Valid Ohio Motor Vehicle Bill of Sale Template

When buying or selling a vehicle in Ohio, understanding the Motor Vehicle Bill of Sale form is essential for both parties involved in the transaction. This document serves as a critical record, capturing key details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), which are vital for confirming ownership and ensuring a smooth transfer. Additionally, it includes the names and addresses of both the buyer and seller, along with the sale price and date of the transaction. Notably, the form may also contain spaces for signatures, which solidify the agreement and provide legal backing should any disputes arise later. By utilizing this form, individuals can protect their interests and fulfill state requirements, making it an indispensable tool in the vehicle sales process. Whether you're a seasoned seller or a first-time buyer, familiarizing yourself with the nuances of the Bill of Sale can pave the way for a hassle-free experience.

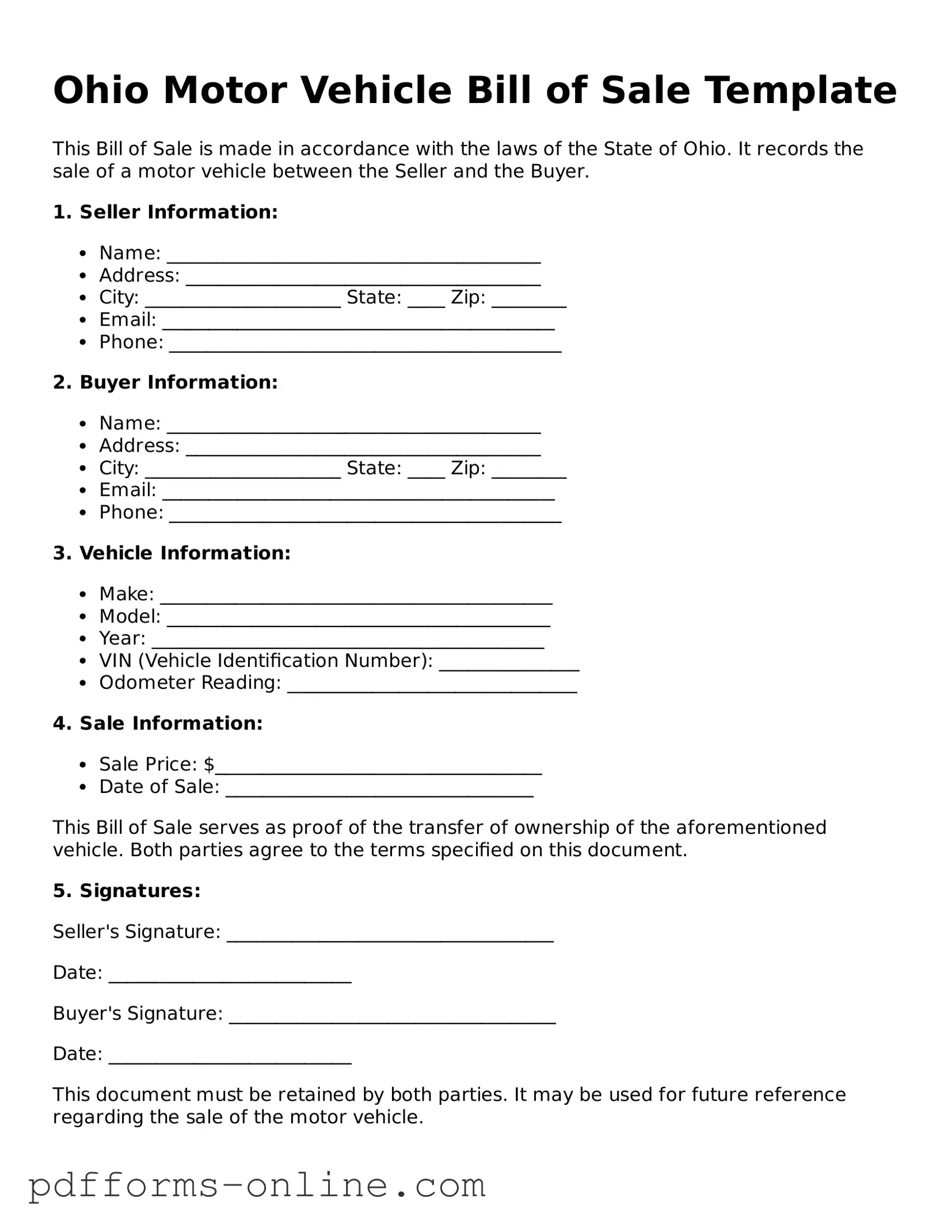

Document Example

Ohio Motor Vehicle Bill of Sale Template

This Bill of Sale is made in accordance with the laws of the State of Ohio. It records the sale of a motor vehicle between the Seller and the Buyer.

1. Seller Information:

- Name: ________________________________________

- Address: ______________________________________

- City: _____________________ State: ____ Zip: ________

- Email: __________________________________________

- Phone: __________________________________________

2. Buyer Information:

- Name: ________________________________________

- Address: ______________________________________

- City: _____________________ State: ____ Zip: ________

- Email: __________________________________________

- Phone: __________________________________________

3. Vehicle Information:

- Make: __________________________________________

- Model: _________________________________________

- Year: __________________________________________

- VIN (Vehicle Identification Number): _______________

- Odometer Reading: _______________________________

4. Sale Information:

- Sale Price: $___________________________________

- Date of Sale: _________________________________

This Bill of Sale serves as proof of the transfer of ownership of the aforementioned vehicle. Both parties agree to the terms specified on this document.

5. Signatures:

Seller's Signature: ___________________________________

Date: __________________________

Buyer's Signature: ___________________________________

Date: __________________________

This document must be retained by both parties. It may be used for future reference regarding the sale of the motor vehicle.

Frequently Asked Questions

-

What is a Motor Vehicle Bill of Sale?

A Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle between a buyer and a seller. This form serves as proof of the transaction and includes important details about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN).

-

Why is a Bill of Sale necessary in Ohio?

In Ohio, a Bill of Sale is not legally required for all vehicle transactions, but it is highly recommended. This document helps protect both the buyer and the seller by providing a record of the sale. It can be useful for tax purposes, registration, and in case of disputes.

-

What information is included in the Ohio Motor Vehicle Bill of Sale?

The form typically includes:

- Names and addresses of both the buyer and seller

- Details of the vehicle, including make, model, year, and VIN

- Sale price

- Date of the sale

- Signatures of both parties

-

Do I need to have the Bill of Sale notarized?

Notarization is not required for the Bill of Sale in Ohio. However, having it notarized can add an extra layer of protection and authenticity to the document.

-

How does the Bill of Sale affect vehicle registration?

The Bill of Sale is often required when registering a vehicle in the buyer's name. It serves as proof of ownership and confirms that the buyer has purchased the vehicle from the seller.

-

What should I do if the seller does not provide a Bill of Sale?

If the seller does not provide a Bill of Sale, you should request one. If they refuse, consider documenting the transaction in writing. Include as much detail as possible and have both parties sign it. This can serve as a makeshift Bill of Sale.

-

Can I use a Bill of Sale for a vehicle purchased from a dealer?

Yes, a Bill of Sale can be used for a vehicle purchased from a dealer. In many cases, dealers provide their own version of a Bill of Sale, which will contain similar information and serve the same purpose.

-

Where can I obtain an Ohio Motor Vehicle Bill of Sale form?

You can obtain a Motor Vehicle Bill of Sale form from various sources, including the Ohio Bureau of Motor Vehicles (BMV) website, legal stationery stores, or online legal form providers. Ensure that the form you choose meets Ohio's requirements.

Misconceptions

The Ohio Motor Vehicle Bill of Sale form is an important document for anyone buying or selling a vehicle in Ohio. However, several misconceptions about this form can lead to confusion. Below are eight common misconceptions and clarifications regarding the Ohio Motor Vehicle Bill of Sale.

- Misconception 1: A Bill of Sale is not necessary for private vehicle sales.

- Misconception 2: A Bill of Sale must be notarized.

- Misconception 3: The Bill of Sale must include the vehicle's VIN.

- Misconception 4: Only the seller needs to sign the Bill of Sale.

- Misconception 5: A Bill of Sale is the same as a title transfer.

- Misconception 6: The Bill of Sale can be handwritten.

- Misconception 7: There is no need to keep a copy of the Bill of Sale.

- Misconception 8: A Bill of Sale is only needed for used vehicles.

In Ohio, while it is not legally required to have a Bill of Sale for private transactions, it is highly recommended. This document serves as proof of the transaction and can help resolve disputes.

Notarization is not a requirement for a Bill of Sale in Ohio. However, having it notarized can provide additional legal protection and verification of the parties involved.

While including the Vehicle Identification Number (VIN) is strongly advised, it is not mandatory. However, omitting it may lead to complications in registration.

Both the buyer and the seller should sign the Bill of Sale. This mutual agreement solidifies the transaction and protects both parties.

A Bill of Sale is not a substitute for a title transfer. The title must be properly signed over to the buyer to complete the ownership change legally.

While a handwritten Bill of Sale is acceptable, it is best to use a standardized form. This helps ensure that all necessary information is included and clearly presented.

It is crucial for both the buyer and seller to retain a copy of the Bill of Sale. This document can be essential for future reference or in case of disputes.

A Bill of Sale is useful for both new and used vehicle transactions. It provides a record of the sale regardless of the vehicle's age.

Common mistakes

-

Failing to include the correct vehicle identification number (VIN). The VIN is essential for identifying the vehicle and ensuring a smooth transfer of ownership.

-

Not providing accurate seller and buyer information. This includes full names, addresses, and contact details, which are necessary for legal records.

-

Omitting the purchase price of the vehicle. This information is crucial for tax purposes and should reflect the agreed-upon amount.

-

Neglecting to date the form. A date is required to establish when the transaction took place, which can be important for legal and tax reasons.

-

Not signing the document. Both the seller and buyer must sign the Bill of Sale for it to be valid.

-

Using incorrect or outdated forms. Always ensure that the most current version of the Ohio Motor Vehicle Bill of Sale is being used.

-

Failing to provide a notarization if required. While not always necessary, some transactions may benefit from having the document notarized for additional legitimacy.

-

Leaving out any additional terms or conditions agreed upon by both parties. Including these can prevent misunderstandings later on.

-

Not keeping a copy of the Bill of Sale for personal records. Both parties should retain a copy for their files to reference in the future.

-

Assuming that a Bill of Sale is the only document needed. Depending on the transaction, additional paperwork, such as title transfer documents, may also be necessary.

Find Some Other Motor Vehicle Bill of Sale Forms for Specific States

How to Fill a Bill of Sale - Both buyer and seller should keep their own copies of the Bill of Sale.

Do I Need a Bill of Sale If I Have the Title in Florida - The form may also include information about whether the vehicle has a lien.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Motor Vehicle Bill of Sale form is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Ohio Revised Code Section 4505.06. |

| Required Information | It must include details such as the vehicle identification number (VIN), make, model, year, and odometer reading. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction. |

| Notarization | While notarization is not required, it is recommended for added legal protection. |

| Transfer of Ownership | The Bill of Sale serves as proof of ownership transfer and may be required for vehicle registration. |

| Tax Implications | Sales tax may apply based on the sale price of the vehicle as indicated on the form. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records. |

| Filing Requirements | There are no filing requirements with the state; however, it is essential for tax and registration purposes. |

Similar forms

The Ohio Motor Vehicle Bill of Sale form shares similarities with the general Bill of Sale. A general Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another. Both documents include essential details such as the names of the buyer and seller, a description of the item being sold, and the sale price. This ensures that both parties have a clear understanding of the transaction and provides proof of ownership transfer.

Another document that resembles the Ohio Motor Vehicle Bill of Sale is the Vehicle Title. The Vehicle Title is an official document issued by the state that proves ownership of a vehicle. While the Bill of Sale is a receipt for the transaction, the title is a legal document that must be transferred to the new owner. Both documents are crucial in the process of buying or selling a vehicle, ensuring that ownership is accurately recorded and recognized by the state.

The Purchase Agreement is also similar to the Ohio Motor Vehicle Bill of Sale. This document outlines the terms and conditions of the sale, including payment details, delivery terms, and any warranties or guarantees. Like the Bill of Sale, the Purchase Agreement serves as a record of the transaction and can help resolve disputes by providing a clear outline of what was agreed upon by both parties.

A Lease Agreement can be compared to the Ohio Motor Vehicle Bill of Sale in terms of documenting the transfer of rights. While a Bill of Sale indicates a full transfer of ownership, a Lease Agreement allows one party to use an asset owned by another party for a specified period. Both documents require signatures from both parties, ensuring that everyone involved understands the terms of the transaction.

The Odometer Disclosure Statement is another document that is closely related to the Ohio Motor Vehicle Bill of Sale. This form is often required during the sale of a vehicle to verify the mileage at the time of sale. Both documents work together to provide transparency in the transaction and help prevent fraud by ensuring that the buyer is aware of the vehicle's condition and history.

The Affidavit of Ownership is similar as well, particularly in situations where a vehicle's title is lost. This document allows the seller to declare ownership and transfer rights to the buyer, even without the original title. Like the Bill of Sale, it serves as a legal affirmation of ownership and helps facilitate the sale process, especially when documentation is incomplete.

The Release of Liability form is another important document that complements the Ohio Motor Vehicle Bill of Sale. This form notifies the state that the seller is no longer responsible for the vehicle after the sale. Both documents protect the interests of the seller and buyer by providing proof of the transaction and ensuring that liability for the vehicle is properly transferred.

Lastly, the Conditional Sales Agreement can be compared to the Ohio Motor Vehicle Bill of Sale, particularly when financing is involved. This document outlines the terms under which a buyer can purchase a vehicle while making installment payments. It includes details about the payment schedule and ownership rights, similar to how a Bill of Sale confirms the sale and terms of ownership transfer.