Valid Ohio Operating Agreement Template

The Ohio Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. It outlines the internal management structure and operational guidelines of the LLC, ensuring that all members understand their rights and responsibilities. This agreement typically includes details such as the distribution of profits and losses, voting procedures, and the process for adding or removing members. Additionally, it addresses how decisions will be made, how disputes will be resolved, and the procedures for dissolving the company if necessary. By clearly defining these aspects, the Operating Agreement helps to prevent misunderstandings and conflicts among members, fostering a more stable business environment. Furthermore, while Ohio law does not mandate that LLCs have an Operating Agreement, having one in place can provide significant legal protection and clarity, making it a wise choice for business owners. Overall, the Ohio Operating Agreement form is a foundational document that supports the smooth operation and governance of an LLC, contributing to its long-term success.

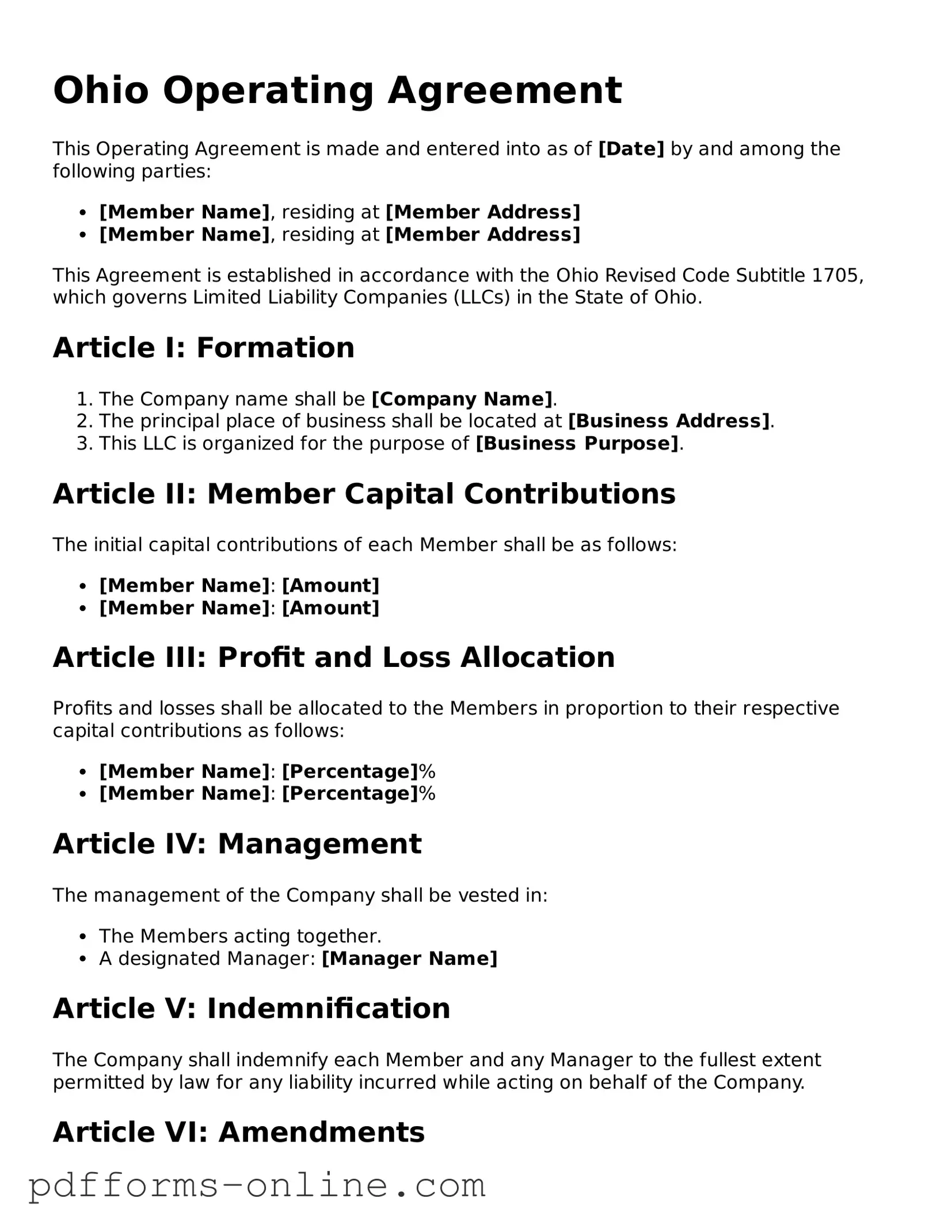

Document Example

Ohio Operating Agreement

This Operating Agreement is made and entered into as of [Date] by and among the following parties:

- [Member Name], residing at [Member Address]

- [Member Name], residing at [Member Address]

This Agreement is established in accordance with the Ohio Revised Code Subtitle 1705, which governs Limited Liability Companies (LLCs) in the State of Ohio.

Article I: Formation

- The Company name shall be [Company Name].

- The principal place of business shall be located at [Business Address].

- This LLC is organized for the purpose of [Business Purpose].

Article II: Member Capital Contributions

The initial capital contributions of each Member shall be as follows:

- [Member Name]: [Amount]

- [Member Name]: [Amount]

Article III: Profit and Loss Allocation

Profits and losses shall be allocated to the Members in proportion to their respective capital contributions as follows:

- [Member Name]: [Percentage]%

- [Member Name]: [Percentage]%

Article IV: Management

The management of the Company shall be vested in:

- The Members acting together.

- A designated Manager: [Manager Name]

Article V: Indemnification

The Company shall indemnify each Member and any Manager to the fullest extent permitted by law for any liability incurred while acting on behalf of the Company.

Article VI: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article VII: Governing Law

This agreement shall be governed by and construed in accordance with the laws of the State of Ohio.

IN WITNESS WHEREOF

The parties have executed this Operating Agreement as of the date first above written, intending to be legally bound.

_________________________ [Member Name]

_________________________ [Member Name]

Frequently Asked Questions

-

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in Ohio. This agreement serves as a foundational document that governs the relationships among members and the operation of the LLC.

-

Is an Operating Agreement required in Ohio?

While Ohio law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having one can help clarify the rights and responsibilities of members, reduce conflicts, and provide a clear framework for decision-making.

-

What should be included in an Operating Agreement?

An Operating Agreement typically includes the following sections:

- Identification of members

- Management structure

- Voting rights and procedures

- Profit and loss distribution

- Procedures for adding or removing members

- Dispute resolution methods

-

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. However, it is advisable to consult with a legal professional to ensure that the document meets all legal requirements and adequately protects the interests of all members.

-

How does an Operating Agreement affect my LLC?

An Operating Agreement provides clarity and structure to your LLC. It helps prevent misunderstandings among members and can outline procedures for handling various situations, such as member departures or business expansion. This can be crucial for maintaining smooth operations.

-

Can the Operating Agreement be changed?

Yes, an Operating Agreement can be amended. The process for making changes should be outlined within the agreement itself. Typically, a majority vote from the members is required to approve any amendments.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, Ohio’s default laws will govern the business. This may not align with the members' intentions and can lead to unexpected outcomes, especially in disputes or decision-making processes.

-

How do I file the Operating Agreement?

An Operating Agreement is not filed with the state. Instead, it is kept on file within the LLC's records. Members should ensure that they have access to the document and that it is updated as needed.

-

Is there a standard template for an Operating Agreement?

While there are many templates available online, it is important to customize any template to fit the specific needs of your LLC. Each business is unique, and the Operating Agreement should reflect that uniqueness.

-

Can I use an Operating Agreement from another state?

Using an Operating Agreement from another state may not be advisable. Each state has its own laws and regulations regarding LLCs. It is best to create an Operating Agreement that complies with Ohio law to ensure its validity.

Misconceptions

When it comes to the Ohio Operating Agreement form, several misconceptions can lead to confusion for business owners and entrepreneurs. Here are nine common misunderstandings:

- It’s only necessary for large businesses. Many believe that only larger companies require an Operating Agreement. In reality, any LLC, regardless of size, benefits from having this document to outline management and operational procedures.

- It’s a one-time document. Some think that once the Operating Agreement is created, it never needs to be updated. However, changes in ownership, business structure, or state laws may necessitate revisions.

- It’s not legally required in Ohio. While Ohio does not mandate an Operating Agreement, having one is highly recommended. It provides clarity and helps prevent disputes among members.

- It must be filed with the state. Many assume that the Operating Agreement needs to be submitted to state authorities. In fact, this document is kept internally and is not filed with the state.

- All members must agree on every detail. Some believe that unanimous consent is required for every aspect of the Operating Agreement. While consensus is important, the agreement can specify how decisions are made, allowing for majority rules in certain situations.

- It’s only for multi-member LLCs. A misconception exists that single-member LLCs do not need an Operating Agreement. However, having one is beneficial for establishing clear business practices and protecting personal assets.

- It’s a complicated legal document. Many think that creating an Operating Agreement requires extensive legal knowledge. In truth, it can be straightforward and tailored to the specific needs of the business.

- It can’t be changed once signed. Some individuals believe that once the Operating Agreement is signed, it cannot be altered. In reality, amendments can be made as long as they follow the procedures outlined in the agreement itself.

- It covers everything about the business. While an Operating Agreement addresses many important aspects, it does not cover every detail of the business. Other documents may be necessary to address specific operational or legal issues.

Understanding these misconceptions can help business owners make informed decisions about their Operating Agreements and ensure their LLC operates smoothly.

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Every member should be included to ensure that the agreement reflects the complete ownership structure.

-

Incorrect Member Information: Providing inaccurate names or addresses can lead to confusion. Always double-check that all details are correct and current.

-

Omitting Capital Contributions: Members should clearly state their initial capital contributions. This information is crucial for understanding ownership percentages and financial responsibilities.

-

Neglecting to Specify Management Structure: Not defining how the LLC will be managed can lead to disputes. Clearly outline whether it will be member-managed or manager-managed.

-

Ignoring Profit and Loss Distribution: Failing to detail how profits and losses will be distributed among members can create misunderstandings later. Be explicit about the distribution method.

-

Not Addressing Decision-Making Processes: It's important to outline how decisions will be made within the LLC. Specify whether decisions require a majority vote or unanimous consent.

-

Leaving Out Dispute Resolution Procedures: A lack of clear procedures for resolving disputes can lead to prolonged conflicts. Include a method for resolving disagreements among members.

-

Failing to Update the Agreement: As circumstances change, the operating agreement should be updated. Regularly review and amend the document to reflect any changes in membership or structure.

-

Not Seeking Legal Advice: Some individuals try to complete the form without consulting a legal professional. It’s wise to seek advice to ensure compliance with Ohio laws.

-

Overlooking Signatures: Finally, forgetting to have all members sign the agreement is a frequent oversight. Ensure that every member’s signature is obtained for the agreement to be valid.

Find Some Other Operating Agreement Forms for Specific States

Llc Operating Agreement Florida - Having an Operating Agreement is often recommended even for single-member LLCs.

To successfully establish your business structure in Arizona, obtaining the necessary documentation is imperative. One essential document is the Arizona Articles of Incorporation, which provides foundational details about your corporation. This form not only requires the corporation's name and purpose but also the initial business office and information regarding its incorporators and directors. For those interested in exploring further resources, you can find everything you need by visiting All Arizona Forms. Completing this form is your first step towards legal recognition as a corporation in the state.

How Do I Create an Operating Agreement for My Llc - This form can help streamline operations and improve efficiency within the LLC.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in Ohio. |

| Governing Law | This agreement is governed by the Ohio Revised Code, specifically Chapter 1705, which pertains to limited liability companies. |

| Membership | It details the rights and responsibilities of each member, including their ownership percentages and voting rights. |

| Flexibility | The agreement allows for flexibility in management, enabling members to choose between member-managed or manager-managed structures. |

| Amendments | Members can amend the Operating Agreement as needed, allowing adjustments to reflect changes in the business or membership. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can help prevent conflicts from escalating. |

| Tax Treatment | The agreement can specify how the LLC will be taxed, including options for pass-through taxation or corporate taxation. |

Similar forms

The Ohio Limited Liability Company (LLC) Articles of Organization serves as a foundational document for forming an LLC. Similar to the Operating Agreement, it outlines essential details about the LLC, including its name, address, and the names of its members. However, while the Articles of Organization is filed with the state to officially create the LLC, the Operating Agreement governs the internal operations and management of the LLC, detailing the rights and responsibilities of its members.

When engaging in the sale of a vehicle, it is crucial to document the transaction properly to protect both the seller and buyer. The Ohio Motor Vehicle Bill of Sale serves this purpose effectively, ensuring that all details of the sale are recorded and verified. For further information, you can refer to the official form available at https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale, which outlines the necessary components to ensure a smooth transfer of ownership.

The Partnership Agreement is another document that shares similarities with the Operating Agreement. This agreement is used in general partnerships to outline the roles, contributions, and profit-sharing arrangements among partners. Like the Operating Agreement, it serves to clarify expectations and prevent disputes. However, it applies to partnerships rather than LLCs and may involve different legal implications regarding liability and management structure.

The Bylaws of a corporation also resemble the Operating Agreement in that they govern the internal management of a corporation. Bylaws detail the roles of officers, procedures for meetings, and voting rights of shareholders. Both documents aim to establish clear governance structures, but bylaws are specific to corporations, whereas Operating Agreements pertain to LLCs.

A Shareholders Agreement is similar to an Operating Agreement in that it outlines the rights and obligations of shareholders within a corporation. This document often includes provisions for the transfer of shares, dispute resolution, and decision-making processes. While both documents serve to protect the interests of members or shareholders, the Shareholders Agreement is specific to corporations, while the Operating Agreement is tailored for LLCs.

The Joint Venture Agreement is another comparable document. This agreement is formed between two or more parties who agree to collaborate on a specific project. Like the Operating Agreement, it defines the roles, contributions, and profit-sharing arrangements of the parties involved. However, a Joint Venture Agreement is typically temporary and project-specific, while an Operating Agreement governs an ongoing business entity.

The Employment Agreement shares similarities with the Operating Agreement in that it outlines the terms and conditions of employment for an individual within a company. Both documents clarify expectations and responsibilities. However, while the Operating Agreement focuses on the management and operation of the LLC, the Employment Agreement specifically addresses the relationship between an employer and employee.

The Non-Disclosure Agreement (NDA) can also be viewed as similar to the Operating Agreement in terms of protecting sensitive information. Both documents aim to establish clear boundaries and expectations among parties. An NDA specifically focuses on confidentiality, while the Operating Agreement addresses the overall governance and operational procedures of an LLC.

Finally, the Operating Agreement is comparable to the Memorandum of Understanding (MOU). An MOU outlines the intentions and agreements between parties, often serving as a preliminary step before formalizing a contract. Both documents aim to clarify the roles and expectations of involved parties, but an MOU is generally less formal and may not have the same legal binding effect as an Operating Agreement.