Blank Operating Agreement Form

An Operating Agreement is a crucial document for any Limited Liability Company (LLC), serving as a roadmap for the internal operations and management of the business. This form outlines the roles and responsibilities of members, clarifying how decisions are made and profits are distributed. It typically includes details on ownership percentages, voting rights, and procedures for adding or removing members. Additionally, the Operating Agreement addresses how disputes will be resolved, ensuring that all parties have a clear understanding of the processes in place. By establishing guidelines for the day-to-day functioning of the LLC, this document helps prevent misunderstandings and conflicts among members, ultimately contributing to a more harmonious business environment.

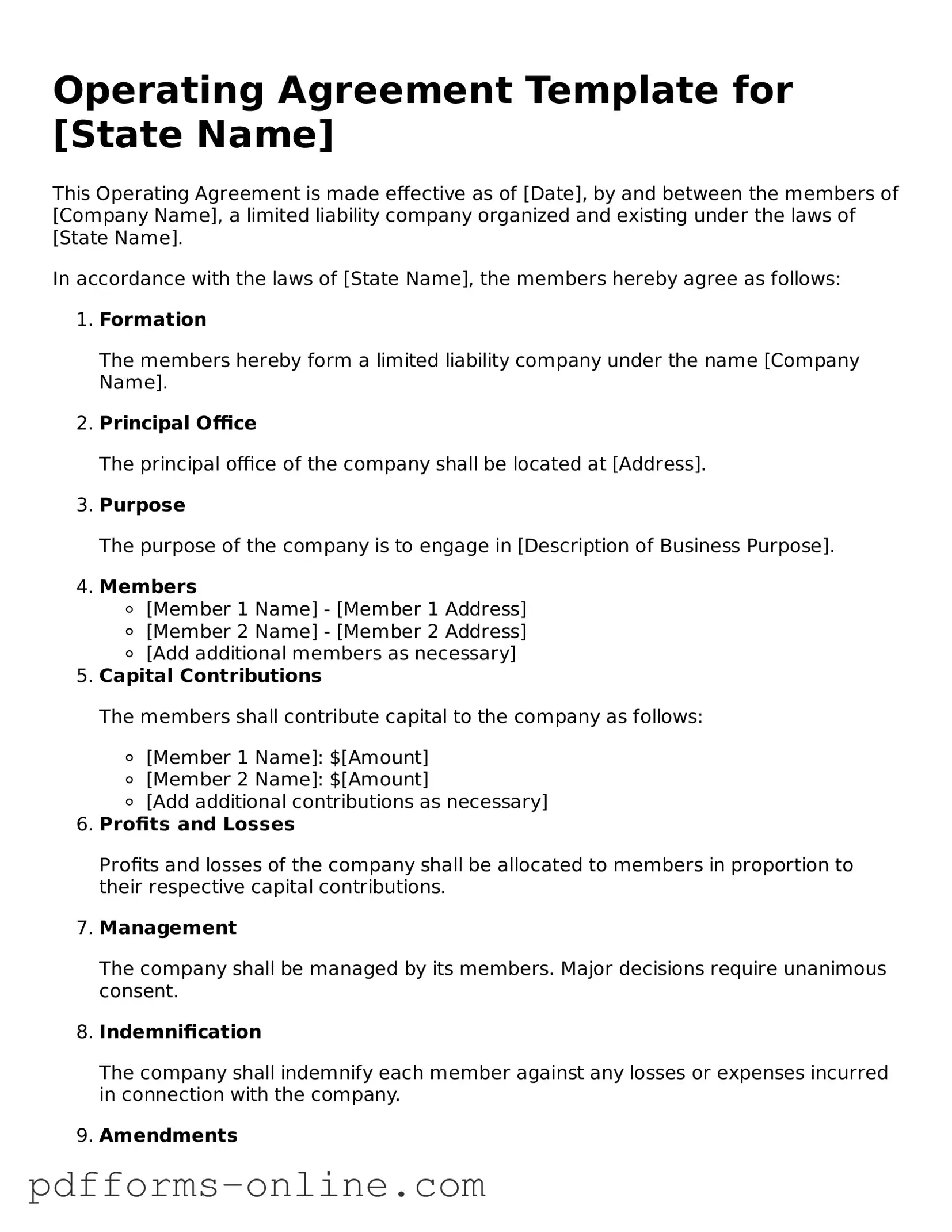

Document Example

Operating Agreement Template for [State Name]

This Operating Agreement is made effective as of [Date], by and between the members of [Company Name], a limited liability company organized and existing under the laws of [State Name].

In accordance with the laws of [State Name], the members hereby agree as follows:

- Formation

The members hereby form a limited liability company under the name [Company Name].

- Principal Office

The principal office of the company shall be located at [Address].

- Purpose

The purpose of the company is to engage in [Description of Business Purpose].

- Members

- [Member 1 Name] - [Member 1 Address]

- [Member 2 Name] - [Member 2 Address]

- [Add additional members as necessary]

- Capital Contributions

The members shall contribute capital to the company as follows:

- [Member 1 Name]: $[Amount]

- [Member 2 Name]: $[Amount]

- [Add additional contributions as necessary]

- Profits and Losses

Profits and losses of the company shall be allocated to members in proportion to their respective capital contributions.

- Management

The company shall be managed by its members. Major decisions require unanimous consent.

- Indemnification

The company shall indemnify each member against any losses or expenses incurred in connection with the company.

- Amendments

This Agreement may be amended only by a written agreement signed by all members.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of [State Name].

IN WITNESS WHEREOF, the parties have executed this Operating Agreement as of the date first above written.

[Member 1 Signature] ____________________ Date: ____________

[Member 2 Signature] ____________________ Date: ____________

[Add additional member signatures as necessary]

State-specific Guides for Operating Agreement Documents

Operating Agreement Form Types

Frequently Asked Questions

-

What is an Operating Agreement?

An Operating Agreement is a crucial document for limited liability companies (LLCs). It outlines the ownership structure, management responsibilities, and operational procedures of the LLC. This agreement serves as an internal guideline for members and helps clarify how the business will be run. Without it, state laws may dictate how the LLC operates, which might not align with the members' intentions.

-

Who needs an Operating Agreement?

Every LLC, regardless of its size or number of members, should have an Operating Agreement. Even single-member LLCs benefit from having this document as it establishes the owner’s rights and responsibilities. For multi-member LLCs, the agreement is even more vital as it helps prevent misunderstandings and disputes among members regarding management and profit distribution.

-

What should be included in an Operating Agreement?

An Operating Agreement typically includes:

- Names and addresses of members

- Percentage of ownership for each member

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Profit and loss distribution

- Rules for meetings and decision-making

- Procedures for adding or removing members

- Buyout provisions in case a member wants to leave

These elements help ensure clarity and agreement among members regarding the operation of the LLC.

-

Is an Operating Agreement legally required?

While many states do not legally require LLCs to have an Operating Agreement, it is highly recommended. Having this document can provide legal protection and clarity for the members. In case of disputes or legal challenges, a well-drafted Operating Agreement can serve as evidence of the members’ intentions and agreements.

-

Can an Operating Agreement be amended?

Yes, an Operating Agreement can be amended. As businesses grow and change, members may find it necessary to update the agreement to reflect new circumstances or decisions. The process for amending the Operating Agreement should be clearly outlined within the document itself. Typically, amendments require a vote among the members, and a record of the changes should be documented.

-

How does an Operating Agreement differ from Articles of Organization?

Articles of Organization are the formal documents filed with the state to legally establish an LLC. They include basic information such as the LLC's name, address, and registered agent. In contrast, an Operating Agreement is an internal document that details the operational rules and member relationships. While Articles of Organization are required for formation, an Operating Agreement is not always mandatory but is highly beneficial.

-

Where can I find a template for an Operating Agreement?

Many resources are available for obtaining a template for an Operating Agreement. Online legal service providers often offer customizable templates. Additionally, state-specific business websites may provide guidance and examples. It is advisable to consult with a legal professional to ensure that the agreement meets specific needs and complies with state laws.

Misconceptions

When it comes to Operating Agreements, many people hold misconceptions that can lead to confusion. Here are nine common misunderstandings about this important document:

- Operating Agreements are only for LLCs. Many believe that only Limited Liability Companies need an Operating Agreement. However, any business structure can benefit from having one, as it outlines the management and operational procedures.

- They are not legally required. While not all states mandate an Operating Agreement, having one is crucial for clarifying roles and responsibilities, even if it’s not legally required.

- All Operating Agreements are the same. Each Operating Agreement should be tailored to fit the specific needs of the business and its members. A one-size-fits-all approach can lead to problems down the line.

- Once created, they can’t be changed. Operating Agreements can and should be updated as the business evolves. Flexibility is key to keeping the document relevant.

- They only cover financial matters. While financial aspects are important, Operating Agreements also address management structure, decision-making processes, and member responsibilities.

- Verbal agreements are sufficient. Relying on verbal agreements can lead to misunderstandings. A written Operating Agreement provides clarity and serves as a reference point for all members.

- They are only necessary at the start of a business. Operating Agreements should be revisited regularly, especially when new members join or significant changes occur in the business.

- Having an Operating Agreement guarantees success. While a solid Operating Agreement is essential, it does not ensure success. It’s just one part of a broader business strategy.

- They are only for large businesses. Small businesses and startups can benefit greatly from an Operating Agreement. It helps establish a clear framework from the beginning.

Understanding these misconceptions can help you better navigate the complexities of forming and running a business. An Operating Agreement is a valuable tool that can provide clarity and direction.

Common mistakes

-

Neglecting to Define Roles and Responsibilities: One common mistake is failing to clearly outline the roles and responsibilities of each member. Without this clarity, misunderstandings can arise, leading to conflicts down the road.

-

Omitting Capital Contributions: It's crucial to specify how much each member is contributing to the business. Leaving this out can create disputes over ownership percentages and profit sharing later on.

-

Ignoring Voting Rights: Many people forget to address how decisions will be made within the company. Not establishing voting rights can lead to confusion and disagreements when important decisions need to be made.

-

Not Including an Exit Strategy: An exit strategy is essential for any business. Failing to include provisions for what happens if a member wants to leave or if the business is dissolved can complicate matters significantly.

-

Using Generic Templates: Relying on generic templates without customization can be a major pitfall. Each business is unique, and an operating agreement should reflect the specific needs and agreements of its members.

Popular Templates

Rental Termination Letter - A formal notice to end a rental agreement.

Scrivener's Affidavit California - A sworn statement that reinforces the scrivener's compliance with established regulations.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a document that outlines the management structure and operating procedures of a limited liability company (LLC). |

| Purpose | This agreement helps to clarify the rights and responsibilities of members, reducing the potential for disputes. |

| Legal Requirement | While not required in all states, having an Operating Agreement is highly recommended for LLCs to establish clear guidelines. |

| State-Specific Forms | Some states, such as Delaware and California, have specific requirements for the content of Operating Agreements. |

| Governing Law | The governing law for an Operating Agreement typically follows the state where the LLC is formed, such as the Delaware Limited Liability Company Act. |

| Member Rights | The agreement specifies the voting rights of members, profit sharing, and procedures for adding or removing members. |

| Flexibility | Operating Agreements can be customized to meet the unique needs of the LLC, allowing for flexibility in management and operations. |

| Dispute Resolution | Many agreements include provisions for resolving disputes among members, such as mediation or arbitration clauses. |

Similar forms

The Operating Agreement is akin to a Partnership Agreement, which outlines the relationship between partners in a business venture. Just as the Operating Agreement defines the roles, responsibilities, and profit-sharing among members of a limited liability company (LLC), a Partnership Agreement serves a similar purpose for partners in a general or limited partnership. Both documents establish the framework for governance and decision-making, ensuring that all parties are aligned in their objectives and expectations.

Another document similar to the Operating Agreement is the Bylaws of a corporation. Bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting protocols, and voting procedures. Like an Operating Agreement, Bylaws serve to clarify the structure and operational guidelines of an entity, promoting transparency and accountability among stakeholders.

The Shareholders Agreement also bears resemblance to the Operating Agreement. This document outlines the rights and obligations of shareholders in a corporation. It addresses issues such as share transfers, voting rights, and dispute resolution. Much like the Operating Agreement, it aims to protect the interests of all parties involved and ensure smooth governance within the entity.

A Joint Venture Agreement shares similarities with the Operating Agreement in that it governs a collaborative business endeavor between two or more parties. This document outlines the contributions, responsibilities, and profit-sharing arrangements of each party involved. Both agreements are essential for establishing clear expectations and minimizing conflicts in business relationships.

The LLC Membership Certificate serves a related purpose by formally recognizing an individual's ownership interest in an LLC. While the Operating Agreement details the operational aspects, the Membership Certificate provides proof of membership and may outline rights associated with ownership. Both documents work together to define the relationship between the members and the company.

A Non-Disclosure Agreement (NDA) can also be compared to the Operating Agreement in terms of protecting sensitive information. While the Operating Agreement focuses on the operational framework, an NDA is designed to safeguard proprietary information shared among parties. Both documents are essential for maintaining trust and confidentiality in business relationships.

The Employment Agreement is another document that parallels the Operating Agreement, particularly in how it defines the terms of employment for individuals within a company. This agreement outlines job responsibilities, compensation, and termination conditions. Similarly, the Operating Agreement delineates the roles of members within an LLC, ensuring clarity in expectations and responsibilities.

A Franchise Agreement shares characteristics with the Operating Agreement, especially in how it regulates the relationship between a franchisor and franchisee. This document specifies the rights and obligations of each party, including operational guidelines and branding standards. Both agreements aim to create a cohesive framework for business operations and protect the interests of all parties involved.

The Terms of Service (ToS) can also be likened to the Operating Agreement, particularly in digital businesses. The ToS outlines the rules and guidelines that users must agree to in order to access a service. Like the Operating Agreement, it sets expectations for behavior and responsibilities, helping to mitigate disputes and clarify the relationship between the service provider and the user.

Lastly, a Buy-Sell Agreement is similar to the Operating Agreement in that it governs the transfer of ownership interests in a business. This document outlines the conditions under which a member can sell their interest, ensuring that all parties understand the process and implications of ownership changes. Both agreements are vital for maintaining stability and continuity in business operations.