Valid Ohio Durable Power of Attorney Template

The Ohio Durable Power of Attorney form is a critical legal document that allows individuals to appoint someone they trust to make decisions on their behalf, particularly in the event of incapacitation. This form provides a framework for managing financial and healthcare matters, ensuring that the appointed agent can act in the best interest of the individual. It remains effective even if the person who created it becomes unable to make decisions, thereby offering peace of mind. The form can be customized to specify the powers granted, which may include handling bank transactions, managing real estate, or making medical decisions. Understanding the requirements for executing this document is essential, as it must be signed in the presence of a notary public or witnessed by two individuals. Furthermore, it’s important to recognize that the Durable Power of Attorney can be revoked at any time, as long as the individual is still competent to do so. This flexibility makes it a valuable tool for planning ahead and ensuring that personal wishes are honored during challenging times.

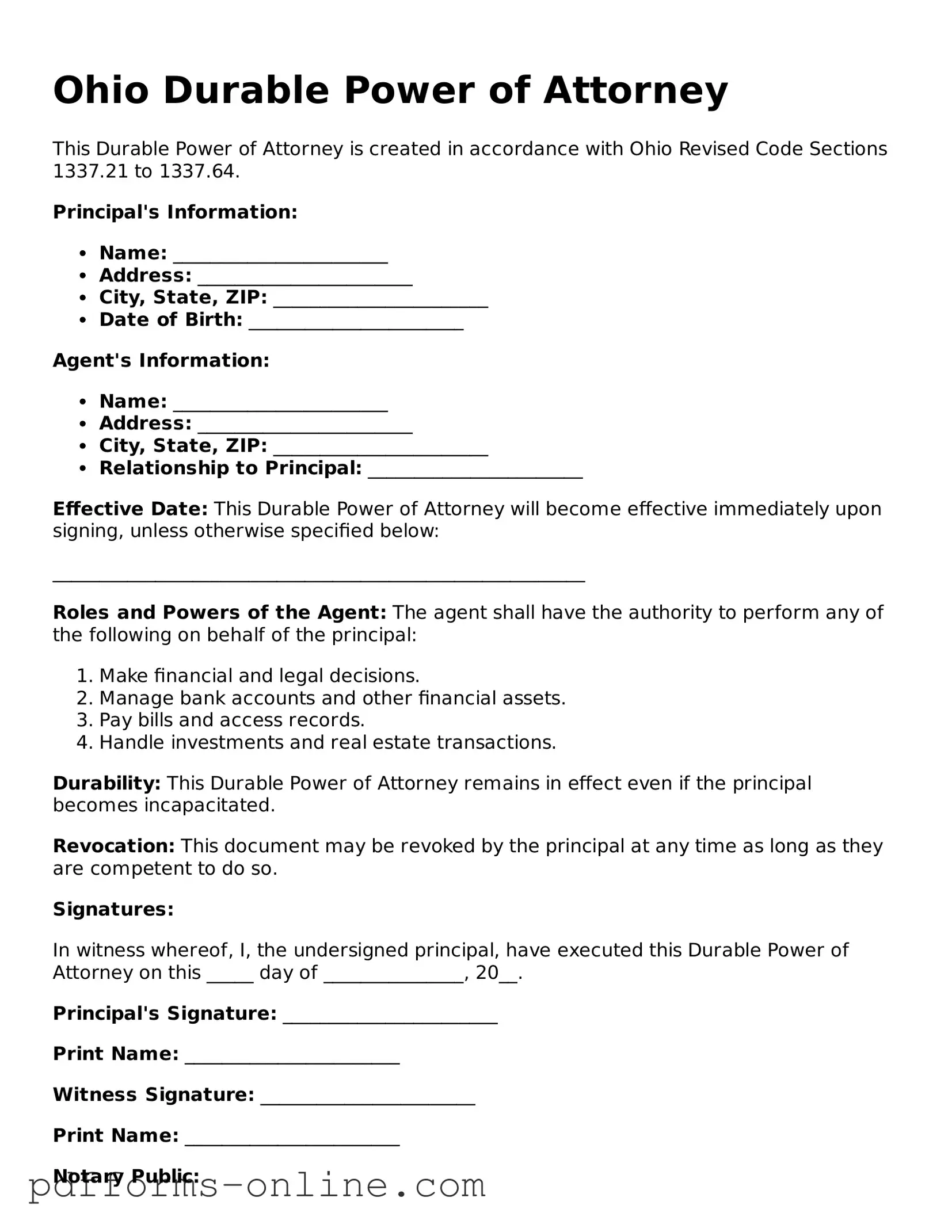

Document Example

Ohio Durable Power of Attorney

This Durable Power of Attorney is created in accordance with Ohio Revised Code Sections 1337.21 to 1337.64.

Principal's Information:

- Name: _______________________

- Address: _______________________

- City, State, ZIP: _______________________

- Date of Birth: _______________________

Agent's Information:

- Name: _______________________

- Address: _______________________

- City, State, ZIP: _______________________

- Relationship to Principal: _______________________

Effective Date: This Durable Power of Attorney will become effective immediately upon signing, unless otherwise specified below:

_________________________________________________________

Roles and Powers of the Agent: The agent shall have the authority to perform any of the following on behalf of the principal:

- Make financial and legal decisions.

- Manage bank accounts and other financial assets.

- Pay bills and access records.

- Handle investments and real estate transactions.

Durability: This Durable Power of Attorney remains in effect even if the principal becomes incapacitated.

Revocation: This document may be revoked by the principal at any time as long as they are competent to do so.

Signatures:

In witness whereof, I, the undersigned principal, have executed this Durable Power of Attorney on this _____ day of _______________, 20__.

Principal's Signature: _______________________

Print Name: _______________________

Witness Signature: _______________________

Print Name: _______________________

Notary Public:

State of Ohio, County of ____________

Subscribed and sworn to me on this _____ day of _______________, 20__.

Notary Public Signature: _______________________

My Commission Expires: _______________________

Frequently Asked Questions

-

What is a Durable Power of Attorney in Ohio?

A Durable Power of Attorney (DPOA) in Ohio is a legal document that allows one person, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. The key feature of a DPOA is that it remains effective even if the principal becomes incapacitated.

-

Why should I consider creating a Durable Power of Attorney?

Creating a DPOA is an important step in planning for the future. It ensures that someone you trust can manage your financial and legal matters if you are unable to do so. This can prevent potential disputes among family members and provide peace of mind knowing that your affairs will be handled according to your wishes.

-

Who can be an agent under a Durable Power of Attorney?

In Ohio, your agent can be a trusted friend, family member, or even a professional, such as an attorney or accountant. However, it is crucial to choose someone who is responsible and has your best interests at heart. The agent must be at least 18 years old and mentally competent.

-

What powers can I grant to my agent?

You have the flexibility to grant a wide range of powers to your agent. These can include managing bank accounts, paying bills, handling real estate transactions, and making decisions about investments. You can specify which powers you wish to grant or limit certain actions to suit your preferences.

-

How do I create a Durable Power of Attorney in Ohio?

To create a DPOA in Ohio, you must complete a form that meets state requirements. The form should clearly state your intentions and include your signature, the date, and the signatures of two witnesses or a notary public. It’s advisable to consult with a legal professional to ensure that the document is valid and reflects your wishes accurately.

-

Can I revoke my Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you should create a written revocation document, notify your agent, and inform any institutions or individuals who have relied on the DPOA. This ensures that your wishes are clear and prevents any confusion.

-

What happens if I don’t have a Durable Power of Attorney?

If you become incapacitated without a DPOA, your family may need to go through a legal process called guardianship to manage your affairs. This process can be time-consuming, costly, and may not align with your preferences. Having a DPOA in place can help avoid these complications.

-

Is a Durable Power of Attorney only for financial matters?

No, while a DPOA often covers financial decisions, you can also create a separate Health Care Power of Attorney that specifically addresses medical decisions. This allows you to appoint someone to make healthcare choices on your behalf if you are unable to do so.

-

How long does a Durable Power of Attorney last?

A Durable Power of Attorney remains effective until you revoke it, pass away, or until a court invalidates it. If you become incapacitated, the DPOA continues to be valid, which is a significant distinction from a standard Power of Attorney.

-

Can I use a Durable Power of Attorney from another state in Ohio?

Generally, Ohio will recognize a Durable Power of Attorney created in another state, as long as it complies with the laws of that state and does not violate Ohio law. However, it is wise to have the document reviewed by a legal professional in Ohio to ensure its validity and effectiveness.

Misconceptions

Understanding the Ohio Durable Power of Attorney form is crucial for making informed decisions about legal and financial matters. However, several misconceptions can lead to confusion. Here are six common misconceptions, along with clarifications:

- Misconception 1: The Durable Power of Attorney is only for elderly individuals.

- Misconception 2: A Durable Power of Attorney can only be used for financial matters.

- Misconception 3: Once the Durable Power of Attorney is signed, it cannot be changed.

- Misconception 4: The agent must be a lawyer or a financial expert.

- Misconception 5: A Durable Power of Attorney is the same as a Living Will.

- Misconception 6: The Durable Power of Attorney becomes invalid upon the individual's death.

This form is beneficial for anyone, regardless of age. It allows individuals to appoint someone they trust to handle their affairs if they become incapacitated, making it relevant for young adults and middle-aged individuals as well.

While it is often associated with financial decisions, a Durable Power of Attorney can also cover healthcare decisions. This allows the appointed agent to make medical choices on behalf of the individual when they are unable to do so.

In reality, individuals can revoke or modify their Durable Power of Attorney at any time, as long as they are mentally competent. This flexibility ensures that the document remains aligned with their current wishes.

This is not true. The appointed agent can be anyone the individual trusts, such as a family member or friend. It is essential, however, that this person is reliable and capable of managing the responsibilities entrusted to them.

These are distinct documents. A Durable Power of Attorney grants authority to an agent to make decisions on behalf of the individual, while a Living Will specifically outlines medical treatment preferences in the event of incapacitation.

This is correct. However, it is important to understand that the authority granted through the Durable Power of Attorney ceases immediately upon the individual's death, at which point the estate plan takes over.

Common mistakes

-

Not naming an agent: Failing to designate a trusted person as your agent can lead to confusion about who is authorized to act on your behalf.

-

Choosing an unsuitable agent: Selecting someone who is not reliable or does not understand your wishes can result in decisions that do not align with your intentions.

-

Leaving out specific powers: Omitting important powers, such as financial management or healthcare decisions, can limit your agent's ability to act effectively.

-

Not signing the document: Forgetting to sign the form invalidates it. Your signature is essential for the document to be legally binding.

-

Failing to date the form: Not including the date can create ambiguity about when the document takes effect, leading to potential disputes.

-

Ignoring witness and notarization requirements: Not having the required witnesses or notary can invalidate the document in Ohio.

-

Not reviewing the form regularly: Failing to update the document as circumstances change can result in outdated information and unintended consequences.

-

Assuming the form is permanent: Believing that the Durable Power of Attorney cannot be revoked is a mistake. You can change or cancel it at any time, as long as you are mentally competent.

Find Some Other Durable Power of Attorney Forms for Specific States

Ca Durable Power of Attorney - Once signed, the Durable Power of Attorney becomes an active legal document.

How to Get a Power of Attorney in Florida - Designate an agent to make healthcare decisions when you are unable to do so.

When creating a Non-compete Agreement, it's essential to have access to the necessary legal documents to ensure compliance with local laws and regulations. In Arizona, you can find a variety of forms that cater specifically to these agreements, providing guidelines and templates that reflect state requirements. To help you navigate this process efficiently, you can access the relevant legal resources through All Arizona Forms, ensuring your agreement is well-crafted and legally sound.

Durable Power Printable Power of Attorney Form - A Durable Power of Attorney can be made effective after a specific event occurs.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Ohio Durable Power of Attorney is a legal document that allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | This form is governed by Ohio Revised Code Section 1337.12, which outlines the requirements and powers granted under a durable power of attorney. |

| Durability | The term "durable" indicates that the authority granted continues even if the principal becomes mentally incapacitated. |

| Principal | The individual who creates the durable power of attorney is known as the principal. |

| Agent | The person appointed to act on behalf of the principal is referred to as the agent or attorney-in-fact. |

| Scope of Authority | The agent can be granted broad or limited powers, depending on the principal's preferences as outlined in the document. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are mentally competent to do so. |

| Signing Requirements | The form must be signed by the principal in the presence of a notary public or two witnesses to be valid. |

| Importance | Having a durable power of attorney is crucial for ensuring that personal and financial matters can be managed by a trusted individual in times of need. |

Similar forms

The Ohio Durable Power of Attorney form is similar to the General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, called the agent, to make decisions on their behalf. However, the key difference lies in durability. The General Power of Attorney becomes invalid if the principal becomes incapacitated, while the Durable Power of Attorney remains effective even in such situations. This makes the Durable version particularly useful for long-term planning and health care decisions.

Another document that shares similarities is the Medical Power of Attorney. Like the Durable Power of Attorney, the Medical Power of Attorney allows a person to designate someone to make health care decisions if they are unable to do so themselves. The focus here is specifically on medical choices, which can include treatment options, end-of-life care, and more. While the Durable Power of Attorney can cover a broader range of financial and legal matters, the Medical Power of Attorney is solely concerned with health-related decisions.

The Living Will is also comparable to the Durable Power of Attorney in that both documents address issues related to incapacity. A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot communicate their preferences. This document specifically deals with end-of-life decisions, whereas the Durable Power of Attorney can encompass a wider array of decisions, including financial and legal matters. Both documents work together to ensure that a person's wishes are respected during times of incapacity.

The Revocable Trust shares some similarities with the Durable Power of Attorney, particularly in the context of managing assets. A Revocable Trust allows a person to place their assets into a trust, which can be managed by a trustee during their lifetime and distributed according to their wishes after death. Like the Durable Power of Attorney, a Revocable Trust can help avoid probate and provide a clear plan for asset management. However, the Durable Power of Attorney is more focused on granting authority to make decisions, while the Revocable Trust is primarily about asset management and distribution.

For those involved in vehicle transactions, it is essential to complete the necessary legal forms to ensure a smooth transfer of ownership. One such document is the Ohio Motor Vehicle Bill of Sale, which provides vital information about the seller, buyer, and the vehicle itself. This legal writing eliminates potential ambiguities surrounding ownership, making the process much more straightforward. For more information or to obtain a template, you can visit documentonline.org/blank-ohio-motor-vehicle-bill-of-sale.

Finally, the Guardianship Agreement is another document that has similarities with the Durable Power of Attorney. A Guardianship Agreement is a legal arrangement where a court appoints someone to make decisions for an individual who is unable to do so due to incapacity. While the Durable Power of Attorney allows individuals to choose their agent without court involvement, a Guardianship requires court approval and oversight. Both documents aim to protect individuals who cannot manage their own affairs, but they differ in the level of control and oversight involved.