Valid Ohio Last Will and Testament Template

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Ohio, this legal document serves as a guide for distributing your assets, appointing guardians for minor children, and designating an executor to manage your estate. The Ohio Last Will and Testament form is designed to be straightforward, allowing individuals to outline their final wishes clearly. Key components of the form include the identification of beneficiaries, the specification of assets, and the inclusion of any specific bequests. Additionally, the form requires the testator's signature and the signatures of witnesses to validate its authenticity. Understanding the importance of this document can help individuals navigate the complexities of estate planning and ensure that their loved ones are taken care of according to their desires.

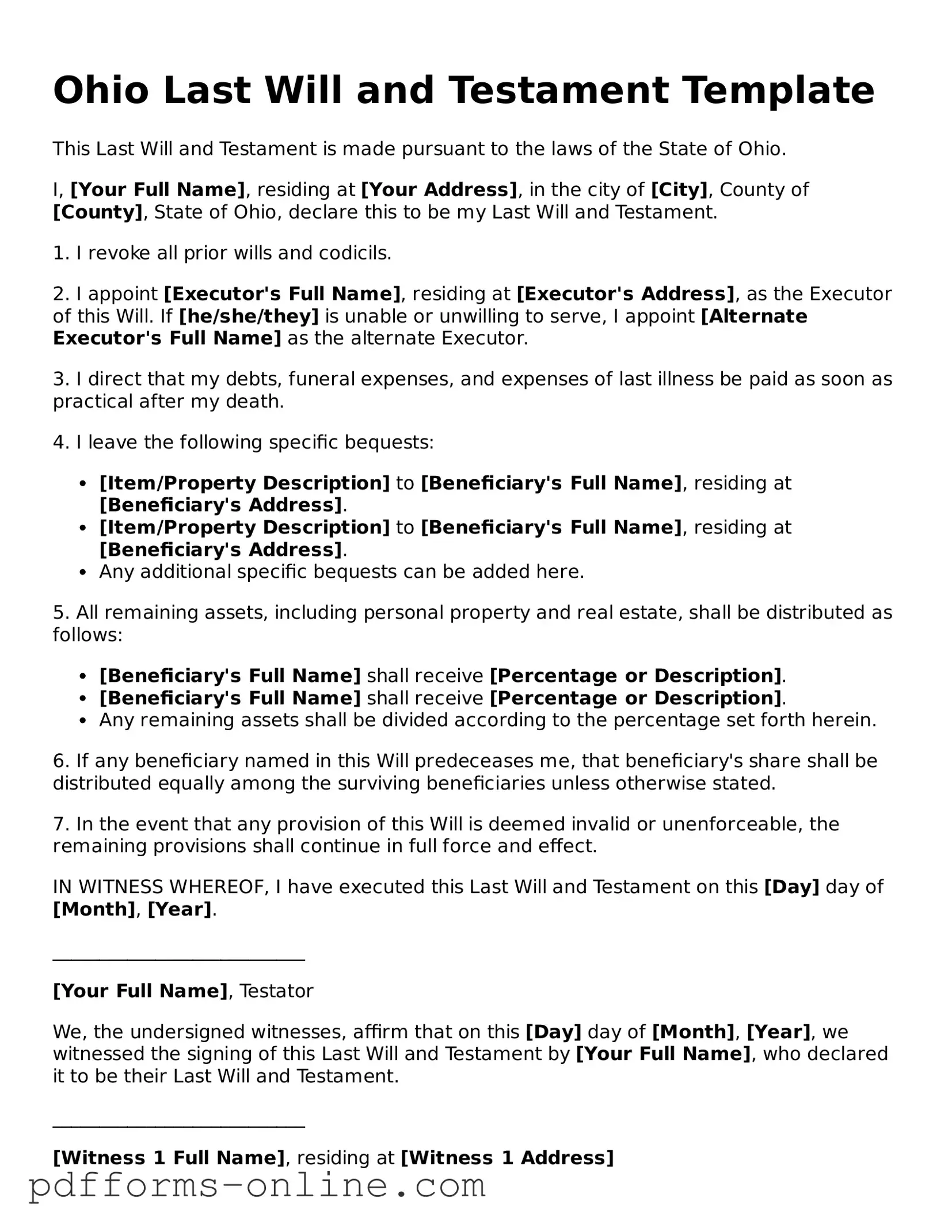

Document Example

Ohio Last Will and Testament Template

This Last Will and Testament is made pursuant to the laws of the State of Ohio.

I, [Your Full Name], residing at [Your Address], in the city of [City], County of [County], State of Ohio, declare this to be my Last Will and Testament.

1. I revoke all prior wills and codicils.

2. I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of this Will. If [he/she/they] is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

3. I direct that my debts, funeral expenses, and expenses of last illness be paid as soon as practical after my death.

4. I leave the following specific bequests:

- [Item/Property Description] to [Beneficiary's Full Name], residing at [Beneficiary's Address].

- [Item/Property Description] to [Beneficiary's Full Name], residing at [Beneficiary's Address].

- Any additional specific bequests can be added here.

5. All remaining assets, including personal property and real estate, shall be distributed as follows:

- [Beneficiary's Full Name] shall receive [Percentage or Description].

- [Beneficiary's Full Name] shall receive [Percentage or Description].

- Any remaining assets shall be divided according to the percentage set forth herein.

6. If any beneficiary named in this Will predeceases me, that beneficiary's share shall be distributed equally among the surviving beneficiaries unless otherwise stated.

7. In the event that any provision of this Will is deemed invalid or unenforceable, the remaining provisions shall continue in full force and effect.

IN WITNESS WHEREOF, I have executed this Last Will and Testament on this [Day] day of [Month], [Year].

___________________________

[Your Full Name], Testator

We, the undersigned witnesses, affirm that on this [Day] day of [Month], [Year], we witnessed the signing of this Last Will and Testament by [Your Full Name], who declared it to be their Last Will and Testament.

___________________________

[Witness 1 Full Name], residing at [Witness 1 Address]

___________________________

[Witness 2 Full Name], residing at [Witness 2 Address]

Frequently Asked Questions

-

What is a Last Will and Testament in Ohio?

A Last Will and Testament is a legal document that outlines how a person's assets and property will be distributed after their death. In Ohio, this document allows individuals to specify their wishes regarding the distribution of their estate, the appointment of guardians for minor children, and the designation of an executor to manage the estate's affairs.

-

Who can create a Last Will and Testament in Ohio?

Any person who is at least 18 years old and of sound mind can create a Last Will and Testament in Ohio. It is important that the individual understands the nature of their assets and the implications of their decisions when drafting this document.

-

What are the requirements for a valid Will in Ohio?

For a Will to be considered valid in Ohio, it must be in writing and signed by the testator (the person making the Will). Additionally, the Will must be witnessed by at least two individuals who are present at the same time. These witnesses must also sign the Will, affirming that they witnessed the testator's signature.

-

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time. To do so, you can create a new Will that revokes the previous one or add a codicil, which is an amendment to the existing Will. It is crucial to follow the same formalities for signing and witnessing when making changes.

-

What happens if I die without a Will in Ohio?

If a person dies without a Will in Ohio, they are considered to have died "intestate." In this case, the state laws of intestacy will determine how the deceased's assets are distributed. This process may not align with the deceased's wishes, which is why having a Will is important.

-

Is it necessary to hire a lawyer to create a Last Will and Testament in Ohio?

While it is not legally required to hire a lawyer to create a Last Will and Testament in Ohio, it is often advisable. A lawyer can help ensure that the Will meets all legal requirements and accurately reflects your wishes. However, individuals can also use online resources or templates to create a Will if they feel comfortable doing so.

Misconceptions

Many people have misunderstandings about the Ohio Last Will and Testament form. Here are six common misconceptions:

-

Only wealthy individuals need a will.

This is not true. Everyone can benefit from having a will, regardless of their financial situation. A will helps ensure that your wishes are followed after your passing.

-

Handwritten wills are not valid.

In Ohio, handwritten wills, also known as holographic wills, can be valid if they meet certain criteria. However, it's always best to use a formal will to avoid complications.

-

Once a will is made, it cannot be changed.

This is a misconception. You can modify or revoke your will at any time, as long as you are of sound mind. Life changes, such as marriage or the birth of a child, often call for updates.

-

All assets automatically go to the spouse.

While many people assume this, it is not always the case. If there is no will, state laws determine asset distribution, which may not align with your wishes.

-

Wills avoid probate.

This is incorrect. A will must go through probate, which is the legal process of validating it. However, having a will can help streamline the process and clarify your wishes.

-

Only lawyers can create a will.

While it's advisable to consult a lawyer, you can create a will on your own using templates. Just ensure it meets Ohio's legal requirements to be valid.

Common mistakes

-

Neglecting to Clearly Identify the Testator

It is crucial to clearly state the full name and address of the person creating the will. Failing to do so can lead to confusion and potential disputes about the validity of the document.

-

Inadequate Witness Signatures

Ohio law requires that a will be signed in the presence of at least two witnesses. Not having the appropriate number of witnesses, or failing to have them sign in the correct manner, can render the will invalid.

-

Ambiguous Language

Using vague or unclear language can create misunderstandings about the testator's intentions. It is important to be specific when describing assets and beneficiaries to avoid confusion.

-

Failing to Update the Will

Life events such as marriage, divorce, or the birth of children may necessitate updates to the will. Neglecting to revise the document can lead to outdated information and unintended distributions.

-

Overlooking Legal Requirements

Each state has specific legal requirements for a valid will. Ignoring these can result in the will being contested or deemed invalid. Familiarity with Ohio's laws is essential for ensuring compliance.

Find Some Other Last Will and Testament Forms for Specific States

Handwritten Will California - May address debts and taxes to be settled from the estate before distribution.

To further explore essential legal documents that can assist in managing employment relationships and safeguarding your business interests, you can access All Arizona Forms, which includes the Non-compete Agreement form tailored for Arizona.

Illinois Will Template - Legally recognizes the testator’s authority over their assets after passing.

Free Michigan Will Template - A Last Will can greatly simplify the probate process for your loved ones.

Last Will and Testament Template Texas - Allows for the appointment of alternate heirs in case primary beneficiaries predecease the individual.

PDF Attributes

| Fact Name | Description |

|---|---|

| Legal Requirement | In Ohio, a Last Will and Testament must be in writing and signed by the testator (the person making the will) to be considered valid. |

| Witnesses | The will must be signed in the presence of at least two witnesses who are not beneficiaries of the will. |

| Testamentary Capacity | The testator must be at least 18 years old and of sound mind to create a valid will under Ohio law. |

| Revocation | A will can be revoked by the testator at any time before their death, typically by destroying the document or creating a new will. |

| Governing Law | The Ohio Revised Code, specifically Chapter 2107, governs the creation and execution of Last Wills and Testaments in Ohio. |

Similar forms

The Ohio Last Will and Testament is similar to a Living Will, which outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. While a Last Will and Testament addresses the distribution of assets after death, a Living Will focuses on healthcare decisions during life. Both documents serve to express the individual's intentions, but they operate in different contexts—one in life and the other in death.

Another document comparable to the Ohio Last Will and Testament is the Durable Power of Attorney. This legal instrument allows a person to designate someone else to manage their financial affairs if they become incapacitated. Like a Last Will, it requires careful consideration of whom to trust and what powers to grant. However, the Durable Power of Attorney takes effect during the individual's lifetime, contrasting with the Last Will, which only becomes operative upon death.

Another important document to consider is the Florida Promissory Note form, which articulates a borrower's commitment to repay a loan according to specified terms and conditions. Understanding this form is vital for both parties involved in a loan agreement. For further insights, you can explore this crucial Florida Promissory Note documentation.

The Revocable Trust is also akin to the Last Will and Testament. This document allows an individual to place their assets into a trust, which can be managed during their lifetime and distributed upon death. Unlike a Last Will, which must go through probate, a Revocable Trust can facilitate a more private and streamlined transfer of assets. Both documents aim to ensure that a person's wishes regarding their estate are honored, yet they differ in terms of management and privacy.

A Health Care Proxy is another document that shares similarities with the Ohio Last Will and Testament. It designates an individual to make medical decisions on behalf of someone who is unable to do so. While the Last Will pertains to the distribution of property after death, the Health Care Proxy is focused on health-related choices during life. Both emphasize the importance of having a trusted person carry out one's wishes.

The Declaration of Guardian is comparable to a Last Will in that it allows an individual to appoint someone to take care of their minor children in the event of their death. This document ensures that the individual's preferences regarding guardianship are respected. While a Last Will addresses asset distribution, the Declaration of Guardian focuses on the welfare of dependents, highlighting the importance of planning for both financial and familial responsibilities.

The Codicil is a document that modifies an existing Last Will and Testament. It allows individuals to make changes without drafting an entirely new will. This document serves a similar purpose in that it expresses the individual’s intentions regarding their estate. However, it specifically addresses amendments, making it a more flexible option for those who wish to update their wishes without starting from scratch.

The Living Trust is another document that parallels the Last Will and Testament. It allows individuals to place their assets into a trust during their lifetime, which can then be managed and distributed according to their wishes. While both documents facilitate the transfer of assets, a Living Trust can help avoid probate, providing a more efficient means of asset distribution. Both documents require careful planning and consideration of one’s estate wishes.

The Bill of Sale can be compared to a Last Will in the context of transferring ownership of personal property. A Bill of Sale is a legal document that records the sale of an item, providing proof of the transaction. While the Last Will deals with the distribution of property after death, a Bill of Sale addresses immediate ownership transfer. Both documents serve to clarify ownership and protect the interests of the parties involved.

Lastly, the Prenuptial Agreement bears some resemblance to the Last Will and Testament in terms of asset distribution. This agreement is created before marriage to outline how assets will be divided in the event of a divorce or death. Similar to a Last Will, it reflects the individual's intentions regarding their property. However, a Prenuptial Agreement is focused on protecting assets during marriage, whereas a Last Will addresses posthumous asset distribution.