Valid Ohio Tractor Bill of Sale Template

When it comes to buying or selling a tractor in Ohio, having the right paperwork is essential to ensure a smooth transaction. The Ohio Tractor Bill of Sale form serves as a vital document that not only provides proof of ownership but also outlines the terms of the sale between the buyer and the seller. This form typically includes important details such as the names and addresses of both parties, a description of the tractor—including its make, model, year, and Vehicle Identification Number (VIN)—and the agreed-upon purchase price. Additionally, the document may include information about any warranties or conditions attached to the sale. By properly completing this form, both parties can protect their interests and maintain clear records of the transaction, minimizing potential disputes in the future. Understanding the nuances of this form can help ensure that all legal requirements are met and that the transfer of ownership is executed efficiently.

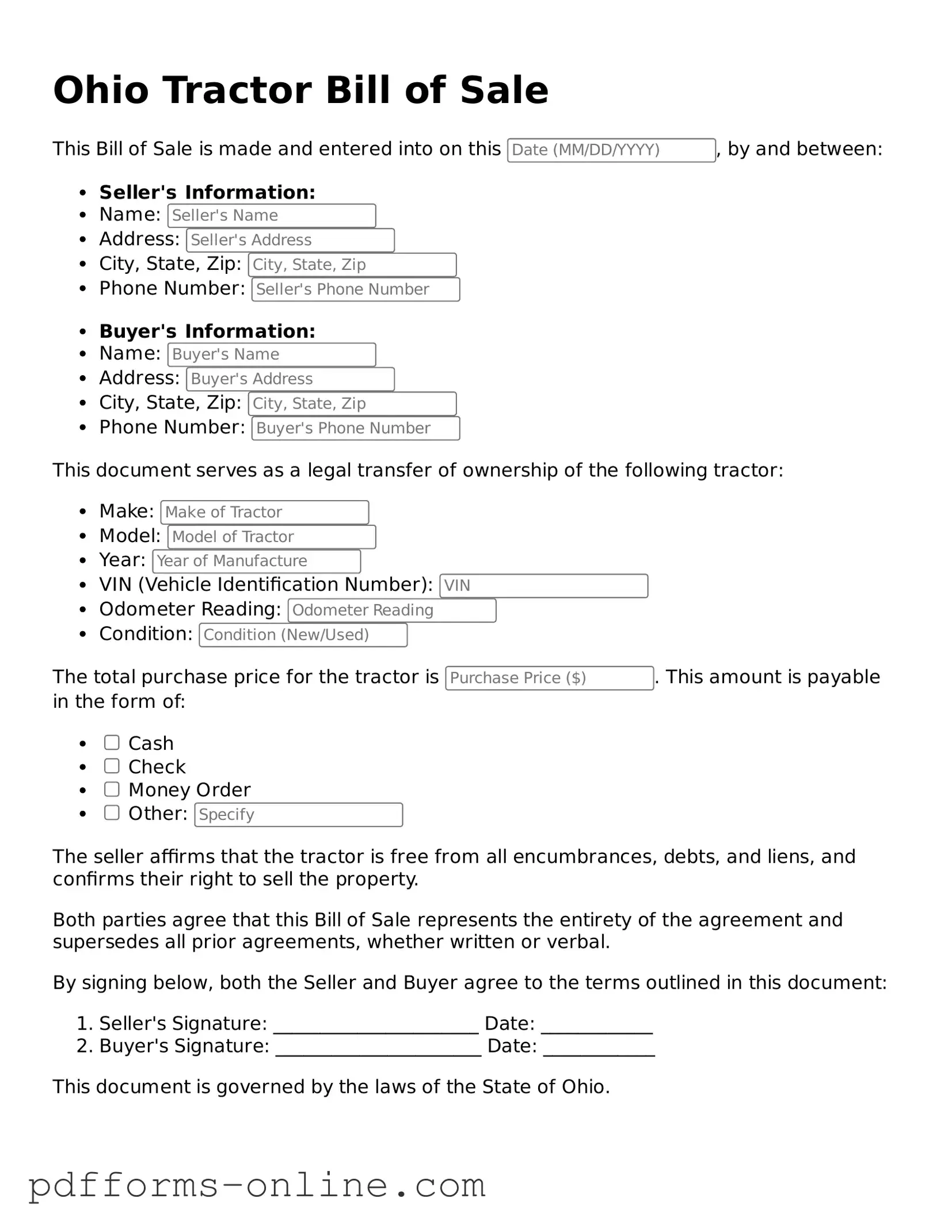

Document Example

Ohio Tractor Bill of Sale

This Bill of Sale is made and entered into on this , by and between:

- Seller's Information:

- Name:

- Address:

- City, State, Zip:

- Phone Number:

- Buyer's Information:

- Name:

- Address:

- City, State, Zip:

- Phone Number:

This document serves as a legal transfer of ownership of the following tractor:

- Make:

- Model:

- Year:

- VIN (Vehicle Identification Number):

- Odometer Reading:

- Condition:

The total purchase price for the tractor is . This amount is payable in the form of:

- Cash

- Check

- Money Order

- Other:

The seller affirms that the tractor is free from all encumbrances, debts, and liens, and confirms their right to sell the property.

Both parties agree that this Bill of Sale represents the entirety of the agreement and supersedes all prior agreements, whether written or verbal.

By signing below, both the Seller and Buyer agree to the terms outlined in this document:

- Seller's Signature: ______________________ Date: ____________

- Buyer's Signature: ______________________ Date: ____________

This document is governed by the laws of the State of Ohio.

Frequently Asked Questions

-

What is a Tractor Bill of Sale in Ohio?

A Tractor Bill of Sale is a legal document that serves as proof of the transfer of ownership of a tractor from one party to another in Ohio. This form includes essential details such as the buyer's and seller's names, the tractor's make, model, year, and Vehicle Identification Number (VIN). It protects both parties by providing a clear record of the transaction.

-

Is a Tractor Bill of Sale required in Ohio?

While a Tractor Bill of Sale is not legally required for every transaction, it is highly recommended. Having this document can help prevent disputes over ownership and clarify the terms of the sale. Additionally, if the buyer plans to register the tractor, a bill of sale may be necessary to complete the registration process.

-

How do I complete a Tractor Bill of Sale?

To complete a Tractor Bill of Sale, both the buyer and seller should fill out the form with accurate information. This includes names, addresses, and contact information for both parties. The tractor's details, such as its make, model, year, and VIN, must also be included. Once completed, both parties should sign and date the document to make it legally binding.

-

What should I do with the Tractor Bill of Sale after the transaction?

After the transaction, both the buyer and seller should keep a copy of the Tractor Bill of Sale for their records. The buyer may need to present this document when registering the tractor with the Ohio Bureau of Motor Vehicles (BMV). It is advisable to store the bill of sale in a safe place, as it may be needed for future reference or in case of any disputes.

Misconceptions

When it comes to the Ohio Tractor Bill of Sale form, several misconceptions can lead to confusion for buyers and sellers alike. Understanding these misconceptions can help ensure a smoother transaction process. Below is a list of common misunderstandings about this important document.

-

It is not legally required. Many people believe that a bill of sale is optional when buying or selling a tractor. However, having a written record can protect both parties and provide proof of ownership.

-

It must be notarized. While notarization adds an extra layer of authenticity, it is not a requirement for the Ohio Tractor Bill of Sale. A simple signed document is often sufficient.

-

All information is optional. Some may think that they can leave out important details. In reality, including specific information about the tractor, such as the VIN, make, model, and sale price, is crucial.

-

It only benefits the seller. This misconception overlooks the advantages for the buyer. A bill of sale serves as proof of purchase and can be essential for future registration or resale.

-

It can be verbal. While verbal agreements might seem convenient, they can lead to disputes. A written bill of sale is always recommended to avoid misunderstandings.

-

Only new tractors need a bill of sale. Whether the tractor is new or used, a bill of sale is important for documenting the transaction and ensuring a clear transfer of ownership.

-

It is the same as a title. A bill of sale and a title serve different purposes. The title indicates legal ownership, while the bill of sale records the transaction details.

-

It can be filled out later. Waiting to complete the bill of sale can lead to issues. It is best to fill it out at the time of the transaction to ensure all details are fresh and accurate.

-

Only one copy is needed. Both the buyer and seller should keep a copy of the bill of sale. This way, both parties have a record of the transaction for future reference.

-

It is not necessary for private sales. Even in private sales, a bill of sale is essential. It provides legal documentation and can help prevent disputes over ownership later on.

By clarifying these misconceptions, individuals can navigate the process of buying or selling a tractor in Ohio with greater confidence and understanding.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Ensure that you include the full names, addresses, and contact information for both the buyer and the seller.

-

Incorrect Vehicle Identification Number (VIN): Double-check the VIN listed on the tractor. An incorrect VIN can lead to complications during registration and ownership transfer.

-

Missing Signatures: Both parties must sign the form. Neglecting to obtain a signature from either the buyer or the seller can render the document invalid.

-

Not Including the Sale Price: Clearly state the sale price of the tractor. Omitting this information can lead to confusion and may affect tax obligations.

-

Failure to Date the Document: Always include the date when the sale occurs. This information is crucial for record-keeping and legal purposes.

-

Ignoring Local Regulations: Be aware of any specific requirements or regulations in your locality. Different counties may have additional forms or steps necessary for a valid sale.

Find Some Other Tractor Bill of Sale Forms for Specific States

Do Tractors Need to Be Registered - A legal document to record the sale of a tractor.

The New York Operating Agreement form is a legal document that outlines the management and operational procedures of a limited liability company (LLC) in New York. This agreement is crucial for defining the roles and responsibilities of members, ensuring clarity and protection for all parties involved. Business owners can find the necessary template by visiting documentonline.org/blank-new-york-operating-agreement, which can help them navigate the complexities of LLC operations effectively.

Is Bill of Sale Same as Title - Documents any agreements regarding modifications or repairs.

Do You Need a Bill of Sale in Florida - Facilitates communication between buyer and seller about tractor specifics.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in Ohio. |

| Governing Law | This form is governed by Ohio Revised Code Section 4505.06, which outlines the requirements for vehicle sales. |

| Information Required | The form typically requires details such as the buyer's and seller's names, addresses, and the tractor's identification information. |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction and confirm the transfer of ownership. |

| Notarization | While notarization is not mandatory, having the form notarized can add an extra layer of authenticity to the transaction. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed bill of sale for their records and future reference. |

| Tax Implications | Sales tax may apply to the transaction, and it is essential to check with local tax authorities for compliance. |

Similar forms

The Ohio Vehicle Bill of Sale is similar to the Tractor Bill of Sale. Both documents serve as proof of transfer of ownership for a vehicle. They include essential details such as the buyer's and seller's information, vehicle identification numbers, and sale price. This helps protect both parties in the transaction by providing a record of the sale.

The Ohio Boat Bill of Sale shares similarities with the Tractor Bill of Sale. Like the tractor, boats require a bill of sale to document the transfer of ownership. This document includes information about the boat, such as its make, model, and hull identification number. Both forms aim to establish clear ownership and can be used for registration purposes.

The Ohio Snowmobile Bill of Sale is also akin to the Tractor Bill of Sale. When purchasing or selling a snowmobile, this document is necessary to confirm the change of ownership. It includes similar information, such as the buyer's and seller's names, and the snowmobile's identification number, ensuring that both parties have a clear record of the transaction.

The Ohio ATV Bill of Sale follows the same principles as the Tractor Bill of Sale. This document is essential for transferring ownership of an all-terrain vehicle. It includes details like the ATV's make, model, and identification number. Both forms help to establish legal ownership and can be used for registration with the state.

The Ohio Mobile Home Bill of Sale is another document that resembles the Tractor Bill of Sale. This form is used when selling or buying a mobile home. It contains information about the mobile home, such as its serial number and sale price. Both documents serve to protect the interests of the buyer and seller by providing a written record of the transaction.

When dealing with legal documents, it's essential to have accurate and effective forms in place, such as the Durable Power of Attorney. This document can significantly impact financial affairs and provides essential guidance in times of need. For further assistance and detailed templates, individuals can turn to OnlineLawDocs.com, which offers valuable resources to simplify the process of creating durable power of attorney forms tailored to Texas regulations.

Lastly, the Ohio Firearm Bill of Sale is similar in function to the Tractor Bill of Sale. This document is used for the sale of firearms and includes important details like the make, model, and serial number of the firearm. Both bills of sale ensure that ownership is properly documented and that the transaction is legally recognized.