Valid Pennsylvania Articles of Incorporation Template

Incorporating a business in Pennsylvania requires careful attention to detail, and the Articles of Incorporation form serves as a crucial starting point in this process. This form establishes the legal existence of a corporation within the state and outlines essential information that defines the entity. Key components include the corporation's name, which must be unique and compliant with state naming requirements, and the registered office address, which provides a physical location for legal correspondence. The form also necessitates the identification of the corporation’s purpose, which can be broad or specific, depending on the business activities planned. Additionally, the Articles of Incorporation require the listing of the incorporators, who are responsible for filing the document and may also be involved in the initial management of the corporation. Importantly, the form may include provisions related to the management structure, such as the number of directors and their powers. Completing the Articles of Incorporation accurately is vital, as it lays the foundation for the corporation’s governance and compliance with state regulations.

Document Example

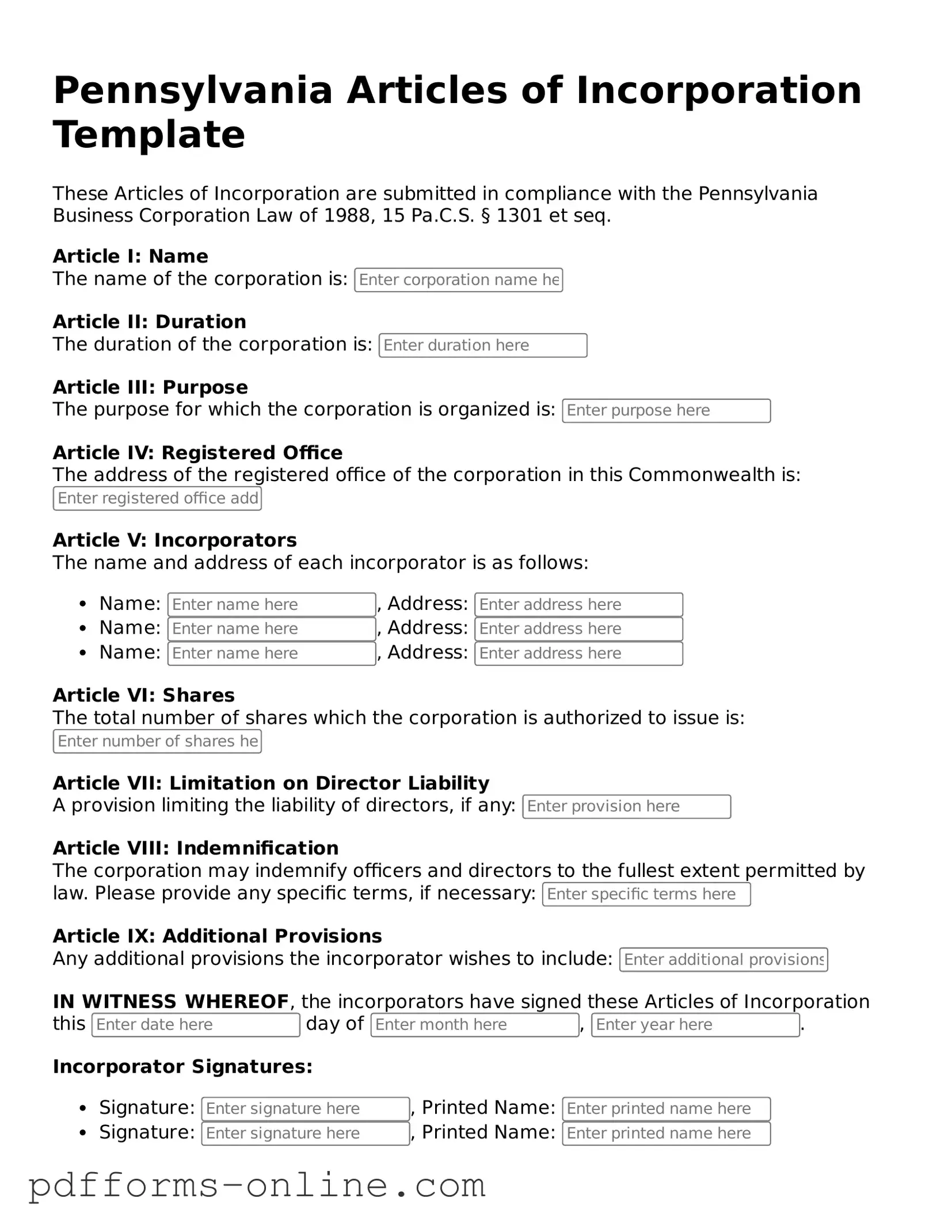

Pennsylvania Articles of Incorporation Template

These Articles of Incorporation are submitted in compliance with the Pennsylvania Business Corporation Law of 1988, 15 Pa.C.S. § 1301 et seq.

Article I: Name

The name of the corporation is:

Article II: Duration

The duration of the corporation is:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Registered Office

The address of the registered office of the corporation in this Commonwealth is:

Article V: Incorporators

The name and address of each incorporator is as follows:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article VI: Shares

The total number of shares which the corporation is authorized to issue is:

Article VII: Limitation on Director Liability

A provision limiting the liability of directors, if any:

Article VIII: Indemnification

The corporation may indemnify officers and directors to the fullest extent permitted by law. Please provide any specific terms, if necessary:

Article IX: Additional Provisions

Any additional provisions the incorporator wishes to include:

IN WITNESS WHEREOF, the incorporators have signed these Articles of Incorporation this day of , .

Incorporator Signatures:

- Signature: , Printed Name:

- Signature: , Printed Name:

Frequently Asked Questions

-

What is the Pennsylvania Articles of Incorporation form?

The Pennsylvania Articles of Incorporation form is a legal document required to establish a corporation in the state of Pennsylvania. This form outlines basic information about the corporation, including its name, purpose, registered office address, and details about its incorporators.

-

Who needs to file the Articles of Incorporation?

Anyone wishing to create a corporation in Pennsylvania must file the Articles of Incorporation. This includes individuals starting a new business, as well as existing businesses that want to formalize their structure as a corporation.

-

What information is required on the form?

The form typically requires the following information:

- The name of the corporation

- The purpose of the corporation

- The address of the registered office

- The names and addresses of the incorporators

- The number of shares the corporation is authorized to issue

-

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online through the Pennsylvania Department of State's website or by mailing a paper form to the appropriate office. Ensure that you include the required filing fee, which can vary based on the type of corporation you are forming.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation you are establishing. Generally, fees range from $125 to $250. It's important to check the latest fee schedule on the Pennsylvania Department of State's website for the most accurate information.

-

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Typically, online submissions are processed more quickly than paper filings. You might expect a turnaround time of a few business days to a few weeks. For expedited processing, you may have the option to pay an additional fee.

-

Do I need to create bylaws for my corporation?

Yes, while not required to be filed with the state, creating bylaws is an essential step in organizing your corporation. Bylaws outline how your corporation will operate, including the roles of officers, how meetings will be conducted, and other governance matters.

-

What should I do after filing the Articles of Incorporation?

After filing, you should keep a copy of the approved Articles of Incorporation for your records. Next, consider obtaining any necessary business licenses or permits, setting up a corporate bank account, and holding an organizational meeting to adopt bylaws and appoint officers.

Misconceptions

When considering the Pennsylvania Articles of Incorporation form, several misconceptions often arise. Understanding these misunderstandings can help individuals navigate the incorporation process more effectively.

- Misconception 1: The Articles of Incorporation are the only requirement for starting a business in Pennsylvania.

- Misconception 2: Any name can be used for a corporation as long as it is included in the Articles of Incorporation.

- Misconception 3: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 4: Incorporating in Pennsylvania is a quick and straightforward process.

Many people believe that simply filing the Articles of Incorporation is enough to legally establish a business. However, additional steps such as obtaining necessary licenses, permits, and registering for taxes are also crucial for compliance.

This is not entirely accurate. The chosen name must be unique and not already in use by another registered entity in Pennsylvania. Additionally, it must comply with state naming regulations, which may include specific words that are required or prohibited.

While the Articles of Incorporation are a foundational document, they can be amended. If changes are needed, such as altering the corporate name or structure, a formal amendment process must be followed, which involves additional filings with the state.

Although the process can be streamlined, it often requires careful attention to detail. Gathering the necessary information, completing the forms accurately, and ensuring compliance with state regulations can take time. Delays may occur if the submitted documents are incomplete or incorrect.

Common mistakes

-

Incorrect Entity Name: Many individuals fail to ensure that the name of the corporation is unique and complies with Pennsylvania regulations. The name must not be similar to existing entities and should include an appropriate designator, such as "Inc." or "Corporation."

-

Inaccurate Registered Office Address: Providing an incorrect or incomplete address for the registered office is a common mistake. The address must be a physical location in Pennsylvania, not a P.O. Box.

-

Missing Purpose Statement: Some applicants overlook the requirement to include a clear statement of the corporation's purpose. This statement should be specific enough to outline the business activities but broad enough to allow for future growth.

-

Failure to Include Incorporators' Information: It's essential to list the names and addresses of all incorporators. Neglecting to provide this information can lead to processing delays or rejection of the application.

Find Some Other Articles of Incorporation Forms for Specific States

Lara Michigan Llc Application - It is necessary for establishing corporate credibility in the market.

Having a well-drafted operating agreement is essential for any Texas LLC to prevent misunderstandings among members and to facilitate effective management. For those looking to easily create this important document, resources like OnlineLawDocs.com provide valuable guidance and templates specifically tailored to Texas law.

Texas Department of Corporations - The document may allow for amendments in the future.

PDF Attributes

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Articles of Incorporation are governed by the Pennsylvania Business Corporation Law of 1988. |

| Purpose | This form is used to create a corporation in the state of Pennsylvania. |

| Filing Requirement | Filing the Articles of Incorporation is required to legally establish a corporation. |

| Information Required | Key information includes the corporation's name, registered office address, and the names of the incorporators. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Processing Time | The processing time for the Articles of Incorporation can vary, but it typically takes a few business days. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and can be accessed by anyone. |

Similar forms

The Pennsylvania Articles of Incorporation form shares similarities with the Certificate of Incorporation used in many other states. Both documents serve as foundational legal paperwork required to establish a corporation. They typically include essential information such as the corporation's name, purpose, and the address of its registered office. Additionally, both documents must be filed with the appropriate state authority, usually the Secretary of State, to gain legal recognition as a corporation. This process ensures that the business is compliant with state laws and regulations from the outset.

Another document that is similar is the Bylaws of a corporation. While the Articles of Incorporation lay the groundwork for the corporation's existence, the Bylaws provide the internal rules and guidelines for its operation. They outline the roles and responsibilities of directors and officers, the process for holding meetings, and how decisions will be made. Like the Articles, Bylaws are crucial for maintaining legal compliance and ensuring smooth governance, although they do not need to be filed with the state.

In addition to the aforementioned forms, it is important to recognize the New York Trailer Bill of Sale, which is a legal document specifically used to facilitate the sale and transfer of ownership of a trailer in New York State. This form ensures that the transaction is documented accurately, protecting both the buyer and seller in the process. For those needing assistance, more information can be found at documentonline.org/blank-new-york-trailer-bill-of-sale/, highlighting its significance in the registration processes with the Department of Motor Vehicles.

The Operating Agreement is another document that bears resemblance, particularly for Limited Liability Companies (LLCs). This agreement outlines the management structure, ownership percentages, and operational procedures for the LLC. Similar to the Articles of Incorporation, the Operating Agreement is essential for defining how the business will function and ensuring all members are on the same page. While the Articles are specific to corporations, the Operating Agreement fulfills a similar purpose for LLCs in establishing legal and operational clarity.

Lastly, the Statement of Information is akin to the Articles of Incorporation, particularly in states where it is required post-incorporation. This document provides updated information about the corporation, including the names and addresses of its officers and directors. It serves to keep the state informed about the corporation’s current status, similar to how the Articles of Incorporation initially inform the state about the corporation’s creation. Timely filing of this document is crucial to maintain good standing and avoid penalties.