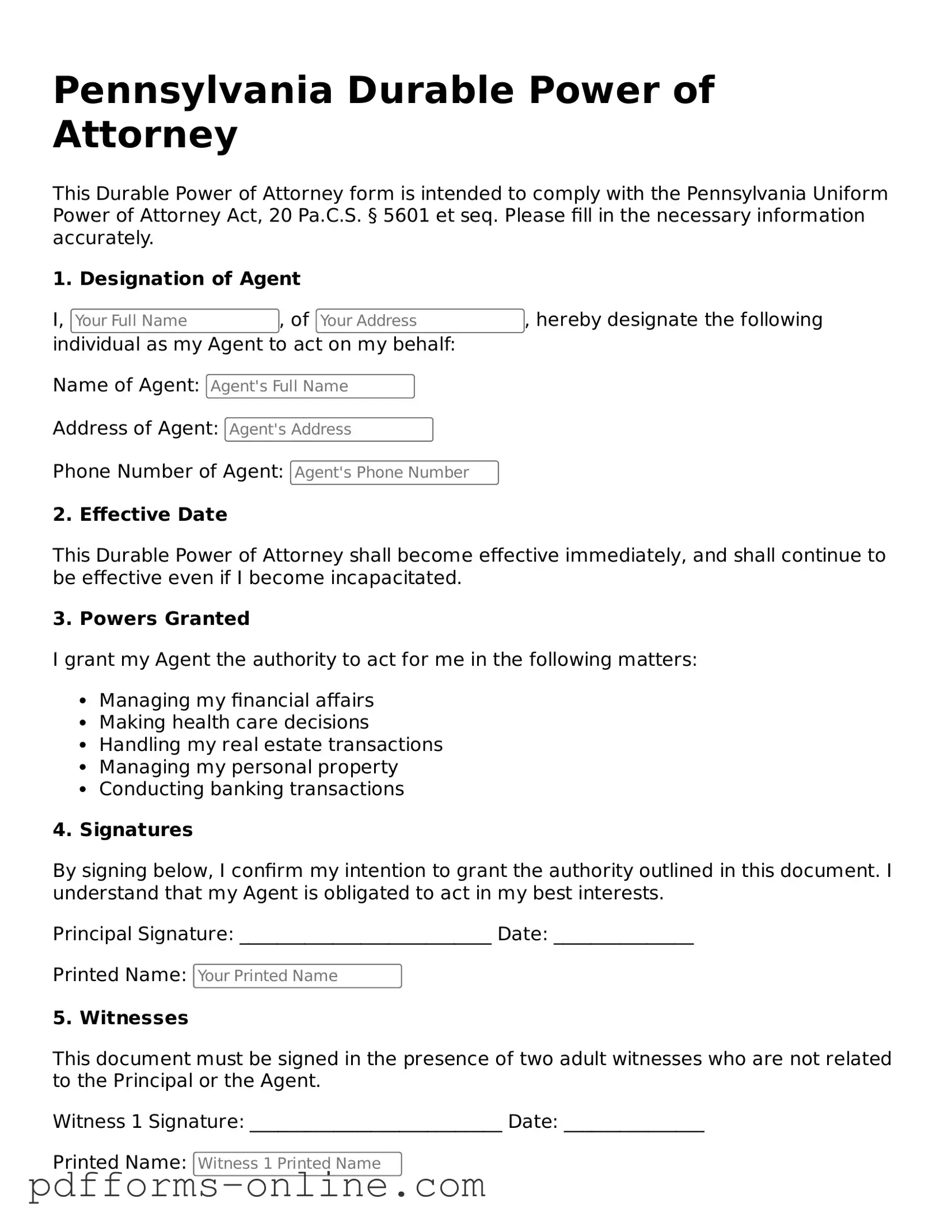

Document Example

Pennsylvania Durable Power of Attorney

This Durable Power of Attorney form is intended to comply with the Pennsylvania Uniform Power of Attorney Act, 20 Pa.C.S. § 5601 et seq. Please fill in the necessary information accurately.

1. Designation of Agent

I, , of , hereby designate the following individual as my Agent to act on my behalf:

Name of Agent:

Address of Agent:

Phone Number of Agent:

2. Effective Date

This Durable Power of Attorney shall become effective immediately, and shall continue to be effective even if I become incapacitated.

3. Powers Granted

I grant my Agent the authority to act for me in the following matters:

- Managing my financial affairs

- Making health care decisions

- Handling my real estate transactions

- Managing my personal property

- Conducting banking transactions

4. Signatures

By signing below, I confirm my intention to grant the authority outlined in this document. I understand that my Agent is obligated to act in my best interests.

Principal Signature: ___________________________ Date: _______________

Printed Name:

5. Witnesses

This document must be signed in the presence of two adult witnesses who are not related to the Principal or the Agent.

Witness 1 Signature: ___________________________ Date: _______________

Printed Name:

Witness 2 Signature: ___________________________ Date: _______________

Printed Name:

6. Notarization

State of Pennsylvania:

County of _________________:

On this _____ day of ________________, 20__, before me, a Notary Public, personally appeared the Principal named above, who has provided proof of identity, and acknowledged the execution of this Durable Power of Attorney.

Notary Public Signature: _______________________

My Commission Expires: _______________________

Frequently Asked Questions

-

What is a Pennsylvania Durable Power of Attorney?

A Pennsylvania Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated.

-

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney can provide peace of mind. It ensures that someone you trust can manage your financial and legal affairs if you are unable to do so. This can be particularly important in cases of illness or injury.

-

Who can be my agent?

Your agent can be anyone you trust, such as a family member, friend, or professional advisor. However, it is important to choose someone who is responsible and capable of handling your affairs. The agent must be at least 18 years old and should not be your healthcare provider.

-

What powers can I grant to my agent?

You can grant a wide range of powers to your agent, including managing bank accounts, paying bills, buying or selling property, and making investment decisions. You can specify which powers your agent has and can also limit their authority as needed.

-

Do I need to have a lawyer to create a Durable Power of Attorney?

While it is not required to have a lawyer to create a Durable Power of Attorney, consulting with one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and reflects your wishes accurately.

-

How do I revoke a Durable Power of Attorney?

You can revoke a Durable Power of Attorney at any time as long as you are competent. To do this, you should create a written revocation document and notify your agent and any relevant institutions. It is advisable to keep a copy of the revocation for your records.

-

Is my Durable Power of Attorney valid in other states?

Generally, a Durable Power of Attorney created in Pennsylvania is valid in other states. However, laws can vary, so it is wise to check the specific requirements of the state where you plan to use it. Some states may have their own forms or specific rules regarding powers of attorney.

Misconceptions

Understanding the Pennsylvania Durable Power of Attorney (DPOA) form is essential for individuals looking to designate someone to make decisions on their behalf. However, several misconceptions can lead to confusion. Below is a list of ten common misconceptions about the DPOA in Pennsylvania, along with clarifications.

- Misconception 1: A DPOA is only for financial matters.

- Misconception 2: The agent must be a lawyer.

- Misconception 3: A DPOA becomes invalid upon the principal's incapacitation.

- Misconception 4: A DPOA is the same as a living will.

- Misconception 5: You cannot revoke a DPOA once it is created.

- Misconception 6: The DPOA must be notarized to be valid.

- Misconception 7: An agent can do anything they want with the DPOA.

- Misconception 8: A DPOA is only necessary for older adults.

- Misconception 9: A DPOA is a one-size-fits-all document.

- Misconception 10: The DPOA is only effective in Pennsylvania.

While many people associate a DPOA with financial decisions, it can also grant authority over health care and other personal matters, depending on the language used in the document.

There is no requirement for the agent, the person designated to act on behalf of the principal, to be a lawyer. Anyone of sound mind and legal age can serve as an agent.

A durable power of attorney remains valid even if the principal becomes incapacitated. This is one of the defining features of a "durable" power of attorney.

A DPOA allows someone to make decisions on behalf of another, while a living will outlines an individual’s wishes regarding medical treatment in the event they cannot communicate those wishes themselves.

Individuals retain the right to revoke a DPOA at any time, as long as they are mentally competent to do so. Revocation must be done in writing.

While notarization is recommended, a DPOA can be valid without it if it is signed by two witnesses. However, certain institutions may require notarization for their records.

The agent must act in the best interests of the principal and follow the guidelines set forth in the DPOA. They cannot act outside the authority granted to them.

People of all ages can benefit from having a DPOA in place, especially those with chronic illnesses, those planning for travel, or anyone who may need assistance in decision-making.

Each DPOA can be customized to fit the specific needs and wishes of the principal. It is important to tailor the document to reflect individual circumstances.

A DPOA created in Pennsylvania may not be recognized in other states. It is advisable to check the laws of other states if the principal plans to move or travel.

Common mistakes

-

Not Specifying Powers Clearly: Individuals often fail to clearly outline the specific powers they wish to grant their agent. It is crucial to be explicit about what decisions the agent can make on behalf of the principal.

-

Choosing the Wrong Agent: Selecting an agent who may not act in the principal's best interest is a common mistake. It is important to choose someone trustworthy and capable of handling the responsibilities involved.

-

Forgetting to Date the Document: Some people overlook the importance of dating the Durable Power of Attorney form. A lack of a date can lead to confusion about when the powers take effect.

-

Not Signing in Front of Witnesses: In Pennsylvania, the form requires signatures to be witnessed. Failing to have the appropriate witnesses present can invalidate the document.

-

Neglecting to Revise or Update: Life changes such as marriage, divorce, or changes in health can necessitate updates to the Durable Power of Attorney. Many individuals forget to revise their documents accordingly.

-

Using Incorrect or Outdated Forms: Utilizing an outdated version of the Durable Power of Attorney form can lead to complications. Always ensure that the most current form is being used.

-

Failing to Discuss with the Agent: Some principals do not have a conversation with their chosen agent about their wishes and expectations. This can result in misunderstandings or disagreements later on.

-

Overlooking Alternate Agents: Designating only one agent without naming an alternate can create issues if the primary agent is unable or unwilling to serve. It is wise to include an alternate to ensure continuity.

Find Some Other Durable Power of Attorney Forms for Specific States

Illinois Durable Power of Attorney for Finances Form - You can grant broad powers or limit them as needed in the document.

An Arizona Deed form is a legal document used to transfer ownership of real estate from one person to another in the state of Arizona. This form ensures the new owner's rights are protected while clearly documenting the transaction. For those looking to complete a property transfer, click the button below to fill out your form accurately and securely. Additionally, you can find more information by visiting All Arizona Forms.

How to Get Power of Attorney in Nc - The authority granted can start immediately or be activated under certain conditions.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Durable Power of Attorney allows an individual to appoint someone to make financial and legal decisions on their behalf. |

| Durability | This form remains effective even if the principal becomes incapacitated, ensuring continuous management of affairs. |

| Governing Law | The form is governed by the Pennsylvania Consolidated Statutes, specifically Title 20, Chapter 5601-5610. |

| Principal Requirements | The principal must be at least 18 years old and mentally competent to create a valid Durable Power of Attorney. |

| Agent Authority | The agent can be granted broad or limited powers, depending on the principal's wishes outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

Similar forms

The Pennsylvania Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney (GPOA). Both documents grant an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of another person, referred to as the principal. However, the GPOA typically becomes ineffective if the principal becomes incapacitated. In contrast, the DPOA remains valid even if the principal can no longer make decisions for themselves. This key difference makes the DPOA a more suitable option for individuals seeking long-term management of their affairs in the event of future incapacity.

When considering the sale of a recreational vehicle, understanding the nuances of the Florida RV Bill of Sale is crucial. This legal document provides an efficient means to record the transaction and protect both parties involved. For a thorough understanding of the process, refer to the comprehensive guidelines on the RV Bill of Sale requirements.

Another document comparable to the DPOA is the Healthcare Power of Attorney (HPOA). While the DPOA generally covers financial and legal matters, the HPOA specifically focuses on medical decisions. This document allows an agent to make healthcare choices for the principal if they are unable to communicate their wishes. Both documents empower agents to act on behalf of the principal, but the HPOA is crucial for ensuring that healthcare preferences are respected, particularly during medical emergencies or end-of-life situations.

Lastly, the Revocable Living Trust (RLT) also shares similarities with the DPOA. An RLT allows individuals to manage their assets during their lifetime and specifies how those assets will be distributed upon their death. Like the DPOA, it provides a mechanism for managing financial affairs, but it also bypasses the probate process, making asset transfer smoother for heirs. While the DPOA is focused on decision-making authority, the RLT emphasizes the management and distribution of assets, offering a comprehensive approach to estate planning.