Valid Ohio Deed in Lieu of Foreclosure Template

The Ohio Deed in Lieu of Foreclosure form serves as a crucial instrument for homeowners facing the possibility of foreclosure. This legal document allows a property owner to voluntarily transfer ownership of their property back to the lender, thereby avoiding the often lengthy and costly foreclosure process. By executing this deed, homeowners can mitigate the negative impacts on their credit scores and potentially negotiate more favorable terms with their lenders. The form typically requires the inclusion of specific details, such as the names of the parties involved, a description of the property, and any outstanding debts associated with the mortgage. Additionally, it may outline the conditions under which the deed is executed, including any agreements regarding the forgiveness of remaining mortgage debt. This option is particularly appealing for those who wish to avoid the public stigma associated with foreclosure while seeking a more dignified exit from a challenging financial situation. Understanding the implications of this deed, as well as the rights and responsibilities it entails, is essential for homeowners considering this route.

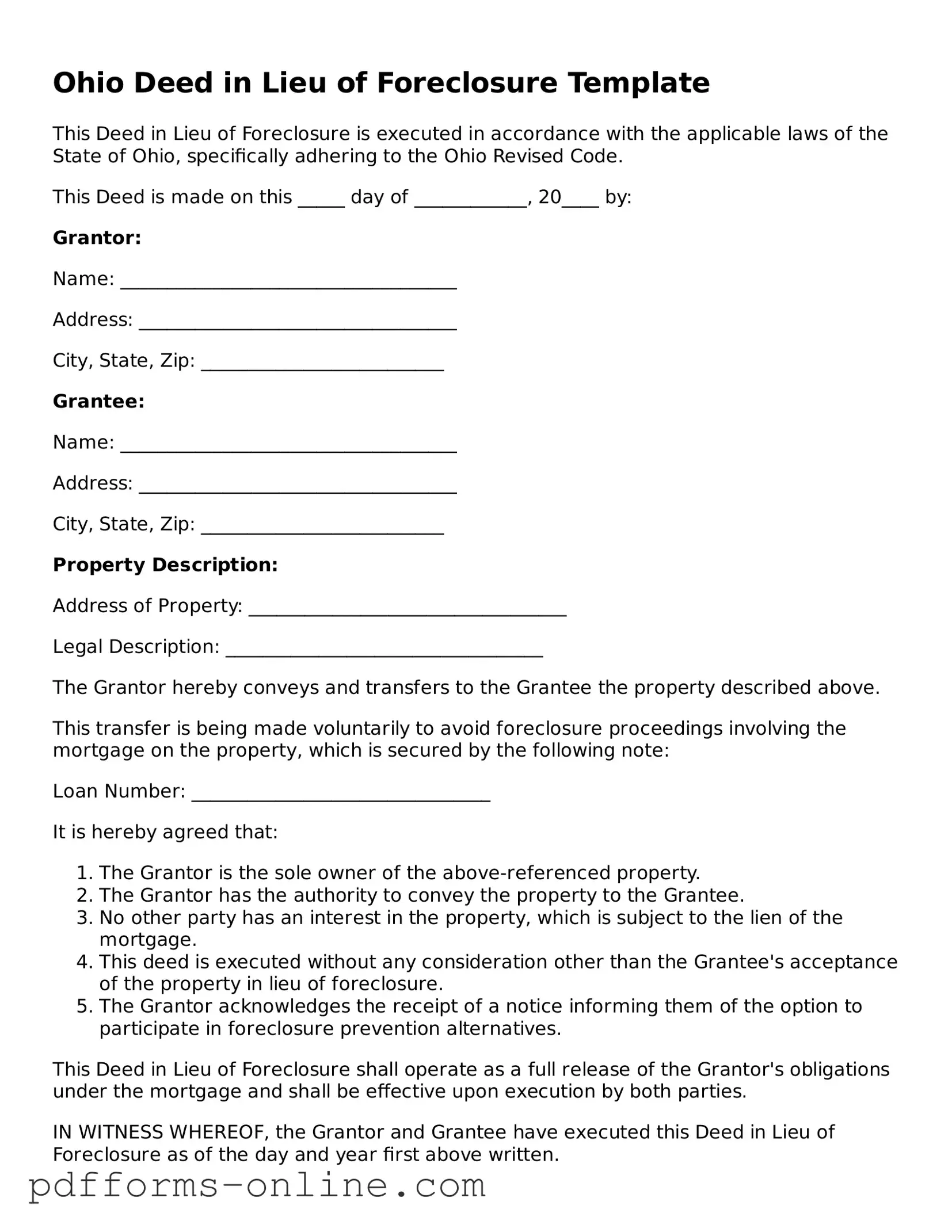

Document Example

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the applicable laws of the State of Ohio, specifically adhering to the Ohio Revised Code.

This Deed is made on this _____ day of ____________, 20____ by:

Grantor:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Grantee:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Property Description:

Address of Property: __________________________________

Legal Description: __________________________________

The Grantor hereby conveys and transfers to the Grantee the property described above.

This transfer is being made voluntarily to avoid foreclosure proceedings involving the mortgage on the property, which is secured by the following note:

Loan Number: ________________________________

It is hereby agreed that:

- The Grantor is the sole owner of the above-referenced property.

- The Grantor has the authority to convey the property to the Grantee.

- No other party has an interest in the property, which is subject to the lien of the mortgage.

- This deed is executed without any consideration other than the Grantee's acceptance of the property in lieu of foreclosure.

- The Grantor acknowledges the receipt of a notice informing them of the option to participate in foreclosure prevention alternatives.

This Deed in Lieu of Foreclosure shall operate as a full release of the Grantor's obligations under the mortgage and shall be effective upon execution by both parties.

IN WITNESS WHEREOF, the Grantor and Grantee have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

______________________________

Grantor's Signature

Date: _______________________

______________________________

Grantee's Signature

Date: _______________________

Notary Public: _______________________

My Commission Expires: _______________

Frequently Asked Questions

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid the foreclosure process. This option can help the homeowner avoid the negative consequences of foreclosure, such as a damaged credit score.

-

Who can use a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties and unable to keep up with mortgage payments may consider this option. However, the lender must agree to accept the deed. It is typically used by borrowers who are in default on their mortgage and wish to avoid foreclosure.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to this approach:

- It can help preserve the homeowner's credit score compared to a foreclosure.

- The process is usually quicker and less expensive than foreclosure.

- Homeowners may be able to negotiate a cash incentive or relocation assistance from the lender.

-

What are the potential downsides?

While there are benefits, there are also some drawbacks to consider:

- Homeowners may still be liable for any remaining mortgage balance if the property is sold for less than the owed amount.

- It may not be available for all homeowners, as lenders have specific criteria.

- Tax implications could arise, as the forgiven debt might be considered taxable income.

-

How do I initiate the process?

To start, contact your lender and express your interest in a Deed in Lieu of Foreclosure. They will provide you with the necessary forms and guide you through their specific requirements. Be prepared to provide financial information and documentation regarding your situation.

-

Is legal advice recommended?

Yes, it is highly advisable to seek legal counsel before proceeding. An attorney can help you understand the implications of signing a Deed in Lieu of Foreclosure and ensure that your rights are protected throughout the process.

Misconceptions

Understanding the Ohio Deed in Lieu of Foreclosure can be tricky. Here are nine common misconceptions that people often have about this process:

- It eliminates all debts associated with the property. Many believe that a deed in lieu will wipe out all financial obligations. However, it typically only addresses the mortgage debt, leaving other debts intact.

- It automatically prevents foreclosure. Some think that signing a deed in lieu means foreclosure is off the table. While it can halt the foreclosure process, it’s not guaranteed until the lender accepts the deed.

- It is a quick and easy solution. Many assume that a deed in lieu is a fast fix for financial troubles. In reality, it can take time to negotiate with the lender and complete the necessary paperwork.

- It has no impact on credit scores. People often believe that a deed in lieu won’t affect their credit. In fact, it can still have a negative impact, though it may be less severe than a foreclosure.

- All lenders accept deeds in lieu. There is a misconception that every lender will agree to this option. In truth, not all lenders offer this as a solution, and terms can vary widely.

- It releases the borrower from all liability. Some think that once the deed is signed, they are free from all legal obligations. However, this is not always the case, especially if there are second mortgages or other liens.

- It is the same as a short sale. Many confuse a deed in lieu with a short sale. While both involve transferring property to the lender, a short sale requires selling the property for less than the mortgage balance.

- It is only for homeowners in dire financial situations. Some believe that only those facing severe financial distress can utilize this option. In reality, it can be a viable choice for various circumstances.

- Legal assistance is not necessary. Many think they can navigate the process alone. However, having legal guidance can help ensure that all aspects are handled correctly and that the borrower’s interests are protected.

By clarifying these misconceptions, individuals can make more informed decisions about their options in the face of financial challenges.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or even rejection of the deed. Ensure every section is fully completed.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create confusion. Always double-check the legal description of the property.

-

Not Signing in the Right Place: Signatures must be placed in designated areas. Missing a signature can invalidate the document.

-

Ignoring Notarization Requirements: Many deeds require notarization. Failing to have the document notarized can render it ineffective.

-

Overlooking Lender Approval: Some lenders may require formal approval before accepting a deed in lieu of foreclosure. Check with your lender to avoid complications.

-

Neglecting to Keep Copies: Always keep a copy of the completed deed for your records. This can be crucial if any disputes arise later.

Find Some Other Deed in Lieu of Foreclosure Forms for Specific States

Foreclosure Process in Georgia - The deed in lieu allows borrowers to take control of their finances by mitigating the hurt of foreclosure.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Homeowners may still have to negotiate for possible relocation assistance.

The New York Mobile Home Bill of Sale form serves as a crucial document that facilitates the transfer of ownership for a mobile home. This form ensures both the buyer and seller have a clear record of the transaction, detailing essential information about the mobile home and its sale. For more information on how to properly complete this form, you can refer to https://documentonline.org/blank-new-york-mobile-home-bill-of-sale. Understanding this form's significance can help streamline the process and provide peace of mind for all parties involved.

Sample Deed in Lieu of Foreclosure - It may allow the homeowner to move on more quickly and avoid lengthy legal battles.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Ohio, the process is governed by Ohio Revised Code § 5301.01 and § 5301.32. |

| Eligibility | Homeowners facing financial difficulties may qualify, but the lender must agree to the terms. |

| Benefits | This option can help homeowners avoid the lengthy foreclosure process and potentially minimize damage to their credit score. |

| Process | The borrower must submit a request to the lender, who will review the financial situation and the property’s value. |

| Title Transfer | Upon acceptance, the property title is transferred to the lender, releasing the borrower from the mortgage obligation. |

| Potential Risks | Homeowners may still face tax implications or liability for any deficiency if the property sells for less than the mortgage balance. |

| Alternative Options | Other alternatives include loan modification or short sale, which may be more suitable depending on individual circumstances. |

Similar forms

A mortgage release is similar to a deed in lieu of foreclosure in that it allows a borrower to relinquish their interest in a property to the lender. In this process, the lender agrees to release the borrower from their mortgage obligations, effectively canceling the debt. This document is typically used when a borrower can no longer afford their mortgage payments but wishes to avoid the lengthy foreclosure process. Both documents aim to provide a smoother transition for the borrower while protecting the lender's interests.

A short sale agreement also shares similarities with a deed in lieu of foreclosure. In a short sale, the lender permits the homeowner to sell the property for less than the outstanding mortgage balance. The lender agrees to accept the proceeds from the sale as full satisfaction of the loan. Both options provide alternatives to foreclosure, allowing borrowers to exit their mortgage obligations while minimizing the financial and emotional toll of losing a home.

Understanding the nuances of financial documents can be essential, especially when dealing with complex situations like property ownership and debt management. One valuable resource for those seeking clarity on various financial forms, including the Profit And Loss form, can be found at OnlineLawDocs.com, which provides comprehensive information to aid both individuals and businesses in navigating their financial reporting needs.

A loan modification agreement is another document that bears resemblance to a deed in lieu of foreclosure. This agreement involves changing the terms of an existing mortgage to make it more affordable for the borrower. By adjusting interest rates, extending the loan term, or altering monthly payments, lenders can help borrowers avoid default. Both documents aim to prevent foreclosure, although a loan modification retains the borrower’s ownership of the property, unlike a deed in lieu.

A quitclaim deed is similar in that it involves the transfer of property ownership, but it does not involve any financial compensation or negotiation with a lender. A quitclaim deed allows one party to transfer their interest in a property to another without any warranties or guarantees. While both documents facilitate the transfer of property, a deed in lieu of foreclosure is a negotiated agreement that often involves debt forgiveness, while a quitclaim deed does not address mortgage obligations.

A foreclosure notice serves a different purpose but is related to the process leading up to a deed in lieu of foreclosure. This document notifies the borrower that they are in default on their mortgage and that the lender intends to initiate foreclosure proceedings. While a deed in lieu is a voluntary action taken by the borrower to avoid foreclosure, a foreclosure notice indicates that the borrower has not taken steps to resolve the default, highlighting the urgency of the situation.

A forbearance agreement is another document that can be compared to a deed in lieu of foreclosure. In a forbearance agreement, the lender allows the borrower to temporarily reduce or suspend mortgage payments due to financial hardship. This arrangement helps the borrower regain financial stability while preventing foreclosure. Both documents serve as tools to manage financial difficulties, but a deed in lieu results in property transfer, while forbearance keeps the borrower in their home temporarily.

A bankruptcy filing can also be seen as related to a deed in lieu of foreclosure. When a borrower files for bankruptcy, they may seek to eliminate or reorganize their debts, including mortgage obligations. This legal process can halt foreclosure proceedings and provide the borrower with a fresh start. Both options aim to address financial distress, but bankruptcy is a legal remedy that impacts all debts, while a deed in lieu focuses specifically on the mortgage associated with the property.

An assumption agreement is another document that resembles a deed in lieu of foreclosure. This agreement allows a new buyer to take over the existing mortgage obligations of the current homeowner. The lender must approve this transfer, ensuring that the new borrower meets their credit requirements. While both documents facilitate the transfer of property and mortgage obligations, a deed in lieu results in the borrower relinquishing ownership, whereas an assumption agreement allows for continued ownership under new terms.

A real estate purchase agreement can also be compared to a deed in lieu of foreclosure. This document outlines the terms of a sale between a buyer and seller. In situations where a homeowner is facing foreclosure, they may opt for a sale to avoid the negative consequences of foreclosure. Both documents involve the transfer of property, but a deed in lieu is a more direct approach to resolving mortgage default without a formal sale process.

Finally, a property settlement agreement, often used in divorce proceedings, can be likened to a deed in lieu of foreclosure. This document outlines how property and debts will be divided between parties. In cases where one spouse cannot maintain mortgage payments, they may agree to transfer their interest in the property to the other spouse or the lender. Both documents facilitate the transfer of property ownership, but a property settlement agreement is typically part of a divorce process, while a deed in lieu focuses on resolving mortgage default.