Blank P 45 It Template

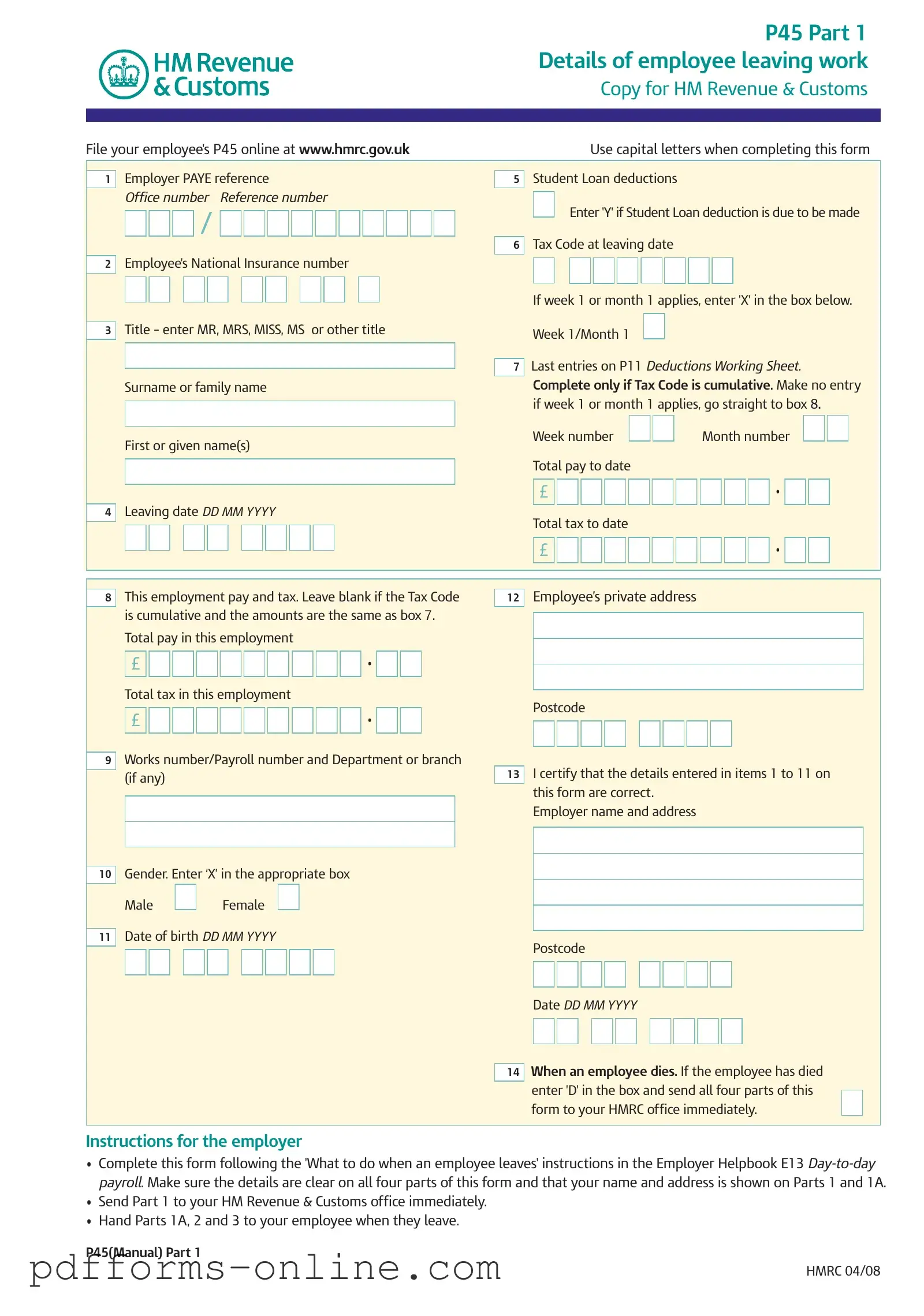

The P45 form is a crucial document that comes into play when an employee leaves a job in the UK. It is divided into three parts, each serving a specific purpose. Part 1 is sent directly to HM Revenue & Customs (HMRC) by the employer, while Parts 1A and 2 are provided to the employee. These sections contain essential information, such as the employee's National Insurance number, tax code at the time of leaving, and details about their earnings and tax deductions. The form also indicates whether any student loan deductions are applicable. Completing the P45 accurately is vital, as it helps ensure that the employee's tax records are up to date, which can prevent issues when they start a new job or claim benefits. Employers must follow specific guidelines when filling out the form, including using capital letters and ensuring clarity in all entries. This attention to detail not only facilitates a smooth transition for the employee but also helps the employer maintain compliance with tax regulations.

Document Example

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 1 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of employee leaving work |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy for HM Revenue & Customs |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Office number |

Reference number |

|

|

|

|

Enter 'Y' if Student Loan deduction is due to be made |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|

||||||||||||||||||||||||

|

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

||||||||||||||||||||||||||

|

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. Make no entry |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if week 1 or month 1 applies, go straight to box 8. |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

8 |

|

This employment pay and tax. Leave blank if the Tax Code |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

is cumulative and the amounts are the same as box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When an employee dies. If the employee has died |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

enter 'D' in the box and send all four parts of this |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

form to your HMRC office immediately. |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for the employer

•Complete this form following the 'What to do when an employee leaves' instructions in the Employer Helpbook E13

•Send Part 1 to your HM Revenue & Customs office immediately.

•Hand Parts 1A, 2 and 3 to your employee when they leave.

P45(Manual) Part 1

HMRC 04/08

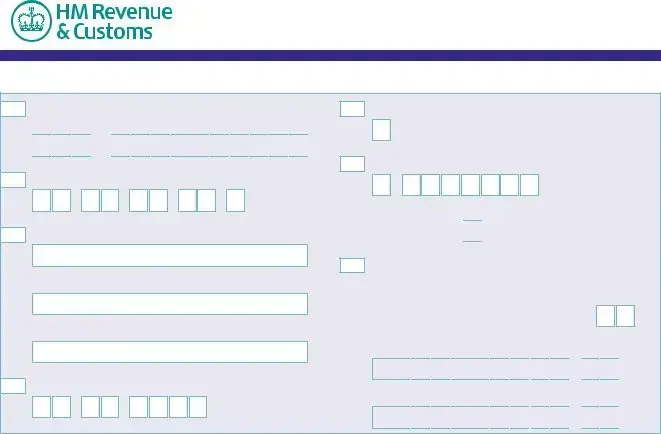

P45 Part 1A

Details of employee leaving work

Copy for employee

|

|

Employer PAYE reference |

|

|

|

|

|

|

|

|

|

|

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

Office number |

Reference number |

|

|

|

|

Student Loan deductions to continue |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

2 |

|

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

|||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS |

or other title |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3 |

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

|

|

|

|

|

|

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6 there will be no entries here. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

Month number |

|

|

|

|

|

||||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s private address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

8 |

|

This employment pay and tax. If no entry here, the amounts |

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

are those shown at box 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Total pay in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Total tax in this employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Works number/Payroll number and Department or branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

(if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

I certify that the details entered in items 1 to 11 on |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this form are correct. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer name and address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gender. Enter ‘X’ in the appropriate box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Male |

|

|

Female |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Date of birth DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the employee

The P45 is in three parts. Please keep this part (Part 1A) safe. Copies are not available. You might need the information in Part 1A to fill in a Tax Return if you are sent one.

Please read the notes in Part 2 that accompany Part 1A. The notes give some important information about what you should do next and what you should do with Parts 2 and 3 of this form.

Tax credits

Tax credits are flexible. They adapt to changes in your life, such as leaving a job. If you need to let us know about a change in your income, phone 0845 300 3900.

To the new employer

If your new employee gives you this Part 1A, please return it to them. Deal with Parts 2 and 3 as normal.

P45(Manual) Part 1A |

HMRC 04/08 |

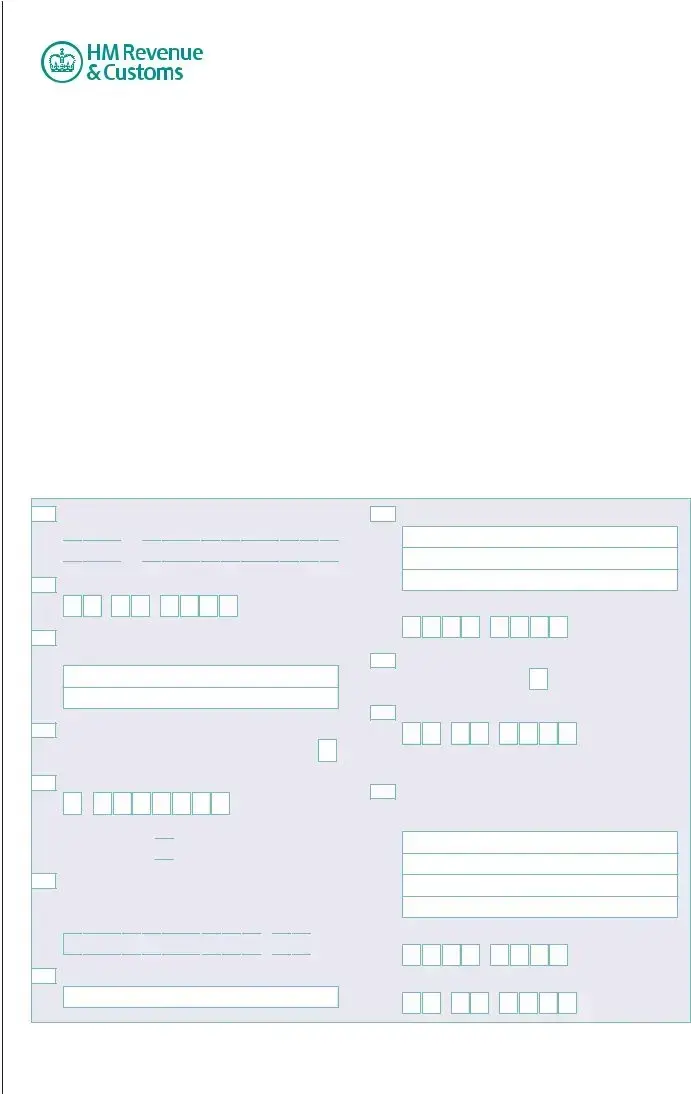

P45 Part 2 Details of employee leaving work

Copy for new employer

1

2

3

4

Employer PAYE reference

Office number Reference number

/

/

Employee's National Insurance number

Title - enter MR, MRS, MISS, MS or other title

Surname or family name

First or given name(s)

Leaving date DD MM YYYY

5Student Loan deductions

Student Loan deductions to continue

6Tax Code at leaving date

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

7Last entries on P11 Deductions Working Sheet. Complete only if Tax Code is cumulative. If there is an ‘X’ at box 6, there will be no entries here.

Week number |

|

|

Month number |

Total pay to date |

|

|

|

£

•

•

Total tax to date

£

•

•

To the employee

This form is important to you. Take good care of it and keep it safe. Copies are not available. Please keep

Parts 2 and 3 of the form together and do not alter them in any way.

Going to a new job

Claiming Jobseeker's Allowance or

Employment and Support Allowance (ESA)

Take this form to your Jobcentre Plus office. They will pay you any tax refund you may be entitled to when your claim ends, or at 5 April if this is earlier.

Give Parts 2 and 3 of this form to your new employer, or you will have tax deducted using the emergency code and may pay too much tax. If you do not want your new employer to know the details on this form, send it to your HM Revenue & Customs (HMRC) office immediately with a letter saying so and giving the name and address of your new employer. HMRC can make special arrangements, but you may pay too much tax for a while as a result of this.

Going abroad

Not working and not claiming Jobseeker's Allowance or Employment and Support Allowance (ESA)

If you have paid tax and wish to claim a refund ask for form P50 Claiming Tax back when you have stopped working from any HMRC office or Enquiry Centre.

Help

If you need further help you can contact any HMRC office or Enquiry Centre. You can find us in The Phone Book under HM Revenue & Customs or go to www.hmrc.gov.uk

If you are going abroad or returning to a country

outside the UK ask for form P85 Leaving the United Kingdom from any HMRC office or Enquiry Centre.

Becoming

You must register with HMRC within three months of becoming

to get a copy of the booklet SE1 Are you thinking of working for yourself?

To the new employer

Check this form and complete boxes 8 to 18 in Part 3 and prepare a form P11 Deductions Working Sheet. Follow the instructions in the Employer Helpbook E13

P45(Manual) Part 2 |

HMRC 04/08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P45 Part 3 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New employee details |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For completion by new employer |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

File your employee's P45 online at www.hmrc.gov.uk |

|

|

|

|

|

|

|

Use capital letters when completing this form |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer PAYE reference |

|

|

Student Loan deductions |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

1 |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Office number Reference number |

|

|

|

|

|

Student Loan deductions to continue |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Tax Code at leaving date |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2 |

Employee's National Insurance number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If week 1 or month 1 applies, enter 'X' in the box below. |

||||||||||||||||||||||

|

|

Title – enter MR, MRS, MISS, MS or other title |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

3 |

|

|

|

|

Week 1/Month 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last entries on P11 Deductions Working Sheet. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Surname or family name |

|

|

|

Complete only if Tax Code is cumulative. If there is an ‘X’ |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

at box 6, there will be no entries here. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week number |

|

|

|

|

|

Month number |

|

|

|

|

||||||||||||

|

|

First or given name(s) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

Total pay to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

|

Leaving date DD MM YYYY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total tax to date |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the new employer Complete boxes 8 to 18 and send P45 Part 3 only to your HMRC office immediately.

8

New employer PAYE reference

Office number Reference number

/

/

15

Employee's private address

9Date new employment started DD MM YYYY

10Works number/Payroll number and Department or branch (if any)

11Enter 'P' here if employee will not be paid by you between the date employment began and the next 5 April.

12Enter Tax Code in use if different to the Tax Code at box 6

If week 1 or month 1 applies, enter 'X' in the box below. Week 1/Month 1

13If the tax figure you are entering on P11 Deductions Working Sheet differs from box 7 (see the E13 Employer Helpbook

figure here.

£

•

•

14New employee's job title or job description

Postcode

16Gender. Enter ‘X’ in the appropriate box

Male |

|

Female |

17Date of birth DD MM YYYY

Declaration

18I have prepared a P11 Deductions Working Sheet in accordance with the details above.

Employer name and address

Postcode

Date DD MM YYYY

P45(Manual) Part 3 |

HMRC 04/08 |

Frequently Asked Questions

-

What is a P45 form?

The P45 form is a document issued by an employer when an employee leaves their job. It contains important information regarding the employee's earnings and the taxes that have been deducted up to the point of leaving. The form is divided into multiple parts, with each part serving a specific purpose for the employer, the employee, and any new employer.

-

What information does the P45 include?

The P45 includes several key details, such as the employee's National Insurance number, tax code at the time of leaving, total pay to date, and total tax deducted. It also records the leaving date and the employer's PAYE reference. This information is crucial for the employee's tax records and for their next employer.

-

How is the P45 form completed?

Employers must fill out the P45 form accurately, following the guidelines provided in the Employer Helpbook E13. They should ensure that all details are clear and that the employer's name and address appear on the relevant parts of the form. Once completed, Part 1 is sent to HM Revenue & Customs (HMRC), while Parts 1A, 2, and 3 are given to the employee.

-

What should an employee do with their P45?

Employees should keep their P45 safe, as it is an important document for tax purposes. They will need it when starting a new job or when filing a tax return. Parts 2 and 3 should be provided to the new employer to ensure proper tax deductions are made. If the employee does not want their new employer to see the details, they can send the form directly to HMRC.

-

What if an employee dies?

If an employee passes away, the employer must mark the P45 with a 'D' in the appropriate box and send all parts of the form to HMRC immediately. This ensures that the tax affairs of the deceased are handled correctly and promptly.

-

What happens if an employee starts a new job?

When starting a new job, an employee should present Part 1A of the P45 to their new employer. This helps the new employer determine the correct tax code to use, preventing the employee from being placed on an emergency tax code, which could lead to overpayment of taxes.

-

Can an employee claim a tax refund using the P45?

Yes, if an employee has overpaid taxes while employed, they can use the P45 to claim a tax refund. They may need to contact HMRC or visit a Jobcentre Plus office to facilitate this process, especially if they are not currently employed or claiming benefits.

-

What should a new employer do with the P45?

A new employer must review the P45 provided by the employee and complete the necessary sections in Part 3. This information is essential for preparing the P11 Deductions Working Sheet. The new employer should send Part 3 to HMRC promptly to ensure accurate tax records are maintained.

-

Where can I find more information about the P45?

Additional information about the P45 form can be found on the HMRC website at www.hmrc.gov.uk. This site offers guidance on completing the form, as well as details about tax codes and deductions. For specific inquiries, employees and employers can also contact HMRC directly.

Misconceptions

Misconceptions about the P45 form can lead to confusion for both employers and employees. Here are four common misconceptions:

- The P45 form is only for employees who are leaving a job permanently. Many believe that the P45 is only issued when an employee permanently leaves their job. However, it can also be relevant for those transitioning to a new job, as it provides necessary tax information for the new employer.

- Employees do not need to keep their P45 after receiving it. Some think that once they receive their P45, they can discard it. In reality, keeping this form is crucial as it contains important tax information that may be needed for future tax returns or claims.

- The P45 form automatically updates tax codes with HMRC. There is a misconception that submitting a P45 automatically updates tax codes with HM Revenue & Customs (HMRC). While the form does inform HMRC of an employee's leaving date and tax details, employees must ensure their new employer has the correct tax code to avoid overpayment of taxes.

- The P45 form is not needed if starting a new job immediately. Some believe that if they start a new job right after leaving their previous one, they do not need to present their P45. This is incorrect. Providing the P45 to the new employer is essential to ensure proper tax deductions and avoid being placed on an emergency tax code.

Common mistakes

-

Not using capital letters: It's essential to fill out the P45 form using capital letters. This ensures clarity and reduces the chances of errors. Many people forget this simple rule, leading to potential misunderstandings.

-

Incorrect National Insurance number: Providing an incorrect National Insurance number can cause significant delays in processing. Double-check this number before submitting the form.

-

Missing the 'X' for Week 1/Month 1: If you are on a Week 1 or Month 1 tax code, failing to mark the box with an 'X' can lead to incorrect tax deductions. This mistake often goes unnoticed until it’s too late.

-

Not certifying the details: It’s crucial to certify that all information entered is correct. Skipping this step can result in complications for both the employee and employer. Make sure to complete this certification before submission.

Additional PDF Templates

Doctors Note Template - A healthcare provider's statement supporting a patient's need for recovery time.

Abn Form Medicare - This notice is not a bill but a warning about potential costs associated with the service.

A New York Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a residential or commercial property. This form serves as a binding contract, detailing essential elements such as rental price, lease duration, and the responsibilities of both parties. Understanding this document is crucial for protecting rights and ensuring a smooth rental experience. For more detailed information, you may refer to the documentonline.org/blank-new-york-lease-agreement.

How to Make Column Graph in Excel - Follow-Up: Schedule a meeting to discuss findings and recommendations.

Document Data

| Fact Name | Description |

|---|---|

| Purpose of P45 | The P45 form is used to document an employee's tax information when they leave a job in the UK. It provides essential details for tax purposes, ensuring accurate tax calculations for future employment. |

| Parts of the Form | The P45 consists of three parts: Part 1 is for HM Revenue & Customs (HMRC), Part 1A is for the employee, and Parts 2 and 3 are for the new employer. |

| Information Required | Key information includes the employee's National Insurance number, leaving date, total pay to date, and total tax to date. This data helps in calculating the tax owed or refunded. |

| Filing Requirements | Employers must send Part 1 to HMRC immediately after an employee leaves. Parts 1A, 2, and 3 should be provided to the employee and new employer, respectively. |

| Student Loan Deductions | The form includes sections for indicating if student loan deductions are applicable. This is crucial for ensuring proper deductions are made in future employment. |

| Emergency Tax Code | If the employee does not provide the P45 to their new employer, they may be placed on an emergency tax code, which could lead to overpayment of taxes. |

| Importance for Employees | Employees should keep Part 1A safe, as it may be needed for tax returns or to claim tax refunds. Losing this part could complicate tax matters. |

| Legal Framework | The P45 form is governed by UK tax law, specifically under the Income Tax (Earnings and Pensions) Act 2003, which outlines the requirements for tax documentation. |

Similar forms

The P45 form is similar to the W-2 form, which is used in the United States to report an employee's annual wages and the taxes withheld from their paychecks. Like the P45, the W-2 provides essential information for tax reporting purposes. Both documents serve as official records of employment and income, helping employees to accurately file their tax returns. While the P45 is issued when an employee leaves a job, the W-2 is provided at the end of the tax year, summarizing earnings and tax withholdings for the entire year.

Another document similar to the P45 is the 1099 form. This form is typically used for independent contractors or freelancers to report income that is not subject to withholding. Like the P45, the 1099 provides details about the total amount earned during a specific period. However, the key difference lies in the employment relationship; the P45 is for employees who have an employer-employee relationship, while the 1099 is for those who work independently. Both forms are crucial for accurate tax reporting.

The P60 form also shares similarities with the P45. In the UK, the P60 is issued at the end of the tax year and summarizes an employee's total pay and tax deductions for that year. This document serves as a record for employees to reference when filing their tax returns. Like the P45, it is important for tax purposes but is provided at a different time in the employment cycle, reflecting a full year of earnings rather than just the period of employment termination.

A Non-disclosure Agreement (NDA) form is essential for anyone dealing with sensitive information in New York. It creates a legal framework that protects confidential data from unauthorized disclosure, offering peace of mind to both individuals and businesses. By clearly outlining the obligations and expectations of all parties involved, it ensures that proprietary information remains secure and is shared only under agreed terms. For further insights into NDAs and their significance, you can visit OnlineLawDocs.com.

The P11D form is another document that has a connection to the P45. This form is used to report benefits and expenses provided to employees that are not included in their regular salary. Similar to the P45, the P11D is relevant for tax calculations. Both documents help ensure that employees and employers fulfill their tax obligations, but they serve different purposes within the employment context.

The IRS Form 1040 is a significant document in the U.S. tax system that also bears similarities to the P45. The 1040 is the standard individual income tax return form used to report income and calculate tax liability. Like the P45, it provides essential information for tax reporting. However, the 1040 encompasses a broader scope, allowing individuals to report various income sources, deductions, and credits, whereas the P45 is focused on employment-related income and tax deductions.

The P60U form, which is less commonly known, is another document that resembles the P45. This form is used to provide a summary of an employee's pay and tax deductions for a specific period, similar to the P60 but for employees who may have had multiple employments within the year. Both the P45 and P60U are critical for ensuring that employees have accurate records for tax reporting, although the P60U is used in a more specific context.