Valid Ohio Transfer-on-Death Deed Template

The Ohio Transfer-on-Death Deed form serves as a valuable estate planning tool, allowing property owners to transfer real estate to beneficiaries upon their death without the need for probate. This form simplifies the process of passing on property, ensuring that the transfer occurs automatically and directly to the designated individuals. By completing this deed, a property owner retains full control of their property during their lifetime, enabling them to sell, lease, or modify it as they wish. The deed must be properly executed, signed, and recorded with the county recorder's office to be legally effective. Beneficiaries named in the deed do not acquire any rights to the property until the owner's death, which helps avoid potential disputes during the owner's lifetime. Additionally, the form allows for the designation of multiple beneficiaries and provides options for contingent beneficiaries, offering flexibility in estate planning. Understanding the nuances of the Transfer-on-Death Deed can aid individuals in making informed decisions about their property and ensuring their wishes are honored after their passing.

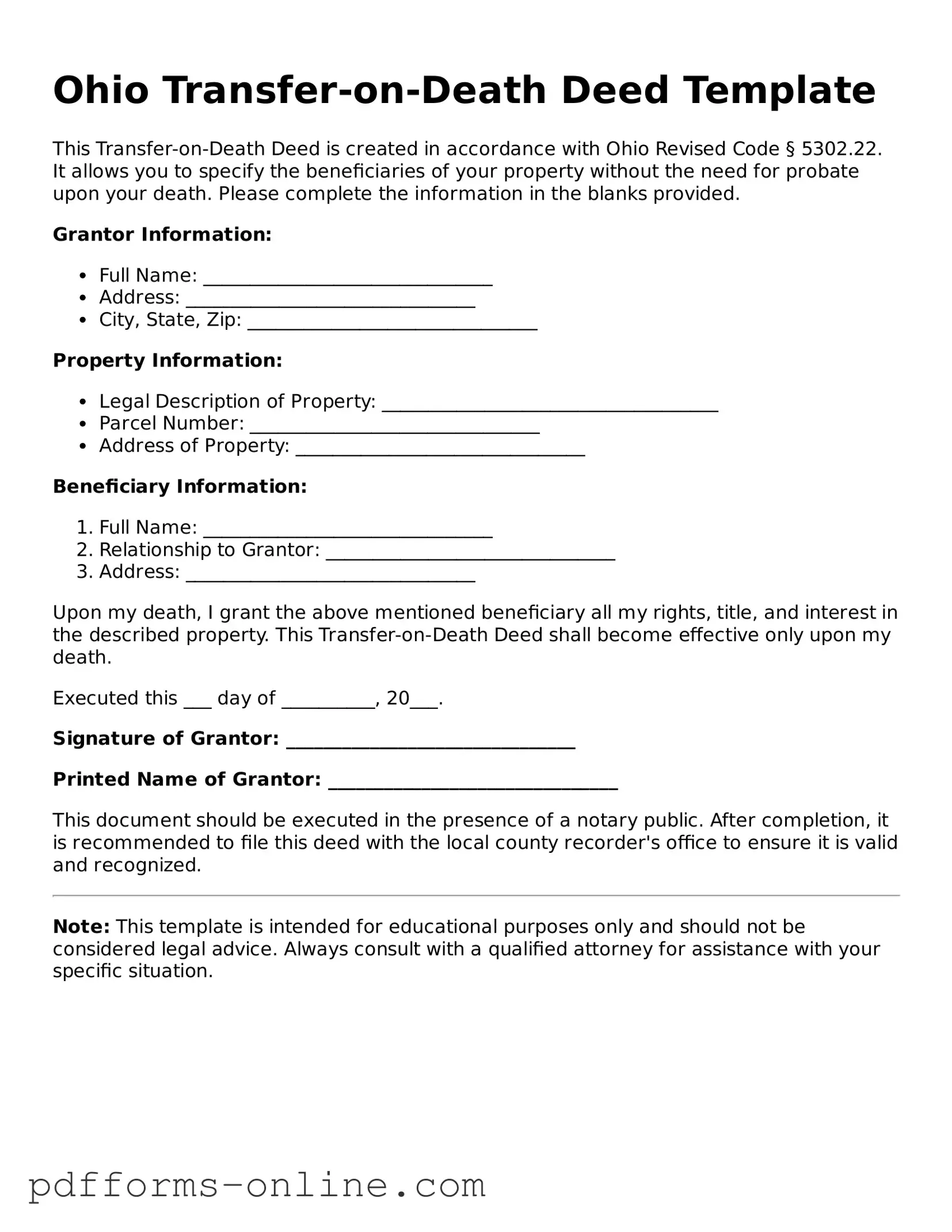

Document Example

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with Ohio Revised Code § 5302.22. It allows you to specify the beneficiaries of your property without the need for probate upon your death. Please complete the information in the blanks provided.

Grantor Information:

- Full Name: _______________________________

- Address: _______________________________

- City, State, Zip: _______________________________

Property Information:

- Legal Description of Property: ____________________________________

- Parcel Number: _______________________________

- Address of Property: _______________________________

Beneficiary Information:

- Full Name: _______________________________

- Relationship to Grantor: _______________________________

- Address: _______________________________

Upon my death, I grant the above mentioned beneficiary all my rights, title, and interest in the described property. This Transfer-on-Death Deed shall become effective only upon my death.

Executed this ___ day of __________, 20___.

Signature of Grantor: _______________________________

Printed Name of Grantor: _______________________________

This document should be executed in the presence of a notary public. After completion, it is recommended to file this deed with the local county recorder's office to ensure it is valid and recognized.

Note: This template is intended for educational purposes only and should not be considered legal advice. Always consult with a qualified attorney for assistance with your specific situation.

Frequently Asked Questions

-

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to transfer real estate to a beneficiary upon their death. This deed enables the owner to maintain control of the property during their lifetime while ensuring a smooth transition of ownership without going through probate.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Ohio can use a Transfer-on-Death Deed. This includes homeowners, landowners, and those who hold property in their name. However, it is important to note that the property must not be held in a trust or owned by a business entity.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you need to fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, it must be signed in the presence of a notary public. Finally, the deed must be recorded with the county recorder's office where the property is located to be legally valid.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do this, you must complete a new deed that either names a different beneficiary or explicitly states that the previous deed is revoked. This new deed also needs to be signed, notarized, and recorded to take effect.

-

What happens if I sell the property before I pass away?

If you sell the property before your death, the Transfer-on-Death Deed becomes void. The beneficiary will not receive the property since it is no longer owned by you. It’s important to keep your beneficiary informed about any changes in ownership.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications for the property owner when using a Transfer-on-Death Deed. However, beneficiaries may face tax obligations upon inheriting the property. It’s advisable to consult with a tax professional for specific guidance based on your situation.

Misconceptions

The Ohio Transfer-on-Death Deed (TODD) form can be a useful tool for estate planning, but several misconceptions often surround its use. Understanding these misconceptions can help individuals make informed decisions about their property and estate. Here are seven common misunderstandings:

-

Misconception 1: The Transfer-on-Death Deed is only for large estates.

This is not true. The TODD can be used for any real estate property, regardless of the estate's size. It provides a straightforward way to transfer property without the complexities of probate.

-

Misconception 2: The property is transferred immediately upon signing the deed.

Actually, the transfer does not take place until the owner passes away. Until that time, the property remains under the owner's control.

-

Misconception 3: A Transfer-on-Death Deed eliminates the need for a will.

This is misleading. While a TODD can simplify the transfer of specific properties, a will may still be necessary to address other assets and matters of the estate.

-

Misconception 4: All heirs must agree to the Transfer-on-Death Deed.

In fact, the property owner can designate beneficiaries without needing the consent of other heirs. This allows for individual preferences in property distribution.

-

Misconception 5: The Transfer-on-Death Deed is complicated to create.

On the contrary, the TODD form is designed to be user-friendly. Many individuals can complete it without professional assistance, though consulting an expert can provide additional peace of mind.

-

Misconception 6: The Transfer-on-Death Deed can be revoked only under specific conditions.

This is incorrect. The property owner can revoke or change the TODD at any time before their death, allowing for flexibility as circumstances change.

-

Misconception 7: The Transfer-on-Death Deed affects how property is taxed.

In reality, the TODD does not change the tax status of the property. Taxes are assessed based on ownership and property value, not on the deed type.

By clearing up these misconceptions, individuals can better navigate their estate planning options and make choices that align with their goals.

Common mistakes

-

Not including the property description. It’s essential to provide a clear and complete description of the property. Without this, the deed may not be valid.

-

Failing to sign the deed. The deed must be signed by the owner. If it’s not signed, it won’t be recognized as valid.

-

Not having the deed notarized. A Transfer-on-Death Deed requires notarization. Without a notary’s signature, the document may be questioned.

-

Incorrectly identifying beneficiaries. Make sure to list the beneficiaries accurately. Errors here can lead to disputes or complications later.

-

Not recording the deed. After filling out the form, it must be filed with the county recorder. If it’s not recorded, it won’t take effect.

-

Ignoring state-specific requirements. Each state has its own rules. Familiarize yourself with Ohio’s specific requirements to avoid pitfalls.

Find Some Other Transfer-on-Death Deed Forms for Specific States

Transfer on Death Deed Nc - The deed typically takes effect automatically upon the owner's death, providing clarity for heirs.

The Texas Hold Harmless Agreement form is a legal document that protects one party from legal and financial responsibilities arising from specific incidents. This agreement is commonly used in situations involving potential risks or damages. By using this form, individuals or entities can conduct business or engage in activities within Texas without worrying about unforeseen liabilities, as highlighted in resources like OnlineLawDocs.com.

Ladybird Deed Texas Form - By designating a Transfer-on-Death Deed, owners can keep their estate plan straightforward.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Transfer-on-Death Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | This deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the owner, provided the revocation is executed and recorded. |

| Beneficiary Designation | Multiple beneficiaries can be named, and they can be designated to receive equal or unequal shares of the property. |

| Recording Requirement | The deed must be recorded with the county recorder's office to be effective. |

| Impact on Taxes | The transfer does not affect property taxes until the property is transferred to the beneficiary upon the owner's death. |

Similar forms

The Ohio Transfer-on-Death Deed (TOD) form is similar to a will in that both documents allow individuals to dictate the distribution of their assets upon death. A will provides a comprehensive plan for asset distribution, appoints guardians for minor children, and can address debts and taxes. However, unlike a will, a TOD deed allows for the direct transfer of real property without the need for probate. This can simplify the process for heirs and ensure a quicker transfer of ownership, as the property passes directly to the named beneficiary upon the owner’s death.

The New York Operating Agreement form is a vital document for LLCs, providing a structured framework for management and operational procedures, which is essential for the clarity and protection of all parties involved. For more detailed information and resources, you can visit https://documentonline.org/blank-new-york-operating-agreement, which can assist business owners in effectively navigating the complexities of LLC operations.