Blank Payroll Check Template

When it comes to managing employee compensation, the Payroll Check form plays a crucial role in ensuring that workers are paid accurately and on time. This essential document not only outlines the amount earned by an employee during a specific pay period but also provides a detailed breakdown of deductions, such as taxes and benefits. Additionally, the form typically includes vital information such as the employee’s name, identification number, and the pay date, all of which contribute to maintaining clear and organized financial records. Understanding the components of the Payroll Check form is key for both employers and employees alike, as it fosters transparency in the payment process and helps prevent discrepancies. With the right knowledge, individuals can navigate the intricacies of payroll with confidence, ensuring that everyone gets their due compensation without any hitches.

Document Example

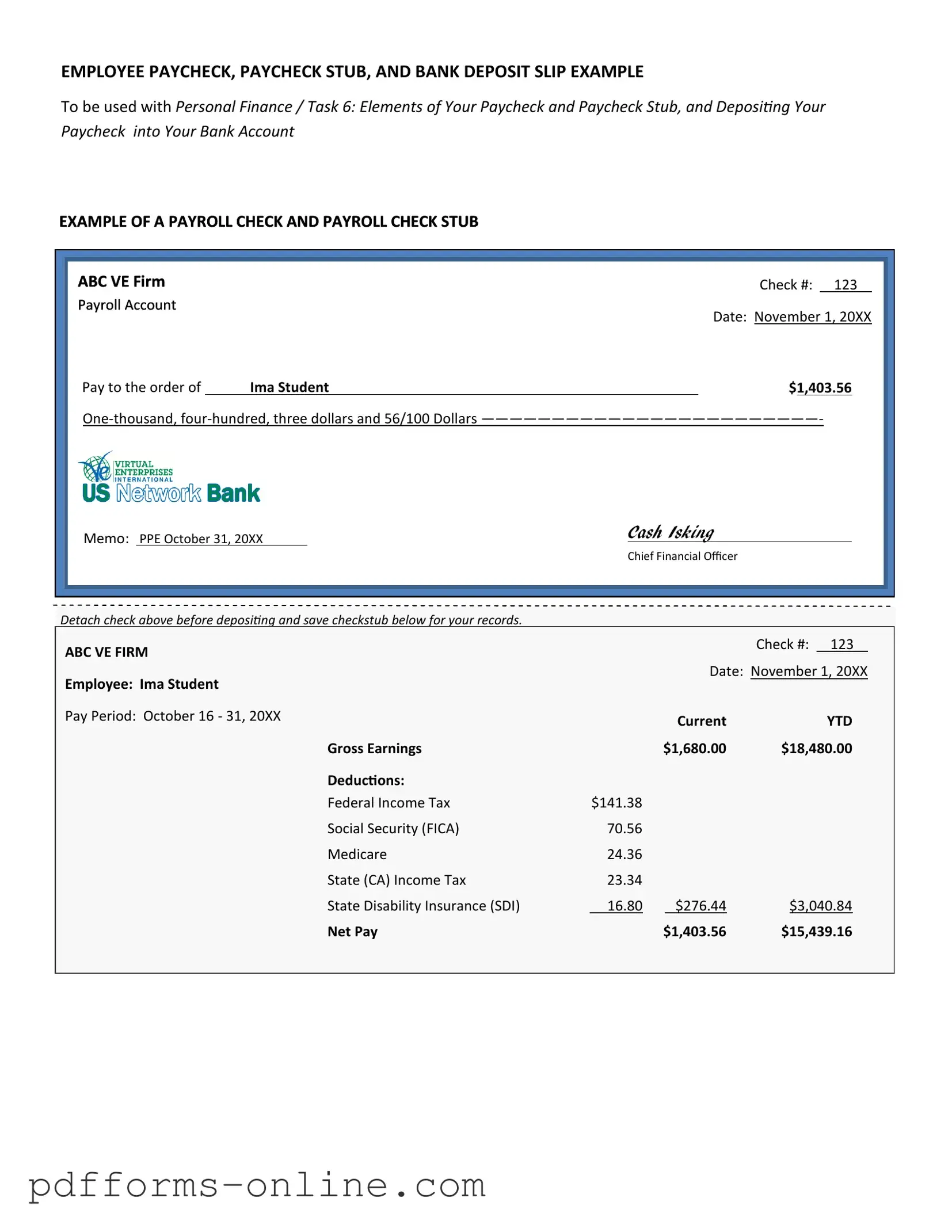

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Frequently Asked Questions

-

What is a Payroll Check form?

A Payroll Check form is a document used by employers to issue payments to employees for their work. This form typically includes details such as the employee's name, the amount being paid, and the pay period. It serves as a formal record of the payment transaction.

-

Who needs to fill out the Payroll Check form?

Employers or payroll administrators are responsible for filling out the Payroll Check form. They must ensure that all necessary information is accurately recorded before issuing checks to employees. Employees do not fill out this form; instead, they receive checks based on the information provided by their employer.

-

What information is required on the Payroll Check form?

The Payroll Check form generally requires the following information:

- Employee's full name

- Employee's identification number or Social Security number

- Pay period dates

- Gross pay amount

- Deductions (taxes, benefits, etc.)

- Net pay amount

- Date of payment

Providing accurate information is crucial to ensure employees receive the correct payment and that the employer remains compliant with tax regulations.

-

How often should Payroll Check forms be issued?

The frequency of issuing Payroll Check forms depends on the employer's payroll schedule. Common pay periods include weekly, bi-weekly, or monthly. Employers should adhere to their established schedule to maintain consistency and ensure employees are paid on time.

-

What happens if there is an error on the Payroll Check form?

If an error is discovered on the Payroll Check form, it is important to correct it promptly. Employers should issue a corrected check if necessary. Additionally, they must communicate with the affected employee to explain the situation and ensure that the employee receives the correct payment.

-

Are Payroll Check forms required for all employees?

Yes, Payroll Check forms are required for all employees who receive payment through traditional payroll methods. This includes full-time, part-time, and temporary employees. However, independent contractors may have different payment processes that do not require a Payroll Check form.

-

Can Payroll Check forms be submitted electronically?

Yes, many employers now use electronic payroll systems that allow for the submission and processing of Payroll Check forms digitally. This can streamline the payroll process, reduce paperwork, and enhance record-keeping. However, it is essential to ensure that all electronic submissions comply with relevant regulations and maintain data security.

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- All payroll checks are the same. Many believe that every payroll check looks identical. In reality, checks can vary based on the employer’s policies, state regulations, and the specific payroll software used.

- Payroll checks are only issued weekly. Some people think payroll checks must be issued on a weekly basis. In truth, pay periods can vary. Employers may choose to pay employees weekly, bi-weekly, semi-monthly, or monthly.

- Overtime is automatically calculated. There’s a misconception that all payroll systems automatically calculate overtime pay. However, some systems require manual entry or adjustments to ensure compliance with labor laws.

- Taxes are deducted only once a year. Many assume that tax deductions from payroll checks occur annually. In fact, taxes are typically deducted from each paycheck throughout the year, which helps avoid a large tax bill at tax time.

- Employees can choose any amount to withhold for taxes. Some people think they can select any withholding amount they desire. While employees can adjust their withholding on their W-4 forms, they must follow IRS guidelines to ensure accurate tax payments.

- Payroll checks are only for hourly employees. A common belief is that payroll checks are exclusive to hourly workers. However, salaried employees also receive payroll checks, reflecting their agreed-upon salary.

- Direct deposit eliminates the need for payroll checks. Some think that if an employee opts for direct deposit, payroll checks are no longer relevant. While direct deposit is popular, payroll checks may still be issued for those who prefer or require a physical check.

- All deductions are mandatory. Many believe that every deduction on a payroll check is required. In reality, some deductions, such as contributions to retirement plans or health insurance, may be optional based on employee choice.

By clarifying these misconceptions, individuals can better understand their payroll checks and the processes behind them.

Common mistakes

-

Incorrect Employee Information: One common mistake is failing to accurately enter the employee's name, Social Security number, or address. This can lead to delays in processing payroll and potential tax issues. Always double-check that the information matches what is on file with the IRS and the employee's identification documents.

-

Inaccurate Hours Worked: Another frequent error involves misreporting the number of hours worked. Employees may forget to log overtime or may not account for unpaid breaks. This can result in underpayment or overpayment, both of which can create complications for the payroll department and the employee.

-

Misclassification of Pay Rates: Sometimes, individuals mistakenly classify an employee's pay rate. For example, an employee may be paid at a different rate for overtime hours, or there may be confusion between salaried and hourly employees. Ensuring that the correct pay rate is applied is crucial for compliance with labor laws.

-

Neglecting Deductions: Failing to account for deductions is another common error. This includes not applying taxes, benefits, or other withholdings correctly. Such oversights can lead to unexpected financial consequences for both the employer and the employee, making it essential to review deductions carefully.

Additional PDF Templates

Ca Dmv Form 256 - The DL 44 form can be submitted for various purposes, including original licenses, renewals, and replacements.

Bf Application Google Form - Fun-loving individual who loves to laugh and enjoys playful banter.

An Arizona Deed form is a legal document used to transfer ownership of real estate from one person to another in the state of Arizona. This form ensures the new owner's rights are protected while clearly documenting the transaction. For those looking to complete a property transfer, click the button below to fill out your form accurately and securely. Additionally, for more information, you can refer to All Arizona Forms.

Prescription Pad Size - Ideal for both routine and specialized medication orders.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to document employee compensation and ensure accurate payment for work performed. |

| Components | This form typically includes employee details, pay period dates, hours worked, and total earnings. |

| Governing Laws | In the United States, payroll practices are governed by the Fair Labor Standards Act (FLSA) and state-specific labor laws. |

| Record Keeping | Employers are required to keep payroll records for a minimum of three years, ensuring compliance with federal and state regulations. |

Similar forms

The Payroll Check form is similar to the Direct Deposit Authorization form. Both documents are used to facilitate employee compensation, but they differ in how payments are delivered. While the Payroll Check form issues physical checks to employees, the Direct Deposit Authorization form allows employees to authorize their employer to deposit their wages directly into their bank accounts. This not only streamlines the payment process but also enhances security and convenience for employees.

Another document that resembles the Payroll Check form is the Pay Stub. Pay stubs accompany each paycheck, whether it's a physical check or a direct deposit. They provide a detailed breakdown of earnings, deductions, and net pay. Just like the Payroll Check form, the pay stub is essential for employees to understand their compensation and tax withholdings.

The W-2 form is also related to the Payroll Check form. While the Payroll Check form is focused on the actual payment process, the W-2 form summarizes an employee's annual earnings and tax withholdings. Employers provide W-2 forms to employees at the end of the year, allowing them to file their income tax returns accurately. Both documents are crucial for financial record-keeping.

For those navigating the sale of a recreational vehicle, it is important to utilize the correct documentation. A useful resource is the standard RV Bill of Sale template, which can streamline the process and ensure compliance with state regulations. This form captures all necessary details for an effective and legal transaction, safeguarding the interests of both buyer and seller.

Similar to the Payroll Check form is the Employee Time Sheet. This document tracks the hours worked by employees, serving as a basis for calculating wages. The information recorded on the time sheet directly influences the amounts reflected on the Payroll Check form, making it an integral part of the payroll process.

The Payroll Register is another document that shares similarities with the Payroll Check form. It is a comprehensive record of all payroll transactions for a specific period, detailing each employee's earnings, deductions, and net pay. The Payroll Register helps employers manage payroll efficiently and ensures accuracy in the amounts issued through the Payroll Check form.

The 1099 form is also comparable to the Payroll Check form, particularly for independent contractors and freelancers. While the Payroll Check form is used for regular employees, the 1099 form is issued to report income earned by non-employees. Both documents serve as important records for tax reporting, but they cater to different types of workers.

The Employment Agreement shares a connection with the Payroll Check form as well. This document outlines the terms of employment, including salary and payment frequency. While the Payroll Check form is a tool for disbursing wages, the Employment Agreement sets the expectations for compensation, ensuring that both parties understand their rights and responsibilities.

Similar to the Payroll Check form is the Garnishment Order. This legal document directs an employer to withhold a portion of an employee's wages to satisfy a debt. While the Payroll Check form is focused on issuing payments, the Garnishment Order affects the amount that employees ultimately receive, demonstrating how legal obligations can impact payroll.

The Benefits Enrollment Form is another document that relates to the Payroll Check form. This form allows employees to select their benefits, which can affect their take-home pay. Deductions for benefits are reflected in the Payroll Check form, making it essential for employees to understand how their choices will impact their compensation.

Lastly, the Payroll Tax Form is similar to the Payroll Check form in that it deals with the financial aspects of employment. This form is used to report and remit payroll taxes to the government. While the Payroll Check form focuses on the distribution of wages to employees, the Payroll Tax Form ensures compliance with tax regulations, highlighting the interconnectedness of payroll processes.