Valid Ohio Employment Verification Template

The Ohio Employment Verification form serves as a vital tool for employers and employees alike, streamlining the process of confirming an individual's employment status. This form is typically used in various situations, such as when applying for loans, housing, or government assistance programs. It includes essential details like the employee's name, job title, and dates of employment, ensuring that all necessary information is accurately recorded. Additionally, the form may require the employer's signature, adding a layer of authenticity to the verification process. Understanding how to properly complete and utilize this form can significantly benefit both parties, making it easier to navigate employment-related inquiries and requirements. With its straightforward design, the Ohio Employment Verification form helps to facilitate communication between employers and third parties, ensuring that employment information is verified efficiently and effectively.

Document Example

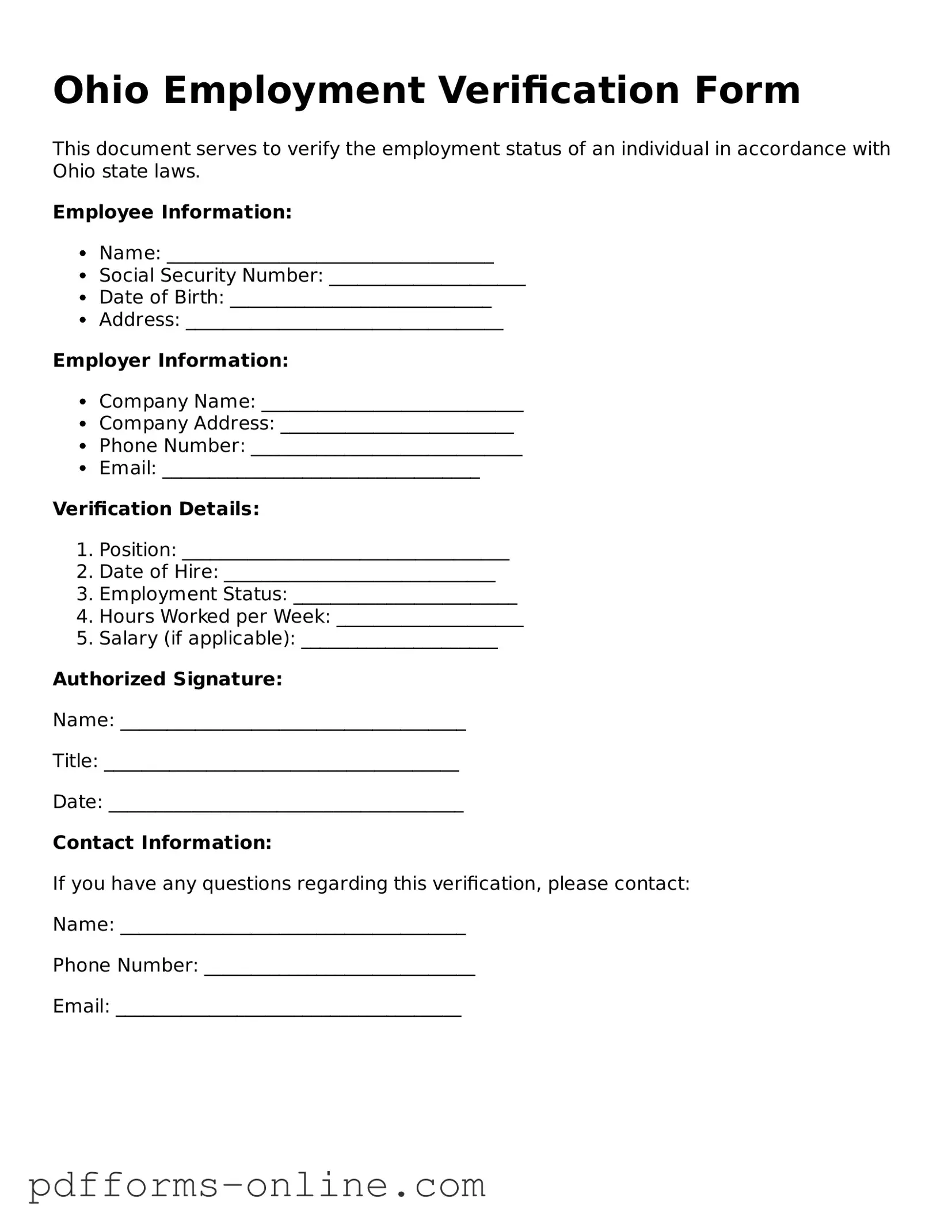

Ohio Employment Verification Form

This document serves to verify the employment status of an individual in accordance with Ohio state laws.

Employee Information:

- Name: ___________________________________

- Social Security Number: _____________________

- Date of Birth: ____________________________

- Address: __________________________________

Employer Information:

- Company Name: ____________________________

- Company Address: _________________________

- Phone Number: _____________________________

- Email: __________________________________

Verification Details:

- Position: ___________________________________

- Date of Hire: _____________________________

- Employment Status: ________________________

- Hours Worked per Week: ____________________

- Salary (if applicable): _____________________

Authorized Signature:

Name: _____________________________________

Title: ______________________________________

Date: ______________________________________

Contact Information:

If you have any questions regarding this verification, please contact:

Name: _____________________________________

Phone Number: _____________________________

Email: _____________________________________

Frequently Asked Questions

-

What is the Ohio Employment Verification form?

The Ohio Employment Verification form is a document used by employers to confirm the employment status of an individual. It typically includes details such as the employee's job title, dates of employment, and salary information. This form is often requested by financial institutions, landlords, or other entities requiring proof of income.

-

Who needs to fill out the Employment Verification form?

Employers are responsible for completing the Employment Verification form. However, the employee may need to provide certain information to assist in the process. This form is usually filled out upon request from an external party, such as a lender or property manager.

-

How do I obtain the Ohio Employment Verification form?

Employers can typically find the Ohio Employment Verification form through their human resources department or online through state government websites. Some companies may have their own version of the form, which can be customized to meet specific needs.

-

What information is required on the form?

The form generally requires the following information:

- Employee's full name

- Employee's job title

- Dates of employment (start and end dates)

- Salary or hourly wage

- Employer's contact information

-

Is the Employment Verification form confidential?

Yes, the information contained in the Employment Verification form is considered confidential. Employers must handle it with care and only share it with authorized parties who have a legitimate need for the information.

-

How long does it take to complete the form?

The time required to complete the Employment Verification form can vary. Generally, if all necessary information is readily available, it can be filled out in a matter of minutes. However, if additional information or verification is needed, it may take longer.

-

Can I refuse to provide my Employment Verification?

Employees can decline to provide an Employment Verification form; however, this may impact their ability to secure loans, rental agreements, or other financial arrangements. It's often beneficial to cooperate with requests for verification when possible.

-

What if my employer refuses to fill out the form?

If an employer refuses to complete the Employment Verification form, the employee should first discuss the issue with their HR department. If that does not resolve the matter, the employee may consider seeking legal advice or exploring alternative methods to verify their employment.

-

Are there any penalties for providing false information on the form?

Yes, providing false information on the Employment Verification form can lead to serious consequences. This may include legal action, loss of employment, or damage to one's reputation. It is crucial to provide accurate and truthful information at all times.

Misconceptions

Understanding the Ohio Employment Verification form is crucial for both employers and employees. Unfortunately, there are several misconceptions that can lead to confusion. Here’s a look at seven common misunderstandings about this important document.

-

It’s only required for new hires.

Many people believe that the Employment Verification form is only necessary when hiring a new employee. In reality, it can be requested at any time to confirm employment status, especially during background checks or loan applications.

-

Only employers can fill it out.

Some assume that only employers have the authority to complete this form. However, employees can also provide information to ensure accuracy, especially regarding their job title and employment dates.

-

It’s the same as a W-2 form.

This misconception arises because both forms deal with employment information. The Employment Verification form focuses on confirming current employment, while the W-2 is used for reporting annual wages and taxes.

-

It’s not legally binding.

Some individuals think that the Employment Verification form carries no legal weight. In fact, it can be used as a formal document in legal proceedings, making accuracy essential.

-

Employers can deny requests without reason.

While employers have discretion over providing verification, they cannot arbitrarily deny requests. If they refuse, they should provide a valid reason to avoid potential disputes.

-

It can be completed verbally.

Some believe that verbal confirmation is sufficient. However, a written form is necessary to maintain a clear and official record of employment verification.

-

Only full-time employees need verification.

This is a common myth. Part-time employees, freelancers, and contractors may also require employment verification for various purposes, such as applying for loans or renting an apartment.

By addressing these misconceptions, individuals can better navigate the employment verification process in Ohio, ensuring that they understand their rights and responsibilities.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This can lead to delays in processing. Double-checking each section is crucial.

-

Incorrect Employer Details: Providing inaccurate information about the employer, such as the company name or address, can cause complications. Ensure that the details match official records.

-

Failure to Sign: Some people neglect to sign the form. A missing signature renders the document invalid. Always remember to sign and date the form before submission.

-

Not Keeping a Copy: After submitting the form, individuals often forget to keep a copy for their records. Retaining a copy can be helpful for future reference or follow-ups.

Find Some Other Employment Verification Forms for Specific States

Employement Verification - This is a common requirement when applying for insurance policies.

Texas Letter of Employment Comfirmation - Includes information on reporting manager.

When entering into various business dealings or contracts, it is crucial to understand the implications of liability, which is where the Texas Hold Harmless Agreement comes into play. This essential legal document offers protection by ensuring that one party is not held responsible for certain incidents, allowing for smoother transactions and peace of mind. For further details on drafting this agreement, you can refer to resources like OnlineLawDocs.com.

Georgia E Verify Law - This form can help expedite the process of job applications by providing clear details.

PDF Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Employment Verification form is used to confirm an individual's employment status, typically for purposes like loan applications or government assistance programs. |

| Required Information | This form generally requires details such as the employee's name, job title, dates of employment, and salary information. |

| Governing Law | The use of employment verification forms in Ohio is governed by the Fair Labor Standards Act (FLSA) and Ohio Revised Code § 4111. |

| Submission Process | Employers may submit the completed form directly to the requesting party, ensuring all information is accurate and up-to-date. |

| Confidentiality | Employers must handle this form with care, as it contains sensitive information about the employee, which should be kept confidential. |

Similar forms

The I-9 form, officially known as the Employment Eligibility Verification form, is a document used by employers in the United States to verify an employee's identity and eligibility to work. Like the Ohio Employment Verification form, the I-9 requires information about the employee's identity, such as name, address, and Social Security number. Both forms aim to confirm that the employee is legally allowed to work in the U.S., though the I-9 is federally mandated while the Ohio form serves state-specific purposes.

The W-2 form, or Wage and Tax Statement, is another document that shares similarities with the Ohio Employment Verification form. While the W-2 reports an employee's annual earnings and tax withholdings, it also includes identifying information about the employee, such as name and Social Security number. Both documents serve to track employment status and financial information, although the W-2 is focused on tax reporting rather than initial employment verification.

Understanding the ins and outs of employment documentation can greatly benefit both employers and employees alike. The necessity of clear and precise documents like the Ohio Employment Verification form helps ensure that hiring processes are transparent and compliant. For business owners in New York looking for additional resources, they might consider exploring the documentonline.org/blank-new-york-operating-agreement/, which provides insights into the important operating agreements that govern LLC operations.

The 1099 form is used to report income received by independent contractors and freelancers. Similar to the Ohio Employment Verification form, it collects essential information like the individual's name and taxpayer identification number. Both documents are used to validate employment status, but the 1099 is specifically for non-employee compensation, while the Ohio form is generally for traditional employees.

The Social Security Administration (SSA) Verification Request is a form that employers can use to confirm an employee's Social Security number. This document is akin to the Ohio Employment Verification form in that both verify critical identifying information. However, the SSA form specifically focuses on Social Security numbers, whereas the Ohio form encompasses broader employment eligibility and identity verification.

The State Tax Withholding Form, often required by employers for state income tax purposes, is another document similar to the Ohio Employment Verification form. Both forms require the employee's personal information, including name and Social Security number. While the State Tax Withholding Form is primarily for tax purposes, the Ohio form aims to verify employment eligibility within the state.

The Employee Information Form is commonly used by employers to gather essential details about new hires. This document is similar to the Ohio Employment Verification form in that it collects personal information, including name, address, and Social Security number. However, the Employee Information Form is often more comprehensive, including additional details like emergency contacts and next of kin, whereas the Ohio form focuses specifically on employment verification.