Blank Owner Financing Contract Form

Owner financing can be a valuable option for both buyers and sellers in real estate transactions, allowing for a more flexible approach to financing a property. The Owner Financing Contract form serves as a crucial document in this process, outlining the terms and conditions under which the buyer will purchase the property directly from the seller. Key components of this form include the purchase price, interest rate, repayment schedule, and any down payment required. Additionally, it addresses the responsibilities of both parties, such as property maintenance and insurance obligations. This contract also specifies the consequences of default, ensuring that both the buyer and seller understand their rights and obligations. By clearly defining these aspects, the Owner Financing Contract helps facilitate a smoother transaction while protecting the interests of both parties involved.

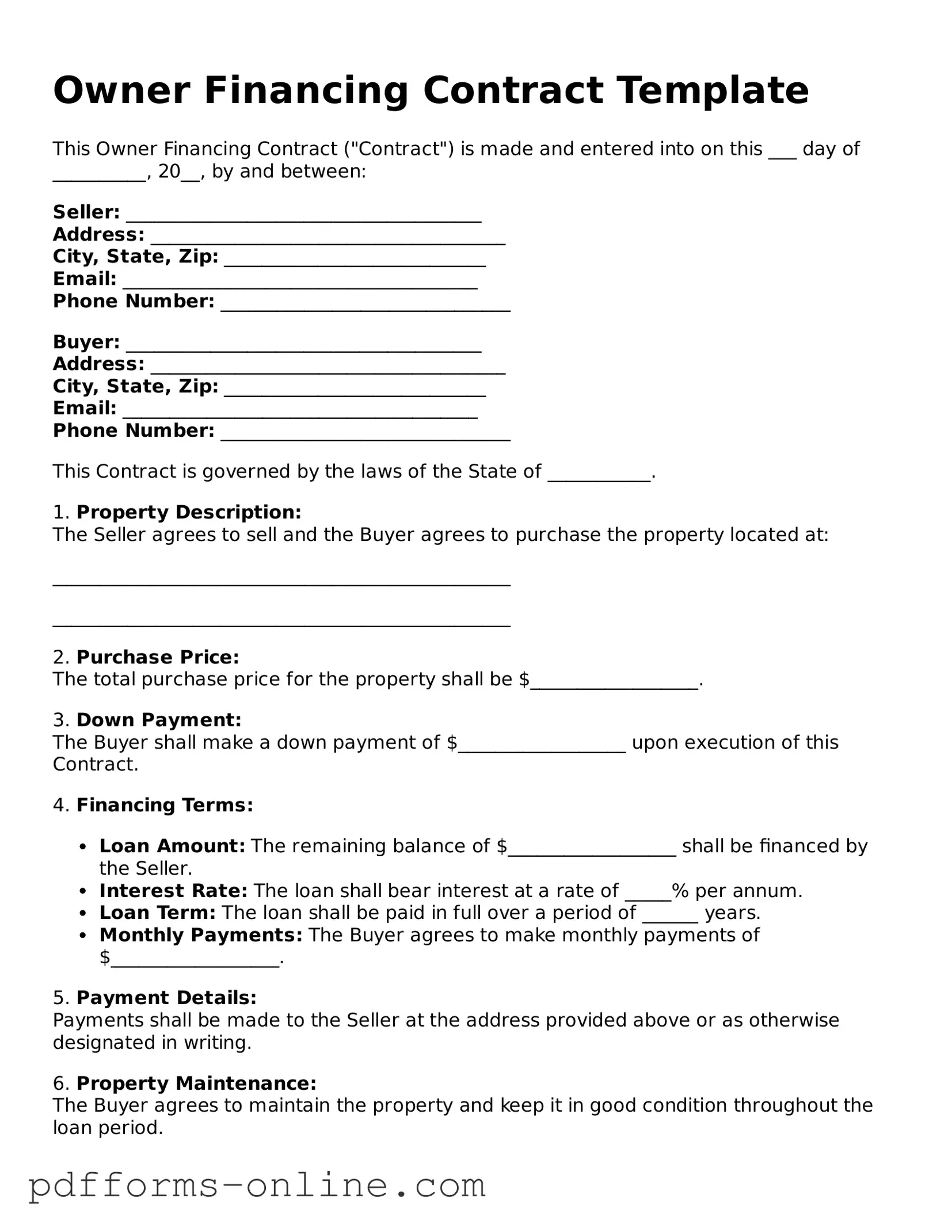

Document Example

Owner Financing Contract Template

This Owner Financing Contract ("Contract") is made and entered into on this ___ day of __________, 20__, by and between:

Seller: ______________________________________

Address: ______________________________________

City, State, Zip: ____________________________

Email: ______________________________________

Phone Number: _______________________________

Buyer: ______________________________________

Address: ______________________________________

City, State, Zip: ____________________________

Email: ______________________________________

Phone Number: _______________________________

This Contract is governed by the laws of the State of ___________.

1. Property Description:

The Seller agrees to sell and the Buyer agrees to purchase the property located at:

_________________________________________________

_________________________________________________

2. Purchase Price:

The total purchase price for the property shall be $__________________.

3. Down Payment:

The Buyer shall make a down payment of $__________________ upon execution of this Contract.

4. Financing Terms:

- Loan Amount: The remaining balance of $__________________ shall be financed by the Seller.

- Interest Rate: The loan shall bear interest at a rate of _____% per annum.

- Loan Term: The loan shall be paid in full over a period of ______ years.

- Monthly Payments: The Buyer agrees to make monthly payments of $__________________.

5. Payment Details:

Payments shall be made to the Seller at the address provided above or as otherwise designated in writing.

6. Property Maintenance:

The Buyer agrees to maintain the property and keep it in good condition throughout the loan period.

7. Default:

In the event of default on the payment schedule, the Seller may take actions permissible under state law, including but not limited to:

- Acceleration of the debt.

- Foreclosure of the property, if applicable.

- Collection of any overdue amounts.

8. Governing Law:

This Contract shall be construed in accordance with the laws of the State of ___________.

9. Entire Agreement:

This document constitutes the entire agreement between the parties. No modifications shall be valid unless in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Owner Financing Contract as of the day and year first above written.

Seller's Signature: _________________________ Date: ____________

Buyer's Signature: _________________________ Date: ____________

Frequently Asked Questions

-

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a property seller and buyer, where the seller provides financing to the buyer to purchase the property. Instead of going through a traditional bank or mortgage lender, the buyer makes payments directly to the seller over an agreed-upon period.

-

What are the benefits of using an Owner Financing Contract?

There are several advantages to owner financing. For buyers, it can provide access to property without the stringent requirements often imposed by banks, such as high credit scores or large down payments. Sellers may benefit from a quicker sale and the ability to earn interest on the financed amount, which can lead to additional income over time.

-

What terms are typically included in an Owner Financing Contract?

Common terms in an Owner Financing Contract include:

- The purchase price of the property

- The down payment amount

- The interest rate

- The repayment schedule (monthly, quarterly, etc.)

- The length of the financing period

- Any consequences for late payments or defaults

-

Are there risks associated with Owner Financing?

Yes, both buyers and sellers face certain risks. Buyers may risk losing their investment if they fail to meet the payment terms. Sellers, on the other hand, could face challenges if the buyer defaults, potentially leading to lengthy and costly foreclosure processes. It's crucial for both parties to understand these risks and consider consulting with a legal professional.

-

Can an Owner Financing Contract be modified?

Yes, an Owner Financing Contract can be modified, but both parties must agree to the changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure that they are legally enforceable.

-

What happens if the buyer defaults on the loan?

If the buyer defaults, the seller typically has the right to initiate foreclosure proceedings. The specific process and consequences depend on the terms outlined in the contract and state laws. Buyers should be aware of their obligations and communicate with the seller if they encounter financial difficulties.

-

Is it necessary to involve a lawyer in an Owner Financing Contract?

While it is not legally required to involve a lawyer, it is highly advisable. A legal professional can help ensure that the contract is properly drafted, that both parties understand their rights and obligations, and that the agreement complies with state laws. This can provide peace of mind and help prevent future disputes.

Misconceptions

Owner financing can be a great option for both buyers and sellers, but several misconceptions often surround the Owner Financing Contract form. Here are six common misunderstandings:

-

Owner financing is only for buyers with bad credit.

While owner financing can help buyers with less-than-perfect credit, it is not exclusively for them. Many buyers choose this option for its flexibility, regardless of their credit score.

-

All owner financing agreements are the same.

Each owner financing contract can be tailored to fit the specific needs of both the buyer and the seller. Terms, interest rates, and repayment schedules can vary widely.

-

The seller has no legal protections.

Sellers can include various protections in the contract, such as clauses that allow them to reclaim the property if the buyer defaults on payments. Properly drafted agreements can safeguard the seller's interests.

-

Owner financing means the seller has to wait years to get paid.

Not true! Sellers can negotiate terms that allow for a lump sum payment after a certain period or can even sell the note to receive cash sooner.

-

Buyers can't build equity with owner financing.

Buyers can build equity just like they would with a traditional mortgage. As they make payments, they increase their ownership stake in the property.

-

Owner financing is only for residential properties.

This financing option can be used for various types of properties, including commercial real estate. Both buyers and sellers can benefit from this arrangement in different markets.

Understanding these misconceptions can help both buyers and sellers make informed decisions about owner financing contracts.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to confusion. Ensure that all fields are filled out completely, including names, addresses, and property details.

-

Incorrect Terms: Misunderstanding the financing terms can create problems later. Double-check the interest rate, payment schedule, and loan duration to avoid future disputes.

-

Not Disclosing Liens: Omitting any existing liens on the property can cause legal issues. Always disclose any outstanding debts associated with the property to protect all parties involved.

-

Ignoring State Laws: Each state has its own regulations regarding owner financing. Familiarize yourself with local laws to ensure compliance and avoid potential legal complications.

-

Failure to Include Contingencies: Not specifying contingencies can lead to misunderstandings. Clearly outline any conditions that must be met for the agreement to be valid.

-

Neglecting Signatures: Forgetting to sign the document can invalidate the contract. Ensure that all parties sign and date the contract to make it legally binding.

Fill out Common Types of Owner Financing Contract Forms

Purchase Agreement Addendum - The addendum is crucial for ensuring compliance with local regulations.

When entering into a real estate transaction in Texas, it is crucial to have a well-drafted agreement in place to protect the interests of both parties involved. For those looking to streamline this process, you can access the document in pdf, which will guide you through the necessary steps to complete your real estate purchase efficiently and effectively.

Contract Cancellation Letter Pdf - This form should be signed by both parties for it to be valid.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller finances the purchase of their property directly to the buyer. |

| Purpose | This contract allows buyers who may not qualify for traditional financing to purchase a home. |

| Governing Law | In the United States, laws regarding owner financing vary by state. It's essential to consult local regulations. |

| Down Payment | Typically, a down payment is required, which can vary based on the agreement between the buyer and seller. |

| Interest Rates | The seller can set the interest rate, which may differ from traditional mortgage rates. |

| Loan Term | Loan terms can be flexible, often ranging from a few years to several decades, depending on the agreement. |

| Default Terms | The contract should outline what happens in case of default, including potential foreclosure procedures. |

| Transferability | Owner financing contracts may include clauses regarding the transfer of the loan if the property is sold. |

| Closing Process | The closing process for an owner financing deal can be simpler than traditional sales, often requiring less documentation. |

Similar forms

The Owner Financing Contract shares similarities with a Purchase Agreement, which outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. Both documents detail the purchase price, property description, and the responsibilities of each party. However, while a Purchase Agreement typically involves a traditional financing method through a lender, the Owner Financing Contract specifically allows the seller to finance the purchase directly to the buyer, bypassing the need for a bank or mortgage company. This direct arrangement can lead to more flexible terms and potentially quicker closings.

Another document that resembles the Owner Financing Contract is the Lease Option Agreement. This agreement allows a tenant to lease a property with the option to purchase it at a later date. Like owner financing, it provides an alternative path to homeownership, particularly for those who may not qualify for traditional financing. The Lease Option Agreement typically includes terms regarding the lease duration, purchase price, and the portion of rent that may be credited toward the purchase price, making it a hybrid of renting and buying.

The Promissory Note is also akin to the Owner Financing Contract. This document serves as a written promise by the buyer to repay the seller for the loan amount, including interest. While the Owner Financing Contract outlines the broader terms of the sale, the Promissory Note focuses specifically on the repayment obligations. It details the loan amount, interest rate, payment schedule, and consequences of default, ensuring both parties have a clear understanding of the financial commitment involved in the transaction.

Additionally, a Deed of Trust bears similarities to the Owner Financing Contract. This document is often used in conjunction with owner financing, as it secures the loan by placing a lien on the property. In the event of default, the Deed of Trust allows the seller to reclaim the property without going through the lengthy foreclosure process typically required by traditional lenders. This security interest provides peace of mind to the seller, knowing they have a legal claim to the property until the buyer fulfills their payment obligations.

When engaging in a real estate transaction, understanding the relevant documents is essential for both buyers and sellers. For instance, the California Real Estate Purchase Agreement form lays out the specific terms of the sale, including price, contingencies, and closing details, which complement other agreements like the Owner Financing Contract. For more information on these agreements, you can visit https://formcalifornia.com/.

The Mortgage Agreement is another document that aligns closely with the Owner Financing Contract. While a Mortgage Agreement is usually associated with traditional bank financing, it serves a similar purpose in establishing the terms under which a buyer borrows money to purchase real estate. Both documents outline the loan amount, interest rate, and repayment terms, but the key difference lies in the source of financing. In owner financing, the seller acts as the lender, whereas in a Mortgage Agreement, a financial institution typically provides the funds.

Lastly, the Real Estate Sales Contract is comparable to the Owner Financing Contract, as both documents facilitate the transfer of property ownership. The Real Estate Sales Contract includes essential details such as the purchase price, closing date, and contingencies. However, the Owner Financing Contract specifically addresses the financing terms, allowing the seller to provide credit to the buyer directly. This distinction can make the Owner Financing Contract a more tailored solution for buyers who may face challenges securing traditional financing.