Valid Ohio Promissory Note Template

The Ohio Promissory Note form serves as a crucial financial instrument in various lending scenarios, facilitating the borrowing and repayment of money between individuals or entities. This legally binding document outlines the borrower's commitment to repay a specified amount of money, along with any applicable interest, to the lender within a defined timeframe. Essential components of the form include the names and addresses of both parties, the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, the note may specify any late fees or penalties for missed payments, providing clarity and structure to the financial agreement. By establishing clear terms, the Ohio Promissory Note helps to protect the interests of both lenders and borrowers, ensuring that expectations are understood and obligations are met. The simplicity and versatility of this form make it a popular choice for personal loans, business financing, and real estate transactions, reflecting its importance in the broader landscape of financial agreements in Ohio.

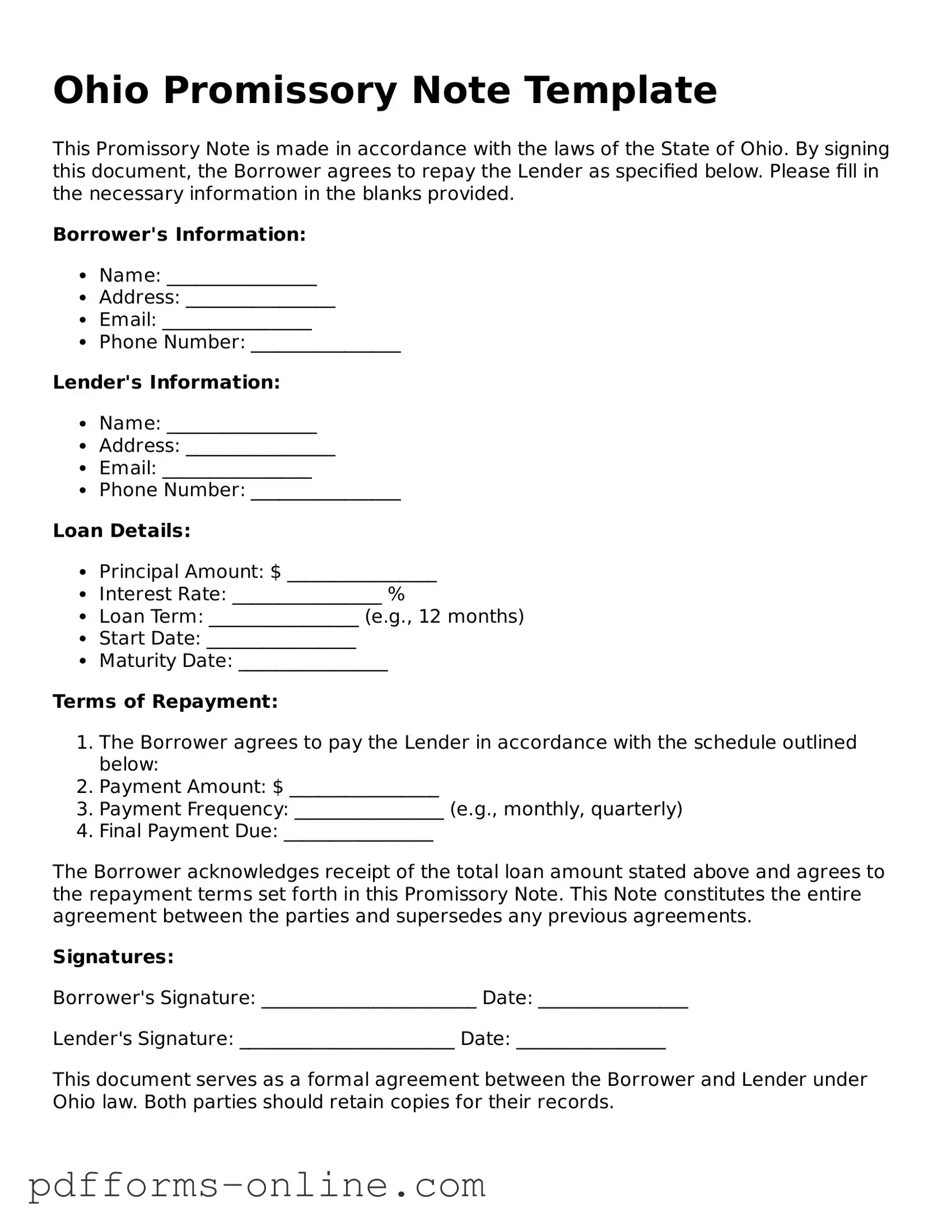

Document Example

Ohio Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Ohio. By signing this document, the Borrower agrees to repay the Lender as specified below. Please fill in the necessary information in the blanks provided.

Borrower's Information:

- Name: ________________

- Address: ________________

- Email: ________________

- Phone Number: ________________

Lender's Information:

- Name: ________________

- Address: ________________

- Email: ________________

- Phone Number: ________________

Loan Details:

- Principal Amount: $ ________________

- Interest Rate: ________________ %

- Loan Term: ________________ (e.g., 12 months)

- Start Date: ________________

- Maturity Date: ________________

Terms of Repayment:

- The Borrower agrees to pay the Lender in accordance with the schedule outlined below:

- Payment Amount: $ ________________

- Payment Frequency: ________________ (e.g., monthly, quarterly)

- Final Payment Due: ________________

The Borrower acknowledges receipt of the total loan amount stated above and agrees to the repayment terms set forth in this Promissory Note. This Note constitutes the entire agreement between the parties and supersedes any previous agreements.

Signatures:

Borrower's Signature: _______________________ Date: ________________

Lender's Signature: _______________________ Date: ________________

This document serves as a formal agreement between the Borrower and Lender under Ohio law. Both parties should retain copies for their records.

Frequently Asked Questions

-

What is a Promissory Note?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. It serves as a legal document that outlines the terms of a loan, including the principal amount, interest rate, and repayment schedule.

-

What are the essential elements of an Ohio Promissory Note?

In Ohio, a valid promissory note typically includes the following elements:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- A statement regarding any late fees or penalties for missed payments.

- The signatures of both the borrower and lender.

-

Do I need a lawyer to create a Promissory Note in Ohio?

While it is not legally required to have a lawyer draft a promissory note, consulting with one can be beneficial. A lawyer can ensure that the document complies with Ohio laws and adequately protects the interests of both parties. If the terms are complex or if significant amounts of money are involved, legal advice is especially recommended.

-

Can a Promissory Note be modified after it is signed?

Yes, a promissory note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This helps prevent misunderstandings and provides a clear record of the agreed-upon changes.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They may pursue collection efforts, which can include contacting the borrower for payment or hiring a collection agency. In some cases, the lender may also choose to take legal action to recover the owed amount, which could result in a court judgment against the borrower.

-

Is a Promissory Note enforceable in Ohio?

Yes, a properly executed promissory note is generally enforceable in Ohio, provided it meets the necessary legal requirements. If the borrower fails to repay the loan, the lender can take legal action to enforce the note and recover the owed amount. However, the enforceability may depend on the specific terms of the note and compliance with relevant laws.

Misconceptions

Understanding the Ohio Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, the terms can vary significantly based on the agreement between the parties involved.

- A Promissory Note Must Be Notarized: Some assume that notarization is required for a promissory note to be valid. While notarization can add an extra layer of authenticity, it is not always necessary for the note to be enforceable.

- Only Written Promissory Notes are Valid: There is a belief that only written notes are enforceable. However, oral agreements can also be considered valid, although they may be harder to prove in court.

- Promissory Notes are Only for Large Loans: Many think promissory notes are only used for substantial loans. In fact, they can be used for any amount, regardless of size.

- Interest Rates Must Be Included: Some people believe that a promissory note must include an interest rate. While including an interest rate is common, it is not a legal requirement.

- Promissory Notes are Only for Personal Loans: There is a misconception that these notes are only applicable in personal lending situations. They can also be used in business transactions and real estate deals.

- All Promissory Notes are Legally Binding: Not all promissory notes are enforceable. For a note to be binding, it must meet specific legal criteria, including clear terms and mutual agreement.

- They Can’t Be Modified: Some believe that once a promissory note is signed, it cannot be changed. In reality, the terms can be modified if both parties agree to the changes.

Understanding these misconceptions can help individuals navigate the complexities of promissory notes more effectively.

Common mistakes

-

Incorrect Borrower Information: Many people forget to include the full legal name of the borrower. This can lead to confusion or disputes later. Always double-check that the name matches official identification.

-

Missing Loan Amount: Failing to specify the exact amount being borrowed is a common mistake. This figure should be clear and precise to avoid misunderstandings.

-

Omitting Interest Rate: Some individuals neglect to include the interest rate or mistakenly leave it blank. This omission can affect the repayment amount significantly. Make sure to state the interest rate clearly.

-

Not Specifying Payment Terms: People often forget to outline the payment schedule. It’s crucial to detail when payments are due and how they should be made to ensure clarity for both parties.

-

Ignoring Signatures: A common oversight is failing to sign the document or not having a witness or notary present if required. Without proper signatures, the note may not be enforceable.

Find Some Other Promissory Note Forms for Specific States

Promissory Note for Personal Loan - This document typically includes a clause detailing the governing law in case of disputes.

For those looking to understand the mechanics of lending and borrowing, a practical resource is the Florida Loan Agreement for clear terms and conditions. You can find a fillable version of this form to simplify the process at an essential Florida Loan Agreement document online.

Promissory Note Template Illinois - In case of disputes, a well-documented promissory note can support your position.

PDF Attributes

| Fact Name | Details |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The Ohio Revised Code, specifically Section 1303.01 to 1303.90, governs promissory notes in Ohio. |

| Parties Involved | The note involves two primary parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties in the note. |

| Repayment Terms | Repayment terms, including the due date and payment schedule, must be clearly stated in the note. |

| Signatures Required | Both the borrower and lender must sign the note for it to be legally binding. |

| Enforceability | If properly executed, the note is enforceable in a court of law, providing the lender with legal recourse in case of default. |

Similar forms

The Ohio Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. A Loan Agreement tends to be more comprehensive, often including clauses about collateral, default, and other conditions. However, like a Promissory Note, it serves as a written acknowledgment of the debt and the borrower's commitment to repay it. Essentially, both documents create a legal obligation for the borrower to repay the lender, but the Loan Agreement provides a more detailed framework for the transaction.

Another document that resembles the Ohio Promissory Note is a Secured Promissory Note. This type of note includes a promise to repay the borrowed amount, similar to a standard Promissory Note, but it also specifies collateral that secures the loan. If the borrower defaults, the lender has the right to claim the collateral. This added layer of security makes the Secured Promissory Note appealing to lenders, as it reduces their risk. Both documents function as evidence of the debt, but the Secured Promissory Note offers additional protection for the lender.

A third document that is similar is the Personal Loan Agreement. This agreement outlines the terms between a borrower and a lender for personal loans, often used for purposes like home improvements or debt consolidation. Like the Ohio Promissory Note, it specifies the loan amount, interest rate, and repayment terms. However, the Personal Loan Agreement may also include conditions regarding the borrower's financial status or stipulations about how the loan can be used. Both documents serve to formalize the borrowing relationship, ensuring that both parties understand their rights and responsibilities.

Understanding the financial implications of various documents, such as the Ohio Promissory Note, is crucial for both lenders and borrowers. For those seeking further insights into related financial documents, OnlineLawDocs.com provides valuable resources and information on topics like the Profit And Loss form, which helps in evaluating a company's overall financial health.

Lastly, the Ohio Promissory Note can be compared to a Business Loan Agreement. This document is utilized when a business borrows funds, and it includes similar elements such as the loan amount, interest rates, and repayment terms. However, a Business Loan Agreement may also address specific business-related conditions, such as the purpose of the loan or the financial health of the business. While both documents create a binding obligation for repayment, the Business Loan Agreement often incorporates additional considerations relevant to commercial transactions, making it tailored for business needs.