Valid Pennsylvania Deed Template

In Pennsylvania, the deed form serves as a crucial document in the transfer of real estate ownership, ensuring that property rights are clearly established and legally recognized. This form typically includes essential information such as the names of the grantor (the seller) and grantee (the buyer), a detailed description of the property being transferred, and the consideration, or payment, involved in the transaction. Additionally, the deed must be signed by the grantor and often requires notarization to validate the transfer. Various types of deeds exist in Pennsylvania, including warranty deeds, quitclaim deeds, and special purpose deeds, each serving different purposes and offering varying levels of protection to the parties involved. Understanding the nuances of the Pennsylvania deed form is vital for anyone engaging in real estate transactions, as it lays the foundation for legal ownership and can significantly impact future property rights and obligations.

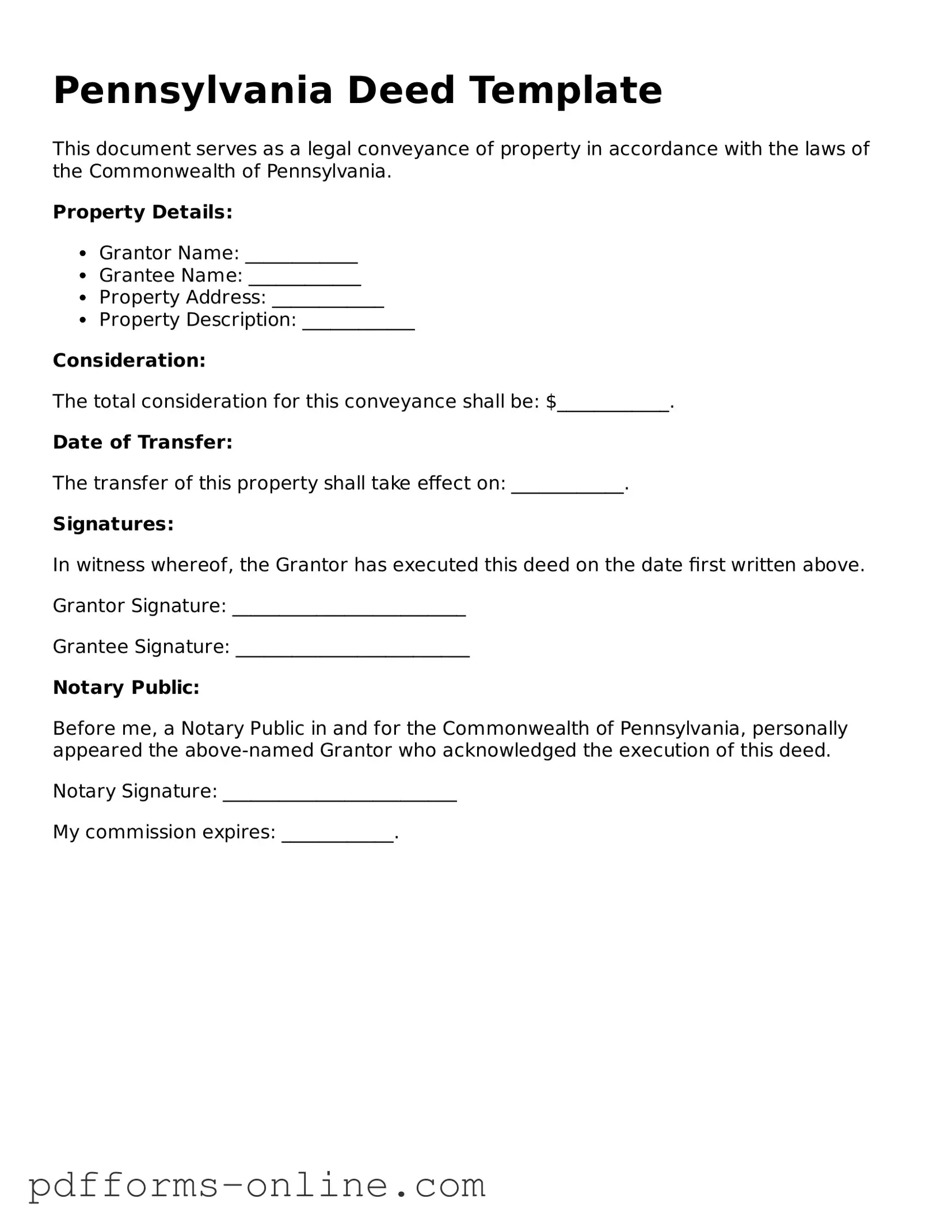

Document Example

Pennsylvania Deed Template

This document serves as a legal conveyance of property in accordance with the laws of the Commonwealth of Pennsylvania.

Property Details:

- Grantor Name: ____________

- Grantee Name: ____________

- Property Address: ____________

- Property Description: ____________

Consideration:

The total consideration for this conveyance shall be: $____________.

Date of Transfer:

The transfer of this property shall take effect on: ____________.

Signatures:

In witness whereof, the Grantor has executed this deed on the date first written above.

Grantor Signature: _________________________

Grantee Signature: _________________________

Notary Public:

Before me, a Notary Public in and for the Commonwealth of Pennsylvania, personally appeared the above-named Grantor who acknowledged the execution of this deed.

Notary Signature: _________________________

My commission expires: ____________.

Frequently Asked Questions

-

What is a Pennsylvania Deed form?

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate property from one party to another. It serves as proof of the transaction and outlines the details of the transfer, including the names of the grantor (seller) and grantee (buyer), the property description, and any conditions or covenants associated with the transfer.

-

What types of deeds are available in Pennsylvania?

In Pennsylvania, there are several types of deeds, including:

- General Warranty Deed: Offers the highest level of protection to the grantee, guaranteeing that the grantor holds clear title to the property and has the right to sell it.

- Special Warranty Deed: Similar to a general warranty deed but only guarantees against defects that occurred during the grantor's ownership.

- Quitclaim Deed: Transfers whatever interest the grantor has in the property without any warranties. This type is often used among family members or in divorce settlements.

-

How do I complete a Pennsylvania Deed form?

To complete a Pennsylvania Deed form, follow these steps:

- Identify the grantor and grantee, ensuring that their names are spelled correctly.

- Provide a complete legal description of the property. This can usually be found on the previous deed or through local tax records.

- Include the consideration amount, which is the price paid for the property.

- Sign the deed in front of a notary public. The notary will verify the identities of the signers and witness the signing.

-

Do I need to record the deed after it is signed?

Yes, recording the deed is crucial. Once the deed is signed and notarized, it should be filed with the local county recorder's office where the property is located. This step provides public notice of the property transfer and protects the grantee's rights to the property.

-

Are there any fees associated with filing a Pennsylvania Deed?

Yes, there are typically fees for recording the deed, which can vary by county. Additionally, there may be transfer taxes based on the property's sale price. It's important to check with the local recorder's office for specific fee schedules and any additional requirements.

Misconceptions

Understanding the Pennsylvania Deed form is essential for anyone involved in real estate transactions. However, several misconceptions often arise. Here are eight common misunderstandings:

- The Pennsylvania Deed form is the same for all property types. Many believe that a single deed form can be used for any property. In reality, different types of deeds exist, such as warranty deeds and quitclaim deeds, each serving distinct purposes.

- All deeds must be notarized. While notarization is common, it is not always required for every type of deed. Some deeds may be valid without a notary, depending on specific circumstances.

- A deed transfer automatically includes all property rights. This is a misconception. The type of deed used will determine what rights are transferred. For example, a quitclaim deed transfers whatever interest the grantor has, without guarantees.

- Only attorneys can prepare a Pennsylvania Deed form. Although legal assistance is beneficial, individuals can prepare their own deeds. However, they should ensure compliance with state laws to avoid issues.

- Once a deed is recorded, it cannot be changed. This is not entirely accurate. While a recorded deed is a matter of public record, it can be modified or revoked through a new deed, as long as proper procedures are followed.

- All deeds must be recorded to be valid. While recording a deed provides public notice and protects the grantee’s interest, a deed can still be valid even if it is not recorded. However, unrecorded deeds may be harder to enforce.

- The seller and buyer must be present during the signing of the deed. This is a common belief, but it is not a requirement. Parties can sign the deed separately, as long as all signatures are obtained and properly witnessed.

- Once signed, the deed is effective immediately. This is misleading. A deed becomes effective upon delivery and acceptance by the grantee, not merely by signing. Understanding this distinction is crucial for both parties involved.

Clarifying these misconceptions can help individuals navigate the process of property transactions in Pennsylvania more effectively.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. Individuals often overlook sections that require specific information about the property, such as the legal description or the parcel number. This can lead to delays or rejection of the deed.

-

Incorrect Signatures: Another frequent error involves signatures. All parties involved in the transaction must sign the deed. If a necessary signature is missing, the deed may not be valid. Additionally, signatures must be notarized, and failure to do so can invalidate the document.

-

Improper Notarization: Notarization is a critical step. Some individuals mistakenly believe that any signature will suffice. However, the notary must be present at the time of signing, and the notary's seal must be clearly affixed to the document. Inadequate notarization can cause legal complications.

-

Failure to Record: After completing the deed, many forget to record it with the county. Recording is essential as it provides public notice of ownership and protects against future claims. Neglecting this step can lead to disputes over property rights.

Find Some Other Deed Forms for Specific States

What Does a Deed Look Like in Illinois - Can incorporate any agreed-upon disclosures between parties.

A Straight Bill of Lading form is a key document used in the shipping industry. It serves as a contract between a shipper and carrier for the transportation of goods. This document specifies the particulars of the cargo, ensuring both parties have clear details about the shipment. For more information on this form, you can visit OnlineLawDocs.com.

New York Warranty Deed Form - May be subject to state-specific requirements and regulations.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Deed form is governed by Title 21 of the Pennsylvania Consolidated Statutes. |

| Types of Deeds | Pennsylvania recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special purpose deeds. |

| Grantor and Grantee | The deed must clearly identify the grantor (seller) and grantee (buyer) with their full legal names. |

| Property Description | A complete and accurate description of the property being transferred is required, often using a metes and bounds description or a lot number. |

| Consideration | The deed must state the consideration, which is the amount paid for the property, although this can be nominal. |

| Execution Requirements | The deed must be signed by the grantor. If the grantor is a corporation, the deed must be executed by an authorized officer. |

| Notarization | Notarization of the grantor's signature is recommended to ensure the deed's validity, although it is not always required. |

| Recording | To provide public notice of the property transfer, the deed must be recorded in the county where the property is located. |

| Transfer Taxes | Pennsylvania imposes a realty transfer tax on property transactions, which must be paid upon recording the deed. |

| Legal Capacity | All parties involved must have the legal capacity to enter into the transaction, meaning they must be of sound mind and of legal age. |

Similar forms

The Pennsylvania Deed form shares similarities with the Quitclaim Deed. Both documents are used to transfer property ownership, but they differ in the level of protection they offer. A Quitclaim Deed transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. This means that if there are any liens or claims against the property, the grantee takes on those risks. In contrast, the Pennsylvania Deed can provide more assurance regarding the title's condition, depending on the type of deed used.

The Warranty Deed is another document that resembles the Pennsylvania Deed. Like the Pennsylvania Deed, a Warranty Deed transfers ownership of real estate. However, it comes with a promise from the seller that they hold clear title to the property and have the right to sell it. This added protection makes Warranty Deeds a popular choice for buyers who want assurance that they will not face future claims against their ownership.

The Bargain and Sale Deed is also similar to the Pennsylvania Deed. This type of deed indicates that the grantor is transferring property ownership but does not provide any warranties about the title. It suggests that the grantor has an interest in the property but does not guarantee that the title is free of defects. This can leave the buyer exposed to potential issues, much like a Quitclaim Deed.

When dealing with property transactions, understanding the importance of a Mobile Home Bill of Sale is essential, as it streamlines the transfer process and ensures clarity in ownership. For those interested, more information can be found at documentonline.org/blank-new-york-mobile-home-bill-of-sale, which outlines the necessary details to facilitate a smooth exchange.

The Special Purpose Deed is another document that serves a specific function, similar to the Pennsylvania Deed. This deed is often used in unique situations, such as transferring property from a trust or as part of a divorce settlement. While it may not cover all the general aspects of a Pennsylvania Deed, it still facilitates the transfer of property ownership in specific circumstances.

The Executor’s Deed is also comparable to the Pennsylvania Deed, particularly in cases of property transfer after someone’s death. When an estate is settled, an Executor’s Deed is used to transfer property from the deceased’s estate to the beneficiaries. This deed ensures that the transfer is legally recognized, much like how a Pennsylvania Deed formalizes ownership changes.

Lastly, the Leasehold Deed is similar in that it deals with property rights, but it focuses on leasing rather than ownership transfer. This document outlines the terms under which a tenant can use a property for a specified period. While it does not transfer ownership like the Pennsylvania Deed, it is essential for establishing the rights of the tenant and landlord, similar to how a deed establishes ownership rights for a property buyer.