Valid Pennsylvania Deed in Lieu of Foreclosure Template

In Pennsylvania, homeowners facing the threat of foreclosure have an alternative option that can help alleviate their financial burdens: the Deed in Lieu of Foreclosure. This legal process allows a homeowner to voluntarily transfer ownership of their property to the lender, effectively settling the mortgage debt without going through the lengthy and often stressful foreclosure process. By executing this form, the homeowner can avoid the negative impacts of foreclosure on their credit score and potentially negotiate more favorable terms with the lender. Key aspects of the Deed in Lieu include the requirement for the homeowner to be in default on their mortgage, the need for the lender's acceptance, and the potential for the homeowner to receive a release from further liability on the mortgage. Understanding this option can empower homeowners to make informed decisions during challenging financial times, offering a path toward a fresh start while minimizing the emotional and financial toll of foreclosure.

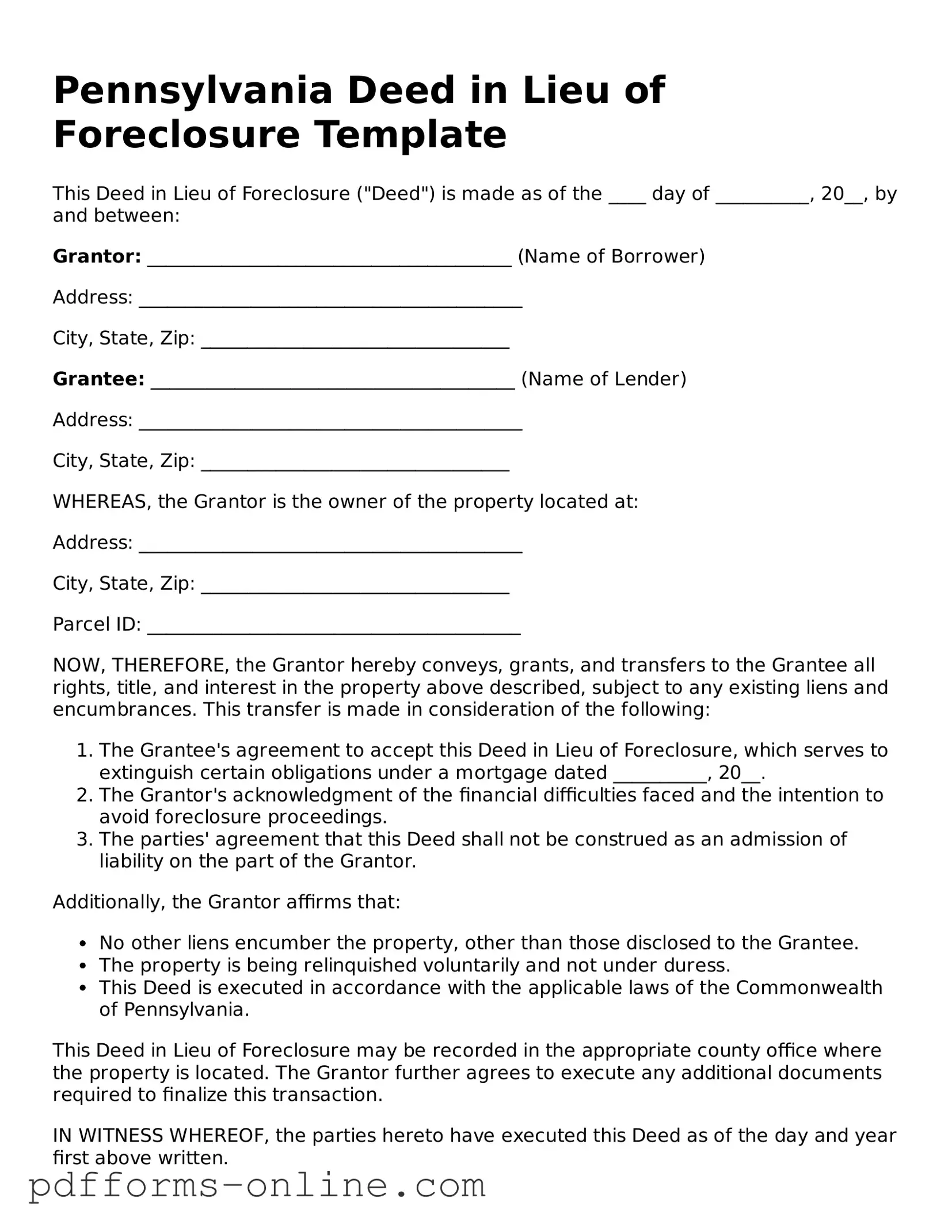

Document Example

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made as of the ____ day of __________, 20__, by and between:

Grantor: _______________________________________ (Name of Borrower)

Address: _________________________________________

City, State, Zip: _________________________________

Grantee: _______________________________________ (Name of Lender)

Address: _________________________________________

City, State, Zip: _________________________________

WHEREAS, the Grantor is the owner of the property located at:

Address: _________________________________________

City, State, Zip: _________________________________

Parcel ID: ________________________________________

NOW, THEREFORE, the Grantor hereby conveys, grants, and transfers to the Grantee all rights, title, and interest in the property above described, subject to any existing liens and encumbrances. This transfer is made in consideration of the following:

- The Grantee's agreement to accept this Deed in Lieu of Foreclosure, which serves to extinguish certain obligations under a mortgage dated __________, 20__.

- The Grantor's acknowledgment of the financial difficulties faced and the intention to avoid foreclosure proceedings.

- The parties' agreement that this Deed shall not be construed as an admission of liability on the part of the Grantor.

Additionally, the Grantor affirms that:

- No other liens encumber the property, other than those disclosed to the Grantee.

- The property is being relinquished voluntarily and not under duress.

- This Deed is executed in accordance with the applicable laws of the Commonwealth of Pennsylvania.

This Deed in Lieu of Foreclosure may be recorded in the appropriate county office where the property is located. The Grantor further agrees to execute any additional documents required to finalize this transaction.

IN WITNESS WHEREOF, the parties hereto have executed this Deed as of the day and year first above written.

_____________________________

Grantor (Signature)

_____________________________

Grantee (Signature)

Witnessed by:

_____________________________

Witness (Signature)

_____________________________

Date

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender. This typically occurs when the homeowner is unable to continue making mortgage payments and wants to avoid the foreclosure process.

-

What are the benefits of using a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- The process is usually quicker and less costly than foreclosure.

- It can help protect your credit score compared to a foreclosure.

- Homeowners may be able to negotiate a "cash for keys" agreement, receiving some financial assistance for relocation.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically includes homeowners who are facing financial hardship and cannot continue making mortgage payments. Lenders may require that the property is not subject to any other liens, and the homeowner must be willing to vacate the property.

-

How does the process work?

The process generally involves the following steps:

- Contact your lender to discuss your situation and express interest in a Deed in Lieu of Foreclosure.

- Submit required documentation, such as proof of income and financial hardship.

- If approved, sign the Deed in Lieu of Foreclosure and any other necessary paperwork.

- Transfer possession of the property to the lender.

-

Will I owe money after the Deed in Lieu of Foreclosure?

In many cases, the lender may agree to forgive any remaining mortgage balance after the property is transferred. However, this can vary by lender, so it’s essential to confirm the terms before proceeding.

-

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure generally has a less severe impact on your credit score compared to a foreclosure. However, it will still be recorded on your credit report and may affect your ability to secure future loans.

-

What if there are other liens on my property?

If there are other liens on the property, the lender may not accept a Deed in Lieu of Foreclosure. It’s crucial to address any outstanding liens before initiating this process.

-

Can I change my mind after signing the Deed in Lieu of Foreclosure?

Once the Deed in Lieu of Foreclosure is signed and recorded, it is legally binding. Therefore, it is essential to be certain about your decision before proceeding. Consult with a legal professional if you have any doubts.

Misconceptions

When it comes to the Pennsylvania Deed in Lieu of Foreclosure, several misconceptions can lead to confusion for homeowners facing financial difficulties. Here are four common misunderstandings:

- It eliminates all debts associated with the property. Many people believe that signing a Deed in Lieu of Foreclosure wipes out all debts. In reality, while it can relieve you of the mortgage obligation, it may not eliminate other liens or debts related to the property, such as unpaid taxes or homeowner association fees.

- It is a quick and easy process. Some homeowners think that a Deed in Lieu of Foreclosure is a simple solution that can be executed quickly. However, the process can be lengthy and involves negotiations with the lender, as well as a thorough review of your financial situation.

- It will not affect your credit score. A common belief is that a Deed in Lieu of Foreclosure has no impact on credit ratings. Unfortunately, this is not true. This action will likely have a negative effect on your credit score, similar to a foreclosure, and can affect your ability to secure future loans.

- It is the same as selling your home. Many homeowners confuse a Deed in Lieu of Foreclosure with a traditional home sale. While both involve transferring ownership, a Deed in Lieu is a voluntary surrender to the lender due to financial hardship, whereas a sale typically involves receiving funds from the transaction.

Understanding these misconceptions can help homeowners make informed decisions during challenging financial times. It's important to seek advice from a qualified professional to navigate the complexities of the process.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the form. This includes not listing all parties involved, omitting property descriptions, or neglecting to include the correct legal names. Missing information can delay the process or lead to rejection.

-

Incorrect Signatures: Signatures must be properly executed. Some people sign without the required witnesses or notarization. This oversight can render the deed invalid. Always ensure that all signatures are obtained according to the legal requirements.

-

Failure to Understand Terms: The terms of the deed in lieu of foreclosure should be clear to all parties. Misunderstanding the implications of the deed can lead to unexpected consequences. It is crucial to fully comprehend what rights are being transferred and any potential liabilities that may remain.

-

Not Consulting Professionals: Many individuals attempt to fill out the form without seeking legal or financial advice. This can lead to mistakes that could have been avoided with proper guidance. Consulting with professionals can provide clarity and ensure compliance with all legal requirements.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

California Property Transfer Deed - A Deed in Lieu of Foreclosure transfers property ownership to the lender to avoid foreclosure.

Foreclosure Vs Deed in Lieu - Documentation related to the property's value may be needed during the process.

Understanding the importance of a Straight Bill of Lading form is crucial for anyone involved in shipping, as it formalizes the agreement between the shipper and the carrier while detailing the cargo specifics. For additional information and resources about such documents, you can visit OnlineLawDocs.com.

Foreclosure Process in Georgia - It is typically considered when the property’s market value is less than the outstanding mortgage balance.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers the property title to the lender to avoid foreclosure proceedings. |

| Governing Law | The process is governed by Pennsylvania state laws, primarily under the Pennsylvania Uniform Commercial Code and relevant property statutes. |

| Eligibility | Homeowners facing financial difficulties may qualify for this option, especially if they can no longer afford their mortgage payments. |

| Benefits | This option can help borrowers avoid the lengthy and stressful foreclosure process, potentially preserving their credit score better than a foreclosure. |

| Considerations | Borrowers should consult with legal and financial advisors to understand the implications, including potential tax consequences and impacts on credit. |

Similar forms

The Pennsylvania Deed in Lieu of Foreclosure form shares similarities with a Short Sale Agreement. In both cases, the homeowner is looking to avoid the lengthy and often stressful foreclosure process. A short sale occurs when the lender agrees to accept less than the total amount owed on the mortgage, allowing the homeowner to sell the property and settle the debt. This option often requires the homeowner to actively market the property and find a buyer, whereas a deed in lieu involves the homeowner simply transferring ownership back to the lender without the need for a sale.

Another document that resembles the Deed in Lieu of Foreclosure is the Loan Modification Agreement. Both options aim to provide relief to homeowners struggling with their mortgage payments. In a loan modification, the lender may agree to change the terms of the existing loan, such as reducing the interest rate or extending the repayment period. This allows the homeowner to keep their property while making it more affordable. In contrast, the deed in lieu results in the homeowner relinquishing ownership, thus eliminating the mortgage obligation altogether.

A Forebearance Agreement is also similar to the Deed in Lieu of Foreclosure. This document allows homeowners to temporarily pause or reduce their mortgage payments due to financial hardship. Both options provide a way to address financial difficulties, but a forbearance keeps the homeowner in their home, while a deed in lieu results in the transfer of property to the lender. Homeowners may choose a forbearance if they expect their financial situation to improve, whereas a deed in lieu is often a last resort.

The Bankruptcy Petition can also be compared to the Deed in Lieu of Foreclosure. Filing for bankruptcy allows individuals to reorganize their debts or eliminate them entirely. In some cases, homeowners may include their mortgage in the bankruptcy proceedings, which can lead to a discharge of the debt. However, a deed in lieu is a more straightforward process that directly addresses the mortgage without the complexities of bankruptcy. Both options can provide relief, but they serve different purposes and have different implications for the homeowner's credit and future financial decisions.

The New York Motorcycle Bill of Sale form is crucial for those involved in the motorcycle trade, providing a clear and official record of the transaction between buyers and sellers. Proper completion of this document can help facilitate a smooth transfer of ownership and protect both parties from potential disputes. For additional information, you can access the form at https://documentonline.org/blank-new-york-motorcycle-bill-of-sale.

A Quitclaim Deed is another document that shares characteristics with the Deed in Lieu of Foreclosure. This legal document allows one party to transfer their interest in a property to another without any guarantees about the title. While a quitclaim deed is often used in personal transactions, such as transferring property between family members, it can also be part of a deed in lieu process. In both cases, the transfer of property occurs, but the quitclaim deed does not necessarily involve a mortgage obligation or lender approval.

Additionally, the Property Settlement Agreement can be likened to the Deed in Lieu of Foreclosure. This document is typically used during divorce proceedings to divide marital property. In situations where a couple is facing foreclosure, they may agree to a settlement that involves one party taking over the mortgage or transferring the property to the other. Similar to a deed in lieu, this agreement can help resolve financial obligations related to the property, but it specifically addresses the division of assets between spouses.

Lastly, the Assignment of Mortgage is a document that bears some resemblance to the Deed in Lieu of Foreclosure. This document allows a lender to transfer their rights and interests in a mortgage to another party. While this transfer does not directly involve the homeowner, it can impact their situation if the new lender decides to pursue foreclosure. In contrast, a deed in lieu results in the homeowner voluntarily giving up their property to the original lender, thus resolving the mortgage obligation in a different manner.